A business needs several key documents to obtain export authorization, including a valid export license, commercial invoice, and packing list. Other essential documents may include a certificate of origin, bill of lading, and any relevant permits specific to the product being exported. Ensuring all paperwork complies with the destination country's regulations is crucial to avoid delays and legal issues.

What Documents Does a Business Need for Export Authorization?

| Number | Name | Description |

|---|---|---|

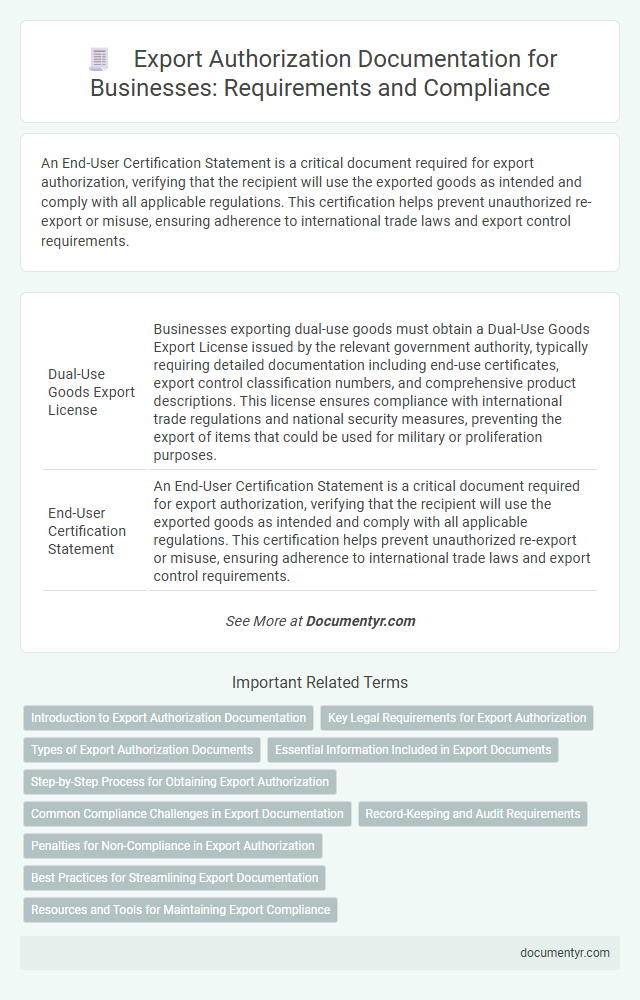

| 1 | Dual-Use Goods Export License | Businesses exporting dual-use goods must obtain a Dual-Use Goods Export License issued by the relevant government authority, typically requiring detailed documentation including end-use certificates, export control classification numbers, and comprehensive product descriptions. This license ensures compliance with international trade regulations and national security measures, preventing the export of items that could be used for military or proliferation purposes. |

| 2 | End-User Certification Statement | An End-User Certification Statement is a critical document required for export authorization, verifying that the recipient will use the exported goods as intended and comply with all applicable regulations. This certification helps prevent unauthorized re-export or misuse, ensuring adherence to international trade laws and export control requirements. |

| 3 | HS Code Classification Sheet | A business requires an HS Code Classification Sheet to accurately identify products under the Harmonized System, ensuring compliance with export regulations and facilitating customs clearance. This document is essential for determining duties, taxes, and any export restrictions tied to specific goods. |

| 4 | Electronic Export Information (EEI) Filing | Electronic Export Information (EEI) filing is a critical document required by the U.S. Census Bureau for export authorization, providing detailed data on shipments valued over $2,500 or those requiring an export license. Accurate EEI submission through the Automated Export System (AES) ensures compliance with export regulations and enables customs clearance by verifying product classification, destination, and consignee details. |

| 5 | Catch-All Control Declaration | A business seeking export authorization must include a Catch-All Control Declaration to cover items not specifically listed on control lists but subject to export controls due to their potential military or terrorism use. This declaration ensures compliance with national export regulations by identifying controlled goods that might otherwise bypass standard licensing requirements. |

| 6 | Importer Security Filing (ISF) Document | The Importer Security Filing (ISF), also known as "10+2," is a critical document required by U.S. Customs and Border Protection for export authorization, designed to provide advance data about cargo destined for the United States. Accurate ISF submission includes details such as the importer of record, consignee, manufacturer, ship-to party, and container stuffing location to ensure compliance and prevent shipment delays. |

| 7 | Authorized Economic Operator (AEO) Certificate | A business seeking export authorization must obtain an Authorized Economic Operator (AEO) certificate, which verifies compliance with security and customs standards, facilitating expedited customs clearance. This certification requires submitting documentation such as proof of a compliant security system, financial solvency, and a history of regulatory compliance to customs authorities. |

| 8 | Sanctions and Restricted Party Screening Report | Export authorization requires a detailed Sanctions and Restricted Party Screening Report to ensure compliance with international trade laws and to avoid transactions involving prohibited entities or countries. This document verifies that the business and its partners are not listed on government sanctions lists, preventing legal violations and potential penalties during the export process. |

| 9 | Letter of Credit Compliance Checklist | A Letter of Credit Compliance Checklist ensures the business submits accurate documents such as the commercial invoice, bill of lading, packing list, certificate of origin, and insurance documents to meet the export authorization requirements. Adhering to this checklist minimizes discrepancies and facilitates smooth transaction approval under the letter of credit terms. |

| 10 | Blockchain-Based Trade Trust Record | A business seeking export authorization must provide a Blockchain-Based Trade Trust Record, which ensures secure, transparent verification of shipment documents and regulatory compliance. This digital ledger enhances the authenticity and traceability of export-related certificates, reducing the risk of fraud and expediting customs clearance. |

Introduction to Export Authorization Documentation

Export authorization is a critical process ensuring that goods shipped internationally comply with legal and regulatory requirements. Proper documentation facilitates smooth customs clearance and prevents shipment delays or penalties.

Essential documents include export licenses, commercial invoices, packing lists, and certificates of origin. These papers verify the legitimacy of the exported goods and confirm adherence to trade regulations.

Key Legal Requirements for Export Authorization

Export authorization requires specific documents to comply with international trade regulations and legal standards. Identifying the key legal requirements helps streamline the export process and avoid penalties.

- Export License - A government-issued license permitting the export of certain goods, ensuring compliance with trade control laws.

- Commercial Invoice - A detailed invoice listing the sold goods, their value, and terms of sale, essential for customs clearance.

- Certificate of Origin - An official document certifying the country where the goods were manufactured or produced, required by customs authorities.

Types of Export Authorization Documents

Export authorization requires specific documents to comply with international trade regulations. Common types of export authorization documents include export licenses, shipping bills, and commercial invoices. Your business must ensure that these documents are accurate and submitted to the relevant authorities for smooth export processing.

Essential Information Included in Export Documents

Export authorization requires specific documents that verify your business complies with international trade regulations. These documents must contain essential information to ensure smooth customs clearance and legal export processing.

Key details in export documents include the description of goods, quantities, and the Harmonized System (HS) code. Additionally, information about the exporter, consignee, and the country of origin plays a critical role in authorization approval.

Step-by-Step Process for Obtaining Export Authorization

Export authorization requires submitting specific documents to comply with national and international trade regulations. Gathering and preparing these documents correctly ensures a smooth approval process for your export activities.

- Complete Export License Application - This includes detailed information about your business, products, and export destinations to verify compliance with trade laws.

- Commercial Invoice - A detailed invoice showing the value, quantity, and description of goods you intend to export for customs and authorization purposes.

- Packing List and Bill of Lading - These documents detail the packaging and shipment method, essential for transportation and export control verification.

Common Compliance Challenges in Export Documentation

Export authorization requires businesses to submit specific documents to comply with regulatory standards. Key documents include the export license, commercial invoice, packing list, and certificate of origin.

The most common compliance challenges involve ensuring accuracy and completeness in documentation to avoid shipment delays or legal penalties. Misclassification of goods and missing licenses often lead to customs clearance issues. Maintaining up-to-date export licenses and adhering to destination country regulations are essential for smooth authorization.

Record-Keeping and Audit Requirements

Businesses seeking export authorization must maintain accurate and comprehensive records of all export transactions, including licenses, shipping documents, and customs declarations. Proper record-keeping ensures compliance with regulatory requirements and facilitates smooth audits by authorities such as the Bureau of Industry and Security (BIS) or customs agencies. Retaining these documents for a minimum period, often five years, helps businesses demonstrate adherence to export laws and avoid potential penalties.

Penalties for Non-Compliance in Export Authorization

Export authorization requires businesses to submit accurate and complete documentation to comply with international trade regulations. Failure to provide the necessary documents can lead to significant legal and financial consequences.

- Loss of Export Privileges - Companies may face suspension or revocation of export licenses, halting all international shipments.

- Financial Penalties - Fines imposed by regulatory authorities can reach substantial amounts, depending on the severity of non-compliance.

- Criminal Charges - Intentional or repeated violations can result in prosecution, including imprisonment for responsible individuals.

Maintaining proper export documentation is essential to avoid these penalties and ensure smooth international trade operations.

Best Practices for Streamlining Export Documentation

What documents does a business need for export authorization? Export authorization requires specific documentation such as export licenses, commercial invoices, packing lists, and certificates of origin. Properly organizing these documents ensures compliance with international trade regulations and speeds up customs clearance.

What are the best practices for streamlining export documentation? Standardizing document templates and using automated software can reduce errors and improve efficiency. Maintaining clear communication with customs authorities and regularly updating export compliance training also helps prevent delays and penalties.

What Documents Does a Business Need for Export Authorization? Infographic