A clear and detailed contract outlining the pet care services and business terms is essential for a bank loan application for a startup. Alongside the contract, key documents include a comprehensive business plan, financial statements, and proof of identity. These documents demonstrate the startup's viability and financial responsibility to bank lenders.

What Documents Are Needed for Bank Loan Application for a Startup?

| Number | Name | Description |

|---|---|---|

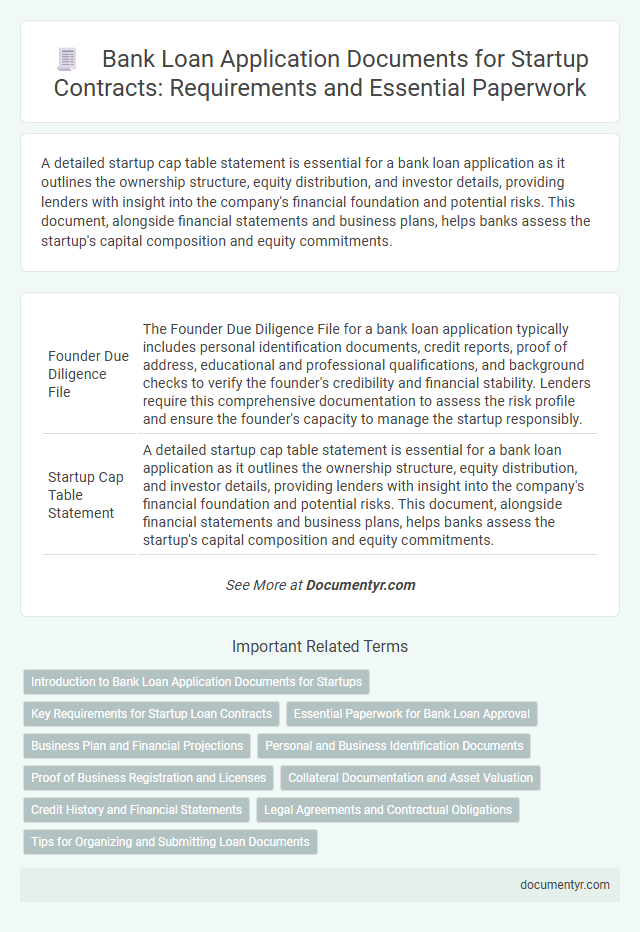

| 1 | Founder Due Diligence File | The Founder Due Diligence File for a bank loan application typically includes personal identification documents, credit reports, proof of address, educational and professional qualifications, and background checks to verify the founder's credibility and financial stability. Lenders require this comprehensive documentation to assess the risk profile and ensure the founder's capacity to manage the startup responsibly. |

| 2 | Startup Cap Table Statement | A detailed startup cap table statement is essential for a bank loan application as it outlines the ownership structure, equity distribution, and investor details, providing lenders with insight into the company's financial foundation and potential risks. This document, alongside financial statements and business plans, helps banks assess the startup's capital composition and equity commitments. |

| 3 | Go-to-Market Strategy Whitepaper | A comprehensive Go-to-Market Strategy Whitepaper is essential for a startup's bank loan application as it outlines the market analysis, target audience, competitive landscape, and revenue projections, demonstrating the business's viability and growth potential. This document provides lenders with detailed insights into the startup's strategic approach, mitigating perceived risks and justifying the loan request. |

| 4 | IP Portfolio Disclosure | A comprehensive IP portfolio disclosure is essential in a bank loan application for a startup, including patents, trademarks, copyrights, and trade secrets documentation to demonstrate the company's intangible asset value. Detailed records of IP ownership, registration certificates, licensing agreements, and any pending applications help establish credibility and strengthen the startup's financial position for loan approval. |

| 5 | Digital Valuation Report | A comprehensive digital valuation report is essential for a startup's bank loan application, providing an accurate assessment of the company's market value based on digital assets, intellectual property, and online presence. This document supports financial institutions in evaluating risk and potential growth, ensuring informed loan approval decisions. |

| 6 | Traction Metrics Dashboard | A Traction Metrics Dashboard is essential for a bank loan application for a startup, showcasing key performance indicators such as monthly revenue growth, customer acquisition rates, and user engagement levels. This document provides concrete evidence of business progress and market validation, increasing lender confidence in the startup's potential for sustainable success. |

| 7 | Data Room Access Log | A comprehensive bank loan application for a startup requires a detailed Data Room Access Log to verify the authenticity and security of all submitted documents, ensuring transparent tracking of user activity and data integrity. This log provides lenders with crucial audit trails of who accessed sensitive financial records, business plans, and legal contracts, facilitating informed decision-making during the loan evaluation process. |

| 8 | Compliance Readiness Certificate | A Compliance Readiness Certificate is essential for a startup bank loan application as it verifies adherence to regulatory and legal standards, ensuring the business meets all compliance requirements. This document supports risk assessment and enhances lender confidence by demonstrating the startup's commitment to operational transparency and legal obligations. |

| 9 | Runway Projection Sheet | A runway projection sheet is essential for a startup's bank loan application, providing a detailed forecast of cash flow, expenses, and operational runway to demonstrate financial sustainability. This document helps lenders assess the startup's ability to manage funds and repay the loan within the projected timeline. |

| 10 | ESG (Environmental, Social, Governance) Declaration Form | A bank loan application for a startup requires standard documents such as a business plan, financial statements, and identification proof, with increasing emphasis on an ESG (Environmental, Social, Governance) Declaration Form to demonstrate the company's commitment to sustainable and ethical practices. The ESG Declaration Form typically includes disclosures on environmental impact, social responsibility initiatives, and governance structure, which lenders assess to evaluate risk and long-term viability. |

Introduction to Bank Loan Application Documents for Startups

Applying for a bank loan as a startup requires preparing specific documents to demonstrate financial stability and business potential. These documents help banks evaluate the risk and feasibility of lending to new businesses. Understanding the essential paperwork streamlines the application process and increases the chances of approval.

Key Requirements for Startup Loan Contracts

| Document | Description | Purpose |

|---|---|---|

| Business Plan | Comprehensive outline of the startup's business model, market analysis, and financial projections. | Demonstrates viability and repayment ability to the bank. |

| Loan Application Form | Official application provided by the bank, filled out with accurate personal and business details. | Initiates the loan review process. |

| Personal Identification | Government-issued IDs such as passport, driver's license, or national identification card. | Verifies identity of the loan applicant. |

| Financial Statements | Balance sheets, profit and loss statements, and cash flow statements, if available. | Assesses current financial health and forecasted revenue streams. |

| Tax Returns | Recent personal and business tax filing documents. | Confirms income and compliance with tax regulations. |

| Legal Documents | Business registration certificate, incorporation papers, and shareholder agreements. | Validates the legal existence and ownership structure of the startup. |

| Collateral Documentation | Proof of assets offered as security for the loan, such as property deeds or equipment inventories. | Provides security assurance to the lender. |

| Credit Report | Credit history from authorized agencies detailing creditworthiness. | Evaluates risk and reliability for loan repayment. |

| Loan Contract Draft | Preliminary draft outlining the terms and conditions between the lender and borrower. | Ensures clarity on obligations, interest rates, and repayment schedules. |

| Bank Statements | Recent statements from your business bank accounts. | Confirms cash flow and account activity. |

Essential Paperwork for Bank Loan Approval

Securing a bank loan for a startup requires submitting specific documents that demonstrate financial stability and business viability. Proper preparation of essential paperwork increases the chances of loan approval.

- Business Plan - A detailed document outlining your startup's goals, target market, and financial projections to convince the bank of your business's potential.

- Financial Statements - Includes income statements, balance sheets, and cash flow statements to reflect the startup's current financial position and performance.

- Legal Documents - Copies of business registration, licenses, and permits proving your startup's legal compliance and operational legitimacy.

- Personal Identification - Valid government-issued ID to verify the identity of the applicant and involved partners.

- Collateral Documentation - Evidence of assets pledged as security to back the loan application when required by the bank.

Meeting these documentation requirements ensures your startup is well-positioned for bank loan approval.

Business Plan and Financial Projections

Applying for a bank loan as a startup requires thorough preparation of key documents that demonstrate business viability. The business plan and financial projections are essential in convincing lenders of your startup's potential for success.

- Business Plan - A comprehensive business plan outlines your startup's mission, target market, competitive analysis, and operational strategy to provide lenders with a clear understanding of your business model.

- Financial Projections - Detailed financial projections include income statements, cash flow forecasts, and balance sheets that predict your startup's financial performance over the next several years.

- Supporting Financial Documents - Additional documents such as tax returns and proof of collateral enhance the credibility of your loan application by supporting the financial projections and business plan.

Personal and Business Identification Documents

What personal identification documents are required for a startup bank loan application? Banks typically require government-issued ID such as a passport or driver's license. Proof of address and a Social Security number or Tax Identification Number are also essential.

Which business identification documents must a startup submit for a bank loan? Startups need to provide their business registration certificate and Employer Identification Number (EIN). Additional documents may include the business license and Articles of Incorporation to verify legal status.

Proof of Business Registration and Licenses

Proof of business registration is a critical document required for a bank loan application for a startup. It validates the legal existence of the business and ensures the startup is officially recognized by government authorities.

Licenses specific to the startup's industry must also be presented to confirm compliance with regulatory standards. These licenses demonstrate that the business operates within legal boundaries and meets all requisite operational requirements.

Collateral Documentation and Asset Valuation

Collateral documentation and asset valuation are critical components of a bank loan application for a startup. These documents help banks assess the security and value of the assets offered against the loan.

- Proof of Ownership - Documents such as title deeds, vehicle registration, or equipment invoices verify the startup's legal ownership of collateral assets.

- Asset Appraisal Report - A professional appraisal provides an accurate market valuation of physical assets to determine their worth as collateral.

- Insurance Papers - Valid insurance documents protect the collateral from unforeseen losses, ensuring the bank's security during the loan tenure.

Credit History and Financial Statements

For a bank loan application for a startup, credit history and financial statements are essential documents. Credit history demonstrates your ability to manage debt and repay loans responsibly, providing lenders with insight into your financial reliability. Financial statements, including profit and loss statements, balance sheets, and cash flow statements, offer a detailed view of your startup's financial health and business potential.

Legal Agreements and Contractual Obligations

Legal agreements are essential for a startup applying for a bank loan, as they establish the foundation of trust and clearly define obligations between parties. Key documents include the Articles of Incorporation, partnership agreements, and shareholder contracts to prove the business's legal structure and ownership.

Contractual obligations such as loan agreements, lease contracts, and employment agreements demonstrate the startup's financial responsibilities and operational commitments. Banks assess these documents to evaluate risk and ensure the startup's ability to meet repayment terms under established contracts.

What Documents Are Needed for Bank Loan Application for a Startup? Infographic