To open a small business bank account, key documents include a government-issued ID, your business formation documents such as articles of incorporation or a partnership agreement, and an Employer Identification Number (EIN) from the IRS. Banks may also require a business license or permit, a resolution authorizing the account opening if applicable, and a copy of your business's operating agreement. Preparing these documents ensures a smooth account setup and compliance with banking regulations.

What Documents Are Necessary for Opening a Small Business Bank Account?

| Number | Name | Description |

|---|---|---|

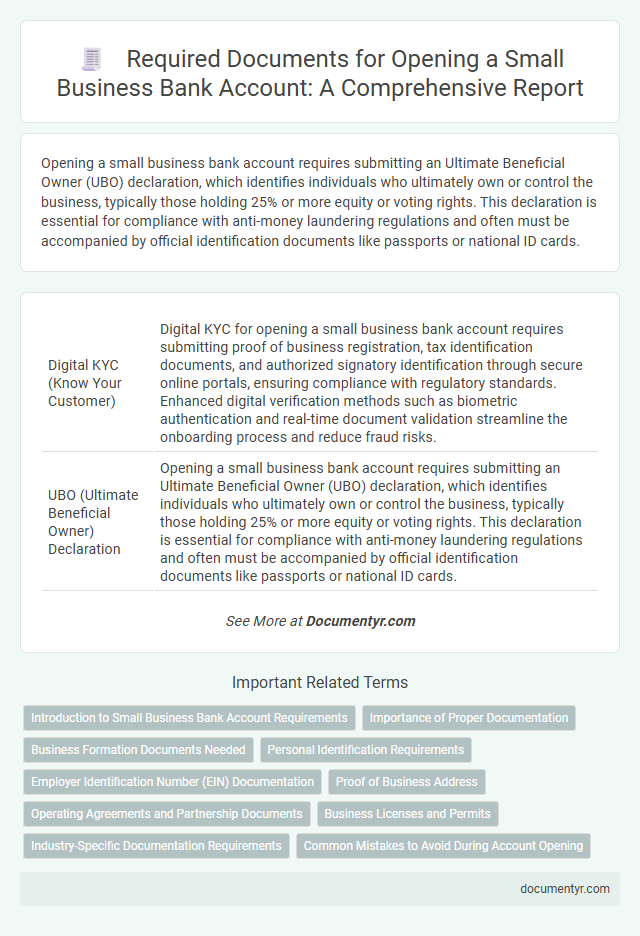

| 1 | Digital KYC (Know Your Customer) | Digital KYC for opening a small business bank account requires submitting proof of business registration, tax identification documents, and authorized signatory identification through secure online portals, ensuring compliance with regulatory standards. Enhanced digital verification methods such as biometric authentication and real-time document validation streamline the onboarding process and reduce fraud risks. |

| 2 | UBO (Ultimate Beneficial Owner) Declaration | Opening a small business bank account requires submitting an Ultimate Beneficial Owner (UBO) declaration, which identifies individuals who ultimately own or control the business, typically those holding 25% or more equity or voting rights. This declaration is essential for compliance with anti-money laundering regulations and often must be accompanied by official identification documents like passports or national ID cards. |

| 3 | Electronic Certificate of Formation | An Electronic Certificate of Formation is a critical document required to open a small business bank account, serving as official proof that the business is legally registered with the state. This electronic certificate must be valid, include the business name, formation date, and registration number, and be presented alongside other identification documents to meet bank verification standards. |

| 4 | E-Signature Authorization Letter | An E-Signature Authorization Letter is essential for opening a small business bank account as it legally permits the use of electronic signatures on banking documents, ensuring efficient and secure transaction processing. This document must clearly state the authorized signatories and comply with relevant e-signature laws to validate the account opening procedure. |

| 5 | Virtual Office Address Verification | To open a small business bank account, providing valid documents for virtual office address verification is essential, which typically includes a lease agreement or utility bill in the virtual office provider's name. Banks require this verification to confirm the legitimacy of the business location, ensuring compliance with regulatory standards and preventing fraud. |

| 6 | EIN Verification Letter (IRS CP 575) | The EIN Verification Letter, also known as IRS CP 575, is a critical document required when opening a small business bank account, as it confirms the business's Employer Identification Number issued by the IRS. This letter validates the legal identity of the business and ensures compliance with federal regulations, making it essential for account verification and transactional legitimacy. |

| 7 | E-Residency Business Registration | Essential documents for opening a small business bank account with an e-Residency business registration include a valid e-Residency digital ID, the company registration certificate issued through the e-Residency portal, proof of business address, and a detailed business plan outlining operational activities. Banks may also require identification documents of company directors or shareholders, and sometimes proof of financial transactions relevant to the e-Residency registered entity. |

| 8 | AML (Anti-Money Laundering) Compliance Form | Banks require a valid government-issued ID, business registration documents, and an AML (Anti-Money Laundering) compliance form to open a small business bank account. The AML form ensures adherence to financial regulations by collecting detailed information on ownership, source of funds, and business activities to prevent money laundering risks. |

| 9 | Business License e-Filing Receipt | A Business License e-Filing Receipt serves as crucial evidence of legal authorization to operate and is often required by banks to verify business legitimacy during account opening. This document confirms that the business has complied with regulatory requirements, ensuring smoother processing of the small business bank account application. |

| 10 | Crypto Wallet Disclosure Form | Opening a small business bank account requires submitting a Crypto Wallet Disclosure Form to comply with regulatory standards and ensure transparency of cryptocurrency transactions. This document provides banks with detailed information about the business's crypto wallet usage, enhancing security and facilitating adherence to anti-money laundering (AML) policies. |

Introduction to Small Business Bank Account Requirements

Opening a small business bank account requires specific documentation to ensure compliance and smooth processing. These documents verify your business identity and operational legitimacy.

Your bank will request various forms, including legal and financial information, to confirm your business status. Understanding the necessary paperwork helps streamline account setup and avoid delays.

Importance of Proper Documentation

Proper documentation is crucial when opening a small business bank account to ensure compliance with legal and banking regulations. Essential documents typically include your business formation paperwork, tax identification number, and personal identification. Submitting accurate and complete documents helps streamline the account opening process and prevents potential delays or rejections.

Business Formation Documents Needed

Opening a small business bank account requires submitting specific business formation documents to verify the legitimacy and structure of the business. These documents vary depending on the type of business entity and the bank's requirements.

- Articles of Incorporation - Official documents filed with the state to legally establish a corporation.

- Operating Agreement - A detailed contract outlining the management structure and operating procedures of an LLC.

- Partnership Agreement - A formal agreement defining the roles, responsibilities, and profit distribution between partners in a business partnership.

Providing accurate business formation documents ensures smooth processing of the bank account application and compliance with legal standards.

Personal Identification Requirements

| Document Type | Description | Purpose |

|---|---|---|

| Government-Issued Photo ID | Driver's license, passport, or state ID card | Proof of identity to verify the individual opening the account |

| Social Security Number (SSN) | Social Security card or Taxpayer Identification Number (TIN) | Used for tax reporting and identity verification |

| Proof of Address | Utility bills, lease agreements, or official mail with current address | Confirms the residential address of the account holder |

| Personal Identification Number (PIN) or Signature | Signature card or PIN setup documentation | Authorizes access and transactions on the bank account |

Employer Identification Number (EIN) Documentation

Opening a small business bank account requires specific documentation to verify the legitimacy of the business. One of the most important documents is the Employer Identification Number (EIN) issued by the IRS.

- Proof of EIN Assignment - This document confirms that the business has been officially registered with the IRS and includes the EIN issued to the business entity.

- EIN Verification Letter (CP 575) - The IRS provides this official letter as permanent proof of the business's EIN, which banks often require for account opening.

- Form SS-4 Application - A copy of the original EIN application form can serve as additional evidence that the EIN has been authorized for Your business activities.

Proof of Business Address

Proof of business address is a critical document required to open a small business bank account. It verifies the physical location where the business operates, assuring the bank of the legitimacy and stability of the enterprise.

Acceptable forms of proof typically include recent utility bills, lease agreements, or official government correspondence tied to the business address. This documentation must clearly show the business's name and address to meet bank verification standards. Ensuring accurate and current proof of business address helps streamline the account opening process and prevents delays or rejections.

Operating Agreements and Partnership Documents

Opening a small business bank account requires specific documents to verify the business's legitimacy and ownership structure. Key among these are Operating Agreements for LLCs and Partnership Documents for multi-owner enterprises.

Operating Agreements outline the management framework and member responsibilities, serving as proof of how your LLC operates internally. Partnership Documents detail roles, ownership stakes, and agreements between partners, essential for banks to confirm business authority and structure.

Business Licenses and Permits

Opening a small business bank account requires specific documents, with business licenses and permits being essential. These licenses and permits verify the legality of the business operations and compliance with local, state, and federal regulations. Banks typically request these documents to confirm the business is authorized to operate within its industry and jurisdiction.

Industry-Specific Documentation Requirements

Opening a small business bank account requires specific documentation that varies by industry. Industry-specific documents ensure compliance with regulations and reflect the nature of business operations.

- Healthcare Industry - Requires professional licenses and Health Insurance Portability and Accountability Act (HIPAA) compliance certificates to verify credentials and patient privacy adherence.

- Construction Sector - Needs contractor licenses and bonding certificates demonstrating legal authorization and financial responsibility for projects.

- Food and Beverage Businesses - Mandates health permits and food safety certifications to confirm adherence to safety and hygiene standards.

What Documents Are Necessary for Opening a Small Business Bank Account? Infographic