Vendor registration with large retailers requires a comprehensive set of documents to ensure compliance and streamline the contracting process. Key documents typically include a completed vendor application form, a valid business license, tax identification numbers, proof of insurance, and financial statements. Providing contract agreements, product certifications, and references further supports eligibility and demonstrates reliability for partnership success.

What Documents Are Required for Vendor Registration with Large Retailers?

| Number | Name | Description |

|---|---|---|

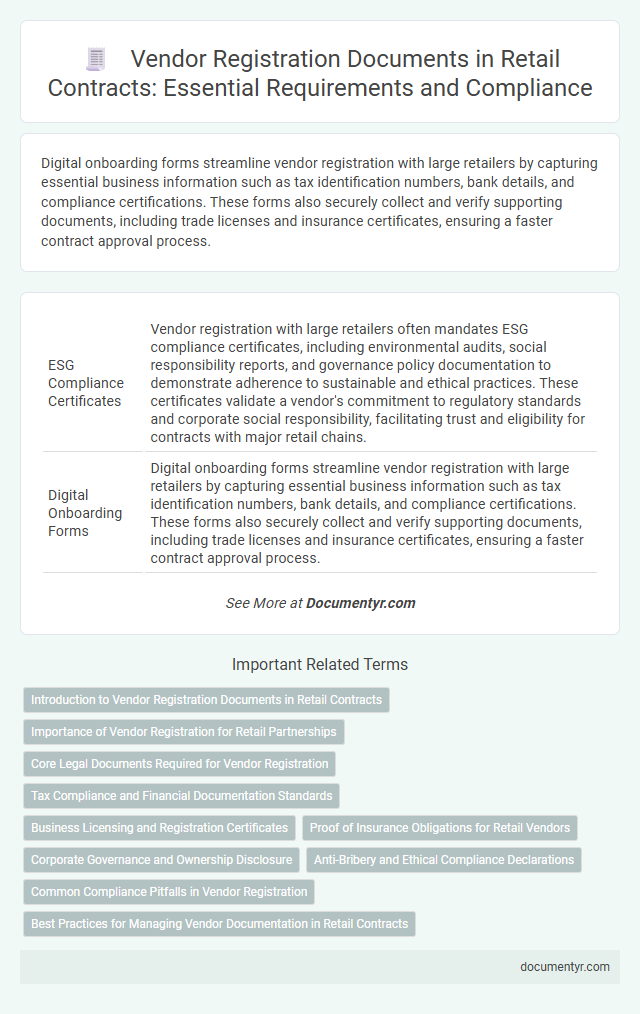

| 1 | ESG Compliance Certificates | Vendor registration with large retailers often mandates ESG compliance certificates, including environmental audits, social responsibility reports, and governance policy documentation to demonstrate adherence to sustainable and ethical practices. These certificates validate a vendor's commitment to regulatory standards and corporate social responsibility, facilitating trust and eligibility for contracts with major retail chains. |

| 2 | Digital Onboarding Forms | Digital onboarding forms streamline vendor registration with large retailers by capturing essential business information such as tax identification numbers, bank details, and compliance certifications. These forms also securely collect and verify supporting documents, including trade licenses and insurance certificates, ensuring a faster contract approval process. |

| 3 | Supplier Diversity Attestation | Vendor registration with large retailers requires a Supplier Diversity Attestation that verifies the business is a certified minority, women-owned, veteran-owned, or other designated diverse supplier. This document supports compliance with corporate diversity initiatives and must be accompanied by certification from recognized agencies such as the National Minority Supplier Development Council or Women's Business Enterprise National Council. |

| 4 | Cybersecurity Self-Assessment | Large retailers typically require vendors to submit a comprehensive Cybersecurity Self-Assessment questionnaire demonstrating compliance with industry-standard frameworks such as NIST or ISO 27001. This document assesses the vendor's risk management practices, data protection measures, and incident response protocols to ensure secure handling of sensitive customer information. |

| 5 | Conflict Minerals Disclosure | Vendor registration with large retailers requires submitting a Conflict Minerals Disclosure document that verifies compliance with the Dodd-Frank Act Section 1502. This disclosure must detail the sourcing of tin, tungsten, tantalum, and gold to ensure materials are not sourced from conflict regions or contribute to human rights violations. |

| 6 | Third-Party Risk Questionnaire | Large retailers require vendors to complete a Third-Party Risk Questionnaire as a critical part of vendor registration to assess potential risks related to compliance, data security, and financial stability. This document ensures thorough due diligence by evaluating vendor controls, regulatory adherence, and operational practices before approving partnerships. |

| 7 | Data Privacy Impact Assessment | Vendor registration with large retailers requires submitting a Data Privacy Impact Assessment (DPIA) to ensure compliance with data protection regulations by identifying and mitigating privacy risks associated with handling customer and transactional data. This document demonstrates the vendor's commitment to securing sensitive information and aligns with retailers' stringent data governance policies. |

| 8 | Modern Slavery Statement | Large retailers typically require a Modern Slavery Statement as part of vendor registration documents to ensure compliance with anti-slavery and human trafficking laws. This statement must detail the vendor's policies and actions taken to identify and mitigate risks of modern slavery within their supply chain. |

| 9 | Blockchain Traceability Report | A Blockchain Traceability Report is essential for vendor registration with large retailers as it provides verified, immutable records of product origin and supply chain movements, ensuring transparency and authenticity. This document supports compliance with retailer standards by demonstrating end-to-end traceability and reducing risks associated with counterfeit goods or unethical sourcing. |

| 10 | Product Carbon Footprint Declaration | Large retailers require a Product Carbon Footprint Declaration as part of vendor registration to ensure transparency in environmental impact and compliance with sustainability standards. This document details the greenhouse gas emissions associated with the product's lifecycle, aiding retailers in verifying eco-friendly supply chain practices. |

Introduction to Vendor Registration Documents in Retail Contracts

Vendor registration with large retailers requires a comprehensive set of documents to ensure compliance and establish credibility. These documents form the foundation of retail contracts, facilitating seamless business partnerships.

- Business License - Validates the legal operation and authenticity of the vendor's business entity.

- Tax Identification Number (TIN) - Confirms tax compliance and enables proper financial transactions.

- Product Certifications - Demonstrates adherence to quality and safety standards pertinent to retail requirements.

Importance of Vendor Registration for Retail Partnerships

What documents are required for vendor registration with large retailers? Vendor registration is crucial for establishing trust and ensuring compliance with retail standards. You must provide specific documents to verify your business credibility and operational capacity.

Core Legal Documents Required for Vendor Registration

Vendor registration with large retailers requires submitting core legal documents to ensure compliance and legitimacy. Essential documents typically include a valid business license, tax identification number, and signed vendor agreement or contract. These documents verify the vendor's legal status, tax obligations, and agreement to retailer policies, facilitating a smooth registration process.

Tax Compliance and Financial Documentation Standards

Vendor registration with large retailers requires strict adherence to tax compliance and financial documentation standards. Essential documents include a valid Tax Identification Number (TIN), recent tax clearance certificates, and audited financial statements to demonstrate fiscal responsibility. Retailers may also request proof of VAT registration and up-to-date bank statements to verify financial stability and regulatory compliance.

Business Licensing and Registration Certificates

Business licensing and registration certificates are essential documents for vendor registration with large retailers. These documents verify that your business operates legally and complies with local regulations.

Retailers require valid business licenses and registration certificates to ensure legitimacy and reduce risk. Providing these documents demonstrates your business's credibility and readiness to engage in formal contracts.

Proof of Insurance Obligations for Retail Vendors

Vendor registration with large retailers typically requires a set of essential documents, including business licenses, tax identification numbers, and financial statements. One crucial document is proof of insurance, demonstrating compliance with the retailer's risk management policies.

Your proof of insurance must cover general liability, product liability, and workers' compensation as specified by the retailer's contract requirements. Providing valid insurance certificates ensures your eligibility to operate safely within the retailer's supply chain and protects both parties from potential risks.

Corporate Governance and Ownership Disclosure

Vendor registration with large retailers demands precise documentation emphasizing corporate governance and ownership disclosure. Proper submission of these documents ensures transparency and compliance with retailer policies.

- Corporate Bylaws - These define the internal rules governing your company's management and operational procedures.

- Ownership Structure Documentation - Detailed records of shareholders or members, clarifying the entity's ownership hierarchy.

- Board of Directors List - An updated roster including roles and responsibilities of all directors involved in corporate decisions.

Providing accurate corporate governance and ownership information facilitates a smooth vendor registration process with large retail chains.

Anti-Bribery and Ethical Compliance Declarations

Vendor registration with large retailers requires specific documents ensuring compliance with ethical standards. Anti-bribery and ethical compliance declarations form a critical part of this documentation process.

- Anti-Bribery Policy Declaration - A formal statement confirming the vendor's commitment to prohibiting bribery and corruption in all business dealings.

- Code of Ethics Compliance - Documentation proving adherence to the retailer's prescribed ethical guidelines and business conduct standards.

- Third-Party Audit Reports - Independent assessments verifying the vendor's compliance with anti-bribery laws and ethical practices.

Common Compliance Pitfalls in Vendor Registration

| Document Type | Description | Common Compliance Pitfalls |

|---|---|---|

| Business License | Official registration proving the vendor's legal business status. | Submitting expired licenses or licenses not matching business activity leads to rejection. |

| Tax Identification Number (TIN) | Government-issued number for tax reporting and compliance. | Incorrect or missing TIN information causes delays in processing and compliance failures. |

| Insurance Certificates | Proof of liability and workers' compensation insurance coverage. | Insurance amounts below retailer requirements or lapsed policies trigger non-compliance flags. |

| Financial Statements | Audited or unaudited reports demonstrating financial stability. | Incomplete, outdated, or unaudited financial records fail to meet large retailers' standards. |

| Product Certifications | Verification of product compliance with safety and quality standards. | Submitting non-certified products or lacking documentation causes compliance breaches. |

| Vendor Code of Conduct Agreement | Document affirming adherence to retailer's ethical and operational policies. | Unsigned or incomplete agreements prevent successful vendor onboarding. |

| W-9 or Equivalent Tax Forms | Required for vendor verification and IRS reporting. | Incorrect or missing taxpayer information delays vendor approval. |

| References and Past Performance Records | Evidence of reliable service and quality assurance from previous clients. | Providing unverifiable or irrelevant references weakens vendor credibility. |

What Documents Are Required for Vendor Registration with Large Retailers? Infographic