Non-citizens must present valid identification such as a passport or consular ID card when opening a U.S. bank account. Banks typically require proof of address, which can be a utility bill or lease agreement, and an Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN) if applicable. Additional documentation may include a visa or immigration status proof, depending on the bank's policies and the type of account being opened.

What Documents Are Required for Opening a U.S. Bank Account as a Non-Citizen?

| Number | Name | Description |

|---|---|---|

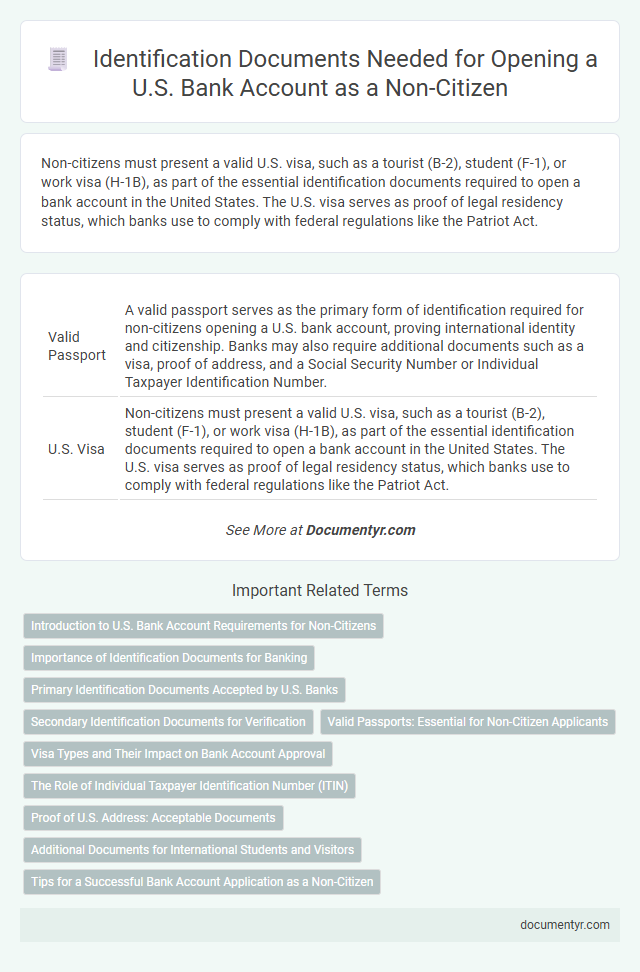

| 1 | Valid Passport | A valid passport serves as the primary form of identification required for non-citizens opening a U.S. bank account, proving international identity and citizenship. Banks may also require additional documents such as a visa, proof of address, and a Social Security Number or Individual Taxpayer Identification Number. |

| 2 | U.S. Visa | Non-citizens must present a valid U.S. visa, such as a tourist (B-2), student (F-1), or work visa (H-1B), as part of the essential identification documents required to open a bank account in the United States. The U.S. visa serves as proof of legal residency status, which banks use to comply with federal regulations like the Patriot Act. |

| 3 | Form I-94 (Arrival/Departure Record) | Form I-94 (Arrival/Departure Record) serves as a crucial document for non-citizens opening a U.S. bank account, proving their lawful entry and authorized stay in the country. Banks require a valid I-94 to verify identity, immigration status, and duration of stay, ensuring compliance with federal regulations. |

| 4 | Foreign Government-Issued ID | Opening a U.S. bank account as a non-citizen requires presenting a valid foreign government-issued ID, such as a passport or national identity card, which serves as the primary form of personal identification. This document must contain a clear photo, full name, date of birth, and expiration date to meet the identification standards set by U.S. financial institutions. |

| 5 | Individual Taxpayer Identification Number (ITIN) | Non-citizens must present an Individual Taxpayer Identification Number (ITIN) issued by the IRS along with a valid passport or government-issued ID to open a U.S. bank account. The ITIN serves as a crucial tax processing number for those without a Social Security Number (SSN), ensuring compliance with federal banking regulations. |

| 6 | Social Security Number (if applicable) | Non-citizens opening a U.S. bank account typically need to provide a valid passport, visa, and proof of address, while a Social Security Number (SSN) is required if applicable for identity verification and tax reporting purposes. If the applicant does not have an SSN, some banks may accept an Individual Taxpayer Identification Number (ITIN) or offer alternative identification options. |

| 7 | Proof of Address (Utility Bill, Lease Agreement, Bank Statement) | Non-citizens opening a U.S. bank account must provide proof of address, which can include a recent utility bill, lease agreement, or bank statement showing their name and U.S. residential address. These documents verify residency and ensure compliance with bank regulatory requirements. |

| 8 | Bank Reference Letter | A bank reference letter is a crucial document when opening a U.S. bank account as a non-citizen, providing proof of good financial standing from your home bank. This letter typically includes your account history, reliability in managing funds, and confirms your identity, which helps U.S. banks assess your trustworthiness. |

| 9 | Student or Work Visa Documentation | Non-citizens opening a U.S. bank account must present valid identification such as a passport and visa documentation, specifically a student visa (F-1) or work visa (H-1B) to verify legal status. Banks also typically require a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) alongside proof of address and an I-94 arrival/departure record. |

| 10 | Employment Authorization Document (EAD) | An Employment Authorization Document (EAD) serves as a primary form of identification and proof of legal work status for non-citizens opening a U.S. bank account, verifying their eligibility to work and reside in the country. Banks typically require the EAD alongside a valid passport and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to complete the account opening process. |

| 11 | Consular Identification Card (Cédula) | Non-citizens opening a U.S. bank account can use a Consular Identification Card (Cedula) as a valid form of ID, which is issued by their home country's consulate to verify identity and residency. Banks may require the Cedula alongside a secondary form of identification, such as a passport or a U.S. address proof, to comply with Know Your Customer (KYC) regulations. |

| 12 | Secondary Photo ID (Driver’s License, State ID) | Non-citizens opening a U.S. bank account must provide a secondary photo ID such as a valid driver's license or state-issued ID card to verify their identity. These documents complement primary identification and help satisfy bank requirements for account opening under federal regulations. |

| 13 | Immigration Documents (Green Card, if applicable) | Non-citizens must present valid immigration documents such as a Green Card (Permanent Resident Card) to verify legal status when opening a U.S. bank account. These documents serve as primary identification alongside a passport and proof of address to fulfill bank compliance requirements. |

| 14 | Proof of Income or Employment | Non-citizens opening a U.S. bank account typically need to provide proof of income or employment such as recent pay stubs, an employment verification letter, or tax returns to verify financial stability. These documents help banks comply with federal regulations and assess the applicant's ability to maintain the account. |

| 15 | Letter of Acceptance (for Students) | Non-citizen students opening a U.S. bank account must provide a Letter of Acceptance from an accredited educational institution as primary identification, verifying their student status. This document, combined with a valid passport and visa, facilitates compliance with banking regulations and account eligibility. |

| 16 | Sponsor Letter (if required by bank) | A sponsor letter is often required by U.S. banks for non-citizens who do not have a Social Security Number or U.S. address, serving as a formal endorsement from a U.S. resident or entity vouching for the account holder's identity and financial credibility. This letter must include the sponsor's contact information, relationship to the applicant, and a commitment to monitor the account holder's banking activities. |

Introduction to U.S. Bank Account Requirements for Non-Citizens

| Introduction to U.S. Bank Account Requirements for Non-Citizens | |

|---|---|

| Overview | Opening a bank account in the United States as a non-citizen requires specific documents that verify identity and residency. Banks must follow federal regulations to prevent fraud and ensure security. |

| Primary Identification | Valid passport or government-issued photo ID from your home country. Some banks may also accept a U.S. visa or a consular identification card. |

| Proof of Residency | Utility bills, lease agreements, or official mail showing your U.S. address are typically required. Some institutions may request a state-issued ID or driver's license. |

| Tax Identification | Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to comply with IRS regulations and reporting requirements. |

| Additional Documentation | Some banks may ask for an employment authorization document, student ID, or proof of income depending on the account type. |

| Summary | You need to provide a combination of identity and residency documents along with tax identification to successfully open a U.S. bank account as a non-citizen. |

Importance of Identification Documents for Banking

Identification documents are crucial for non-citizens opening a U.S. bank account to verify identity and comply with federal regulations. Providing the correct documents ensures smooth account setup and protects against fraud.

- Proof of Identity - Valid passports or government-issued IDs confirm the account holder's identity and nationality.

- Proof of Address - Utility bills, lease agreements, or bank statements verify the residency address required by banks.

- Immigration Status Documentation - Visas, work permits, or green cards demonstrate legal permission to open and maintain a bank account in the U.S.

Ensuring accurate and complete identification documents is essential for compliance with the USA PATRIOT Act and banking policies.

Primary Identification Documents Accepted by U.S. Banks

Opening a U.S. bank account as a non-citizen requires presenting valid primary identification documents. Your identification must be government-issued and acceptable by the bank to verify your identity.

- Passport - A valid, unexpired passport from your home country is the most commonly accepted primary identification document.

- Permanent Resident Card (Green Card) - U.S. banks accept this as proof of legal residency status in the United States.

- Foreign National Identification Card - Some banks accept government-issued national ID cards with photo, depending on their policies and compliance requirements.

Secondary Identification Documents for Verification

Secondary identification documents play a crucial role in verifying the identity of non-citizens opening a U.S. bank account. Acceptable secondary IDs commonly include foreign passports, consular identification cards, and employment authorization documents. These documents complement primary IDs, ensuring compliance with banking regulations and facilitating account approval.

Valid Passports: Essential for Non-Citizen Applicants

A valid passport is a fundamental document required for non-citizens to open a U.S. bank account. It serves as the primary form of identification proving the applicant's identity and nationality.

- Government-Issued Validity - The passport must be current and issued by the applicant's home country government to verify nationality and personal details.

- Photo Identification - It includes a photograph of the holder, essential for visually confirming identity during the account opening process.

- Travel and Residency Verification - Passports often contain visa stamps or residency permits, helping banks assess the applicant's legal status in the U.S.

Visa Types and Their Impact on Bank Account Approval

Opening a U.S. bank account as a non-citizen requires specific identification documents, including a valid passport and proof of residency. The type of visa held significantly influences the approval process and documentation requirements.

Common visa types such as H-1B, F-1, and L-1 each have different implications for bank account eligibility. For example, H-1B visa holders often need to provide employment verification, while F-1 student visa holders may need to show a valid I-20 form alongside their passport.

The Role of Individual Taxpayer Identification Number (ITIN)

What documents are required for opening a U.S. bank account as a non-citizen? Non-citizens must provide valid identification such as a passport, proof of address, and immigration documents. An Individual Taxpayer Identification Number (ITIN) plays a crucial role in facilitating the account opening process for those without a Social Security Number.

How does an Individual Taxpayer Identification Number (ITIN) affect non-citizens opening bank accounts? The ITIN serves as a tax processing number issued by the IRS, allowing non-citizens to meet identification requirements. Banks often accept the ITIN as a key document to verify identity and establish financial records for account holders.

Proof of U.S. Address: Acceptable Documents

Proof of U.S. address is a critical requirement for non-citizens opening a bank account in the United States. Acceptable documents include utility bills, lease agreements, and official government correspondence that clearly display the applicant's name and U.S. residential address. Banks may also accept bank statements from other U.S. financial institutions or a letter from a U.S.-based employer as valid proof of address.

Additional Documents for International Students and Visitors

Non-citizens opening a U.S. bank account must provide primary identification such as a valid passport and a visa or permanent resident card. Proof of address in the United States is also typically required to complete the account setup process.

International students often need to present additional documents, including their Form I-20 or DS-2019 and a valid Student or Exchange Visitor visa. Visitors may need to provide evidence of their stay duration and purpose, such as a tourist visa or travel itinerary. Some banks also request a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) when available, to comply with federal regulations.

What Documents Are Required for Opening a U.S. Bank Account as a Non-Citizen? Infographic