A subcontractor must submit a detailed invoice specifying labor, materials, and hours worked to secure payment. Proof of lien releases and compliance certificates may also be required to demonstrate project adherence. Subcontractors should provide any contractually mandated documentation, such as progress reports or approved change orders, to ensure timely and accurate payment processing.

What Documents Does a Subcontractor Need to Submit for Payment?

| Number | Name | Description |

|---|---|---|

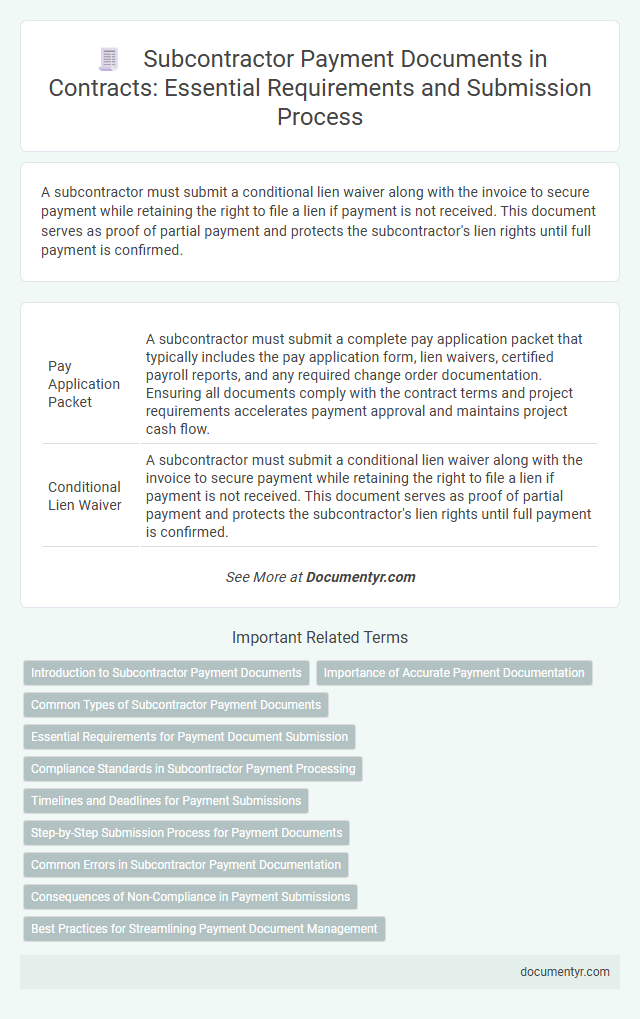

| 1 | Pay Application Packet | A subcontractor must submit a complete pay application packet that typically includes the pay application form, lien waivers, certified payroll reports, and any required change order documentation. Ensuring all documents comply with the contract terms and project requirements accelerates payment approval and maintains project cash flow. |

| 2 | Conditional Lien Waiver | A subcontractor must submit a conditional lien waiver along with the invoice to secure payment while retaining the right to file a lien if payment is not received. This document serves as proof of partial payment and protects the subcontractor's lien rights until full payment is confirmed. |

| 3 | Unconditional Lien Release | Subcontractors must submit an Unconditional Lien Release to confirm they waive future lien rights once payment is received, ensuring clear title transfer and facilitating smooth fund disbursement. This document is critical for validating payment claims and preventing liens on the property during contract execution. |

| 4 | Electronic Invoice Submission | Subcontractors must submit electronic invoices that comply with the primary contractor's specified format, including detailed work descriptions, contract references, and authorized signatures, to ensure timely payment processing. These digital documents often require integration with project management systems and may need supporting attachments such as lien waivers and change order approvals for verification. |

| 5 | Digital Timekeeping Records | Subcontractors must submit digital timekeeping records that accurately detail hours worked, including timestamps and task descriptions, to ensure transparent and verifiable payment processing. These records should be compatible with the main contractor's project management system and comply with contract-specific requirements to facilitate timely approval and disbursement. |

| 6 | Certified Payroll Reports | Subcontractors must submit Certified Payroll Reports to verify compliance with labor laws and ensure accurate wage payments on public works projects. These reports detail employee work hours, wages, and classifications, providing transparency and facilitating timely payment approval. |

| 7 | E-notarized Compliance Certificates | Subcontractors must submit E-notarized compliance certificates along with invoices to ensure payment eligibility, as these digitally verified documents authenticate adherence to contractual and regulatory requirements. These certificates streamline the approval process by providing legally recognized proof of compliance, reducing payment delays and enhancing transparency between contractors and subcontractors. |

| 8 | Subcontractor Progress Affidavit | A Subcontractor Progress Affidavit is a critical document required for payment, confirming that labor, materials, and services have been provided as agreed without liens or claims against the project. This affidavit typically includes detailed work descriptions, payment request amounts, and certifications that all subcontractor obligations are up-to-date, ensuring transparent financial and legal compliance during the contract execution. |

| 9 | Blockchain-Tracked Delivery Receipts | Subcontractors must submit blockchain-tracked delivery receipts to ensure transparent, tamper-proof verification of materials and services provided, facilitating prompt and accurate payment processing. These digitally secured records streamline audit trails and enhance trust between contractors and subcontractors by providing immutable proof of delivery. |

| 10 | AI-Generated Work Completion Photos | Subcontractors must submit AI-generated work completion photos alongside standard documentation such as lien waivers, invoices, and signed change orders to verify progress and facilitate accurate payment processing. These AI-enhanced images provide precise visual proof of work performed, improving transparency and reducing disputes in construction contract payments. |

Introduction to Subcontractor Payment Documents

Submitting the correct documents ensures timely and accurate payment for subcontractors. These documents verify the work completed and compliance with contract terms.

Your payment request typically includes a signed subcontract agreement, detailed invoices, and lien waivers. Proof of insurance and certification of completed work are also essential for approval.

Importance of Accurate Payment Documentation

Accurate payment documentation is crucial for subcontractors to ensure timely and full compensation for completed work. Required documents typically include detailed invoices, lien waivers, and proof of compliance with contract terms. Maintaining precise records protects your financial interests and facilitates smooth communication with the primary contractor.

Common Types of Subcontractor Payment Documents

Subcontractors must submit specific documents to ensure timely and accurate payment. These documents verify work completion and compliance with contractual terms.

- Invoice - A detailed bill outlining the services performed and payment requested.

- Lien Waiver - A document that waives the right to place a lien after receiving payment.

- Progress Payment Application - A form requesting payment based on the percentage of work completed to date.

Essential Requirements for Payment Document Submission

What documents does a subcontractor need to submit for payment? Subcontractors must provide a detailed invoice and a signed lien waiver to initiate payment processing. Proof of insurance and compliance certificates are also essential to validate eligibility for payment.

Compliance Standards in Subcontractor Payment Processing

Subcontractors must meet specific compliance standards to ensure timely and accurate payment processing. Proper documentation verifies adherence to contractual and legal requirements.

- Compliance Certificates - Proof of meeting industry and safety standards required for project eligibility.

- Tax Forms - Submission of W-9 or equivalent tax documentation ensures proper tax reporting and withholding.

- Lien Waivers - Signed waivers prevent future claims and confirm payment has been appropriately allocated.

Your prompt submission of these documents supports smooth payment approval and maintains compliance integrity.

Timelines and Deadlines for Payment Submissions

| Document Type | Submission Deadline | Description |

|---|---|---|

| Invoice | Within 15 days after work completion | Detailed statement of work performed including quantities, rates, and total amount due for payment processing. |

| Lien Waivers | Along with each invoice submission | Legal documents releasing lien rights for the submitted work and payment received to date. |

| Work Progress Reports | Monthly or as specified in contract | Documentation of completed milestones and percentage of work finished used to verify payment eligibility. |

| Change Order Requests | Within 5 business days of scope change | Formal request for additional compensation or time due to changes in project scope or unforeseen conditions. |

| Certified Payroll Reports | With each payment application or monthly | Proof of labor compliance required on public or government contracts to confirm wage standards. |

| Insurance Certificates | Prior to subcontract start and upon renewal | Proof of required insurance coverage ensuring risk management compliance during project execution. |

| Payment Application | As per contract schedule, commonly monthly | Formal request summarizing all documentation and supporting evidence demanding payment. |

Step-by-Step Submission Process for Payment Documents

Subcontractors must follow a precise submission process to ensure timely payment for their work. Proper documentation facilitates clear communication and verification between parties.

- Invoice Submission - Submit a detailed invoice that lists work performed, timeframes, and agreed rates.

- Lien Waivers - Provide lien waivers to confirm that payments received will not result in future claims against the property.

- Certified Payroll Records - Include certified payroll records to verify labor compliance and wage standards.

- Change Order Documentation - Submit approved change orders to account for any modifications or additional work requested.

- Compliance Certificates - Attach necessary compliance certificates such as safety and licensing to meet contract requirements.

Common Errors in Subcontractor Payment Documentation

Subcontractors must submit accurate and complete payment documentation to ensure timely processing. Essential documents typically include signed invoices, lien waivers, and proof of completed work or deliverables.

Common errors in subcontractor payment documentation often involve missing signatures, incorrect invoice details, or incomplete lien waivers. These mistakes can delay payment and cause disputes between contractors and subcontractors, impacting your cash flow and project timelines.

Consequences of Non-Compliance in Payment Submissions

Subcontractors must submit detailed invoices, lien waivers, certified payroll records, and any required tax forms to ensure timely payment. Failure to provide these documents accurately and promptly can delay payment processing and disrupt project cash flow.

Non-compliance with payment submission requirements may result in withheld payments, legal disputes, and damage to the subcontractor's reputation. Contractors often require strict adherence to documentation protocols to maintain clear financial records and protect against claims. Consistent non-compliance can jeopardize future contract opportunities and lead to contract termination.

What Documents Does a Subcontractor Need to Submit for Payment? Infographic