An LLC Operating Agreement requires essential documents such as the LLC's Articles of Organization, which officially register the business, and the federal Employer Identification Number (EIN) for tax purposes. Member information, including ownership percentages and roles, must be clearly detailed within the agreement to define responsibilities and voting rights. Financial arrangements, profit distribution methods, and procedures for adding or removing members are necessary to ensure legal clarity and smooth business operations.

What Documents are Necessary for an LLC Operating Agreement?

| Number | Name | Description |

|---|---|---|

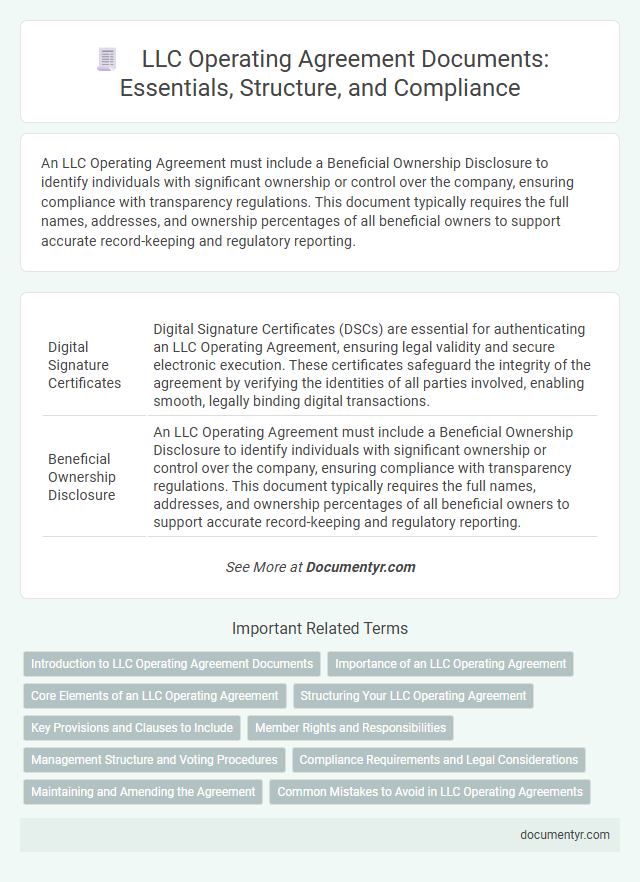

| 1 | Digital Signature Certificates | Digital Signature Certificates (DSCs) are essential for authenticating an LLC Operating Agreement, ensuring legal validity and secure electronic execution. These certificates safeguard the integrity of the agreement by verifying the identities of all parties involved, enabling smooth, legally binding digital transactions. |

| 2 | Beneficial Ownership Disclosure | An LLC Operating Agreement must include a Beneficial Ownership Disclosure to identify individuals with significant ownership or control over the company, ensuring compliance with transparency regulations. This document typically requires the full names, addresses, and ownership percentages of all beneficial owners to support accurate record-keeping and regulatory reporting. |

| 3 | Registered Agent Consent Form | A Registered Agent Consent Form is essential for an LLC Operating Agreement to confirm the agent's acceptance of legal responsibilities and service of process on behalf of the company. This document ensures the registered agent is officially designated and agrees to receive official correspondence, which is critical for maintaining legal compliance. |

| 4 | Membership Interest Ledger | A Membership Interest Ledger is essential for an LLC Operating Agreement as it records each member's ownership percentage, capital contributions, and transfer history, ensuring accurate tracking of membership interests. This document provides transparency and legal clarity, helping to prevent disputes and facilitate smooth management of member rights and responsibilities. |

| 5 | Series LLC Addendum | A Series LLC Addendum is a critical document that outlines the formation and management structure of each series within a Series LLC, specifying the rights, duties, and obligations distinct to each series. This addendum complements the primary LLC Operating Agreement by addressing the unique assets, liabilities, and governance protocols for individual series, ensuring legal clarity and operational efficiency. |

| 6 | EIN Confirmation Letter | The EIN Confirmation Letter, issued by the IRS, is essential for an LLC Operating Agreement as it verifies the company's Employer Identification Number, which is crucial for tax reporting and opening bank accounts. This document ensures the LLC's legal recognition and compliance with federal regulations, making it a key component in formalizing the operating agreement. |

| 7 | Operating Agreement Acknowledgment Receipt | An LLC Operating Agreement Acknowledgment Receipt serves as formal proof that members have received and reviewed the Operating Agreement, ensuring clarity and legal acknowledgment of the document's terms. This receipt is essential for maintaining accurate records and demonstrating member consent in disputes or regulatory inquiries. |

| 8 | Unanimous Member Action Record | The Unanimous Member Action Record is essential for an LLC Operating Agreement as it documents the unanimous consent of all members on key decisions, ensuring legal validity without a formal meeting. This record guarantees that all members agree on the terms outlined in the Agreement, preventing future disputes and reinforcing the company's governance structure. |

| 9 | Electronic Filing Affidavit | An Electronic Filing Affidavit is a crucial document in the LLC Operating Agreement process, serving as a sworn statement that verifies the authenticity and accuracy of electronically submitted formation documents. This affidavit ensures compliance with state regulations, facilitating the legal recognition and smooth processing of the LLC's official records. |

| 10 | Locality Compliance Attestation | An LLC Operating Agreement requires a Locality Compliance Attestation to verify adherence to state and local regulations, including business licenses and zoning laws applicable to the LLC's registered address. This attestation ensures all documents meet jurisdiction-specific legal standards, preventing operational disruptions and legal penalties. |

Introduction to LLC Operating Agreement Documents

An LLC Operating Agreement is a crucial document that outlines the management structure and operational guidelines of a Limited Liability Company. This agreement helps define the roles, responsibilities, and ownership percentages of the members.

You need several key documents to create a comprehensive LLC Operating Agreement, including Articles of Organization and member information. These documents ensure legal compliance and clarify operational procedures within the LLC.

Importance of an LLC Operating Agreement

An LLC Operating Agreement is a crucial document that outlines the management structure and operating procedures of a Limited Liability Company. It helps prevent conflicts by clearly defining member roles and responsibilities.

- Proof of LLC Formation - This document verifies the legal establishment of the LLC and is necessary to reference in the Operating Agreement.

- Member Information - Detailed records of LLC members are essential to specify ownership percentages and voting rights within the agreement.

- Capital Contributions - Documentation of each member's financial input is important to ensure accurate profit and loss distribution as outlined in the Operating Agreement.

Core Elements of an LLC Operating Agreement

| Document | Description | Importance |

|---|---|---|

| LLC Articles of Organization | Legal document filed with the state to officially form the LLC, outlining basic company information. | Provides the foundational legal recognition necessary to operate the LLC. |

| Operating Agreement | Core agreement detailing the management, ownership percentages, and operational procedures of the LLC. | Defines member roles, voting rights, profit distribution, and dispute resolution. |

| Member Information Sheets | Documents containing names, addresses, and ownership percentages of LLC members. | Essential for clarifying member identities and ownership stakes. |

| Capital Contribution Records | Records specifying initial and ongoing contributions made by each member. | Tracks financial commitments and basis for profit and loss allocations. |

| Management Structure Documentation | Description of whether the LLC is member-managed or manager-managed, including designated roles. | Clarifies authority and decision-making processes within the LLC. |

| Dissolution Procedures | Documents describing the process for winding up the LLC, distributing assets, and resolving liabilities. | Ensures an agreed method for legal and financial closure of the LLC. |

Structuring Your LLC Operating Agreement

Structuring your LLC Operating Agreement requires essential documents that define member roles, ownership percentages, and management responsibilities. Key components include the initial Articles of Organization, detailed membership agreements, and any amendments reflecting changes in the LLC structure. Including clear voting procedures and profit distribution methods ensures a well-organized and legally sound Operating Agreement.

Key Provisions and Clauses to Include

What documents are necessary for an LLC Operating Agreement? The primary document is the Operating Agreement itself, which outlines the ownership structure, management roles, and operational procedures of the LLC. Key provisions include member contributions, profit and loss distribution, voting rights, and procedures for adding or removing members.

Which clauses are essential to include in an LLC Operating Agreement? Important clauses cover decision-making authority, member duties, dispute resolution mechanisms, and procedures for dissolution or exit strategies. Incorporating confidentiality, indemnification, and amendment procedures ensures legal clarity and protection for the LLC.

Why should your LLC Operating Agreement detail member responsibilities? Defining each member's roles and obligations prevents misunderstandings and streamlines business operations. Clear terms about capital contributions, management duties, and compensation promote transparency and accountability within the LLC.

Member Rights and Responsibilities

An LLC Operating Agreement defines the essential documents to establish and govern your business. It clarifies member rights and responsibilities to ensure smooth management and legal compliance.

- Member Identification Documents - These include personal identification and ownership percentage details to verify each member's rights within the LLC.

- Roles and Responsibilities Outline - A document specifying each member's duties, decision-making authority, and contribution requirements to the company's operations.

- Profit and Loss Allocation Agreement - This defines how profits and losses are distributed among members, reflecting their ownership stakes and investment agreements.

Management Structure and Voting Procedures

An LLC Operating Agreement requires clear documentation of the management structure to define the roles and responsibilities of members or managers. This section establishes whether the LLC is member-managed or manager-managed, providing clarity on decision-making authority.

Voting procedures must be explicitly detailed, including voting rights, quorum requirements, and the method for resolving tie votes. Proper documentation ensures transparency and smooth operation, preventing disputes among members.

Compliance Requirements and Legal Considerations

Establishing an LLC Operating Agreement requires specific documents to ensure compliance with state laws and proper business governance. These documents typically include the Articles of Organization, member identification, and any existing business licenses.

Your Operating Agreement must address ownership percentages, management structure, and profit distribution to meet legal standards. State-specific compliance requirements may mandate additional filings or disclosures. Ensuring all documents are accurate and complete helps prevent future legal disputes and maintains good standing with regulatory authorities.

Maintaining and Amending the Agreement

An LLC Operating Agreement requires the initial signed document outlining members' roles and ownership percentages. To maintain the Agreement, it is essential to keep accurate records of any business decisions and financial transactions. Amendments must be documented formally, with all members' consent, and appended to the original Agreement to ensure legal compliance and clarity.

What Documents are Necessary for an LLC Operating Agreement? Infographic