Home loan pre-approval requires essential documents such as proof of identity, income verification, and credit history. Borrowers typically need to submit valid identification, salary slips or tax returns, bank statements, and employment details to verify financial stability. Mortgage lenders use these documents to assess eligibility and determine the loan amount and terms.

What Documents are Required for a Home Loan Pre-Approval?

| Number | Name | Description |

|---|---|---|

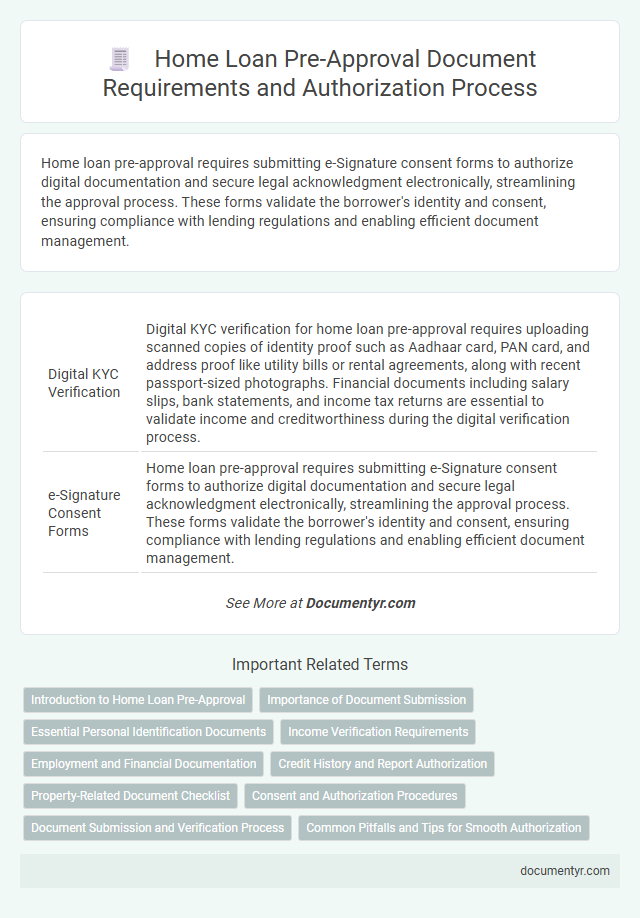

| 1 | Digital KYC Verification | Digital KYC verification for home loan pre-approval requires uploading scanned copies of identity proof such as Aadhaar card, PAN card, and address proof like utility bills or rental agreements, along with recent passport-sized photographs. Financial documents including salary slips, bank statements, and income tax returns are essential to validate income and creditworthiness during the digital verification process. |

| 2 | e-Signature Consent Forms | Home loan pre-approval requires submitting e-Signature consent forms to authorize digital documentation and secure legal acknowledgment electronically, streamlining the approval process. These forms validate the borrower's identity and consent, ensuring compliance with lending regulations and enabling efficient document management. |

| 3 | Income Tax e-Assessment Printouts | Income Tax e-Assessment Printouts serve as critical documents for home loan pre-approval, providing lenders with verified proof of your income and tax compliance. These printouts, directly accessible from the Income Tax Department's portal, confirm your annual earnings, tax payments, and financial credibility essential for loan sanctioning. |

| 4 | Gig Economy Income Proof | Lenders require gig economy income proof such as 1099 forms, bank statements showing consistent deposits, and profit and loss statements to verify self-employment earnings for home loan pre-approval. Providing at least two years of tax returns and contracts or invoices from clients further strengthens the authorization process. |

| 5 | Alternate Credit Scoring Reports | Alternate credit scoring reports such as rent payment history, utility bills, and bank statements provide valuable verification of an applicant's financial reliability during home loan pre-approval. Lenders use these documents to assess creditworthiness when traditional credit reports are insufficient or unavailable. |

| 6 | e-Aadhaar XML File | The e-Aadhaar XML file serves as a crucial digital identity proof for home loan pre-approval, containing encrypted personal and biometric information verified by UIDAI. Lenders require this secure document to authenticate the applicant's identity quickly and ensure compliance with regulatory authorization standards. |

| 7 | API-Shared Bank Statements | API-shared bank statements provide a secure and efficient way for lenders to verify an applicant's financial history during the home loan pre-approval process, eliminating the need for manually submitted bank documents. This digital authorization allows real-time access to transaction data, ensuring accurate income assessment and expediting loan eligibility decisions. |

| 8 | Non-Traditional Employment Letters | Non-traditional employment letters for home loan pre-approval must include detailed income verification from freelance contracts, gig economy work, or self-employment, signed by authorized clients or business partners to validate consistent earnings. Lenders often require supplementary documents like bank statements, tax returns, and profit-and-loss statements to support these letters and assess financial stability accurately. |

| 9 | Open Banking Consent Forms | Open Banking consent forms are essential for home loan pre-approval as they authorize lenders to access your financial data directly from banks, ensuring accurate assessment of your creditworthiness. These documents streamline the verification process by providing real-time insights into your income, expenses, and financial behavior. |

| 10 | Crypto Asset Disclosure Statements | Home loan pre-approval requires submitting a Crypto Asset Disclosure Statement detailing all cryptocurrency holdings, transactions, and wallet addresses to assess financial stability and collateral value. Lenders use this document to verify digital asset authenticity and ensure compliance with regulatory standards during the authorization process. |

Introduction to Home Loan Pre-Approval

Home loan pre-approval is an essential step in the mortgage process, providing borrowers with a clear understanding of their borrowing capacity. This preliminary approval helps streamline the home buying journey by confirming financial eligibility before property selection.

To obtain pre-approval, lenders require specific documents that verify income, creditworthiness, and financial stability. These documents enable accurate assessment of the borrower's ability to repay the loan and ensure a faster approval process.

Importance of Document Submission

Submitting the required documents is essential for securing a home loan pre-approval. These documents verify your financial stability and eligibility to lenders.

Key documents include proof of identity, income statements, bank statements, and credit reports. Accurate and timely submission accelerates the approval process and enhances trust with the lender. Missing or incorrect documents can lead to delays or rejection of the pre-approval application.

Essential Personal Identification Documents

Essential personal identification documents are crucial for obtaining a home loan pre-approval. These documents verify your identity and help lenders assess your eligibility accurately.

Commonly required identification includes a valid government-issued ID such as a passport or driver's license. Lenders may also request your Social Security number to perform credit checks and confirm your financial background.

Income Verification Requirements

Income verification is a crucial component of a home loan pre-approval process. Lenders typically require recent pay stubs, tax returns from the past two years, and W-2 forms to assess an applicant's financial stability. Self-employed individuals may need to provide profit and loss statements along with bank statements for comprehensive income evaluation.

Employment and Financial Documentation

What documents related to employment and finances are required for a home loan pre-approval? Employment verification typically includes recent pay stubs, W-2 forms, and sometimes employment letters. Financial documentation often involves bank statements, tax returns, and proof of other income sources.

Credit History and Report Authorization

For a home loan pre-approval, your credit history plays a crucial role in assessing your financial reliability. Lenders require authorization to access your credit report, which details your borrowing and repayment patterns. Providing this consent allows the lender to verify your creditworthiness and proceed with the loan evaluation.

Property-Related Document Checklist

Securing a home loan pre-approval requires submitting specific property-related documents to verify the asset's legitimacy and value. These documents help lenders assess the loan risk and confirm property details.

- Sale Agreement - A legally binding document between buyer and seller outlining the terms and conditions of the property purchase.

- Title Deed - Proof of property ownership that verifies the seller's legal right to sell the property.

- Property Tax Receipts - Recent receipts that confirm all property taxes have been paid up to date.

Consent and Authorization Procedures

Home loan pre-approval requires specific documents to verify identity, financial status, and consent. Authorization procedures ensure compliance with legal and financial regulations during the application process.

- Consent Form - Authorizes the lender to access credit reports and financial information necessary for loan assessment.

- Identification Documents - Includes government-issued IDs to confirm the applicant's identity as part of authorization standards.

- Income Verification - Payslips, tax returns, or bank statements provide proof of income and consent for financial evaluation.

Document Submission and Verification Process

| Document Type | Description | Purpose in Verification |

|---|---|---|

| Proof of Identity | Government-issued ID such as passport, driver's license, or national ID card | Confirms your identity and eligibility for the loan |

| Proof of Income | Recent pay stubs, tax returns, or bank statements showing consistent earnings | Verifies your financial capacity to repay the loan |

| Credit Report Authorization | Signed consent form allowing the lender to check your credit history | Enables evaluation of creditworthiness and risk factors |

| Employment Verification | Letter from employer or contact details for direct verification | Confirms job stability and income reliability |

| Property Details | Information about the intended property, including price and location | Assists in assessing loan eligibility based on property value |

| Bank Statements | Statements from the past 3-6 months showing financial transactions | Provides insight into spending habits and available funds |

| Authorization and Consent Forms | Documents granting permission to process personal data and verify documents | Ensures compliance with legal and privacy standards |

The document submission and verification process involves careful review of all submitted files. Your lender will cross-check each document for authenticity, completeness, and accuracy. This step reduces errors and expedites the loan pre-approval, providing a clear picture of financial health and risk before final approval.

What Documents are Required for a Home Loan Pre-Approval? Infographic