An LLC must prepare and submit specific documents for its annual state filing, primarily the Annual Report or Statement of Information, which includes updated business address, member or manager details, and registered agent information. Some states require financial statements or a certificate of good standing to accompany the report. Ensuring timely and accurate filing of these documents maintains the LLC's compliance and good standing with the state.

What Documents Does an LLC Need for Annual State Filing?

| Number | Name | Description |

|---|---|---|

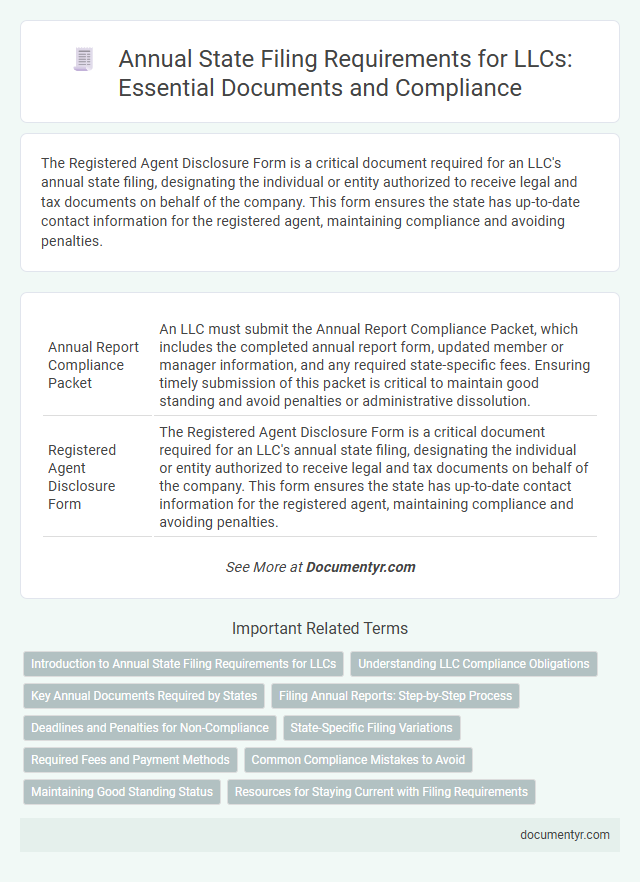

| 1 | Annual Report Compliance Packet | An LLC must submit the Annual Report Compliance Packet, which includes the completed annual report form, updated member or manager information, and any required state-specific fees. Ensuring timely submission of this packet is critical to maintain good standing and avoid penalties or administrative dissolution. |

| 2 | Registered Agent Disclosure Form | The Registered Agent Disclosure Form is a critical document required for an LLC's annual state filing, designating the individual or entity authorized to receive legal and tax documents on behalf of the company. This form ensures the state has up-to-date contact information for the registered agent, maintaining compliance and avoiding penalties. |

| 3 | State Franchise Tax Statement | The State Franchise Tax Statement is a crucial document required for an LLC's annual state filing, detailing tax obligations based on the company's net worth or capital. This statement ensures compliance with state regulations and often determines the LLC's annual franchise tax liability. |

| 4 | Beneficial Ownership Information Report | LLCs must file a Beneficial Ownership Information Report annually to comply with state regulations, detailing individuals with significant control or ownership interest exceeding specified thresholds. This report ensures transparency by identifying all beneficial owners, including their names, addresses, dates of birth, and ownership percentages, as mandated by applicable state laws. |

| 5 | Digital Filing Confirmation Receipt | An LLC must obtain a Digital Filing Confirmation Receipt as proof of submission for its annual state filing, which typically includes the Annual Report or Statement of Information. This receipt serves as legally binding evidence that the LLC has complied with state requirements, ensuring the business remains in good standing and avoids penalties or dissolution. |

| 6 | Certificate of Good Standing Request | LLCs must submit a Certificate of Good Standing request as part of their annual state filing to verify compliance with state regulations and confirm that the business is authorized to operate legally. This document, often required alongside the annual report and filing fees, ensures the LLC maintains its active status and can be crucial for securing financing or entering contracts. |

| 7 | LLC Management Structure Declaration | An LLC must submit its Management Structure Declaration as part of the annual state filing, clearly outlining whether it operates under member-managed or manager-managed governance. This document ensures legal compliance by providing the state with accurate information regarding the LLC's internal management framework. |

| 8 | State-Specific Public Information Report | An LLC must file a State-Specific Public Information Report annually, which typically includes updated details such as the company's principal address, registered agent, management structure, and member or manager names as required by the state's business regulatory authority. This report ensures compliance with state laws and maintains the LLC's good standing by providing accurate public records for legal and tax purposes. |

| 9 | Electronic Annual Statement e-Filing | An LLC must submit an Electronic Annual Statement e-Filing to maintain good standing with the state, which typically includes updated member information, registered agent details, and the LLC's principal address. This electronically filed document ensures compliance with state regulations and serves as the official record for the LLC's operational status. |

| 10 | Supplemental Business License Renewal | LLCs must submit a Supplemental Business License Renewal form along with their annual state filing to maintain compliance and continue lawful operations. This document typically includes updated business information, payment of renewal fees, and any required certificates specific to the state's regulatory requirements. |

Introduction to Annual State Filing Requirements for LLCs

| Topic | Details |

|---|---|

| Introduction to Annual State Filing Requirements for LLCs | Every Limited Liability Company (LLC) must comply with state-mandated annual filing requirements to maintain good standing and legal operation. These filings provide updated business information to the state and ensure regulatory compliance. Requirements vary by state but generally include submitting specific documents and paying associated fees. |

| Key Documents Required | Most states require an Annual Report or Statement of Information. This document typically contains the LLC's name, principal office address, registered agent details, names of members or managers, and sometimes the nature of the business. Some states may also require updated financial information or a Certificate of Good Standing. |

| Deadline and Frequency | Annual filings must be submitted by a deadline specified by the state, often based on the LLC's formation date or fiscal year. Missing this deadline can result in penalties or administrative dissolution. Timely submission ensures your LLC remains compliant and legally authorized to operate. |

| Filing Methods | States typically offer online filing portals, mail-in options, or in-person filing. Online filing is the most efficient and commonly preferred method. You should check your specific state's Secretary of State website for detailed instructions and access. |

| Importance of Annual Filing | Annual state filings help maintain accurate public records, protect your LLC's limited liability status, and avoid fines or administrative actions. Maintaining compliance signals professionalism and reliability to clients, partners, and regulators. |

Understanding LLC Compliance Obligations

Understanding the documents required for your LLC's annual state filing is crucial for maintaining compliance and good standing. Properly submitting these documents ensures your business meets state regulatory obligations.

- Annual Report - A detailed summary of your LLC's current information such as address, owners, and registered agent.

- State Filing Fee - A mandatory payment accompanying your annual report to process the submission.

- Amendments or Updates - Any changes to your LLC's structure or information that must be reported during filing.

Meeting these document requirements every year preserves your LLC's legal status and operational legitimacy.

Key Annual Documents Required by States

States require specific documents for LLC annual filings to maintain good standing and compliance. Your timely submission of these documents ensures legal operation and avoids penalties.

- Annual Report - A summary of basic company information including ownership, address, and registered agent details submitted yearly.

- State Tax Return - A report detailing the LLC's income and expenses for state tax calculation purposes, required in many states.

- Franchise Tax Filing - A payment or report based on the LLC's net worth or income, demanded by some states to fund state operations.

Filing Annual Reports: Step-by-Step Process

LLCs must submit specific documents to maintain good standing during annual state filings. Filing the Annual Report is a critical step that ensures compliance with state regulations.

- Locate State Requirements - Identify your state's specific annual report filing deadlines and form requirements on the Secretary of State's website.

- Complete the Annual Report Form - Provide updated business information including LLC name, registered agent details, and principal office address.

- Submit Payment - Pay the required filing fee online or by mail as mandated by your state's filing office.

Deadlines and Penalties for Non-Compliance

An LLC must file an Annual Report with the state to maintain good standing and comply with state regulations. This report typically includes updated information about the LLC's members, registered agent, and business address.

Deadlines for Annual Report submission vary by state, often falling on the anniversary month of the LLC's formation or the end of the calendar year. Missing the filing deadline can result in late fees, penalties, or even administrative dissolution of the LLC.

State-Specific Filing Variations

State-specific filing requirements for LLC annual reports vary significantly across the United States. Some states mandate a simple annual report with basic company information, while others require detailed financial statements or updates on member changes. You should verify your state's specific document requirements to ensure compliance and avoid penalties.

Required Fees and Payment Methods

When filing your LLC's annual state report, you typically need to submit the completed annual report form along with the required filing fee. Fees vary by state but commonly range from $50 to $300, depending on your LLC's location and business type. Payment methods often include online credit card payments, checks, or electronic funds transfer, ensuring a convenient process for your submission.

Common Compliance Mistakes to Avoid

LLCs must file specific documents annually to maintain good standing with the state, typically including the Annual Report or Statement of Information and the updated Registered Agent information. Failure to file these documents on time can result in penalties or administrative dissolution.

Common compliance mistakes include missing the annual filing deadline, submitting incomplete or inaccurate information, and neglecting to update changes in ownership or address. Many LLCs overlook the requirement to pay the associated filing fees, which can lead to rejection of the submission. Ensuring timely and accurate filings protects the LLC from unnecessary legal and financial consequences.

Maintaining Good Standing Status

Maintaining good standing status for an LLC requires timely submission of specific state documents each year. Key documents typically include the Annual Report or Franchise Tax Report, depending on state regulations.

These filings verify crucial business information such as registered agent details, principal office address, and member or manager information. Ensuring accuracy and meeting deadlines prevents penalties and potential administrative dissolution.

What Documents Does an LLC Need for Annual State Filing? Infographic