To open a business bank account in Florida, essential documents include a valid government-issued ID, such as a driver's license or passport, and the business's Employer Identification Number (EIN) issued by the IRS. Banks also require the business formation documents, like Articles of Incorporation, a partnership agreement, or a DBA certificate for sole proprietorships. Proof of address for the business and authorized signatories may be requested to verify legitimacy and compliance with state regulations.

What Documents are Needed for Opening a Business Bank Account in Florida?

| Number | Name | Description |

|---|---|---|

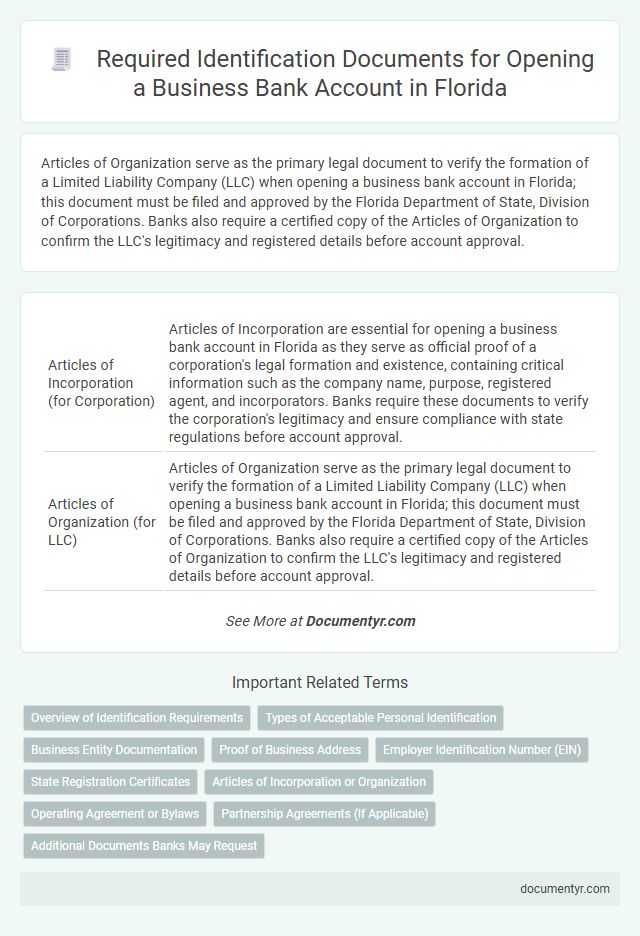

| 1 | Articles of Incorporation (for Corporation) | Articles of Incorporation are essential for opening a business bank account in Florida as they serve as official proof of a corporation's legal formation and existence, containing critical information such as the company name, purpose, registered agent, and incorporators. Banks require these documents to verify the corporation's legitimacy and ensure compliance with state regulations before account approval. |

| 2 | Articles of Organization (for LLC) | Articles of Organization serve as the primary legal document to verify the formation of a Limited Liability Company (LLC) when opening a business bank account in Florida; this document must be filed and approved by the Florida Department of State, Division of Corporations. Banks also require a certified copy of the Articles of Organization to confirm the LLC's legitimacy and registered details before account approval. |

| 3 | Partnership Agreement (for Partnership) | A Partnership Agreement is a crucial document required for opening a business bank account in Florida, as it verifies the formation and operational rules of the partnership. Banks typically require a notarized or certified copy of the Partnership Agreement to confirm the legitimacy of the business and the authority of the individuals managing the account. |

| 4 | Certificate of Formation/Registration | A Certificate of Formation or Registration is a crucial document required to open a business bank account in Florida, verifying the legal establishment of your business entity with the state. This document must be submitted alongside other identification forms to confirm compliance with Florida's business registration requirements. |

| 5 | Employer Identification Number (EIN) from IRS | A valid Employer Identification Number (EIN) issued by the IRS is essential for opening a business bank account in Florida, serving as the business's federal tax ID. This nine-digit number verifies the company's legal identity for tax reporting and banking purposes. |

| 6 | Operating Agreement (for LLC) | An Operating Agreement is essential for opening a business bank account in Florida for an LLC, as it verifies the company's structure and outlines member roles and responsibilities. Banks require this document to ensure proper authorization for account access and to comply with state regulations. |

| 7 | Corporate Bylaws (for Corporation) | Corporate bylaws serve as a critical document for opening a business bank account in Florida, establishing the governance framework of the corporation and authorizing representatives to act on behalf of the business. Banks require certified copies of the corporate bylaws to verify the corporation's legitimacy and confirm the authority of signatories. |

| 8 | Business License | A business license is a critical document required to open a business bank account in Florida, serving as official proof of your business's legal authorization to operate within the state. Banks typically require the original or a certified copy of the business license along with other identification documents to verify the legitimacy of the business entity. |

| 9 | Fictitious Name Certificate/DBA (Doing Business As) | A Fictitious Name Certificate, also known as a DBA (Doing Business As), is required for opening a business bank account in Florida when the business operates under a name different from the owner's legal name. This document must be filed with the Florida Division of Corporations to verify the legitimacy of the assumed business name for banking and legal purposes. |

| 10 | Florida Department of State Registration | To open a business bank account in Florida, you must provide proof of registration with the Florida Department of State, including the Articles of Incorporation or Registration of Fictitious Name. These documents confirm your business's legal status and eligibility to operate within Florida. |

| 11 | Personal Identification (Driver’s License, Passport) | Opening a business bank account in Florida requires personal identification such as a valid driver's license or passport to verify the identity of the account holder. Financial institutions use these government-issued IDs to comply with federal regulations and prevent fraud. |

| 12 | Ownership Agreements (Shareholder or Membership Agreements) | Ownership agreements, such as Shareholder Agreements for corporations or Membership Agreements for LLCs, are essential documents required to open a business bank account in Florida, as they establish the legal structure and operational rules of the business. These agreements provide the bank with verified information on ownership percentages, roles, and responsibilities, ensuring compliance with state regulations and facilitating smoother account management. |

| 13 | Certificate of Good Standing | A Certificate of Good Standing is essential for opening a business bank account in Florida as it verifies the company's legal status and compliance with state regulations. Banks require this document alongside the Articles of Incorporation and Employer Identification Number (EIN) to confirm the business is authorized to operate and conduct financial transactions. |

| 14 | Banking Resolution (if required) | A Banking Resolution may be required to open a business bank account in Florida, especially for corporations and LLCs, serving as formal authorization from the board or members to open the account and designate authorized signers. This document typically complements standard identification paperwork such as the Employer Identification Number (EIN), Articles of Incorporation or Organization, and personal identification for the business owners. |

Overview of Identification Requirements

Opening a business bank account in Florida requires specific identification documents to verify the legitimacy of the business and its owners. Banks mandate these documents to comply with federal regulations and prevent fraud.

Primary identification includes a valid government-issued photo ID, such as a driver's license or passport, for all authorized signers. The business must provide formation documents like Articles of Incorporation or a Certificate of Formation. Additional requirements may include the Employer Identification Number (EIN) issued by the IRS and any applicable business licenses or permits.

Types of Acceptable Personal Identification

When opening a business bank account in Florida, providing acceptable personal identification is essential to verify the identity of the business owner. Banks require government-issued IDs to meet regulatory compliance and prevent fraud.

Acceptable types of personal identification include a valid Florida driver's license, a U.S. passport, or a state-issued identification card. Some banks also accept military identification or permanent resident cards as proof of identity for business account registration.

Business Entity Documentation

| Document Type | Description |

|---|---|

| Business Formation Certificate | Official paperwork proving the legal establishment of your business, such as Articles of Incorporation for corporations or Articles of Organization for LLCs filed with the Florida Division of Corporations. |

| Employer Identification Number (EIN) | Issued by the IRS, this unique nine-digit number is necessary for tax reporting and financial transactions involving your business. |

| Operating Agreement or Bylaws | Documents outlining ownership structure and operational guidelines, typically required for LLCs and corporations to define internal business governance. |

| Fictitious Name Registration (if applicable) | Filed with the Florida Division of Corporations when operating under a different name than the legal business name, also known as a "Doing Business As" (DBA) certificate. |

| Proof of Authorized Signers | Legal documents or resolutions designating individuals permitted to open accounts and conduct banking activities on behalf of the business entity. |

Proof of Business Address

Proof of business address is a critical requirement for opening a business bank account in Florida. This ensures the bank verifies the physical location of your business entity within the state.

- Utility Bill - A recent utility bill in your business's name confirms the operating address.

- Lease Agreement - A valid commercial lease or rental agreement proves your right to use the business premises.

- Business License - A Florida-issued business license displaying the registered address validates your business location.

Employer Identification Number (EIN)

What documents are needed for opening a business bank account in Florida? A valid Employer Identification Number (EIN) issued by the IRS is essential. This unique identifier verifies your business for tax and banking purposes.

State Registration Certificates

State Registration Certificates are essential documents for opening a business bank account in Florida. These certificates verify your business's legal registration with the state, confirming its legitimacy. Banks require these documents to comply with state regulations and ensure your business is officially recognized.

Articles of Incorporation or Organization

Opening a business bank account in Florida requires specific documents that verify the legitimacy and structure of the business. One critical document is the Articles of Incorporation or Articles of Organization, which establish the business as a legal entity.

- Articles of Incorporation - This document is filed for corporations to legally register the business with the state of Florida.

- Articles of Organization - Required for LLCs, this document officially creates the limited liability company in Florida.

- Proof of Filing - The bank may require a stamped or certified copy from the Florida Department of State to confirm the document's authenticity.

Submitting the Articles of Incorporation or Organization helps the bank verify the business's legal existence and ownership structure before opening the account.

Operating Agreement or Bylaws

When opening a business bank account in Florida, you must present specific documents that verify your company's legal structure. An Operating Agreement or Bylaws are essential for LLCs and corporations, respectively, as these documents outline the management framework and ownership details.

The Operating Agreement or Bylaws demonstrate your authority to act on behalf of the business, a requirement for most banks. These documents also provide clarity on roles and responsibilities, helping streamline the account opening process for your business.

Partnership Agreements (If Applicable)

Opening a business bank account in Florida requires specific identification documents, especially if your business operates as a partnership. Partnership agreements are essential to prove the authority and responsibilities of each partner involved.

- Partnership Agreement - This legal document outlines the roles, responsibilities, and ownership percentages of each partner within the business.

- Identification Verification - Banks require valid government-issued IDs from all partners to confirm their identities.

- Business Registration Documents - Official state filings, such as the Certificate of Partnership or fictitious name registration, validate your business's legal existence in Florida.

What Documents are Needed for Opening a Business Bank Account in Florida? Infographic