To open a bank account, a business must provide essential documents including a government-issued identification, proof of business registration such as articles of incorporation or a business license, and an Employer Identification Number (EIN) or tax ID. Banks often require a partnership agreement or operating agreement if applicable, alongside a resolution authorizing the account opening for corporations. Ensuring these documents are complete and accurate facilitates a smooth account setup and compliance with banking regulations.

What Documents Does a Business Need to Open a Bank Account?

| Number | Name | Description |

|---|---|---|

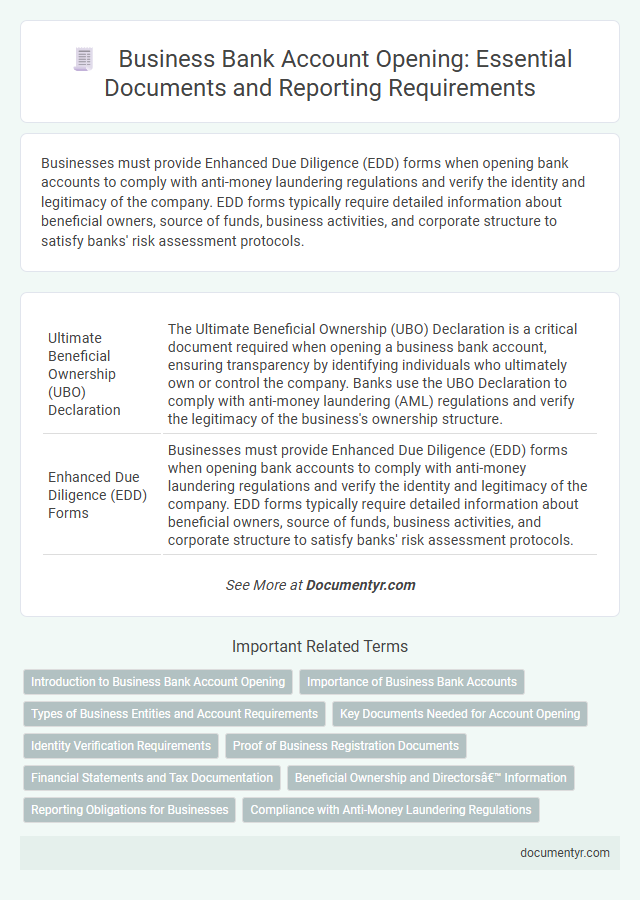

| 1 | Ultimate Beneficial Ownership (UBO) Declaration | The Ultimate Beneficial Ownership (UBO) Declaration is a critical document required when opening a business bank account, ensuring transparency by identifying individuals who ultimately own or control the company. Banks use the UBO Declaration to comply with anti-money laundering (AML) regulations and verify the legitimacy of the business's ownership structure. |

| 2 | Enhanced Due Diligence (EDD) Forms | Businesses must provide Enhanced Due Diligence (EDD) forms when opening bank accounts to comply with anti-money laundering regulations and verify the identity and legitimacy of the company. EDD forms typically require detailed information about beneficial owners, source of funds, business activities, and corporate structure to satisfy banks' risk assessment protocols. |

| 3 | FATCA Self-Certification | Businesses opening a bank account must provide various documents, including identification, proof of address, and incorporation papers, alongside a FATCA Self-Certification form to comply with the Foreign Account Tax Compliance Act. The FATCA Self-Certification verifies the business's U.S. tax status to ensure proper reporting and withholding of taxes on U.S. source income. |

| 4 | Corporate Structure Chart | A Corporate Structure Chart is essential to demonstrate the ownership and management hierarchy of the business when opening a bank account. This document clarifies roles and decision-making authority, ensuring compliance with the bank's verification and due diligence requirements. |

| 5 | Certificate of Incumbency | A Certificate of Incumbency is a critical document required by banks to verify the identities of a company's officers authorized to open and manage the account. This certificate typically includes names, titles, and signatures, ensuring the bank conducts secure and compliant transactions with the correct representatives. |

| 6 | Proof of Trading Address | A business must provide a valid proof of trading address such as recent utility bills, lease agreements, or official correspondence dated within the last three months to open a bank account. Banks require these documents to verify the business's physical location and ensure compliance with regulatory standards. |

| 7 | Memorandum and Articles of Association | The Memorandum and Articles of Association are essential documents required for opening a business bank account, as they define the company's constitution and governance framework. Banks rely on these documents to verify the company's legal status, shareholder structure, and operational guidelines, ensuring compliance with regulatory requirements. |

| 8 | Board Resolution for Bank Account Opening | A Board Resolution for Bank Account Opening is a formal document authorized by a company's board of directors that specifies the approval to open and operate a bank account on behalf of the business. This resolution typically includes details such as the bank's name, account signatories, authorized transaction limits, and is essential for complying with banking regulations and verifying corporate authority during the account opening process. |

| 9 | Digital Identity Verification Document | To open a business bank account, digital identity verification documents such as scanned government-issued IDs, passport photos, and proof of address files are essential for online authentication processes. Banks increasingly rely on biometric data and encrypted digital signatures to securely verify the business owner's identity and prevent fraud. |

| 10 | Authorized Signatory List | A business must provide an Authorized Signatory List when opening a bank account to specify individuals permitted to operate the account on behalf of the company. This document ensures clear identification of authorized personnel, reducing risks of unauthorized access and streamlining transaction approvals. |

Introduction to Business Bank Account Opening

Opening a business bank account is a crucial step for managing your company's finances efficiently. It separates personal and business transactions, ensuring clear financial records.

To open a business bank account, you need specific documents that verify your business identity and compliance. These documents help the bank assess your business's legitimacy and banking needs.

Importance of Business Bank Accounts

Opening a business bank account requires submitting key documents such as your business license, Employer Identification Number (EIN), and formation documents like articles of incorporation or a partnership agreement. These documents verify your business's legal status and identity, ensuring compliance with banking regulations. Maintaining a dedicated business bank account is crucial for separating personal and business finances, simplifying tax reporting, and enhancing your company's credibility with clients and lenders.

Types of Business Entities and Account Requirements

Opening a bank account for a business requires specific documents that vary based on the type of business entity. Banks enforce strict account requirements to ensure legal compliance and proper identification.

- Sole Proprietorship - Requires a Social Security Number, a government-issued ID, and a business license or DBA (Doing Business As) certificate.

- Partnership - Needs a partnership agreement, EIN (Employer Identification Number), and personal identification for all partners.

- Corporation or LLC - Must provide Articles of Incorporation or Organization, EIN, corporate resolutions authorizing the account, and identification for authorized signers.

Understanding the specific documentation for each business entity streamlines the process of opening a bank account effectively.

Key Documents Needed for Account Opening

What key documents does a business need to open a bank account? Essential documents include proof of business registration, identification of business owners, and tax identification numbers. Banks require these documents to verify legitimacy and comply with regulatory standards.

Identity Verification Requirements

To open a bank account, businesses must provide valid identity verification documents to comply with regulatory requirements. Commonly required documents include government-issued photo IDs such as passports or driver's licenses for all authorized signers. Banks may also request an Employer Identification Number (EIN) and proof of business registration to verify the entity's legitimacy.

Proof of Business Registration Documents

Opening a bank account for your business requires specific documentation to verify its legitimacy. Among the most critical documents are proof of business registration documents.

Proof of business registration confirms that your business is officially recognized by the relevant government authorities. Common examples include a business license, certificate of incorporation, or registration certificate from local or state agencies. These documents establish your entity's legal status, which banks use to comply with regulatory requirements and assess account eligibility.

Financial Statements and Tax Documentation

To open a business bank account, financial statements such as balance sheets and income statements are essential. These documents provide the bank with a clear picture of the company's financial health and stability.

Tax documentation, including recent tax returns and employer identification numbers (EIN), is also required. These papers verify the legitimacy of the business and ensure compliance with regulatory standards.

Beneficial Ownership and Directors’ Information

| Document Type | Description | Purpose |

|---|---|---|

| Beneficial Ownership Information | Details identifying individuals who ultimately own or control the business. This includes full names, dates of birth, nationality, and ownership percentages. | Used by banks to comply with anti-money laundering (AML) regulations and verify the true owners behind the account. |

| Directors' Information | Official documentation listing all current directors of the company. Includes names, addresses, dates of birth, and identification documents like passports or driver's licenses. | Enables banks to verify authorized signatories and assess senior management in the context of risk and compliance requirements. |

Reporting Obligations for Businesses

Opening a bank account requires businesses to submit specific documents to comply with regulatory and reporting obligations. These documents ensure the bank verifies the business identity and legal status accurately.

- Business Registration Documents - Proof of business existence such as articles of incorporation or a business registration certificate is mandatory to establish legitimacy.

- Tax Identification Number (TIN) - Providing a valid TIN ensures the business complies with tax reporting and filing requirements.

- Identification of Authorized Signatories - Banks require government-issued IDs of owners or authorized representatives to verify responsible parties for account management.

What Documents Does a Business Need to Open a Bank Account? Infographic