Personal loan applications typically require proof of identity, such as a passport or driver's license, and proof of address, like utility bills or rental agreements. Applicants must also provide income verification documents, including salary slips, bank statements, or tax returns, to demonstrate repayment ability. Some lenders may request additional paperwork, such as employment letters or credit reports, to assess creditworthiness and finalize the loan approval process.

What Documents are Required for Personal Loan Applications?

| Number | Name | Description |

|---|---|---|

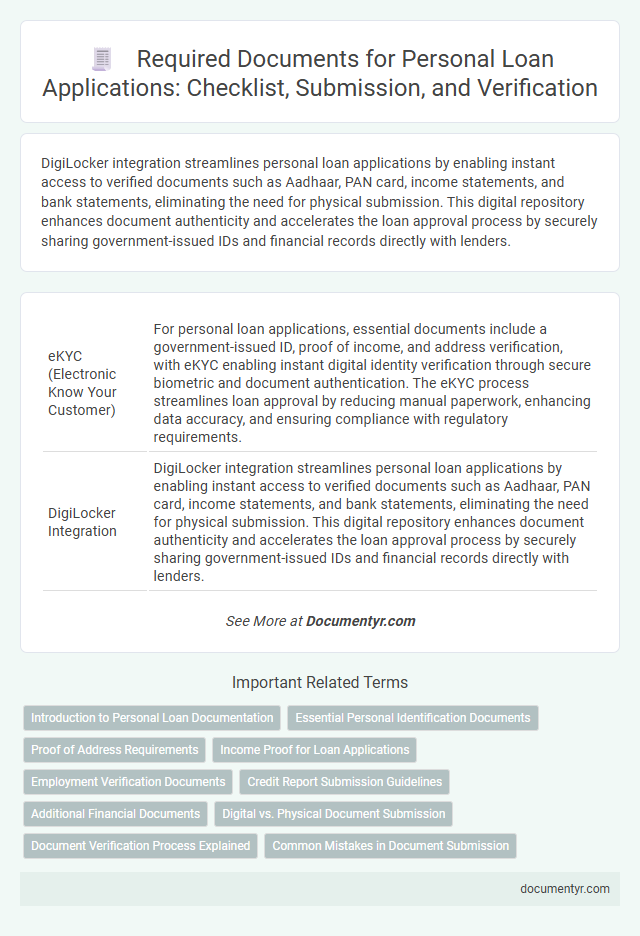

| 1 | eKYC (Electronic Know Your Customer) | For personal loan applications, essential documents include a government-issued ID, proof of income, and address verification, with eKYC enabling instant digital identity verification through secure biometric and document authentication. The eKYC process streamlines loan approval by reducing manual paperwork, enhancing data accuracy, and ensuring compliance with regulatory requirements. |

| 2 | DigiLocker Integration | DigiLocker integration streamlines personal loan applications by enabling instant access to verified documents such as Aadhaar, PAN card, income statements, and bank statements, eliminating the need for physical submission. This digital repository enhances document authenticity and accelerates the loan approval process by securely sharing government-issued IDs and financial records directly with lenders. |

| 3 | Income Sources Declaration | Income source declaration requires submission of recent salary slips, bank statements, and income tax returns to verify financial stability and repayment capacity. Self-employed applicants must provide business financial statements, profit and loss accounts, and GST returns to substantiate declared income. |

| 4 | Digital Bank Statement Fetching | Personal loan applications require essential documents such as identity proof, address proof, income statements, and bank statements, with digital bank statement fetching becoming increasingly critical for expedited verification. Digital bank statement fetching enables automatic retrieval of transaction history directly from financial institutions, enhancing accuracy and reducing application processing time compared to manual submissions. |

| 5 | Consent-Based Data Sharing | Personal loan applications require consent-based data sharing documents such as identity proof, address proof, income statements, and a signed consent form authorizing the lender to access credit history and financial information from credit bureaus. This process ensures secure and compliant verification while enabling faster loan processing through authorized data sharing channels. |

| 6 | Soft Bureau Pull Report | A Soft Bureau Pull Report for personal loan applications includes essential documents such as proof of identity, recent pay stubs, bank statements, and a credit report obtained without impacting the applicant's credit score. This non-intrusive credit inquiry helps lenders assess creditworthiness while allowing applicants to check loan eligibility discreetly. |

| 7 | e-Signature Authentication | Personal loan applications require identity proof, address verification, income statements, and bank statements, with e-Signature authentication enhancing security and streamlining the verification process. This digital method ensures faster approval by enabling secure, legally binding signatures without physical documentation. |

| 8 | Video-based Verification | Video-based verification for personal loan applications requires a valid government-issued ID, proof of income such as salary slips or bank statements, and a recent photograph or live video selfie for identity confirmation, ensuring real-time authentication. Lenders may also request utility bills or address proof documents during the video call to validate the applicant's residential address effectively. |

| 9 | Alternate Credit Scoring Documents | Alternate credit scoring documents for personal loan applications include bank statements, utility bill payments, rental payment history, and employment verification letters, which help assess creditworthiness beyond traditional credit scores. These documents provide lenders with additional financial behavior insights, particularly for applicants with limited or no formal credit history. |

| 10 | Automated Document Scrubbing | Automated document scrubbing significantly improves the accuracy and efficiency of processing essential personal loan application documents such as identity proof, income statements, address verification, and credit reports. By leveraging AI-driven technology, financial institutions can quickly validate, extract, and verify critical data points, reducing manual errors and expediting loan approval workflows. |

Introduction to Personal Loan Documentation

Applying for a personal loan requires submitting specific documents to verify identity, income, and creditworthiness. Proper documentation streamlines the approval process and ensures compliance with lender requirements.

- Proof of Identity - Valid government-issued ID such as a passport or driver's license confirms the applicant's identity.

- Income Verification - Recent salary slips, income tax returns, or bank statements demonstrate the borrower's ability to repay the loan.

- Address Proof - Utility bills, rental agreements, or official correspondence establish the applicant's residential address.

Providing accurate and complete documents increases the likelihood of personal loan approval and expedites processing times.

Essential Personal Identification Documents

Applying for a personal loan requires submitting specific identification documents to verify your identity and eligibility. Proper documentation ensures a smooth loan approval process.

- Government-issued ID - A valid passport, driver's license, or national ID card is necessary to confirm your identity.

- Proof of Address - Utility bills, rental agreements, or bank statements showing your current residential address are commonly accepted.

- Social Security Number (SSN) or Tax Identification Number - This is required for credit verification and background checks by the lender.

Proof of Address Requirements

Proof of address is a critical requirement for personal loan applications, serving to verify your residence and maintain security. Acceptable documents often include utility bills, bank statements, rental agreements, government-issued IDs with address details, and recent official correspondence. Lenders typically require documents dated within the last three months to ensure accuracy and relevance.

Income Proof for Loan Applications

Income proof is a crucial document for personal loan applications, serving as evidence of your repayment capability. Commonly accepted income proofs include salary slips, bank statements, income tax returns, and Form 16. Providing accurate and updated income documents can significantly improve the chances of loan approval.

Employment Verification Documents

Employment verification documents are essential for personal loan applications as they confirm the applicant's current job status and income stability. Lenders use these documents to assess the risk and repayment ability of the borrower.

- Recent Pay Stubs - Provide proof of steady income by showing salary details over the past few months.

- Employment Verification Letter - A formal letter from the employer confirming the applicant's job title, duration, and salary.

- Tax Returns or W-2 Forms - Historical income records that offer a comprehensive view of annual earnings and employment consistency.

Credit Report Submission Guidelines

| Document Type | Description | Credit Report Submission Guidelines |

|---|---|---|

| Credit Report | Official credit report issued by recognized credit bureaus such as Experian, Equifax, or TransUnion. | The credit report must be recent, typically issued within the last 30 to 60 days. It should accurately reflect the applicant's credit history, including current balances, payment history, and credit inquiries. Submission must be in an electronic format (PDF preferred) or original physical copy. Reports obtained directly from bureaus or authorized third-party agencies are accepted. Personal loans require a clear and comprehensive credit report for proper risk assessment. |

| Identity Proof | Government-issued identification such as passport, driver's license, or national ID card. | Not related to credit report but required alongside documentation for loan verification. |

| Income Proof | Recent pay slips, bank statements, or tax returns to establish income stability. | Income documents help validate repayment capacity but are separate from credit report submission. |

| Address Proof | Recent utility bills, rental agreements, or official correspondence showing current residence. | Address proof is submitted independently; it does not influence the credit report evaluation process. |

Additional Financial Documents

What additional financial documents are required for personal loan applications? Lenders typically request documents beyond basic identification and income proof to assess the applicant's financial stability. These include bank statements, tax returns, and credit reports to provide a comprehensive financial profile.

Digital vs. Physical Document Submission

Personal loan applications require specific documents to verify identity, income, and address. Commonly requested documents include government-issued ID, proof of income, bank statements, and address proof.

Digital document submission offers convenience and faster processing by allowing you to upload scanned copies or photos online. Physical document submission may require in-person visits, causing delays and additional effort in handling paper files.

Document Verification Process Explained

Loan applications require specific documents to verify identity, income, and creditworthiness. Key documents include a government-issued ID, income proof, address proof, and bank statements.

The document verification process involves checking the authenticity of your submitted papers against official records. Lenders assess these documents to minimize risk and ensure you meet eligibility criteria.

What Documents are Required for Personal Loan Applications? Infographic