To obtain an FHA loan pre-approval, borrowers must provide essential documents that verify their financial status and identity. These include recent pay stubs, W-2 forms from the past two years, bank statements, and a valid government-issued ID. Lenders may also require documentation of any additional income, employment verification, and credit history to assess eligibility accurately.

What Documents Are Necessary for FHA Loan Pre-Approval?

| Number | Name | Description |

|---|---|---|

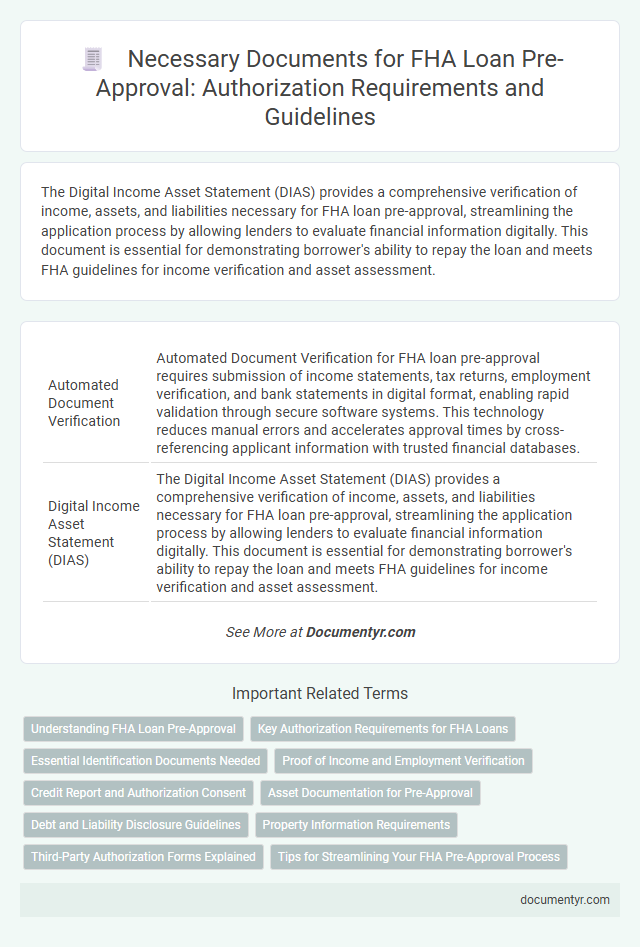

| 1 | Automated Document Verification | Automated Document Verification for FHA loan pre-approval requires submission of income statements, tax returns, employment verification, and bank statements in digital format, enabling rapid validation through secure software systems. This technology reduces manual errors and accelerates approval times by cross-referencing applicant information with trusted financial databases. |

| 2 | Digital Income Asset Statement (DIAS) | The Digital Income Asset Statement (DIAS) provides a comprehensive verification of income, assets, and liabilities necessary for FHA loan pre-approval, streamlining the application process by allowing lenders to evaluate financial information digitally. This document is essential for demonstrating borrower's ability to repay the loan and meets FHA guidelines for income verification and asset assessment. |

| 3 | Employment API Authorization | For FHA loan pre-approval, Employment API Authorization allows lenders to securely verify an applicant's employment history and income by accessing payroll and employer data electronically, streamlining the verification process. This authorization requires applicants to provide consent forms and personal identification documents to enable secure data access through approved API platforms. |

| 4 | E-Consent Audit Trail | The FHA loan pre-approval process requires submission of key financial documents such as pay stubs, tax returns, and bank statements, with the E-Consent audit trail ensuring secure electronic authorization and compliance tracking. This digital record captures timestamps, IP addresses, and user actions, enhancing transparency and safeguarding borrower authentication throughout the consent process. |

| 5 | Tri-Merge Credit Report | An FHA loan pre-approval requires a tri-merge credit report, which consolidates credit data from Equifax, Experian, and TransUnion to provide a comprehensive view of the borrower's creditworthiness. This report is essential for lenders to assess credit scores, debt history, and overall financial behavior, ensuring accurate evaluation for FHA loan eligibility. |

| 6 | Smart Asset Documentation | Smart Asset documentation for FHA loan pre-approval requires bank statements, recent pay stubs, W-2 forms, tax returns, and proof of employment to verify financial stability and income. This comprehensive documentation ensures accurate assessment of the borrower's ability to repay the loan under FHA guidelines. |

| 7 | Zero-Print Bank Statement | Zero-print bank statements are a crucial document for FHA loan pre-approval, providing detailed account activity without highlighted transactions, which enhances lender verification accuracy. These statements help lenders assess the applicant's financial stability by showing consistent income deposits, regular expenses, and overall cash flow. |

| 8 | E-Signature Full Disclosure | FHA loan pre-approval requires submission of a fully executed E-Signature full disclosure form, ensuring electronic acknowledgment of loan terms and borrower rights. This document, alongside income verification and credit history, is essential for compliance with FHA authorization standards. |

| 9 | AI-Powered Paystub Parser | Lenders require documents such as recent pay stubs, W-2s, tax returns, and bank statements for FHA loan pre-approval, with AI-powered paystub parsers enhancing accuracy by quickly extracting and verifying income data. This technology streamlines the authorization process, ensuring faster, more reliable assessment of borrower eligibility. |

| 10 | Synthetic Identity Screening Logs | FHA loan pre-approval requires submission of synthetic identity screening logs to verify borrower authenticity and prevent fraud. These logs, including detailed transaction histories and identity validation reports, are essential documents for accurate risk assessment during the authorization process. |

Understanding FHA Loan Pre-Approval

Understanding FHA loan pre-approval involves submitting specific documents to verify your financial stability and creditworthiness. Essential documents include proof of income such as pay stubs or tax returns, credit history reports, and identification like a valid driver's license or passport. These documents help lenders assess your eligibility and determine the loan amount you qualify for under FHA guidelines.

Key Authorization Requirements for FHA Loans

Pre-approval for an FHA loan requires specific documentation to verify your financial and personal information. These documents ensure that lenders can accurately assess your eligibility and creditworthiness for FHA-backed financing.

- Proof of Identity - Valid government-issued ID such as a driver's license or passport is required to confirm your identity.

- Income Verification - Recent pay stubs, tax returns, and W-2 forms demonstrate your consistent income stream and ability to repay the loan.

- Credit Authorization - Applicants must consent to a credit check, allowing lenders to review their credit history and scores for FHA loan qualification.

Essential Identification Documents Needed

Obtaining FHA loan pre-approval requires submitting specific identification documents. These papers verify your identity and financial history to meet lender requirements.

- Government-issued photo ID - Valid driver's license or passport confirms your identity and citizenship status.

- Social Security number - Essential for credit checks and verifying your financial records with the IRS.

- Proof of residency - Utility bills or lease agreements establish your current address and residency status.

Providing accurate identification documents speeds up the FHA loan pre-approval process and strengthens your application.

Proof of Income and Employment Verification

For FHA loan pre-approval, providing proof of income is essential to demonstrate financial stability. Common documents include recent pay stubs, W-2 forms, and tax returns, which validate consistent earnings. Employment verification often requires a letter from your employer or direct contact by the lender to confirm job status and income details.

Credit Report and Authorization Consent

Your credit report is a crucial document for FHA loan pre-approval, providing a detailed history of your credit activity and payment patterns. Lenders use this report to assess your financial responsibility and creditworthiness.

Authorization consent allows the lender to access your credit information and verify your financial status securely. Without this consent, the loan approval process cannot proceed.

Asset Documentation for Pre-Approval

| Document Type | Description | Purpose for FHA Loan Pre-Approval |

|---|---|---|

| Bank Statements | Recent statements from checking and savings accounts, typically covering the last 2-3 months | Verifies available liquid assets and ensures sufficient funds for down payment and closing costs |

| Investment Account Statements | Statements from brokerage accounts, retirement accounts, or mutual funds showing current balances | Confirms additional reserves or assets that can support the loan qualification |

| Gift Letters | A formal letter confirming a monetary gift from an approved donor, including donor details and relationship | Documents non-repayable contributions toward the down payment or closing costs |

| Asset Withdrawal Documentation | Records of recent withdrawals or transfers from assets to verify the source of funds | Ensures transparency of funds and confirms that assets are readily accessible |

| Retirement Account Statements | Detailed statements of 401(k), IRA, or other retirement plans reflecting available cash surrender value | Substantiates reserves and serves as supplemental assets for qualification |

Debt and Liability Disclosure Guidelines

FHA loan pre-approval requires thorough disclosure of your debts and liabilities to assess your financial stability accurately. Proper documentation ensures compliance with FHA guidelines and helps in obtaining an accurate pre-approval decision.

- Debt Documentation - You must provide current statements for all outstanding debts including credit cards, student loans, and auto loans.

- Liability Verification - Documentation of liabilities such as child support, alimony, or any other monthly obligations is required.

- Credit Report Authorization - FHA lenders need your authorization to pull your credit report, which includes detailed information on your debts and payment history.

Property Information Requirements

For FHA loan pre-approval, providing accurate property information is essential. This includes the property's address, type, and current market value to assess eligibility.

Documentation such as the property appraisal report and purchase agreement may be required. Your lender uses these details to verify the property's condition and ensure it meets FHA standards.

Third-Party Authorization Forms Explained

What documents are necessary for FHA loan pre-approval regarding third-party authorization forms? Third-party authorization forms grant lenders permission to verify your financial information with other entities. These forms streamline the loan approval process by allowing access to crucial data from employers, banks, and credit bureaus.

What Documents Are Necessary for FHA Loan Pre-Approval? Infographic