To open a bank account for minors, key identification documents typically required include the minor's birth certificate, a valid government-issued photo ID if available, and the parent or guardian's identification such as a passport or driver's license. Banks may also request proof of address for both the minor and the adult co-signer or guardian. Ensuring all these documents meet the bank's specific requirements helps streamline the account opening process for minors.

What Identification Documents Are Needed for Opening a Bank Account for Minors?

| Number | Name | Description |

|---|---|---|

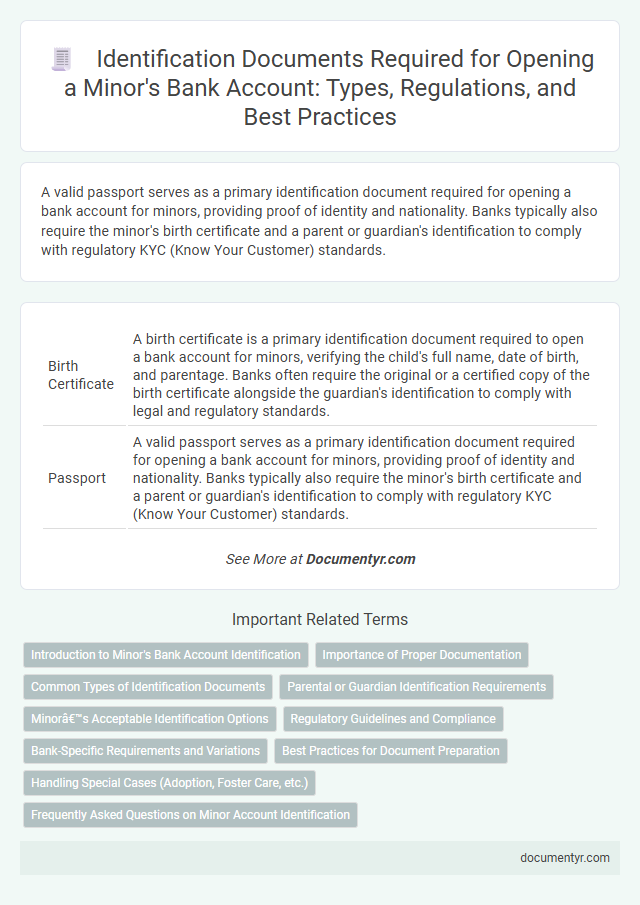

| 1 | Birth Certificate | A birth certificate is a primary identification document required to open a bank account for minors, verifying the child's full name, date of birth, and parentage. Banks often require the original or a certified copy of the birth certificate alongside the guardian's identification to comply with legal and regulatory standards. |

| 2 | Passport | A valid passport serves as a primary identification document required for opening a bank account for minors, providing proof of identity and nationality. Banks typically also require the minor's birth certificate and a parent or guardian's identification to comply with regulatory KYC (Know Your Customer) standards. |

| 3 | National ID Card | A valid National ID Card serves as a primary identification document required for opening a bank account for minors, confirming their legal identity and citizenship. Banks typically mandate the original National ID Card along with a photocopy to verify age and verify the minor's eligibility for account ownership. |

| 4 | Social Security Card | A Social Security Card is a critical identification document required when opening a bank account for minors, serving as proof of the child's legal Social Security Number (SSN). Banks use the SSN to verify identity, comply with federal regulations, and facilitate tax reporting associated with the minor's account. |

| 5 | School ID Card | A School ID card is a crucial identification document often required when opening a bank account for minors, serving as proof of the minor's identity and enrollment in an educational institution. Banks use the School ID card to verify the minor's age and student status, complementing other documents like birth certificates or parental identification. |

| 6 | Parent or Guardian’s Government-issued ID | Opening a bank account for minors requires the parent or guardian to provide a valid government-issued identification document such as a passport, driver's license, or state ID card for verification purposes. This ensures compliance with anti-money laundering regulations and helps establish the adult's legal authority to manage the minor's account. |

| 7 | Proof of Address (utility bill, rental agreement, etc.) | Proof of address for opening a bank account for minors typically includes a recent utility bill, rental agreement, or official government correspondence dated within the last three months to verify the minor's residential address. Banks require these documents to ensure compliance with anti-money laundering regulations and to confirm the minor's residency within the institution's service area. |

| 8 | Immunization Record | An immunization record serves as a valuable secondary identification document when opening a bank account for minors, providing verified proof of the child's identity and birth details. Banks may accept these records alongside primary identification documents such as a birth certificate or Social Security card to comply with regulatory requirements. |

| 9 | Baptismal Certificate | A baptismal certificate serves as a valid identification document for minors when opening a bank account, especially if no government-issued ID is available. Banks often accept this certificate to verify the minor's identity and date of birth, complying with regulatory requirements for account opening. |

| 10 | Hospital Record of Birth | A hospital record of birth serves as a primary identification document required for opening a bank account for minors, providing official proof of birth details and parental information. This document is often accepted alongside a parent's or guardian's identification to verify the minor's identity and legal guardianship. |

| 11 | Adoption Papers | Adoption papers serve as primary identification documents when opening a bank account for minors, verifying legal guardianship and the child's identity. Banks require these documents alongside the minor's birth certificate and Social Security number to comply with regulatory standards and ensure proper account management. |

| 12 | Court-issued Guardianship Papers | Court-issued guardianship papers serve as crucial identification documents when opening a bank account for minors, verifying the legal guardian's authority to act on behalf of the child. Banks require these documents to comply with regulatory standards and ensure proper account management in the minor's best interest. |

| 13 | Consular Report of Birth Abroad (CRBA) | The Consular Report of Birth Abroad (CRBA) serves as a vital identification document for minors opening bank accounts, verifying U.S. citizenship and birth details issued by the Department of State. Banks recognize the CRBA alongside a minor's Social Security card and passport to fulfill federal identification requirements and comply with Know Your Customer (KYC) regulations. |

| 14 | Department of Social Welfare/Child Welfare Documentation | For opening a bank account for minors, the Department of Social Welfare or Child Welfare documentation, such as a Certificate of Guardianship or Barangay Clearance verifying custodial authority, is essential to establish legal guardianship and identity. These documents complement the minor's birth certificate and government-issued IDs to ensure compliance with banking regulations and protect the minor's interests. |

Introduction to Minor's Bank Account Identification

Opening a bank account for minors requires specific identification documents to ensure compliance with financial regulations. These documents verify the minor's identity and protect against fraud.

You will need to provide valid identification for both the minor and the guardian or parent. Commonly accepted documents include a birth certificate, Social Security card, and government-issued photo ID.

Importance of Proper Documentation

Proper identification documentation is crucial when opening a bank account for minors to ensure legal compliance and protect the child's financial interests. Banks require specific documents to verify the minor's identity and the guardian's authorization.

- Birth Certificate - Confirms the minor's full name and date of birth, serving as a primary identification document.

- Parent or Guardian ID - Validates the identity and legal authority of the adult opening the account on behalf of the minor.

- Social Security Number (SSN) - Used for tax reporting and to uniquely identify the minor within the financial system.

Ensuring the correct documents are provided streamlines the account opening process and safeguards against fraud.

Common Types of Identification Documents

When opening a bank account for minors, common types of identification documents include the minor's birth certificate, Social Security card, and a valid government-issued photo ID such as a passport or state ID. Parents or guardians often need to provide their own identification, such as a driver's license or passport, to verify their authority. Some banks may also require proof of address, like a utility bill, to complete the identification process.

Parental or Guardian Identification Requirements

Opening a bank account for minors requires valid identification from the parent or guardian. These documents verify the adult's legal authority to manage the minor's financial activities.

Common parental or guardian identification includes a government-issued photo ID such as a passport or driver's license. Proof of relationship, like a birth certificate or legal guardianship papers, may also be required. Banks often request a Social Security Number or Tax Identification Number to complete the verification process.

Minor’s Acceptable Identification Options

Opening a bank account for minors requires specific identification documents to verify their identity and comply with banking regulations. Your minor must present acceptable identification options that the bank recognizes for account setup.

- Birth Certificate - A government-issued birth certificate establishes the minor's identity and date of birth as proof.

- Social Security Card - The Social Security card is often required to verify the minor's social security number for tax and identification purposes.

- State-Issued ID or Passport - A state-issued identification card or a valid passport serves as an official photo ID for minors over a certain age.

Regulatory Guidelines and Compliance

Identification documents required for opening a bank account for minors vary by jurisdiction but generally include a government-issued ID for the minor, such as a birth certificate or passport. Regulatory guidelines mandate that these documents be authentic and up-to-date to ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

Your guardian or parent may need to provide their identification and proof of address as part of the verification process. Financial institutions follow these compliance measures strictly to prevent fraud and safeguard the minor's account.

Bank-Specific Requirements and Variations

What identification documents are required to open a bank account for minors, considering bank-specific requirements and variations? Banks typically require a minor's birth certificate, Social Security number, and a valid photo ID of the guardian. Requirements may vary, with some banks also requesting proof of address and the guardian's identification documentation.

Best Practices for Document Preparation

When opening a bank account for minors, essential identification documents typically include the minor's birth certificate, a valid government-issued photo ID (such as a passport), and the guardian's identification. Best practices for document preparation involve ensuring that all copies are clear, current, and properly notarized if required by the bank. Organizing these documents in advance helps streamline the account opening process and prevents delays.

Handling Special Cases (Adoption, Foster Care, etc.)

Opening a bank account for minors requires specific identification documents to establish their identity and legal guardianship. Special cases such as adoption and foster care involve additional documentation to verify parental or guardian rights.

- Adoption Records - Official adoption papers serve as proof of legal guardianship and identity for the minor.

- Foster Care Authorization - A court order or foster care placement letter must be presented to confirm foster guardianship.

- Parental Consent Forms - Signed consent from biological or legal guardians is mandatory when the minor cannot provide standard identification.

What Identification Documents Are Needed for Opening a Bank Account for Minors? Infographic