First-time homebuyer grants require several key documents, including proof of income such as pay stubs or tax returns, valid identification like a driver's license or passport, and a pre-approval letter from a mortgage lender. Applicants must also provide documentation proving their first-time homebuyer status, such as a signed affidavit, along with purchase agreements for the property. Verification of citizenship or legal residency is often necessary to confirm eligibility for grant programs.

What Documents Are Required for First-Time Homebuyer Grants?

| Number | Name | Description |

|---|---|---|

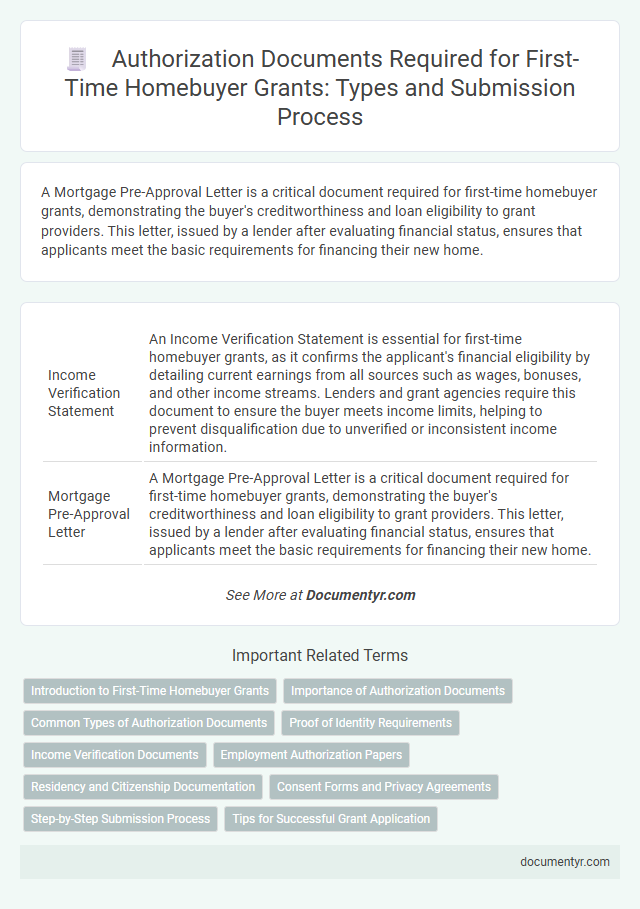

| 1 | Income Verification Statement | An Income Verification Statement is essential for first-time homebuyer grants, as it confirms the applicant's financial eligibility by detailing current earnings from all sources such as wages, bonuses, and other income streams. Lenders and grant agencies require this document to ensure the buyer meets income limits, helping to prevent disqualification due to unverified or inconsistent income information. |

| 2 | Mortgage Pre-Approval Letter | A Mortgage Pre-Approval Letter is a critical document required for first-time homebuyer grants, demonstrating the buyer's creditworthiness and loan eligibility to grant providers. This letter, issued by a lender after evaluating financial status, ensures that applicants meet the basic requirements for financing their new home. |

| 3 | First-Time Homebuyer Affidavit | The First-Time Homebuyer Affidavit is crucial for securing grants, serving as legal proof that the applicant has not owned a home in the past three years. This document must be accurately completed and submitted alongside proof of income, property purchase agreement, and identification to meet grant eligibility requirements. |

| 4 | Household Composition Declaration | The Household Composition Declaration is a critical document for first-time homebuyer grants, detailing all individuals residing in the household to verify eligibility criteria. This declaration typically requires the names, ages, and relationships of all household members to ensure accurate assessment of grant qualifications. |

| 5 | Asset Disclosure Form | First-time homebuyer grants typically require an Asset Disclosure Form to verify the applicant's financial assets and ensure eligibility for the program. This document lists all assets including savings, investments, and property to assess the buyer's overall financial status. |

| 6 | Purchase Agreement Contract | The Purchase Agreement Contract is a crucial document for first-time homebuyer grants, serving as proof of the property's purchase price and terms. Lenders and grant authorities require this legally binding contract to verify eligibility and finalize funding authorization. |

| 7 | Grant-Specific Eligibility Certificate | Grant-specific eligibility certificates are crucial documents required for first-time homebuyer grants, verifying that applicants meet all program criteria such as income limits, residency status, and property qualifications. These certificates must be issued by authorized agencies or grant providers to ensure compliance with grant conditions before funds can be disbursed. |

| 8 | HUD Counseling Certificate | First-time homebuyer grants typically require a HUD Counseling Certificate, which verifies completion of a HUD-approved housing counseling program essential for grant eligibility. This certificate demonstrates that applicants have received expert guidance on home buying, budgeting, and credit management, ensuring informed decision-making throughout the process. |

| 9 | Occupancy Commitment Letter | An Occupancy Commitment Letter is a critical document for first-time homebuyer grants, serving as a legally binding agreement that the buyer will occupy the property as their primary residence. This letter ensures compliance with grant requirements and often accompanies income verification and property purchase agreements. |

| 10 | Down Payment Source Documentation | First-time homebuyer grants require thorough down payment source documentation, including recent bank statements, gift letters if funds are from family or friends, and proof of any earned income or savings contributions. Lenders demand these documents to verify legitimate and traceable funds, ensuring compliance with grant authorization and preventing fraud. |

Introduction to First-Time Homebuyer Grants

First-time homebuyer grants provide financial assistance to individuals purchasing their initial property. These grants aim to reduce the burden of down payments and closing costs.

Applicants must submit specific documents to verify eligibility and support the grant application. Understanding these requirements is crucial to a successful application process.

Importance of Authorization Documents

| Document | Purpose | Importance in Authorization |

|---|---|---|

| Proof of Income | Verifies eligibility based on income limits set by the grant program | Authorizes the grant provider to confirm financial qualification |

| Credit Report | Assesses creditworthiness and financial responsibility | Grants permission to review credit history for approval decisions |

| Identification Documents (Driver's License, Passport) | Confirms identity and residency status | Allows authorization to verify your personal information |

| Purchase Agreement | Details the home purchase terms | Serves as authorization evidence of intended property acquisition |

| Grant Application Form | Collects essential data for processing the grant | Authorizes collection and use of personal and financial information |

Common Types of Authorization Documents

First-time homebuyer grants require various authorization documents to verify eligibility and identity. Understanding common authorization documents helps streamline the application process.

- Government-Issued Identification - Valid photo IDs like a driver's license or passport confirm the applicant's identity.

- Proof of Income - Documents such as pay stubs or tax returns verify financial eligibility for grant programs.

- Residency Authorization - Utility bills or lease agreements serve as proof of current residency and intent to occupy the home.

Providing accurate and complete authorization documents is essential to secure first-time homebuyer grants efficiently.

Proof of Identity Requirements

Proof of identity is a critical component when applying for first-time homebuyer grants to verify the applicant's legal status. Accurate identity documentation ensures eligibility and prevents fraud in the grant approval process.

- Valid Government-Issued ID - Applicants must submit a current government-issued identification card such as a driver's license or passport.

- Social Security Number Verification - Submission of a Social Security card or official document that confirms the applicant's Social Security Number is required.

- Additional Residency Evidence - Documents such as utility bills or lease agreements may be necessary to establish residency status along with identity.

Income Verification Documents

Income verification documents are essential for first-time homebuyer grants to confirm eligibility. Commonly required documents include recent pay stubs, W-2 forms, and federal tax returns from the past two years. Self-employed applicants may need to provide profit and loss statements or 1099 forms to validate their income.

Employment Authorization Papers

Employment authorization papers are a key requirement for first-time homebuyer grants. These documents verify your legal permission to work and contribute to income eligibility assessments.

- Employment Authorization Document (EAD) - Official proof issued by the U.S. Citizenship and Immigration Services confirming work eligibility.

- Valid Social Security Number - Required to substantiate your identity and employment records.

- Recent Pay Stubs or Employment Verification Letter - Demonstrates current employment status and income consistency.

Residency and Citizenship Documentation

What residency and citizenship documents are needed for first-time homebuyer grants? Proof of legal residency or citizenship is essential to qualify for these grants. Typically, applicants must provide documents like a valid passport, permanent resident card, or naturalization certificate.

Consent Forms and Privacy Agreements

First-time homebuyer grants require applicants to submit consent forms that authorize the grant agency to verify financial and personal information. Privacy agreements ensure that all collected data remains confidential and is used solely for processing the grant application. These documents protect both the applicant's rights and the agency's compliance with data protection regulations.

Step-by-Step Submission Process

First-time homebuyer grants require specific documentation to verify eligibility and financial status. These documents typically include proof of income, identity, and residency.

The submission process begins with gathering essential documents such as government-issued ID, recent pay stubs, and tax returns. Applicants must complete the grant application form accurately, attaching all required documents. Finally, submit the compiled application package to the designated housing authority or grant program office for review.

What Documents Are Required for First-Time Homebuyer Grants? Infographic