Small businesses need several key documents for vendor contract agreements, including a detailed vendor agreement outlining the terms and conditions, scope of work, payment terms, and delivery schedules. Legal identification documents such as business licenses and tax identification numbers ensure compliance and verification. Additionally, proof of insurance and non-disclosure agreements (NDAs) may be required to protect both parties and maintain confidentiality.

What Documents Does a Small Business Need for Vendor Contract Agreements?

| Number | Name | Description |

|---|---|---|

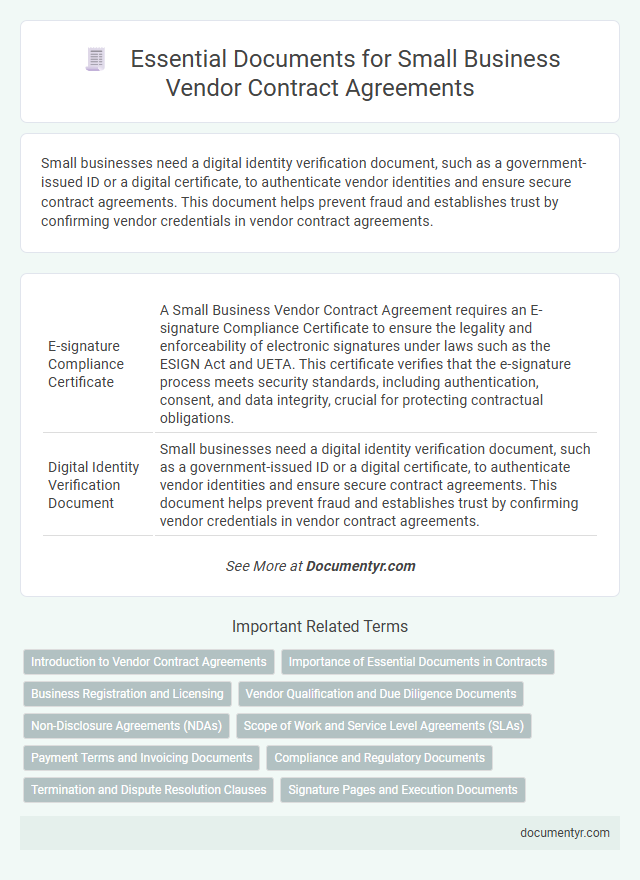

| 1 | E-signature Compliance Certificate | A Small Business Vendor Contract Agreement requires an E-signature Compliance Certificate to ensure the legality and enforceability of electronic signatures under laws such as the ESIGN Act and UETA. This certificate verifies that the e-signature process meets security standards, including authentication, consent, and data integrity, crucial for protecting contractual obligations. |

| 2 | Digital Identity Verification Document | Small businesses need a digital identity verification document, such as a government-issued ID or a digital certificate, to authenticate vendor identities and ensure secure contract agreements. This document helps prevent fraud and establishes trust by confirming vendor credentials in vendor contract agreements. |

| 3 | Third-party Risk Assessment Report | A Third-party Risk Assessment Report evaluates the potential risks associated with vendor partnerships, covering compliance, security, and financial stability. Small businesses must include this report in vendor contract agreements to ensure informed decision-making and mitigate vulnerabilities related to third-party interactions. |

| 4 | Subcontractor Disclosure Statement | A Subcontractor Disclosure Statement is essential in vendor contract agreements to identify all third parties involved in project execution, ensuring transparency and compliance with regulatory requirements. This document protects small businesses by clearly outlining subcontractor responsibilities, labor classifications, and payment terms within the contract framework. |

| 5 | Clause-specific Insurance Endorsement | A small business needs a Clause-specific Insurance Endorsement document to ensure vendor contracts explicitly detail the required insurance coverage tailored to specific liabilities and project risks. This endorsement protects the business by clearly outlining the vendor's insurance obligations, minimizing financial exposure and legal disputes. |

| 6 | Data Processing Addendum (DPA) | A Data Processing Addendum (DPA) is essential for vendor contract agreements involving personal data, ensuring compliance with data protection regulations such as GDPR. It outlines the responsibilities of both parties regarding data processing, security measures, and breach notification protocols, safeguarding sensitive information in business transactions. |

| 7 | ESG (Environmental, Social, Governance) Declaration | Small businesses need to include an ESG (Environmental, Social, Governance) Declaration as part of their vendor contract agreements to demonstrate compliance with sustainability and ethical standards. This document outlines commitments to environmental protection, social responsibility, and transparent governance practices, ensuring vendors align with the company's ESG criteria. |

| 8 | Cybersecurity Readiness Statement | A Small Business Vendor Contract Agreement should include a Cybersecurity Readiness Statement detailing the business's protocols for data protection, incident response, and compliance with industry standards such as NIST or ISO 27001. This document verifies the vendor's commitment to safeguarding sensitive information and helps mitigate risks associated with cyber threats in contractual transactions. |

| 9 | Blockchain Transaction Log | A blockchain transaction log provides an immutable record of all contract-related activities, ensuring transparency and security in vendor agreements for small businesses. This decentralized ledger enhances trust by chronologically documenting every transaction, mitigating disputes and streamlining contract verification processes. |

| 10 | AI Usage Policy Attachment | Small businesses require a clear AI Usage Policy Attachment within vendor contract agreements to outline permissible AI applications, data privacy standards, and liability for automated decision-making. This document ensures compliance with regulatory frameworks like GDPR and mitigates risks associated with AI-driven processes in vendor collaborations. |

Introduction to Vendor Contract Agreements

What documents does a small business need for vendor contract agreements? Vendor contract agreements establish clear terms between your business and suppliers or service providers to ensure mutual understanding and legal protection. These documents typically include the contract itself, confidentiality agreements, and proof of insurance to safeguard all parties involved.

Importance of Essential Documents in Contracts

| Document Type | Description | Importance in Vendor Contract Agreements |

|---|---|---|

| Vendor Contract Agreement | Official written agreement outlining terms and conditions between the small business and the vendor. | Defines scope of work, payment terms, delivery schedules, and responsibilities. Protects both parties legally in case of disputes. |

| Business Licenses and Permits | Legal authorizations allowing the business to operate within specific industries or jurisdictions. | Ensures the vendor complies with regulatory requirements and avoids legal complications during contract enforcement. |

| Non-Disclosure Agreement (NDA) | Confidentiality agreement protecting sensitive business information shared with the vendor. | Safeguards proprietary data, maintaining competitive advantage and preventing unauthorized disclosure. |

| Insurance Certificates | Proof of insurance coverage, such as liability, workers' compensation, or property insurance. | Mitigates risk by ensuring vendor accountability and coverage for potential damages or losses. |

| Tax Identification Documents | Employer Identification Number (EIN) or other tax-related identification numbers. | Essential for tax reporting, verifying vendor legitimacy, and compliance with tax regulations. |

| Purchase Orders | Documents authorizing a purchase transaction between the business and the vendor. | Provides formal record of requested goods or services, helps manage inventory and budgeting. |

| Invoices | Detailed bills submitted by the vendor for goods or services provided. | Facilitates accurate payment processing and financial tracking within the business. |

Business Registration and Licensing

Small businesses must secure proper documentation to ensure vendor contract agreements are valid and enforceable. Business registration and licensing documents establish the legal foundation for entering binding contracts with vendors.

- Business Registration Certificate - This document proves that the business is officially registered with the appropriate government authority, confirming its legal existence.

- Employer Identification Number (EIN) - Issued by the IRS, the EIN serves as a unique identifier necessary for tax reporting and vendor agreements.

- Relevant Business Licenses - Industry-specific licenses validate that the business meets regulatory requirements, ensuring compliance during vendor contract execution.

Vendor Qualification and Due Diligence Documents

Small businesses require specific documents for vendor contract agreements to ensure compliance and mitigate risks. Vendor qualification and due diligence documents play a crucial role in evaluating and selecting reliable vendors.

Common vendor qualification documents include business licenses, tax identification numbers, and proof of insurance. Due diligence documents often consist of financial statements, references, and compliance certifications.

Non-Disclosure Agreements (NDAs)

Small businesses require specific documents to establish vendor contract agreements effectively. One crucial document is the Non-Disclosure Agreement (NDA), which protects sensitive information exchanged between parties.

NDAs ensure that proprietary data, trade secrets, and confidential business strategies remain secure during vendor collaborations. These agreements define the scope of confidentiality and the duration of the obligation. Implementing NDAs minimizes the risk of information leaks and fosters trust between the small business and its vendors.

Scope of Work and Service Level Agreements (SLAs)

Small businesses require detailed documents to secure clear expectations and responsibilities in vendor contract agreements. Two critical documents are the Scope of Work and Service Level Agreements (SLAs), which define project parameters and performance standards.

- Scope of Work (SOW) - Outlines specific tasks, deliverables, timelines, and responsibilities to ensure both parties understand project expectations.

- Service Level Agreements (SLAs) - Establish measurable performance metrics and response times to guarantee service quality and accountability.

- Contract Agreement Document - Combines these components into a legally binding framework protecting your business interests throughout the vendor relationship.

Payment Terms and Invoicing Documents

Small businesses must include clear payment terms in vendor contract agreements to establish deadlines, payment methods, and any penalties for late payments. Detailed invoicing documents are essential for tracking transactions, ensuring accuracy, and facilitating timely payments. Proper documentation helps prevent disputes and maintains a transparent financial relationship between the business and its vendors.

Compliance and Regulatory Documents

Small businesses must prepare specific compliance and regulatory documents to ensure legal adherence in vendor contract agreements. These documents protect the business from liabilities and establish clear operational standards.

- Business License - Validates the legal operation of the business within its jurisdiction.

- Tax Identification Number (TIN) - Ensures accurate tax reporting and compliance with government regulations.

- Compliance Certifications - Demonstrates adherence to industry-specific laws and regulatory standards.

Maintaining these documents is essential for smooth vendor relations and regulatory compliance in contract agreements.

Termination and Dispute Resolution Clauses

Small businesses require clear vendor contract agreements to define terms of termination and dispute resolution. Termination clauses specify conditions under which either party can end the contract, protecting business interests and minimizing risks. Dispute resolution clauses outline procedures like mediation or arbitration to efficiently handle conflicts without costly litigation.

What Documents Does a Small Business Need for Vendor Contract Agreements? Infographic