Submitting the FAFSA requires key documents including your Social Security Number, federal income tax returns, W-2 forms, and records of any untaxed income. Students also need to provide their driver's license if applicable and bank statements to verify assets. Accurate information from these documents ensures timely and correct processing of financial aid.

What Documents Are Required for College Financial Aid (FAFSA) Submission?

| Number | Name | Description |

|---|---|---|

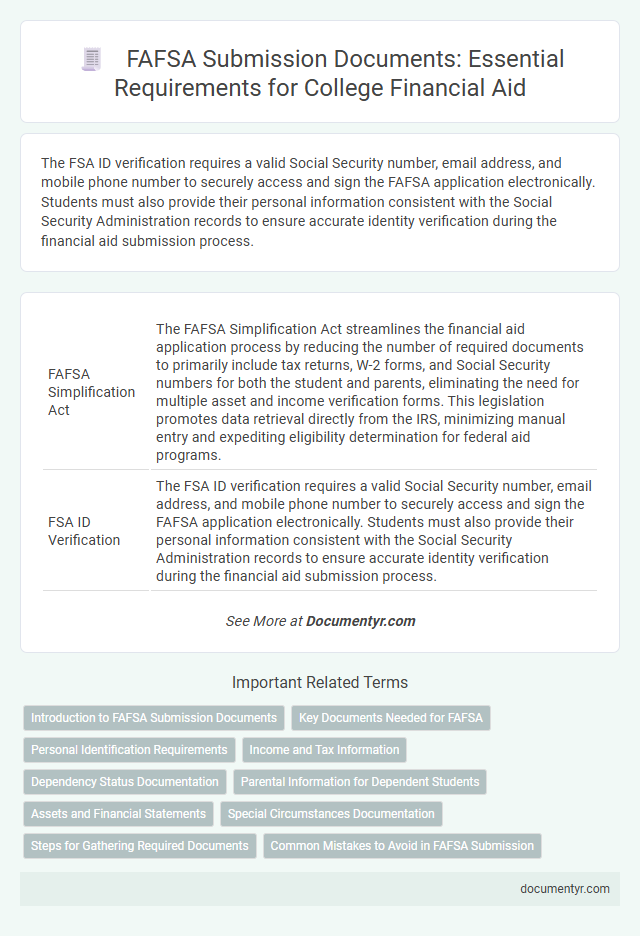

| 1 | FAFSA Simplification Act | The FAFSA Simplification Act streamlines the financial aid application process by reducing the number of required documents to primarily include tax returns, W-2 forms, and Social Security numbers for both the student and parents, eliminating the need for multiple asset and income verification forms. This legislation promotes data retrieval directly from the IRS, minimizing manual entry and expediting eligibility determination for federal aid programs. |

| 2 | FSA ID Verification | The FSA ID verification requires a valid Social Security number, email address, and mobile phone number to securely access and sign the FAFSA application electronically. Students must also provide their personal information consistent with the Social Security Administration records to ensure accurate identity verification during the financial aid submission process. |

| 3 | IRS Data Retrieval Tool (DRT) | The IRS Data Retrieval Tool (DRT) enables applicants to directly import accurate tax return information into the FAFSA, reducing errors and speeding up the verification process. Essential documents for FAFSA submission include the most recent federal tax returns, W-2 forms, and records of untaxed income, which the DRT securely accesses to streamline financial aid applications. |

| 4 | Parent Contributor Information | Parent contributor information for FAFSA submission requires accurate details from recent tax returns, including IRS Form 1040, W-2 forms, and records of untaxed income. Additional documentation such as Social Security numbers, marriage certificates, and proof of household size may also be necessary to verify eligibility and calculate the Expected Family Contribution (EFC). |

| 5 | Asset Protection Allowance | To accurately calculate the Asset Protection Allowance for FAFSA submission, applicants must provide detailed documentation of all assets including bank statements, investment account summaries, and real estate valuations. These documents ensure precise assessment of resources that are exempt from being counted toward the Expected Family Contribution. |

| 6 | Selective Service Registration Requirement | Selective Service registration is mandatory for male applicants aged 18 to 25 submitting the FAFSA for college financial aid, as verification ensures eligibility. Proof of registration or a valid exemption document must be presented to fulfill this federal requirement. |

| 7 | Student Aid Index (SAI) | To accurately calculate the Student Aid Index (SAI) for FAFSA submission, applicants must provide essential documents including their prior-prior year tax returns, W-2 forms, and records of untaxed income such as child support or veteran benefits. These documents enable precise assessment of financial need, ensuring appropriate allocation of federal, state, and institutional aid based on the SAI score. |

| 8 | SAR (Student Aid Report) Corrections | The Student Aid Report (SAR) is essential for verifying the accuracy of FAFSA data, highlighting the need for prompt corrections to ensure eligibility for college financial aid. Key documents for SAR corrections include your original FAFSA confirmation, a valid Social Security number, federal tax returns, W-2 forms, and any necessary documentation supporting income or dependency status changes. |

| 9 | Dependency Override Documentation | Dependency override documentation for FAFSA submission typically includes a letter from a school financial aid administrator explaining the unusual circumstances preventing students from obtaining parental information, along with supporting documents like court orders, police reports, or letters from social workers or counselors. These documents must clearly demonstrate the student's independence due to situations such as abuse, abandonment, or other severe family disruptions. |

| 10 | Prior-Prior Year (PPY) Tax Information | College financial aid submission through FAFSA requires Prior-Prior Year (PPY) tax information, including IRS tax return transcripts or tax return documents for the designated PPY to verify income and tax details. Accurate PPY documentation, such as W-2 forms and proof of untaxed income, is essential for timely and correct financial aid eligibility assessment. |

Introduction to FAFSA Submission Documents

Submitting the Free Application for Federal Student Aid (FAFSA) requires specific documents to ensure accurate financial assessment. Key documents include tax returns, Social Security numbers, and income records for both the student and parents. Gathering these materials beforehand streamlines the application process and maximizes potential aid eligibility.

Key Documents Needed for FAFSA

Submitting the Free Application for Federal Student Aid (FAFSA) requires several key documents to ensure an accurate financial aid assessment. These documents provide the necessary financial and personal information needed to determine eligibility for federal and state aid programs.

Essential documents include your Social Security number, driver's license (if applicable), and prior year federal income tax returns, W-2 forms, and other records of money earned. Additional documents such as untaxed income records, current bank statements, and records of investments may be required. Having these ready streamlines the FAFSA application process and helps secure the maximum financial aid available.

Personal Identification Requirements

Submitting a Free Application for Federal Student Aid (FAFSA) requires specific personal identification documents to verify the applicant's identity. These documents ensure the accuracy and legitimacy of the financial aid request.

Key personal identification documents include a valid Social Security card, a U.S. driver's license, or a state-issued ID card. Additionally, applicants must provide their Alien Registration Number if they are not U.S. citizens.

Income and Tax Information

Income and tax information are essential documents for FAFSA submission to determine eligibility for college financial aid. Required documents include federal tax returns, W-2 forms, and records of untaxed income such as Social Security benefits or child support. You must provide accurate and complete income data to ensure proper evaluation of financial need.

Dependency Status Documentation

What documents are required to prove dependency status for FAFSA submission? Dependency status impacts the type and amount of financial aid a student may receive. Students must provide specific documentation to verify their dependency status accurately.

Which forms establish an independent student status for FAFSA? Documents such as a valid military ID, court orders, or proof of marriage can demonstrate independent status. Dependency overrides may require additional documentation like a letter from a social worker or a court-appointed guardian.

How should a student document parental information if classified as dependent? FAFSA requires parental tax returns, W-2 forms, and other income verification documents. Accurate parental financial records are crucial for eligibility assessment.

What is needed if a student cannot provide parental information due to special circumstances? The student may submit a Dependency Override Appeal accompanied by professional documentation such as a counselor's statement. Social worker or legal documents can support this exception.

Why is accurate dependency documentation important for FAFSA submission? It ensures the financial aid office assesses eligibility correctly and allocates resources efficiently. Missing or incorrect documents can delay application processing and impact aid eligibility.

Parental Information for Dependent Students

Submitting the FAFSA form for college financial aid requires specific parental documents for dependent students. These documents ensure accurate evaluation of financial need and eligibility.

- Parental Tax Returns - Provide detailed income information necessary for determining the Expected Family Contribution (EFC).

- W-2 Forms - Verify earned income from employers within the previous tax year.

- Asset Records - Include bank statements, investment accounts, and property valuations to assess family financial resources.

Gathering these essential parental documents streamlines the FAFSA submission and maximizes your potential financial aid package.

Assets and Financial Statements

Submitting the Free Application for Federal Student Aid (FAFSA) requires accurate documentation of assets and financial statements. These documents help determine eligibility for federal and state financial aid programs.

Essential documents include recent bank statements, investment account summaries, and records of business or farm assets. Tax returns and W-2 forms also provide crucial financial information to complete the FAFSA accurately.

Special Circumstances Documentation

| Document Type | Description | Purpose |

|---|---|---|

| Special Circumstances Form | Official form provided by the financial aid office explaining unique family or financial situations. | Allows the college to adjust financial aid eligibility beyond standard FAFSA data. |

| Proof of Income Change | Recent pay stubs, termination letters, or unemployment benefits statements. | Documents reduced income due to job loss, reduced hours, or other financial hardships. |

| Medical Expense Documentation | Receipts, bills, or statements from healthcare providers outlining medical costs not covered by insurance. | Demonstrates high unreimbursed medical expenses affecting financial capacity. |

| Divorce or Separation Papers | Legal documents confirming divorce, separation, or changes in custody arrangements. | Reflects family structure changes that influence FAFSA's dependency status and financial data. |

| Death Certificate | Official death certificate of a parent or spouse. | Validates loss of income or change in household composition impacting financial aid evaluation. |

| Disability Documentation | Medical or legal certification of disability affecting earning ability. | Supports consideration of reduced financial resources due to disability. |

Special circumstances require submission of specific documentation to ensure accurate assessment of Your financial aid eligibility during FAFSA processing.

Steps for Gathering Required Documents

Submitting the Free Application for Federal Student Aid (FAFSA) requires specific financial and identification documents. Gathering these materials in advance streamlines the application process and ensures accurate information.

- Social Security Number - Verify your Social Security number for identity confirmation and eligibility verification.

- Federal Income Tax Returns - Collect relevant tax returns such as IRS Form 1040 to report income details accurately.

- Untaxed Income Records - Gather documentation of untaxed income like child support or veteran's benefits to provide a complete financial picture.

What Documents Are Required for College Financial Aid (FAFSA) Submission? Infographic