Landlords require several key documents to conduct thorough tenant background screenings, including government-issued identification, rental application forms, and consent for background and credit checks. Verification of employment and income statements helps assess the tenant's financial stability. Gathering previous landlord references ensures a comprehensive evaluation of the applicant's rental history and reliability.

What Documents Does a Landlord Need for Tenant Background Screening?

| Number | Name | Description |

|---|---|---|

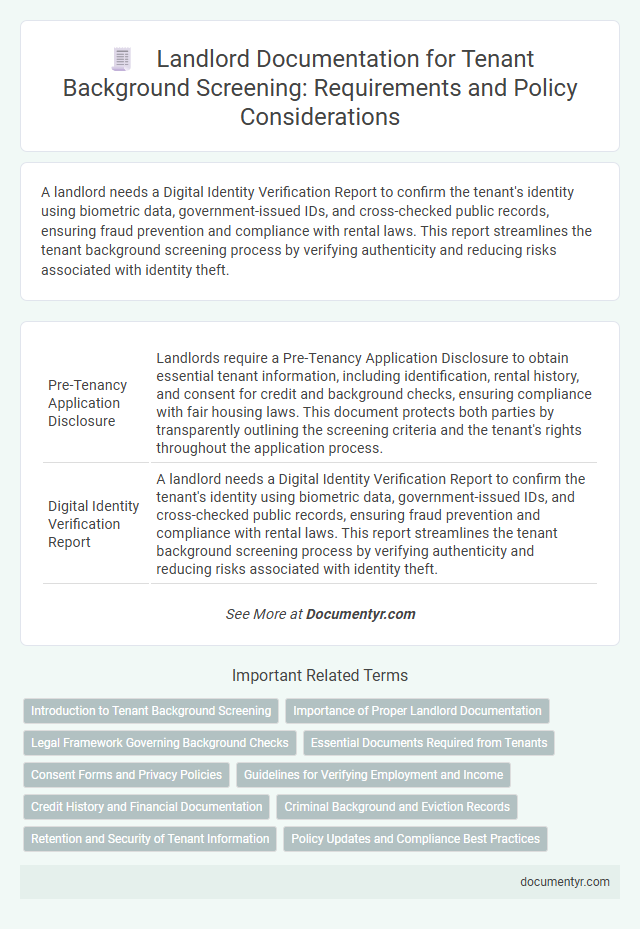

| 1 | Pre-Tenancy Application Disclosure | Landlords require a Pre-Tenancy Application Disclosure to obtain essential tenant information, including identification, rental history, and consent for credit and background checks, ensuring compliance with fair housing laws. This document protects both parties by transparently outlining the screening criteria and the tenant's rights throughout the application process. |

| 2 | Digital Identity Verification Report | A landlord needs a Digital Identity Verification Report to confirm the tenant's identity using biometric data, government-issued IDs, and cross-checked public records, ensuring fraud prevention and compliance with rental laws. This report streamlines the tenant background screening process by verifying authenticity and reducing risks associated with identity theft. |

| 3 | Enhanced Rent Payment History Statement | A landlord needs an Enhanced Rent Payment History Statement as a critical document for tenant background screening, providing detailed insights into the applicant's previous rental payment behavior, including timeliness and consistency. This statement helps landlords assess financial reliability and mitigate risks by verifying accurate rent payment records directly from past landlords or payment platforms. |

| 4 | Open Banking Consent Form | Landlords require an Open Banking Consent Form to securely obtain and verify tenants' financial data directly from banking institutions, ensuring accurate background screening. This form authorizes access to transaction histories and financial status, enhancing the reliability of creditworthiness assessments in rental applications. |

| 5 | AI-Powered Fraud Detection Summary | Landlords require government-issued identification, credit reports, and rental history to conduct thorough tenant background screenings, with AI-powered fraud detection tools enhancing accuracy by analyzing document authenticity and identifying suspicious activity. These advanced systems cross-reference multiple databases and employ machine learning algorithms to reduce the risk of identity theft and rental fraud. |

| 6 | Social Media Activity Consent Waiver | A Social Media Activity Consent Waiver allows landlords to legally review a tenant's online presence as part of background screening, ensuring compliance with privacy regulations and fair housing laws. This document protects landlords by obtaining explicit permission to access and evaluate social media profiles, reducing risks of discrimination claims. |

| 7 | Tenant Risk Analytics Certificate | A Tenant Risk Analytics Certificate provides landlords with a detailed report including credit history, criminal background, and eviction records, essential for assessing tenant reliability and minimizing leasing risks. This document integrates data from multiple sources to offer a comprehensive risk profile, enabling informed decision-making in tenant selection. |

| 8 | Real-Time Employment Verification Notice | A Real-Time Employment Verification Notice is essential for landlords during tenant background screening to confirm the applicant's current employment status and income stability promptly. This document helps reduce tenant risk by providing accurate, up-to-date employment verification directly from employers or third-party services. |

| 9 | Anti-Money Laundering (AML) Compliance Check | Landlords conducting tenant background screening must obtain identification documents such as government-issued IDs, proof of address, and financial statements to ensure thorough Anti-Money Laundering (AML) compliance checks. Verifying these documents against AML databases helps detect and prevent potential money laundering risks linked to tenant activities. |

| 10 | Blockchain Lease Validation Record | Landlords require a blockchain lease validation record to securely verify tenant identities and rental history, ensuring the authenticity of documents and reducing fraud risk. This decentralized ledger enhances transparency and immutability for background screening processes, streamlining tenant approval while protecting sensitive information. |

Introduction to Tenant Background Screening

Tenant background screening is a crucial step landlords take to ensure they select reliable and responsible renters. This process helps evaluate the tenant's history and mitigate potential risks before signing a lease agreement.

- Consent Form - Landlords must obtain written permission from tenants to conduct background checks in compliance with legal requirements.

- Identification Documents - Valid government-issued IDs verify the tenant's identity and prevent fraudulent applications.

- Screening Reports - Comprehensive reports include credit history, criminal records, and eviction status to assess tenant suitability.

Importance of Proper Landlord Documentation

Proper landlord documentation is essential for conducting thorough tenant background screenings and ensuring legal compliance. Key documents include the tenant application form, consent for background checks, and a copy of the lease agreement. Having these records organized helps protect your property and supports transparent tenant selection processes.

Legal Framework Governing Background Checks

The legal framework governing tenant background screening is primarily shaped by the Fair Credit Reporting Act (FCRA). This federal law sets strict guidelines for how landlords can obtain and use consumer reports during the tenant screening process.

Landlords must obtain written consent from prospective tenants before conducting background checks. Your compliance with state-specific laws, which may impose additional restrictions, is also essential to ensure lawful screening practices.

Essential Documents Required from Tenants

Landlords must collect specific documents to conduct comprehensive tenant background screenings. These documents verify identity, financial stability, and rental history to ensure a reliable tenant selection process.

- Government-issued ID - Confirms the tenant's legal identity and prevents fraud during the application process.

- Proof of Income - Demonstrates the tenant's ability to pay rent consistently through pay stubs, tax returns, or bank statements.

- Previous Rental References - Provides insight into the tenant's rental behavior and reliability from former landlords.

Your collection of these essential documents helps protect your property and maintain a secure rental environment.

Consent Forms and Privacy Policies

| Document Type | Purpose | Key Elements | Importance in Tenant Screening |

|---|---|---|---|

| Consent Form | Authorizes landlord to collect tenant's personal and credit information | Tenant's signature, full disclosure of screening process, scope of information accessed, date of consent | Ensures legal compliance by obtaining explicit permission before accessing sensitive information, protecting tenant rights |

| Privacy Policy | Explains how tenant information will be collected, used, stored, and protected | Details on data handling, third-party sharing policies, retention period, tenant rights under applicable laws | Builds trust and meets regulatory requirements for data protection, clarifying how your tenant's data is managed during screening |

Guidelines for Verifying Employment and Income

Landlords require specific documents to verify a tenant's employment and income during background screening. Commonly accepted documents include recent pay stubs, employment verification letters, and bank statements showing consistent income deposits. These materials help landlords assess the tenant's financial stability and ability to meet rent obligations reliably.

Credit History and Financial Documentation

Landlords require specific documents to perform a thorough tenant background screening, focusing on credit history and financial documentation. These materials help assess a tenant's ability to meet rental obligations consistently.

Credit reports provide detailed insights into a tenant's financial behavior, including payment history and outstanding debts. Financial documentation such as pay stubs, bank statements, or tax returns verifies income stability and supports the credit evaluation process for your rental property.

Criminal Background and Eviction Records

What documents does a landlord need for tenant background screening? Landlords require specific documents to verify criminal background and eviction records accurately. These documents help ensure a thorough assessment of a tenant's rental history and legal standing.

Is a criminal background check necessary for tenant screening? A criminal background check is essential to identify any past legal issues that could affect rental safety. Landlords typically use official criminal record reports from authorized agencies to obtain accurate information.

Which eviction records should landlords review during tenant screening? Landlords need access to court-ordered eviction judgments and rental history reports. These records reveal any prior evictions that could indicate potential risks or non-compliance with lease agreements.

How can landlords obtain reliable criminal and eviction records? Official databases and tenant screening services provide authenticated reports for landlords. These sources ensure that landlords receive updated and legally compliant documentation for tenant evaluation.

What role do consent forms play in tenant background screening? Landlords must secure signed consent forms from prospective tenants before accessing criminal and eviction records. This legal requirement protects tenant privacy and ensures adherence to fair housing policies.

Retention and Security of Tenant Information

Landlords must retain tenant background screening documents securely to comply with privacy regulations and prevent unauthorized access. Proper retention policies ensure that sensitive information remains protected throughout the tenancy and after it ends.

Documents such as credit reports, criminal background checks, and rental history should be stored in encrypted digital files or locked physical cabinets. Retention periods typically align with local laws, often requiring landlords to keep records for at least one to three years after tenant screening. You must implement strict access controls to safeguard tenant information from breaches and misuse.

What Documents Does a Landlord Need for Tenant Background Screening? Infographic