Loan forgiveness applications require several essential documents, including the completed loan forgiveness form, payroll records verifying employee salaries and hours worked during the covered period, and documentation of eligible non-payroll expenses such as rent, utilities, and mortgage interest payments. Borrowers must also submit copies of their loan agreements and payment schedules to confirm loan eligibility and amounts. Accurate and thorough documentation is crucial to ensure a smooth review process and maximize the chances of full loan forgiveness.

What Documents Are Needed for Loan Forgiveness Applications?

| Number | Name | Description |

|---|---|---|

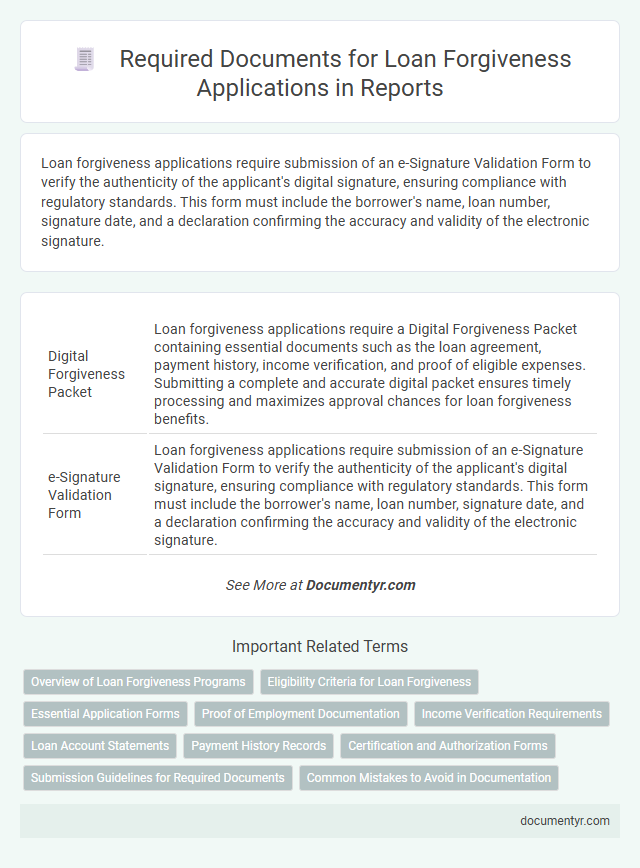

| 1 | Digital Forgiveness Packet | Loan forgiveness applications require a Digital Forgiveness Packet containing essential documents such as the loan agreement, payment history, income verification, and proof of eligible expenses. Submitting a complete and accurate digital packet ensures timely processing and maximizes approval chances for loan forgiveness benefits. |

| 2 | e-Signature Validation Form | Loan forgiveness applications require submission of an e-Signature Validation Form to verify the authenticity of the applicant's digital signature, ensuring compliance with regulatory standards. This form must include the borrower's name, loan number, signature date, and a declaration confirming the accuracy and validity of the electronic signature. |

| 3 | Payroll Cost Documentation Ledger | Payroll Cost Documentation Ledger must include detailed records of employee wages, hours worked, and benefits paid during the covered period to substantiate payroll expenses for loan forgiveness applications. Accurate documentation should align with bank statements and tax filings such as IRS Form 941 to ensure compliance and approval. |

| 4 | Safe Harbor Attestation | Loan forgiveness applications require submission of a Safe Harbor Attestation form, confirming compliance with eligibility criteria to prevent PPP loan misuse. Supporting documents include payroll records, tax filings, and proof of eligible expenses, ensuring the attestation accurately reflects loan usage under Safe Harbor provisions. |

| 5 | Covered Period Certification | Loan forgiveness applications require accurate Covered Period Certification documentation, including payroll records, bank statements, and receipts verifying expenses incurred within the designated covered period. Supporting documents must align with the specific dates and criteria outlined by the Small Business Administration to ensure eligibility and maximize forgiveness amounts. |

| 6 | Alternative Payroll Covered Report | Alternative Payroll Covered Reports require detailed documentation including alternative payroll records such as timesheets, payment vouchers, and bank statements to verify employee compensation and hours worked. Supporting documents like tax forms (IRS Form 941 or equivalent) and proof of payment ensure compliance and accuracy in loan forgiveness applications. |

| 7 | FTE (Full-Time Equivalent) Reconciliation Sheet | The Full-Time Equivalent (FTE) Reconciliation Sheet is essential for loan forgiveness applications, serving as a detailed record of employee hours used to calculate FTE reductions during the covered period. Accurate completion of this document substantiates payroll-related forgiveness claims, ensuring compliance with lender and SBA requirements. |

| 8 | Forgiveness Supporting Schedule | The Forgiveness Supporting Schedule requires detailed documentation such as payroll records, tax forms (Form 941), and proof of eligible expenses related to rent, utilities, and mortgage interest payments. Accurate submission of these documents ensures proper calculation and validation of loan forgiveness amounts under the Paycheck Protection Program (PPP) guidelines. |

| 9 | Nonpayroll Expense Tracker | Accurate Nonpayroll Expense Tracker records are essential for loan forgiveness applications, including documentation of mortgage interest payments, rent, utilities, and eligible operational costs incurred during the covered period. Supporting documents must include invoices, receipts, and canceled checks to verify nonpayroll expenses and ensure compliance with SBA loan forgiveness requirements. |

| 10 | Borrower Demographic Disclosure | Borrower Demographic Disclosure requires submitting documentation such as self-reported demographic information forms, including race, ethnicity, and gender data, to comply with Equal Credit Opportunity Act (ECOA) requirements. Lenders typically collect and retain this information through standardized forms like the Borrower Demographic Information form or the Uniform Residential Loan Application (Form 1003) to support loan forgiveness applications. |

Overview of Loan Forgiveness Programs

Loan forgiveness programs require specific documents to verify eligibility and application accuracy. Understanding these requirements helps streamline the application process and improves approval chances.

- Proof of Employment - Documentation such as pay stubs or employer certification confirms qualifying employment periods.

- Loan Account Statements - Official loan statements from the lender verify outstanding balances and payment history.

- Financial Documentation - Tax returns or income statements demonstrate financial status relevant to income-driven repayment forgiveness.

Eligibility Criteria for Loan Forgiveness

Loan forgiveness applications require specific documents to verify eligibility criteria accurately. These documents ensure that applicants meet the necessary conditions for loan forgiveness programs.

Eligibility criteria often include proof of employment in qualifying sectors, documentation of loan disbursement, and evidence of timely payments. You must provide income statements, tax returns, and certification forms as required by the loan servicer or government program. Detailed records help confirm compliance with program requirements and expedite the review process.

Essential Application Forms

Loan forgiveness applications require specific essential forms to ensure accurate processing. These documents verify eligibility and substantiate loan usage.

The primary forms include the official loan forgiveness application and supporting financial statements. You must also provide payroll documentation and proof of expenses related to the loan terms.

Proof of Employment Documentation

Proof of employment documentation is essential for loan forgiveness applications to verify that loan proceeds were used for eligible payroll expenses. Acceptable documents include payroll reports, tax forms such as IRS Form 941, and bank statements showing payroll transactions.

Employers must provide clear evidence of employee compensation during the covered period to qualify for forgiveness. Detailed timesheets, employee wage reports, and records of salary payments support the application and reduce the risk of denial.

Income Verification Requirements

Loan forgiveness applications require specific documents to verify your income accurately. Common income verification documents include recent pay stubs, tax returns, and bank statements that reflect consistent earnings. These documents help ensure eligibility by providing a clear picture of your financial status during the loan period.

Loan Account Statements

What documents are required for loan forgiveness applications? Loan account statements are essential for verifying the amounts disbursed and payments made. These statements provide detailed records that support the accuracy of your loan forgiveness request.

Payment History Records

Payment history records are essential documents for loan forgiveness applications, providing proof of timely loan payments. These records help verify your eligibility and ensure accurate processing of your application.

- Loan Statements - Detailed monthly statements showing payment amounts and dates.

- Bank Statements - Records from your bank confirming payment withdrawals corresponding to loan payments.

- Payment Receipts - Official receipts provided by the lender as evidence of payment.

Submitting comprehensive payment history records supports a smooth loan forgiveness application review.

Certification and Authorization Forms

Loan forgiveness applications require specific documentation to confirm eligibility and authorize the processing of your request. Certification and authorization forms play a crucial role in verifying information and granting permission for review.

- Certification Form - This document verifies the accuracy of the information provided in your loan forgiveness application.

- Authorization Form - Grants lenders and servicers permission to access necessary financial and employment data.

- Signed Declarations - Confirms your understanding and agreement to the loan forgiveness program terms.

Submission Guidelines for Required Documents

| Document Type | Purpose | Submission Guidelines |

|---|---|---|

| Loan Forgiveness Application Form | Primary form to request loan forgiveness | Submit the completed and signed form in PDF format through the official loan servicer portal. |

| Payroll Documentation | Proof of employee salaries and wages during the covered period | Include pay stubs, bank statements, or IRS Form 941. Documents must be clear, recent, and correspond to the loan covered period. |

| Proof of Eligible Expenses | Verification of allowable costs such as rent, utilities, and mortgage interest | Attach receipts, contracts, or invoices. Ensure all documents are dated within the loan forgiveness timeframe. |

| Certification and Attestation | Confirmation that information provided is accurate and true | Sign the certification section on the application form. Electronic or handwritten signatures are accepted. |

| Additional Supporting Documents | Optional documents that may strengthen the application | Submit scanned copies through the online portal, clearly labeled and organized by document type and date. |

What Documents Are Needed for Loan Forgiveness Applications? Infographic