To complete the Free Application for Federal Student Aid (FAFSA), students must provide their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Parents' financial information is also required if the student is dependent, including income and asset details. Accurate documentation ensures eligibility for scholarships, grants, and loans through federal student aid programs.

What Documents are Necessary for Federal Student Aid (FAFSA)?

| Number | Name | Description |

|---|---|---|

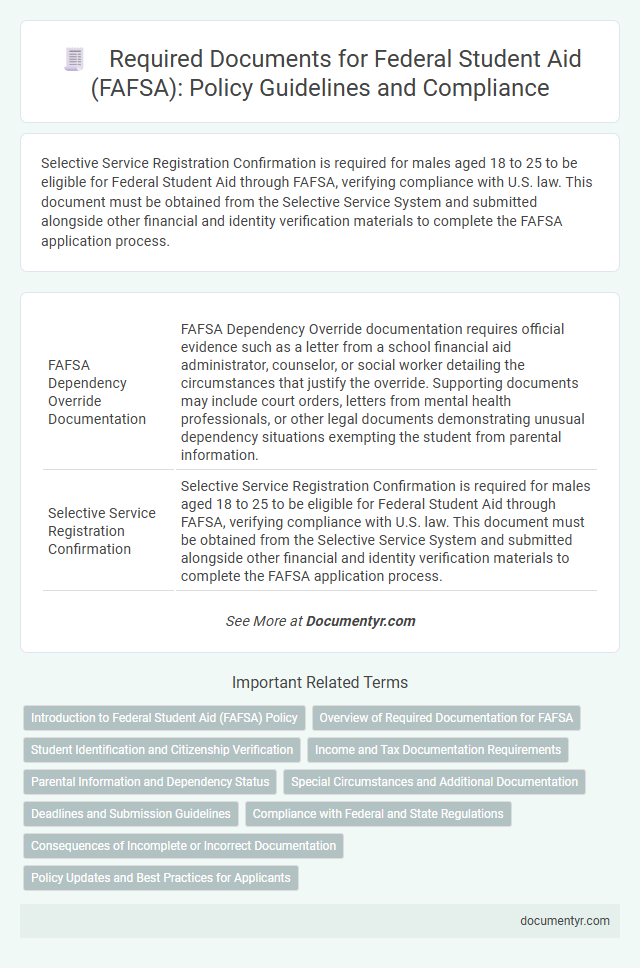

| 1 | FAFSA Dependency Override Documentation | FAFSA Dependency Override documentation requires official evidence such as a letter from a school financial aid administrator, counselor, or social worker detailing the circumstances that justify the override. Supporting documents may include court orders, letters from mental health professionals, or other legal documents demonstrating unusual dependency situations exempting the student from parental information. |

| 2 | Selective Service Registration Confirmation | Selective Service Registration Confirmation is required for males aged 18 to 25 to be eligible for Federal Student Aid through FAFSA, verifying compliance with U.S. law. This document must be obtained from the Selective Service System and submitted alongside other financial and identity verification materials to complete the FAFSA application process. |

| 3 | Non-Tax Filer Statement | A Non-Tax Filer Statement is required for federal student aid applicants who did not file taxes, verifying that they had no income to report for the FAFSA application year. This document typically includes a signed statement explaining the reasons for not filing taxes and proof of income or a signed certification of no income from the IRS or relevant tax authority. |

| 4 | Asset Verification Worksheet | The Asset Verification Worksheet is a critical document required by the Department of Education to validate the accuracy of financial information provided on the FAFSA, specifically detailing assets such as savings, investments, and business ownership. This worksheet ensures proper assessment of a student's financial need and eligibility for federal student aid by confirming reported asset values. |

| 5 | SNAP Benefits Verification Letter | A SNAP Benefits Verification Letter is essential for confirming eligibility when applying for Federal Student Aid (FAFSA) as it validates participation in the Supplemental Nutrition Assistance Program. This document helps determine qualification for certain need-based aid by providing proof of income and household status. |

| 6 | Homeless Youth Determination Letter | A Homeless Youth Determination Letter, issued by a high school or a homeless shelter, is essential for verifying the independent status of homeless applicants on the Free Application for Federal Student Aid (FAFSA). This letter confirms the student's lack of permanent housing, enabling access to federal grants, loans, and work-study programs without parental income information. |

| 7 | Eligible Noncitizen Documentation (Form I-94, Green Card) | Eligible noncitizens applying for Federal Student Aid (FAFSA) must submit documentation such as Form I-94, which records arrival and departure information, or a valid Green Card (Permanent Resident Card) to verify their immigration status. These documents confirm eligibility under federal guidelines, ensuring access to aid programs for qualified noncitizen students. |

| 8 | Emancipated Minor Court Order | An emancipated minor court order is a critical document required for federal student aid (FAFSA) as it legally verifies a student's independent status, exempting them from parental information on the application. This court order must be an official, certified copy issued by a judge or court clerk, demonstrating emancipation under state law. |

| 9 | Foster Care Ward Documentation | Foster care ward documentation for Federal Student Aid (FAFSA) includes official records confirming current or prior status as a foster care ward, such as court orders, letters from social services agencies, or placement verification forms. These documents establish eligibility for specific FAFSA benefits and ensure accurate processing of aid applications for students with foster care backgrounds. |

| 10 | Special Circumstance Appeal Statement | The Special Circumstance Appeal Statement must clearly detail changes in financial or family status that affect eligibility for Federal Student Aid (FAFSA), such as job loss or medical expenses. Supporting documentation like termination letters, medical bills, or legal papers should accompany the appeal to substantiate the request for reevaluation. |

Introduction to Federal Student Aid (FAFSA) Policy

Federal Student Aid (FAFSA) policy establishes the requirements and guidelines for students seeking financial assistance for higher education. Understanding the necessary documents is crucial for accurate and timely application submission.

- Identification Documents - Valid government-issued identification such as a Social Security number or Alien Registration Number is mandatory for verification purposes.

- Income Information - Recent tax returns, W-2 forms, or income statements are required to assess financial need and eligibility.

- Dependency Status Documentation - Additional paperwork like parental information or legal guardianship proof may be needed to determine dependency classification under FAFSA rules.

Overview of Required Documentation for FAFSA

| Document Type | Description | Purpose |

|---|---|---|

| Social Security Number (SSN) | Official Social Security card or tax documents showing your SSN | Verify identity and citizenship status |

| Federal Income Tax Returns | IRS Form 1040, 1040A, or 1040EZ from the most recent tax year | Provide accurate income information for financial need assessment |

| W-2 Forms and Other Records of Income | W-2 forms or other proof of earnings for you and your parents, if applicable | Supplement income data to ensure precise financial analysis |

| Driver's License | State-issued driver's license or state ID card | Confirm identity and residency |

| Alien Registration Number (if applicable) | Permanent Resident Card (Green Card) or other immigration documents | Verify eligibility for federal student aid if not a U.S. citizen |

| Records of Untaxed Income | Documentation of benefits such as child support, veterans benefits, or untaxed IRA distributions | Include all sources of income for accurate aid calculation |

| Current Bank Statements | Checking, savings, and investment account statements | Assess liquid assets as part of financial status evaluation |

Student Identification and Citizenship Verification

To complete the Free Application for Federal Student Aid (FAFSA), you must provide valid student identification such as a Social Security number or Alien Registration Number. Citizenship verification requires documentation like a U.S. passport, birth certificate, or permanent resident card. Accurate verification of these documents ensures eligibility for federal grants, loans, and work-study programs.

Income and Tax Documentation Requirements

Federal Student Aid (FAFSA) requires specific income and tax documents to verify eligibility and calculate the Expected Family Contribution (EFC). Key documents include federal tax returns, W-2 forms, and records of untaxed income.

IRS tax transcripts from the prior-prior year are often necessary to confirm reported income details. Financial records such as income statements, Social Security benefits documentation, and investment income records may also be required to support accurate reporting.

Parental Information and Dependency Status

To complete the Free Application for Federal Student Aid (FAFSA), specific documents related to parental information and dependency status are required. These include your parents' Social Security numbers, tax returns, and records of income, which help determine your dependency classification and financial need. Providing accurate and complete parental data ensures proper evaluation for federal aid eligibility.

Special Circumstances and Additional Documentation

Federal Student Aid (FAFSA) requires specific documents to verify special circumstances and provide additional information. These documents ensure accurate assessment of financial need and eligibility for aid.

- Proof of Special Circumstances - Documentation such as letters from employers, medical records, or court orders may be required to validate changes in income or family status.

- Tax Transcripts - The IRS Tax Return Transcript is often requested to confirm reported income, especially when discrepancies arise.

- Verification Worksheets - Students may need to complete and submit FAFSA verification forms to address any inconsistencies or submit extra financial details.

Submitting accurate and complete documentation is essential for processing special circumstances on FAFSA applications.

Deadlines and Submission Guidelines

What documents are necessary for submitting the Free Application for Federal Student Aid (FAFSA)? Applicants must have their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income ready. These documents ensure accurate financial information is provided to determine eligibility.

When is the deadline for FAFSA submission to qualify for federal student aid? The federal deadline is June 30 following the academic year for which aid is requested, but many states and colleges set earlier deadline dates. Submitting FAFSA as soon as possible after October 1 maximizes access to available funds.

What guidelines must be followed when submitting FAFSA documents? All required documents should be uploaded or entered accurately on the official FAFSA website to avoid processing delays. Applicants should verify information and ensure all signatures and certifications are completed before final submission.

Compliance with Federal and State Regulations

Understanding the necessary documents for Federal Student Aid (FAFSA) ensures strict compliance with federal and state regulations. Proper documentation supports verification processes and prevents delays in financial aid distribution.

- Social Security Number (SSN) - Your SSN must be accurately provided to verify identity and eligibility under federal law.

- Federal Income Tax Returns - These documents confirm your income and tax status, aligning with federal reporting requirements for aid determination.

- Proof of U.S. Citizenship or Eligible Noncitizen Status - Compliance requires submission of documentation verifying citizenship or eligible immigration status for FAFSA eligibility.

Consequences of Incomplete or Incorrect Documentation

Submitting the Free Application for Federal Student Aid (FAFSA) requires accurate and complete documentation, including tax returns, Social Security numbers, and proof of citizenship. Missing or incorrect documents can delay the processing of aid or result in ineligibility for federal grants, loans, and work-study programs.

Incomplete FAFSA submissions increase the risk of financial aid reduction or denial, impacting a student's ability to fund their education. Students must carefully review all required documentation to ensure timely disbursement and avoid potential loss of essential financial support.

What Documents are Necessary for Federal Student Aid (FAFSA)? Infographic