Mortgage loan approval requires key documents such as proof of income, including recent pay stubs, W-2 forms, and tax returns, to verify financial stability. Lenders also request credit reports, employment verification, and details about existing debts to assess creditworthiness. Property-related documents like the purchase agreement, appraisal report, and title insurance are essential to finalize the loan process.

What Documents Are Needed for Mortgage Loan Approval?

| Number | Name | Description |

|---|---|---|

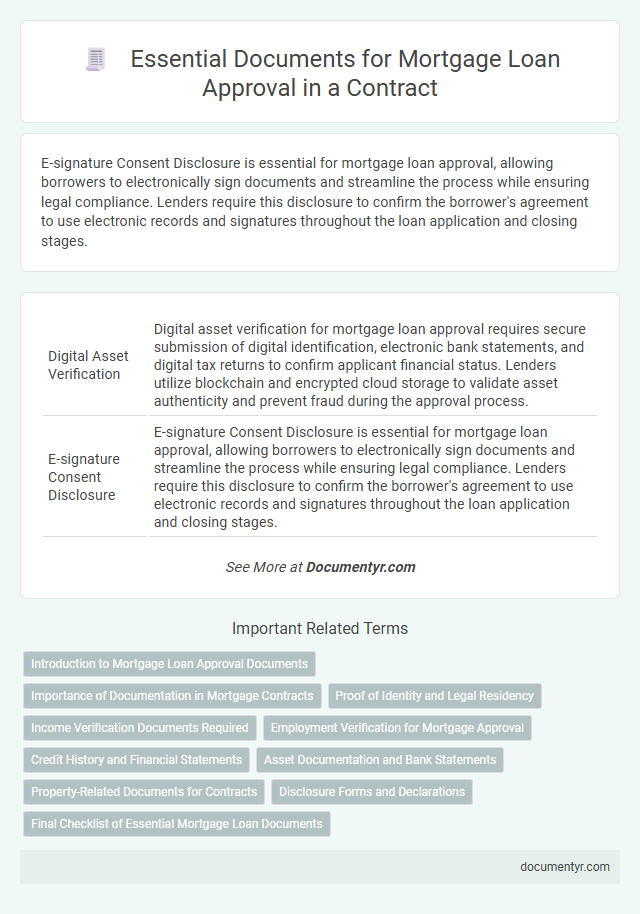

| 1 | Digital Asset Verification | Digital asset verification for mortgage loan approval requires secure submission of digital identification, electronic bank statements, and digital tax returns to confirm applicant financial status. Lenders utilize blockchain and encrypted cloud storage to validate asset authenticity and prevent fraud during the approval process. |

| 2 | E-signature Consent Disclosure | E-signature Consent Disclosure is essential for mortgage loan approval, allowing borrowers to electronically sign documents and streamline the process while ensuring legal compliance. Lenders require this disclosure to confirm the borrower's agreement to use electronic records and signatures throughout the loan application and closing stages. |

| 3 | Cryptocurrency Holdings Statement | A Cryptocurrency Holdings Statement is essential for mortgage loan approval when digital assets contribute to your financial profile, providing verification of ownership, wallet addresses, transaction history, and current market value. Lenders use this document to assess liquidity, mitigate risks associated with asset volatility, and ensure compliance with financial disclosure requirements. |

| 4 | Automated Income Verification (AIV) Report | Automated Income Verification (AIV) Report streamlines mortgage loan approval by providing real-time access to borrowers' income data directly from payroll systems and financial institutions. This report enhances accuracy and reduces processing time by validating employment status, pay frequency, and income consistency essential for underwriting decisions. |

| 5 | Remote Employment Confirmation Letter | A Remote Employment Confirmation Letter is essential for mortgage loan approval as it verifies stable income and job security from a remote position, ensuring lenders of the borrower's ability to repay the loan. This document should include employer contact information, job title, remote work duration, and confirmation of continued remote employment status. |

| 6 | Rent Payment Ledger (FinTech-synced) | A rent payment ledger synced with FinTech platforms provides verified proof of consistent tenant payments, enhancing the credibility of income stability crucial for mortgage loan approval. Mortgage underwriters prioritize these digital ledgers as they offer transparent, real-time rental income data, reducing risk and expediting the contract evaluation process. |

| 7 | Open Banking Authorization | Open Banking Authorization is a crucial document in mortgage loan approval, enabling lenders to securely access applicants' financial data for accurate credit assessment. This authorization streamlines the verification process by providing real-time access to bank statements, transaction histories, and income details, ensuring a faster and more transparent loan approval decision. |

| 8 | Digital Bank Statement Aggregator File | A Digital Bank Statement Aggregator File provides a consolidated and verified financial overview essential for mortgage loan approval by streamlining income and expense documentation directly from multiple bank accounts. Lenders rely on this digital file to efficiently assess a borrower's financial stability, enabling faster and more accurate underwriting decisions. |

| 9 | COVID-19 Forbearance Exit Letter | Lenders require a COVID-19 forbearance exit letter as proof that the borrower has successfully completed their forbearance plan and resumed regular mortgage payments, facilitating the mortgage loan approval process. This document verifies the borrower's current financial status and ensures compliance with post-forbearance terms, critical for assessing loan eligibility. |

| 10 | Gig Economy Income Assessment Document | Mortgage loan approval for gig economy workers requires comprehensive income assessment documentation, including detailed profit and loss statements, bank statements showing consistent deposits, 1099 forms, and tax returns for at least two years. Lenders also consider invoices, contracts, and client payment records to verify income stability and accurately assess repayment capacity. |

Introduction to Mortgage Loan Approval Documents

What documents are essential for mortgage loan approval? Mortgage loan approval requires a set of specific documents to verify your financial stability and creditworthiness. Understanding these documents is crucial to streamline the approval process.

Importance of Documentation in Mortgage Contracts

Mortgage loan approval requires a comprehensive set of documents to verify financial stability and creditworthiness. These documents form the foundation of mortgage contracts, ensuring transparency and legal compliance.

Key documents include income statements, tax returns, credit reports, and property appraisal reports. Proper documentation safeguards your interests and facilitates a smooth contract approval process.

Proof of Identity and Legal Residency

Proof of identity is essential for mortgage loan approval to verify your legal status and prevent fraud. Documents such as a valid passport, government-issued ID, or driver's license are commonly required.

Legal residency must be demonstrated with appropriate documentation to confirm your right to live and work in the country. Accepted documents include a permanent resident card, visa, or green card. Lenders require these to ensure compliance with federal lending regulations.

Income Verification Documents Required

Income verification is a critical component of the mortgage loan approval process. Lenders require specific documents to assess an applicant's financial stability and repayment ability.

- Pay Stubs - Recent pay stubs, typically covering the last 30 days, demonstrate current income and employment status.

- W-2 Forms - W-2 forms from the past two years provide a comprehensive overview of annual earnings and tax compliance.

- Tax Returns - Complete federal tax returns, including schedules, help verify income consistency, especially for self-employed individuals.

Employment Verification for Mortgage Approval

Employment verification is a crucial document required for mortgage loan approval. Lenders typically request recent pay stubs, W-2 forms, and contact information for your employer to confirm your income and job stability. This verification assures lenders of your ability to repay the mortgage loan consistently.

Credit History and Financial Statements

Credit history is a crucial document for mortgage loan approval, as it provides lenders with a detailed record of your past borrowing and repayment behavior. Financial statements, including recent pay stubs, bank statements, and tax returns, offer insight into your current income and financial stability. Together, these documents enable lenders to assess your creditworthiness and determine your ability to repay the mortgage loan.

Asset Documentation and Bank Statements

Obtaining mortgage loan approval requires thorough verification of your financial assets and consistent bank activity. Asset documentation and bank statements play a crucial role in demonstrating your financial stability to lenders.

- Recent Bank Statements - Lenders typically require the last two to three months of bank statements to evaluate your spending habits and verify available funds.

- Proof of Asset Ownership - Documentation such as investment account statements, retirement fund summaries, and property deeds is necessary to confirm your financial assets.

- Liquid Asset Verification - Statements showing readily accessible funds, like savings or checking account balances, help establish your ability to cover down payments and closing costs.

Property-Related Documents for Contracts

Property-related documents are essential for mortgage loan approval as they verify ownership and legal status. These documents ensure the property is free from disputes and encumbrances before the loan is granted.

Key documents include the title deed, which proves ownership, and the property tax receipts, confirming payment history. A certified property survey and the sales agreement or contract provide additional verification for the lender.

Disclosure Forms and Declarations

| Document Type | Description |

|---|---|

| Disclosure Forms | These are mandatory documents that lenders provide to inform you about the terms, costs, and risks associated with your mortgage loan. Key disclosure forms include the Loan Estimate, Closing Disclosure, and Truth-in-Lending Statement. They ensure transparency and help you understand the financial obligations before final approval. |

| Declarations | Declarations are statements you provide regarding your financial status, property, and loan application details. Common declarations include information on outstanding lawsuits, bankruptcy history, ownership of other properties, and occupancy intentions. Accurate and complete declarations are critical for the loan underwriter to assess your eligibility and risk profile. |

What Documents Are Needed for Mortgage Loan Approval? Infographic