To sign a lease agreement, essential documents include a valid government-issued photo ID, proof of income such as pay stubs or bank statements, and a rental application form completed by the tenant. Landlords may also require references from previous landlords and a credit report to assess financial responsibility. Providing these documents ensures a smooth and legally binding lease agreement process.

What Documents are Required for a Lease Agreement Signature?

| Number | Name | Description |

|---|---|---|

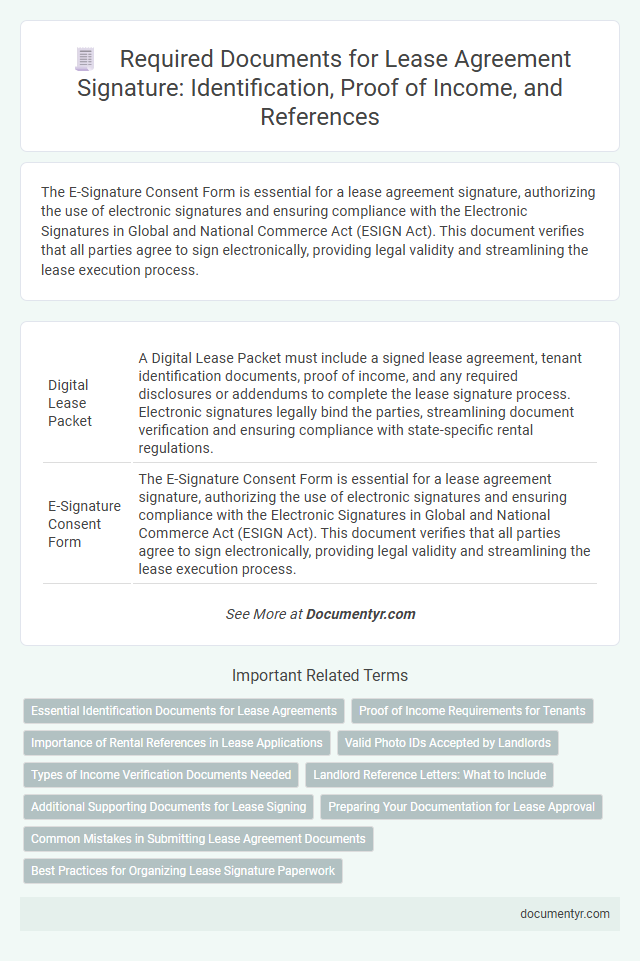

| 1 | Digital Lease Packet | A Digital Lease Packet must include a signed lease agreement, tenant identification documents, proof of income, and any required disclosures or addendums to complete the lease signature process. Electronic signatures legally bind the parties, streamlining document verification and ensuring compliance with state-specific rental regulations. |

| 2 | E-Signature Consent Form | The E-Signature Consent Form is essential for a lease agreement signature, authorizing the use of electronic signatures and ensuring compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN Act). This document verifies that all parties agree to sign electronically, providing legal validity and streamlining the lease execution process. |

| 3 | Identity Verification Token | An Identity Verification Token is essential for confirming the tenant's identity securely during a lease agreement signature, reducing the risk of fraud. This token typically accompanies government-issued IDs such as passports or driver's licenses, ensuring compliance with legal and rental regulations. |

| 4 | Proof of Income API Report | A Proof of Income API Report is essential for verifying a tenant's financial stability when signing a lease agreement, providing real-time income data directly from payroll or financial institutions. This document enhances the accuracy and speed of the approval process by automating income verification and reducing the risk of fraud. |

| 5 | Digital Background Check Certificate | A digital background check certificate is essential for verifying tenant credibility before signing a lease agreement, ensuring a secure rental process. This document typically includes criminal history, credit score, and employment verification, safeguarding landlords against potential risks. |

| 6 | Remote Notarization Transcript | A remote notarization transcript captures the electronic verification and acknowledgment of identities during the lease agreement signing process, ensuring legal compliance without physical presence. This document, alongside a valid identification, digital lease agreement, and electronic signature, is essential for validating remote lease agreements. |

| 7 | Blockchain Timestamp Receipt | A Blockchain Timestamp Receipt serves as a crucial document to verify the exact time a lease agreement was signed, providing tamper-proof evidence that enhances the security and authenticity of the contract. This digital timestamp integrates with the lease agreement to ensure non-repudiation and facilitate dispute resolution by confirming the document's existence and integrity at a specific moment. |

| 8 | Smart Lease Addendum | For a Lease Agreement signature, essential documents include the Smart Lease Addendum, which integrates digital terms and automated compliance protocols to streamline contract execution. This addendum enhances standard lease agreements by embedding smart clauses that trigger actions based on predefined conditions, ensuring transparency and efficiency. |

| 9 | AML (Anti-Money Laundering) Declaration | A valid lease agreement signature requires submitting an AML (Anti-Money Laundering) declaration to verify the identity and legal compliance of all parties involved. This declaration must include government-issued identification, proof of address, and confirmation that the lessee is not flagged in any anti-money laundering databases to ensure regulatory adherence. |

| 10 | Tenant Risk Scoring Sheet | The Tenant Risk Scoring Sheet is a crucial document required for a lease agreement signature as it assesses the potential risks associated with the tenant based on financial stability, rental history, and credit score. This sheet helps landlords make informed decisions by quantifying tenant reliability and reducing the risk of default or lease violations. |

Essential Identification Documents for Lease Agreements

Essential identification documents for lease agreements include a valid government-issued photo ID such as a passport or driver's license to verify the tenant's identity. Proof of income, such as recent pay stubs or bank statements, is required to ensure the tenant's ability to meet rent obligations. Additionally, a Social Security number or tax identification number is often requested for background and credit checks during the lease approval process.

Proof of Income Requirements for Tenants

Proof of income is a critical requirement for validating a tenant's ability to pay rent consistently. Common documents include recent pay stubs, bank statements, or tax returns that demonstrate stable earnings.

Providing accurate proof of income ensures that the lease agreement can be signed with confidence. You may also submit employment verification letters or social security benefits statements as supplementary evidence.

Importance of Rental References in Lease Applications

Rental references play a crucial role in lease agreement applications by validating a tenant's rental history and reliability. Landlords use these references to assess the applicant's ability to meet payment obligations and maintain the property responsibly. Providing strong rental references increases the likelihood of a lease agreement being approved swiftly.

Valid Photo IDs Accepted by Landlords

Landlords require valid photo identification to verify the identity of prospective tenants before signing a lease agreement. Accepted IDs typically include government-issued documents such as a driver's license, passport, or state identification card.

These valid photo IDs help prevent fraud and ensure compliance with rental regulations. Providing an up-to-date and clear photo ID speeds up the lease signing process and establishes trust between landlord and tenant.

Types of Income Verification Documents Needed

What types of income verification documents are required for a lease agreement signature? You typically need to provide recent pay stubs or bank statements as proof of income. Tax returns and employment verification letters may also be requested to confirm your financial stability.

Landlord Reference Letters: What to Include

Landlord reference letters play a crucial role in the lease agreement signature process by verifying your rental history and reliability. Understanding what to include in these letters helps ensure a smooth approval.

- Previous rental duration - Clearly state the length of time you rented from the landlord to establish your rental stability.

- Payment reliability - Confirm consistent and timely rent payments to demonstrate financial responsibility.

- Property care - Highlight your respect for the property and adherence to lease terms to show good tenancy behavior.

Additional Supporting Documents for Lease Signing

| Document Type | Description | Purpose |

|---|---|---|

| Proof of Income | Recent pay stubs, tax returns, or bank statements. | Verifies financial stability and ability to pay rent. |

| Identification Documents | Government-issued ID such as a driver's license or passport. | Confirms identity of the tenant for lease validation. |

| Rental History | Reference letters from previous landlords or lease agreements. | Demonstrates previous rental experience and reliability. |

| Credit Report | Recent credit report obtained from a credit agency. | Assesses creditworthiness and financial responsibility. |

| Guarantor or Co-signer Documents | Proof of income and identification of guarantor or co-signer. | Provides additional security for lease payments if required. |

| Pet Documentation | Vaccination records and pet agreement forms. | Ensures landlord approval for pet occupancy and health safety. |

| Renter's Insurance | Proof of active renter's insurance policy. | Protects both tenant and landlord against damage or loss. |

Preparing Your Documentation for Lease Approval

Preparing your documentation for lease approval streamlines the signature process and ensures a smooth agreement experience. Knowing the required documents in advance reduces delays and simplifies verification.

- Proof of Identity - Government-issued ID such as a passport or driver's license is essential to verify tenant identity.

- Income Verification - Recent pay stubs, tax returns, or bank statements demonstrate financial stability and ability to pay rent.

- Rental History - Previous landlord references or a rental ledger verify rental experience and reliability.

Common Mistakes in Submitting Lease Agreement Documents

Submitting the correct documents is crucial for a smooth lease agreement signature process. Common mistakes can delay approval or cause misunderstandings.

- Incomplete Documentation - Failing to provide all required documents such as identification, proof of income, and references can halt the lease approval.

- Incorrect or Outdated Information - Submitting documents with mismatched or expired details often leads to additional verification requests.

- Unreadable or Poor-Quality Copies - Scanned or photographed documents that are blurry or unclear may be rejected, delaying the process.

You can avoid delays by carefully reviewing all lease agreement documents before submission.

What Documents are Required for a Lease Agreement Signature? Infographic