To obtain inheritance tax clearance, key documents include the original will or probate grant, a detailed inventory of the deceased's assets and liabilities, and the inheritance tax return form (IHT400 or IHT205). Supporting paperwork such as bank statements, property valuations, and death certificates are also essential. Ensuring these documents are accurate and complete facilitates timely approval from tax authorities.

What Documents are Required for Inheritance Tax Clearance?

| Number | Name | Description |

|---|---|---|

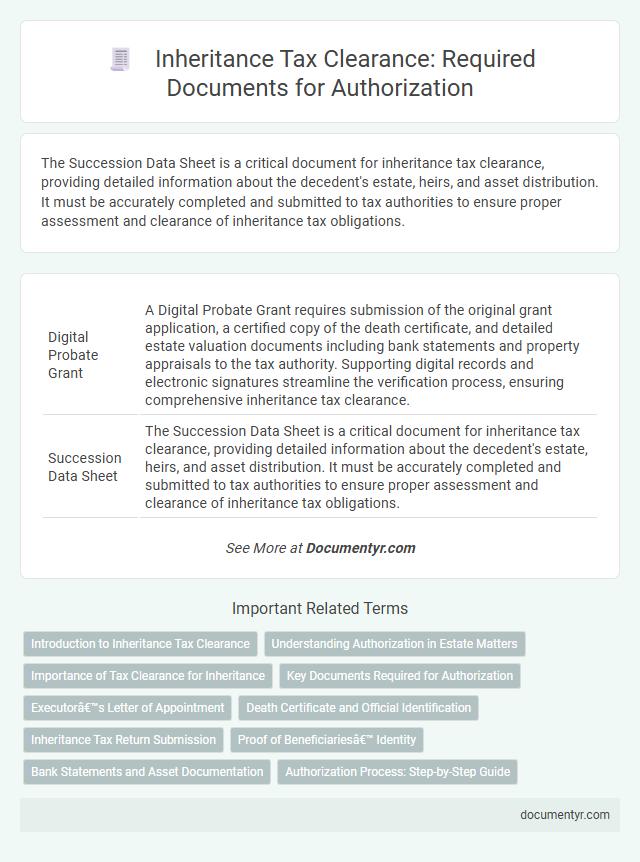

| 1 | Digital Probate Grant | A Digital Probate Grant requires submission of the original grant application, a certified copy of the death certificate, and detailed estate valuation documents including bank statements and property appraisals to the tax authority. Supporting digital records and electronic signatures streamline the verification process, ensuring comprehensive inheritance tax clearance. |

| 2 | Succession Data Sheet | The Succession Data Sheet is a critical document for inheritance tax clearance, providing detailed information about the decedent's estate, heirs, and asset distribution. It must be accurately completed and submitted to tax authorities to ensure proper assessment and clearance of inheritance tax obligations. |

| 3 | e-IRB (Electronic Inheritance Return Bundle) | To obtain inheritance tax clearance, the e-IRB (Electronic Inheritance Return Bundle) must include the deceased's death certificate, a detailed inventory of the estate's assets and liabilities, and the completed inheritance tax return forms. Accurate submission of these documents through the e-IRB system ensures timely processing and approval by the tax authorities. |

| 4 | Blockchain-stamped Will | Inheritance tax clearance requires submitting a valid will, death certificate, and completed inheritance tax forms, with increasing adoption of blockchain-stamped wills to ensure authenticity and prevent fraud. Blockchain technology provides a secure, tamper-proof digital record of the will, streamlining verification processes during inheritance tax clearance. |

| 5 | Virtual Estate Valuation Report | A Virtual Estate Valuation Report is essential for inheritance tax clearance, providing a comprehensive digital appraisal of all virtual assets such as cryptocurrencies, NFTs, and online accounts. This report ensures accurate valuation and substantiates asset ownership, facilitating compliance with tax authorities. |

| 6 | AI-generated Asset Inventory | An AI-generated asset inventory provides a detailed, automated record of all inherited assets, including real estate, investments, and personal property, streamlining the documentation needed for inheritance tax clearance. Essential documents typically include the asset inventory report, death certificate, will or probate documents, and any relevant tax filings to ensure accurate valuation and compliance with tax authorities. |

| 7 | Multi-jurisdictional Heir Certification | Multi-jurisdictional heir certification requires submitting authenticated legal documents such as wills, probate certificates, and death certificates from each relevant jurisdiction to the tax authority. These documents must comply with local inheritance laws and often need to be translated and notarized to ensure clearance for inheritance tax across different countries. |

| 8 | Cryptocurrency Estate Declaration | Inheritance tax clearance requires a comprehensive estate declaration, including detailed records of cryptocurrency holdings such as wallet addresses, transaction histories, and valuation reports at the date of death. Official documents like the deceased's will, probate grant, identification proofs, and tax returns must accompany digital asset disclosures to ensure accurate assessment and clearance. |

| 9 | Biometric Executor Authorization | Biometric executor authorization requires the submission of government-issued identification with biometric data, such as a passport or national ID card, alongside the deceased's death certificate and the court-issued grant of probate. These documents ensure the executor's identity is verified for inheritance tax clearance, facilitating secure and legal transfer of estate assets. |

| 10 | Secure e-Notarized Title Transfer | Inheritance tax clearance requires submission of the original death certificate, estate inventory, tax payment receipts, and a notarized affidavit of heirship. Secure e-notarized title transfer ensures a legally binding digital certification that expedites property ownership transfer while maintaining compliance with tax authorities. |

Introduction to Inheritance Tax Clearance

Inheritance tax clearance is a crucial step in the administration of an estate, ensuring that all due taxes are properly paid before assets are distributed. Understanding the necessary documents helps streamline this process and avoid legal complications.

- Death Certificate - Official proof of the decedent's passing required to initiate the clearance process.

- Will or Probate Grant - Legal documents establishing the executor's authority to manage the estate and settle taxes.

- Valuation of Estate Assets - Detailed inventory and appraisal of property and belongings subject to inheritance tax.

Your prompt submission of these documents facilitates efficient tax clearance and estate administration.

Understanding Authorization in Estate Matters

Authorization in estate matters ensures that the rightful heirs can manage and distribute assets according to legal requirements. Obtaining inheritance tax clearance is a crucial step in this process, verifying that all tax obligations are settled.

Documents required for inheritance tax clearance typically include the death certificate, the will or grant of probate, and detailed estate accounts. You must also provide tax returns and any necessary documentation proving the value of the estate to secure proper authorization.

Importance of Tax Clearance for Inheritance

Tax clearance for inheritance is essential to ensure all due taxes are accurately paid before assets are transferred to beneficiaries. Required documents typically include the death certificate, the will or probate documents, and relevant tax returns. Obtaining tax clearance prevents legal disputes and facilitates a smooth transfer of inherited property.

Key Documents Required for Authorization

Inheritance tax clearance requires specific documents to verify the estate's tax obligations. These key documents ensure proper authorization and legal compliance during the inheritance process.

The primary documents required include the original will, the grant of probate or letters of administration, and detailed estate valuation reports. Tax clearance certificates issued by the tax authority confirm that all inheritance taxes have been settled. You must provide identification documents and any relevant financial statements to support the claim for authorization.

Executor’s Letter of Appointment

What documents are required for inheritance tax clearance? The Executor's Letter of Appointment is essential for proving Your legal authority to manage the estate. This document confirms Your role and is necessary to proceed with tax clearance.

Death Certificate and Official Identification

Obtaining inheritance tax clearance requires submitting specific official documents to verify identity and the decedent's death. The death certificate and official identification are essential for processing Your inheritance tax obligations.

- Death Certificate - This vital record officially confirms the time and place of death, necessary for initiating inheritance tax clearance.

- Official Identification of the Deceased - Identification documents such as a passport or national ID card authenticate the deceased's identity in tax records.

- Your Official Identification - Providing Your valid ID proves Your authority to act on behalf of the estate during the clearance process.

Inheritance Tax Return Submission

Inheritance tax clearance requires submitting the Inheritance Tax Return along with essential documents such as the original will, death certificate, and detailed valuation of the estate. Proof of payment or arrangements for paying any owed tax must accompany the submission for processing. You must ensure all relevant financial statements, including bank and investment accounts, are accurately reported to avoid delays in clearance.

Proof of Beneficiaries’ Identity

| Document Type | Description | Purpose |

|---|---|---|

| Valid Government-Issued ID | Passports, National ID cards, or Driver's Licenses of beneficiaries | Verify the identity of each beneficiary involved in the inheritance |

| Birth Certificates | Official birth records linking beneficiaries to the deceased | Establish legal relationship and confirm beneficiary status |

| Marriage Certificates | Documents proving spousal relationships for beneficiaries | Confirm spouse as legal heir when applicable |

| Probate or Letters of Administration | Legal authorization documents naming beneficiaries or administrators | Demonstrate lawful authority to claim inheritance |

| Proof of Residence | Recent utility bills or official correspondence showing beneficiary's address | Corroborate identity and residency status |

| Affidavit of Identity | Notarized statement confirming beneficiary identity when standard documents are unavailable | Supplement official documents to validate identity |

Bank Statements and Asset Documentation

Inheritance tax clearance requires detailed documentation to verify the deceased's financial status. Bank statements and asset documentation play a crucial role in providing accurate information for tax assessment.

- Bank Statements - Provide a clear record of all transactions and balances to establish the estate's liquid assets.

- Asset Documentation - Includes property deeds, investment certificates, and other proof of ownership to assess the total estate value.

- Account Summaries - Summarize all financial accounts to assist tax authorities in verifying the reported estate worth.

What Documents are Required for Inheritance Tax Clearance? Infographic