To complete an SBA loan application, applicants must provide a variety of essential documents including personal and business tax returns, financial statements such as profit and loss statements and balance sheets, and legal documents like business licenses and articles of incorporation. Authorization forms granting permission for the SBA to verify credit history and access personal financial information are also required. Proper documentation ensures compliance with SBA requirements and facilitates a smoother loan approval process.

What Documents are Necessary for SBA Loan Application?

| Number | Name | Description |

|---|---|---|

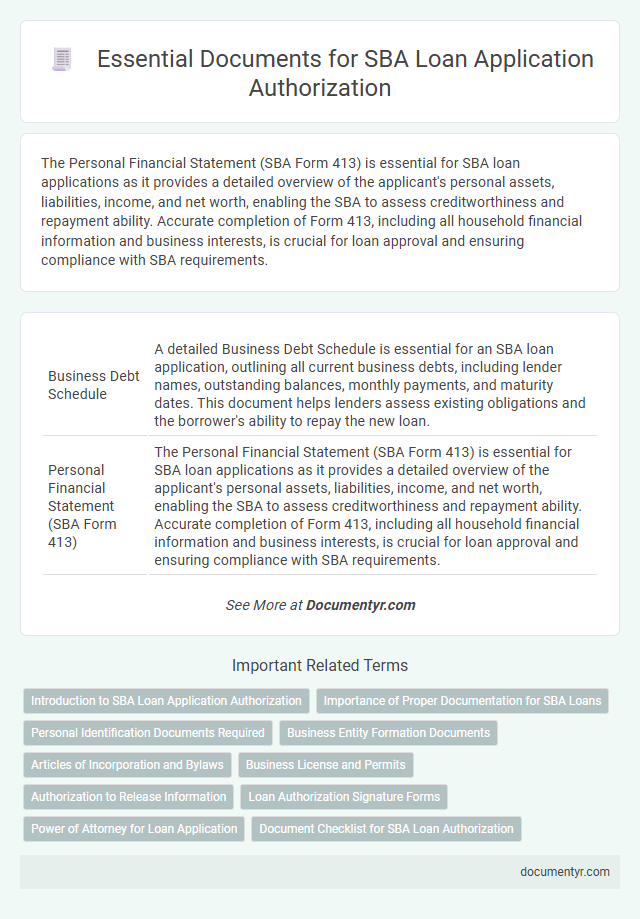

| 1 | Business Debt Schedule | A detailed Business Debt Schedule is essential for an SBA loan application, outlining all current business debts, including lender names, outstanding balances, monthly payments, and maturity dates. This document helps lenders assess existing obligations and the borrower's ability to repay the new loan. |

| 2 | Personal Financial Statement (SBA Form 413) | The Personal Financial Statement (SBA Form 413) is essential for SBA loan applications as it provides a detailed overview of the applicant's personal assets, liabilities, income, and net worth, enabling the SBA to assess creditworthiness and repayment ability. Accurate completion of Form 413, including all household financial information and business interests, is crucial for loan approval and ensuring compliance with SBA requirements. |

| 3 | Beneficial Ownership Certification | The Small Business Administration (SBA) requires a Beneficial Ownership Certification as part of the loan application process to verify the identities of individuals owning 25% or more of the business. This document, essential for compliance with SBA regulations, ensures transparency and helps prevent fraud by detailing ownership interests and control within the business. |

| 4 | Business Continuity Plan | A comprehensive Business Continuity Plan is essential for SBA loan applications as it demonstrates how a business will maintain operations during disruptions, ensuring lender confidence in financial stability. This document should outline risk assessments, recovery strategies, and communication protocols to meet SBA authorization requirements. |

| 5 | Digital Asset Disclosure | Digital Asset Disclosure requires precise documentation of cryptocurrency holdings, digital wallets, and transaction histories to verify asset legitimacy and value. Proper authorization forms and digital asset statements are essential for SBA loan eligibility and risk assessment. |

| 6 | Environmental Impact Questionnaire | The Environmental Impact Questionnaire is essential for SBA loan applications, as it assesses potential ecological effects related to the proposed project. This document, along with other financial and business records, ensures compliance with SBA environmental regulations and facilitates the loan authorization process. |

| 7 | EIDL Advance Reconciliation Statement | The SBA loan application process requires submitting the EIDL Advance Reconciliation Statement to verify the accurate use of Economic Injury Disaster Loan funds and to reconcile any advance payments received. This document is essential for ensuring compliance with SBA guidelines and avoiding potential loan forgiveness issues or repayment demands. |

| 8 | NAICS Code Verification | Verification of the NAICS code is a critical document in the SBA loan application process, as it categorizes the business within the standardized industry classification system required by the SBA. Accurate NAICS code documentation ensures eligibility and proper alignment with SBA loan programs, facilitating approval and compliance with federal guidelines. |

| 9 | Revenue Classification Report | The Revenue Classification Report is a critical document for SBA loan applications, detailing a company's income sources and categorizing revenue streams to verify financial stability. Lenders use this report to assess eligibility and repayment capacity, making it essential alongside tax returns and financial statements. |

| 10 | Economic Injury Worksheet | The Economic Injury Worksheet is essential for SBA loan applications as it provides detailed financial data demonstrating the extent of economic harm due to the pandemic. Accurate completion of this worksheet supports the calculation of the maximum loan amount based on the applicant's actual economic injury. |

Introduction to SBA Loan Application Authorization

Authorization is a critical step in the SBA loan application process. It grants the Small Business Administration permission to verify your financial and personal information.

Essential documents include a signed authorization form, personal identification, and business financial statements. These documents enable thorough background checks and credit evaluations. Proper authorization ensures compliance with SBA requirements and accelerates loan approval.

Importance of Proper Documentation for SBA Loans

Proper documentation is crucial for a successful SBA loan application. Accurate and complete documents ensure compliance with SBA requirements and streamline the approval process.

- Financial Statements - These documents provide a clear picture of your business's financial health, including profit and loss statements and balance sheets.

- Personal and Business Tax Returns - Tax returns verify income and help SBA assess creditworthiness and repayment ability.

- Business Plan - A detailed business plan demonstrates your strategy, market analysis, and loan utilization, which are vital for lender evaluation.

Submitting proper SBA loan documents increases the likelihood of securing funding efficiently.

Personal Identification Documents Required

Personal identification documents are essential for verifying the identity of applicants during the SBA loan application process. These documents help prevent fraud and ensure compliance with federal regulations.

- Government-issued Photo ID - A valid driver's license, passport, or state ID card is required to confirm the applicant's identity.

- Social Security Number - The applicant must provide their Social Security number for background and credit checks.

- Proof of Legal Residency - Non-U.S. citizens must present immigration documents such as a green card or visa to verify their legal status.

Business Entity Formation Documents

Business entity formation documents are essential for an SBA loan application because they verify the legal structure of your business. Common documents include articles of incorporation, partnership agreements, and operating agreements.

These documents establish ownership, management roles, and compliance with state regulations, which the SBA requires for loan approval. Providing accurate and complete formation documents helps demonstrate legitimacy and organizational stability.

Articles of Incorporation and Bylaws

For SBA loan applications, proper authorization documents are crucial to prove your business's legal structure. Articles of Incorporation and Bylaws are key documents lenders require to verify legitimacy and governance.

- Articles of Incorporation - This document establishes your business as a legal entity and outlines the corporation's purpose and registered agent.

- Bylaws - Bylaws define your company's internal management rules, including the roles and responsibilities of directors and officers.

- Authorization Verification - Lenders use these documents to confirm that your business is legally authorized to operate and enter into loan agreements.

Business License and Permits

| Document | Description | Purpose in SBA Loan Application |

|---|---|---|

| Business License | Official permission issued by a government agency allowing the business to operate legally within a particular jurisdiction. | Confirms the legitimacy of the business and its authorized operation location. Required by SBA to verify compliance with local regulations and legal operation status. |

| Permits | Specific authorizations required for certain business activities such as health permits, zoning permits, building permits, or environmental permits. | Ensures the business adheres to industry-specific regulations and safety requirements. SBA requires these to assess risk and ensure lawful operation of specific business activities. |

Authorization to Release Information

Authorization to Release Information is a critical document for SBA loan applications, allowing lenders to verify your financial and business details. This document grants permission to third parties, such as banks and credit agencies, to share necessary information with the SBA. Ensuring proper authorization helps streamline the approval process and maintains compliance with SBA guidelines.

Loan Authorization Signature Forms

What documents are necessary for SBA loan application, specifically for loan authorization signature forms? These forms verify your consent to the loan terms and allow the SBA to access relevant financial information. Properly completed signature forms are essential to expedite the approval process.

Power of Attorney for Loan Application

For an SBA loan application, it is essential to provide specific documents, including a valid Power of Attorney (POA) if someone other than you is handling the loan process. The Power of Attorney authorizes a representative to act on your behalf during the loan application, ensuring legal and financial decisions are properly managed. Submitting a correctly executed POA along with financial statements and business documentation helps streamline the SBA loan approval process.

What Documents are Necessary for SBA Loan Application? Infographic