To open a bank account for minors, essential documents include the child's birth certificate or passport as proof of identity and age, along with the parent's or guardian's valid identification such as a driver's license or passport. Proof of address, like a recent utility bill or bank statement in the parent's name, is also typically required. Some banks may request the minor's Social Security number or taxpayer identification number for regulatory compliance.

What Documents Are Needed for Opening a Bank Account for Minors?

| Number | Name | Description |

|---|---|---|

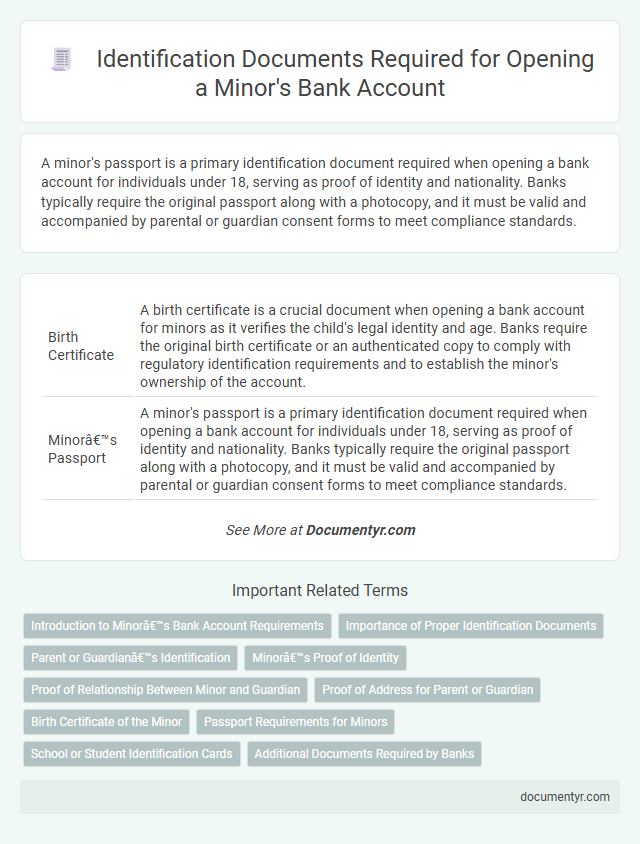

| 1 | Birth Certificate | A birth certificate is a crucial document when opening a bank account for minors as it verifies the child's legal identity and age. Banks require the original birth certificate or an authenticated copy to comply with regulatory identification requirements and to establish the minor's ownership of the account. |

| 2 | Minor’s Passport | A minor's passport is a primary identification document required when opening a bank account for individuals under 18, serving as proof of identity and nationality. Banks typically require the original passport along with a photocopy, and it must be valid and accompanied by parental or guardian consent forms to meet compliance standards. |

| 3 | Minor’s National ID Card | A Minor's National ID Card serves as a primary identification document required for opening a bank account, verifying the minor's legal identity and age. Banks often mandate the original National ID Card along with a copy, ensuring compliance with regulatory standards and preventing identity fraud. |

| 4 | School ID Card | A valid school ID card serves as an essential proof of identity and enrollment when opening a bank account for minors, verifying the minor's age and student status. Banks often require this document alongside a birth certificate or guardian's ID to comply with regulatory identification standards. |

| 5 | Parent or Guardian’s Photo ID | A parent or guardian's valid government-issued photo ID, such as a passport or driver's license, is essential when opening a bank account for minors to verify legal custody and authorization. This identification ensures compliance with banking regulations and helps protect the minor's financial interests. |

| 6 | Parent or Guardian’s Address Proof | For opening a bank account for minors, the parent or guardian must provide valid address proof, such as a utility bill, passport, or government-issued ID reflecting their current residence. This documentation ensures compliance with KYC regulations and verifies the legal guardian's eligibility to manage the minor's account. |

| 7 | Minor’s Address Proof (if available) | Acceptable minor's address proof for opening a bank account may include a school ID card displaying the residential address, a recent utility bill in the parent's name with the minor's name included, or a ration card listing the minor's address. Banks often accept a self-declaration of address signed by the parent or guardian if official documents are not available. |

| 8 | Passport-sized Photographs (of minor and guardian) | Passport-sized photographs of both the minor and the guardian are essential documents required for opening a bank account for minors, as they serve to verify the identity of both parties. Banks typically require recent, clear photos that meet specific size and background color standards to ensure accurate identification and compliance with regulatory guidelines. |

| 9 | PAN Card (of minor or guardian, as required) | Opening a bank account for minors requires a valid PAN card, either belonging to the minor if available or the guardian, as this serves as a primary identification and tax compliance document. Banks mandate submission of the PAN card to verify identity and link the account with the appropriate individual for legal and financial accountability. |

| 10 | Aadhaar Card (of minor or guardian, as required) | Opening a bank account for minors requires submission of an Aadhaar Card as a primary identification document, either belonging to the minor or their guardian, depending on the bank's specific KYC requirements. This biometric-based identity proof ensures compliance with regulatory guidelines and facilitates seamless account verification. |

| 11 | Court Order or Guardianship Certificate (if applicable) | For opening a bank account for minors, a court order or guardianship certificate is required when a legal guardian is appointed instead of the parent. These documents legally authorize the guardian to manage the minor's financial matters and must be presented alongside proof of the minor's identity and address. |

| 12 | Relationship Proof (minor and guardian) | To open a bank account for minors, providing relationship proof between the minor and the guardian is essential, typically through documents such as the minor's birth certificate, a legal guardianship certificate, or a court order establishing custody. These documents verify the guardian's authority to act on behalf of the minor and are required by banks to comply with identification and authorization regulations. |

| 13 | Bank’s Account Opening Form | The bank's account opening form for minors requires completion by a parent or legal guardian, including details such as the minor's full name, date of birth, and relationship to the guardian. Supporting identification documents, such as the minor's birth certificate and guardian's government-issued ID, must be submitted alongside the form to comply with verification and regulatory requirements. |

Introduction to Minor’s Bank Account Requirements

Opening a bank account for minors requires specific documentation to comply with banking regulations and ensure proper identification. Banks have distinct requirements to verify the identity of both the minor and the guardian involved in the account setup.

Your minor's bank account application must include proof of the minor's identity, such as a birth certificate or passport. Guardians typically need to provide government-issued identification and proof of relationship to the minor, like legal guardianship documents or a parent's ID.

Importance of Proper Identification Documents

Opening a bank account for minors requires specific identification documents to ensure legal compliance and security. Proper identification verifies the minor's identity and protects against fraud.

Essential documents often include the minor's birth certificate, a government-issued ID for the guardian, and proof of address. Banks may also request the minor's Social Security number or tax identification number. Providing accurate and complete identification documents speeds up the account opening process and safeguards your minor's financial future.

Parent or Guardian’s Identification

What identification documents are required from a parent or guardian to open a bank account for a minor? You must provide a valid government-issued ID such as a passport or driver's license. A utility bill or proof of address may also be required to verify your residency status.

Minor’s Proof of Identity

| Required Document | Description | Examples |

|---|---|---|

| Minor's Proof of Identity | This document verifies the identity of the minor. It must be an official, government-issued ID that clearly displays the minor's full name, date of birth, and photograph or biometric data when applicable. | Birth certificate, Passport, School ID card (with photograph and date of birth), Government-issued identity card (such as Aadhaar or Social Security card) |

| Parent or Guardian's Proof of Identity | Required to establish the legal relationship between the minor and the adult opening the account. | Driver's license, Passport, National ID card |

| Minor's Proof of Address | Confirms the residence of the minor, usually necessary depending on bank policies. | Utility bill, Bank statement, Rental agreement |

| Parent or Guardian's Proof of Address | Validates the address linked to the guardian, if different from the minor. | Utility bill, Bank statement, Lease agreement |

| Guardian Consent or Authorization | Official document authorizing the parent or guardian to open and manage the minor's bank account. | Notarized consent form, Court order, Legal guardianship papers |

To open a bank account for a minor, your primary focus should be providing valid proof of the minor's identity. This ensures compliance with legal and banking regulations designed to protect minors while enabling them to access financial services.

Proof of Relationship Between Minor and Guardian

Opening a bank account for minors requires specific documents to prove the guardian's relationship with the child. Proper proof ensures the bank complies with legal and security requirements.

- Birth Certificate - Shows the child's name along with the parents' names, establishing a clear biological relationship.

- Legal Guardianship Papers - Official documents issued by the court confirming your status as the minor's guardian.

- Adoption Records - Provides proof of a legally recognized parental relationship for adopted children.

Presenting these documents accurately helps streamline the account opening process for your minor.

Proof of Address for Parent or Guardian

Proof of address for the parent or guardian is essential when opening a bank account for minors. Acceptable documents include utility bills, bank statements, or official government correspondence dated within the last three months. These documents verify the residential address and establish the adult's legal responsibility for the minor's account.

Birth Certificate of the Minor

The birth certificate is a crucial document required to open a bank account for minors. It serves as the primary proof of identity and age for the child.

- Proof of Identity - The birth certificate verifies the minor's full name and date of birth, essential for account registration.

- Legal Guardian Verification - It helps confirm the relationship between the minor and the parent or guardian opening the account.

- Compliance with Banking Regulations - Banks mandate the birth certificate to ensure adherence to legal age and identification requirements.

Passport Requirements for Minors

Opening a bank account for minors requires specific identification documents, with the passport serving as a crucial form of proof. Your minor's passport must be valid and include all necessary personal information to ensure smooth account processing.

- Valid Passport - The minor's passport must be current and not expired at the time of account opening.

- Parental or Guardian Authorization - Some banks require a notarized letter from parents or guardians alongside the minor's passport for verification.

- Proof of Address - The passport must show the minor's residential address or must be accompanied by a recent utility bill or official document with the same address.

School or Student Identification Cards

School or student identification cards are commonly accepted documents when opening a bank account for minors. These IDs verify the minor's enrollment and identity, providing the bank with essential proof. You should ensure the card is current and includes a photo for seamless account verification.

What Documents Are Needed for Opening a Bank Account for Minors? Infographic