To obtain health insurance reimbursement, essential documents include the original medical bills, detailed invoices specifying services provided, and the physician's prescription or referral where applicable. A completed claim form from the insurance provider and proof of payment such as receipts or bank statements are also required. Maintaining copies of all documents ensures smoother processing and quicker reimbursement approval.

What Documents are Necessary for Health Insurance Reimbursement?

| Number | Name | Description |

|---|---|---|

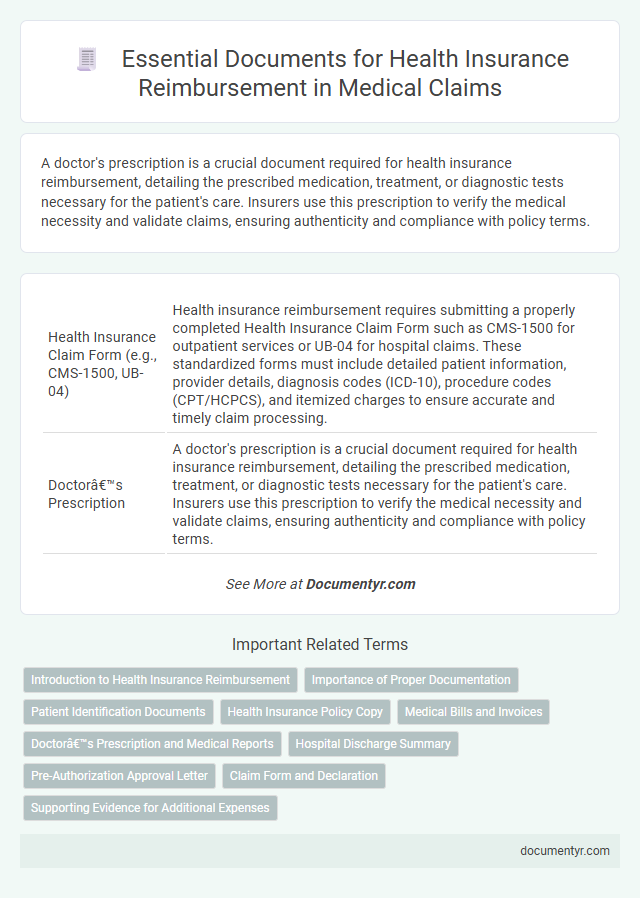

| 1 | Health Insurance Claim Form (e.g., CMS-1500, UB-04) | Health insurance reimbursement requires submitting a properly completed Health Insurance Claim Form such as CMS-1500 for outpatient services or UB-04 for hospital claims. These standardized forms must include detailed patient information, provider details, diagnosis codes (ICD-10), procedure codes (CPT/HCPCS), and itemized charges to ensure accurate and timely claim processing. |

| 2 | Doctor’s Prescription | A doctor's prescription is a crucial document required for health insurance reimbursement, detailing the prescribed medication, treatment, or diagnostic tests necessary for the patient's care. Insurers use this prescription to verify the medical necessity and validate claims, ensuring authenticity and compliance with policy terms. |

| 3 | Hospital Discharge Summary | A Hospital Discharge Summary is essential for health insurance reimbursement as it provides a detailed record of the patient's diagnosis, treatment, procedures performed, and recommendations for follow-up care. This document verifies the medical necessity of hospitalization and supports the claim by outlining the scope and duration of the stay required for recovery. |

| 4 | Diagnostic Test Reports | Diagnostic test reports are essential documents for health insurance reimbursement as they provide verified medical evidence of the diagnosis and treatment required. These reports must be detailed, including the patient's information, test results, dates, and the healthcare provider's credentials to ensure accurate claim processing and approval. |

| 5 | Pharmacy Bills & Receipts | Pharmacy bills and receipts detailing the medication name, dosage, quantity, purchase date, and pharmacy information are essential documents for health insurance reimbursement claims. These documents must be original, itemized, and include valid prescriptions to ensure accurate processing and approval of the claim. |

| 6 | Hospital Bills & Invoices | Hospital bills and invoices are essential documents for health insurance reimbursement, detailing treatment dates, services rendered, itemized charges, and payment receipts. Insurance providers require these documents to verify expenses, assess coverage eligibility, and process claims accurately and promptly. |

| 7 | Payment Receipts | Payment receipts are essential documents for health insurance reimbursement as they provide proof of medical expenses incurred, including detailed information such as the date of service, amount paid, and the healthcare provider's details. Accurate and itemized payment receipts ensure a smooth claims process by verifying eligibility and facilitating prompt reimbursement from the insurance company. |

| 8 | Consultation Notes | Accurate consultation notes, detailing the patient's diagnosis, treatment plan, and physician's recommendations, are essential for health insurance reimbursement claims. These documents must be clearly legible, signed by the attending healthcare provider, and should directly link the medical services provided to the insurance claim. |

| 9 | Pre-authorization Approval (if applicable) | Pre-authorization approval documents are essential for health insurance reimbursement when required by the insurer, serving as proof that the medical service or procedure has been reviewed and authorized in advance. Submitting the pre-authorization approval alongside itemized medical bills, receipts, and the healthcare provider's report ensures compliance and expedites the reimbursement process. |

| 10 | Insurance Policy Copy | A copy of the insurance policy is essential for health insurance reimbursement as it outlines the coverage details, terms, and insured benefits required for claim processing. Submitting the policy copy alongside medical bills and prescriptions ensures verification of eligibility and accelerates the approval of reimbursement claims. |

| 11 | Identity Proof (Patient/Insured) | Identity proof documents essential for health insurance reimbursement typically include government-issued IDs such as a passport, driver's license, or Aadhaar card, confirming the patient's or insured individual's identity. These documents ensure accurate verification of the insured party, facilitating smooth claim processing by insurers and healthcare providers. |

| 12 | Referral Letters (if required) | Referral letters are essential for health insurance reimbursement when treatment requires specialist consultation or diagnostic tests beyond primary care. These documents must be clearly issued by a primary care physician, specifying the medical necessity to ensure claim approval and avoid delays. |

| 13 | Treatment Summary | A detailed treatment summary is essential for health insurance reimbursement, as it provides a comprehensive overview of the medical procedures, medications, and duration of care received. This document must be accurately prepared by the healthcare provider to ensure prompt and successful claim processing. |

| 14 | Attending Physician’s Statement | The Attending Physician's Statement (APS) is crucial for health insurance reimbursement as it provides detailed medical information, including diagnosis, treatment history, and prognosis, which helps insurers verify the claim's validity. Submitting a complete and accurate APS expedites the approval process and reduces the risk of claim denial due to insufficient medical documentation. |

| 15 | Claimant’s Bank Details (Cancelled Cheque/Bank Passbook) | For health insurance reimbursement, submitting the claimant's bank details such as a cancelled cheque or a bank passbook copy is essential to verify account ownership and ensure direct deposit of the claim amount. Accurate bank information minimizes processing delays and facilitates seamless transfer of funds from the insurer to the claimant's account. |

| 16 | Ambulance Bill (if applicable) | For health insurance reimbursement, essential documents include the original ambulance bill detailing the date, time, and medical necessity of the transportation, itemized service charges, and proof of payment if applicable. Supporting medical records, such as hospital admission forms or doctor's prescriptions justifying ambulance use, enhance claim approval chances. |

| 17 | FIR/Medico-Legal Certificate (for accident cases) | For health insurance reimbursement in accident cases, submitting the First Information Report (FIR) and Medico-Legal Certificate (MLC) is essential, as these documents establish the incident's authenticity and provide detailed medical and legal evidence. Insurers rely on the FIR and MLC to assess the claim's validity and ensure comprehensive coverage for treatment related to the accident. |

| 18 | Surgery/Procedure Reports | Surgery and procedure reports are essential documents for health insurance reimbursement as they provide detailed information about the type of surgery performed, the methods used, and the outcomes, which validate the medical necessity of the claim. These reports must be accurate, comprehensive, and signed by the operating physician to ensure timely approval and processing of insurance claims. |

| 19 | Consent Forms (if applicable) | Consent forms are crucial documents for health insurance reimbursement, as they authorize the release of medical information necessary for claim processing. These forms ensure compliance with privacy regulations and facilitate timely review and approval of insurance claims. |

| 20 | Cashless Authorization Letter (if any) | For health insurance reimbursement, a Cashless Authorization Letter is essential when opting for cashless hospitalization, as it pre-approves the insurer's payment directly to the healthcare provider. This document must be submitted along with original medical bills, discharge summary, and diagnostic reports to ensure seamless processing of the claim. |

Introduction to Health Insurance Reimbursement

Health insurance reimbursement allows patients to recover medical expenses from their insurance provider after receiving healthcare services. To ensure a smooth reimbursement process, submitting the correct documents is crucial. Essential documents typically include medical bills, insurance claim forms, and proof of payment.

Importance of Proper Documentation

Proper documentation is crucial for successful health insurance reimbursement claims. Accurate and complete records ensure timely processing and minimize the risk of claim denials.

- Medical Bills and Receipts - Itemized bills from healthcare providers verify the services rendered and their costs.

- Doctor's Prescription and Diagnosis Reports - These documents confirm the medical necessity of treatments and medications.

- Insurance Claim Form - A correctly filled claim form is essential for initiating the reimbursement process with the insurer.

Patient Identification Documents

Patient identification documents are essential for health insurance reimbursement claims. These documents verify the insured individual's identity and help process the claim accurately.

Your health insurance provider typically requires a government-issued ID, such as a passport or driver's license, to confirm your identity. A recent photograph or a health insurance card may also be necessary to match the patient with the policyholder. Ensuring these documents are clear and up to date can expedite the reimbursement process effectively.

Health Insurance Policy Copy

| Document | Description | Importance for Reimbursement |

|---|---|---|

| Health Insurance Policy Copy | A complete and valid copy of the health insurance policy issued by the insurer, detailing coverage, terms, and conditions. | Serves as proof of insurance coverage; essential for verifying eligibility and claim processing. Contains policy number, insured person details, coverage limits, and exclusions. |

| Doctor's Prescription | Official prescription from a licensed medical practitioner recommending medicines or treatment. | Validates the medical necessity of treatment for claim approval. |

| Medical Bills and Receipts | Invoices and payment receipts from hospitals, clinics, or pharmacies. | Proof of expenditure; necessary to claim reimbursement for incurred medical costs. |

| Discharge Summary | A document issued upon hospital discharge summarizing diagnosis, treatment, and follow-up instructions. | Confirms hospitalization details; used to support claims related to inpatient care. |

| Claim Form | Standardized form provided by the insurance company to submit reimbursement requests. | Required for processing claims; must be completed accurately and signed by the claimant. |

| Identity Proof | Government-issued identification such as passport, driver's license, or ID card. | Verifies identity of the insured individual to avoid fraudulent claims. |

| Hospitalization Records | Detailed medical records related to hospital admission including diagnosis reports and treatment details. | Supports claim evidence; substantiates the nature and necessity of medical interventions. |

Medical Bills and Invoices

Medical bills and invoices are essential documents for health insurance reimbursement. They provide detailed information about the treatments, procedures, and services you received.

These documents must include the provider's name, date of service, type of treatment, and the total cost incurred. Submitting accurate and itemized medical bills ensures a smoother claims process with your insurance company.

Doctor’s Prescription and Medical Reports

Health insurance reimbursement requires specific documents to validate your medical expenses. Doctor's prescriptions and detailed medical reports are crucial for claim approval.

- Doctor's Prescription - Provides official authorization for medications and treatments prescribed by your healthcare provider.

- Medical Reports - Offer comprehensive information on diagnosis, treatment procedures, and patient progress from medical professionals.

- Supporting Documentation - Includes test results, hospital bills, and discharge summaries that substantiate the medical necessity and costs.

Submitting accurate and complete documents ensures a smoother health insurance reimbursement process.

Hospital Discharge Summary

What documents are necessary for health insurance reimbursement related to hospital stays? A hospital discharge summary is a critical document that outlines the patient's treatment, diagnosis, and hospital course. This summary serves as key evidence for insurance claims to ensure accurate and prompt reimbursement.

Pre-Authorization Approval Letter

Health insurance reimbursement requires specific documentation to ensure claims are processed efficiently. The Pre-Authorization Approval Letter is a critical document that confirms prior approval from the insurance provider for a medical procedure or service.

- Proof of Insurance Approval - The Pre-Authorization Approval Letter verifies that the insurance company has reviewed and approved the treatment or service in advance.

- Claims Processing Requirement - Insurance companies mandate this letter to process reimbursement claims without delays or denials.

- Patient Financial Protection - Obtaining pre-authorization helps avoid unexpected out-of-pocket expenses for treatments not covered by the insurer.

Claim Form and Declaration

For health insurance reimbursement, submitting a completed claim form is essential as it contains detailed information about the treatment and expenses incurred. The declaration section must be accurately filled to confirm the authenticity of the documents and the details provided. You should ensure that both the claim form and declaration are signed and attached with original bills and medical reports to facilitate smooth processing.

What Documents are Necessary for Health Insurance Reimbursement? Infographic