Patients filing out-of-network insurance claims typically need to submit the itemized medical bills, detailed receipts, and a completed claim form from their insurance provider. It is essential to include a referral or pre-authorization document if required by the insurance plan, along with any medical records or reports supporting the treatment received. Keeping copies of all correspondence and proof of payment can expedite the claims process and reduce the likelihood of denial.

What Documents Does a Patient Need for Out-of-Network Insurance Claims?

| Number | Name | Description |

|---|---|---|

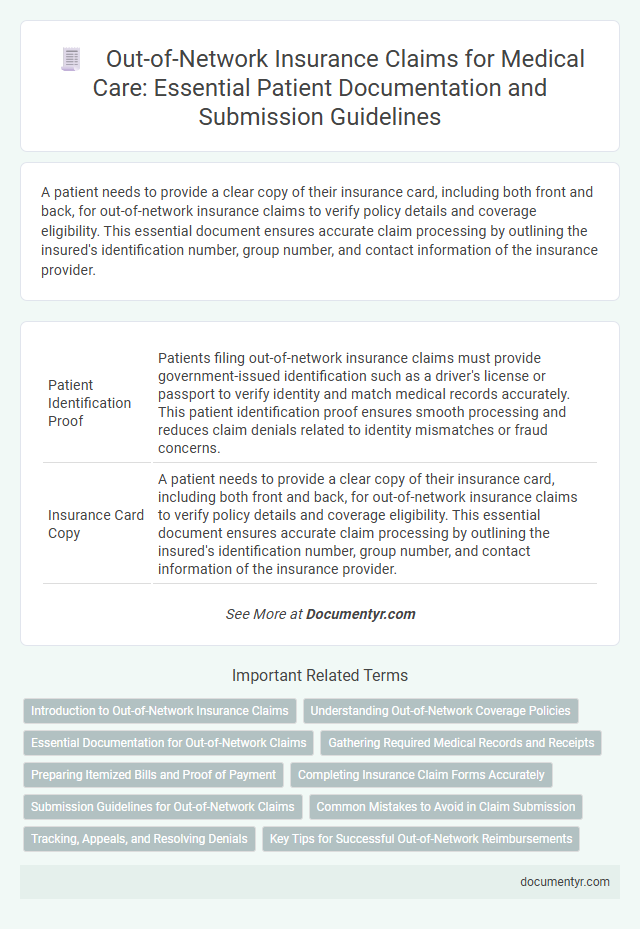

| 1 | Patient Identification Proof | Patients filing out-of-network insurance claims must provide government-issued identification such as a driver's license or passport to verify identity and match medical records accurately. This patient identification proof ensures smooth processing and reduces claim denials related to identity mismatches or fraud concerns. |

| 2 | Insurance Card Copy | A patient needs to provide a clear copy of their insurance card, including both front and back, for out-of-network insurance claims to verify policy details and coverage eligibility. This essential document ensures accurate claim processing by outlining the insured's identification number, group number, and contact information of the insurance provider. |

| 3 | Out-of-Network Claim Form | Patients filing out-of-network insurance claims must complete the Out-of-Network Claim Form accurately, including detailed information about the healthcare provider, treatment dates, and itemized medical services received. Alongside this form, supporting documents such as original medical bills, proof of payment, and a detailed physician's report are essential to ensure timely and successful claim processing. |

| 4 | Itemized Hospital Bill | An itemized hospital bill is essential for out-of-network insurance claims, detailing each service, procedure, and medication with corresponding costs to ensure accurate reimbursement. This document enables the insurance provider to verify expenses and assess claim validity against policy coverage. |

| 5 | Detailed Medical Reports | Detailed medical reports are essential for out-of-network insurance claims as they provide comprehensive documentation of the diagnosis, treatment plan, and progress notes. These reports must include physician notes, test results, imaging studies, and any prescribed medications to substantiate the medical necessity and support claim approval. |

| 6 | Discharge Summary | A discharge summary is a critical document for out-of-network insurance claims as it details the patient's diagnosis, treatment provided, and the duration of hospitalization. Insurers use this summary to verify the medical necessity of services and to process reimbursement efficiently. |

| 7 | Doctor’s Prescription | A doctor's prescription is a critical document for out-of-network insurance claims, providing proof of medically necessary treatment recommended by a licensed healthcare professional. Insurance companies require this prescription to validate the legitimacy of the services received and to process reimbursement accurately. |

| 8 | Payment Receipts | Patients submitting out-of-network insurance claims must provide detailed payment receipts that clearly itemize medical services rendered, dates of service, provider information, and amounts paid. These receipts serve as crucial evidence for reimbursement and typically need to be original or certified copies, reflecting payments made out-of-pocket. |

| 9 | Diagnostic Test Reports | Patients must provide detailed diagnostic test reports, including lab results, imaging scans, and specialist evaluations, to support out-of-network insurance claims. Accurate and comprehensive documentation of these reports ensures proper claim processing and maximizes reimbursement eligibility. |

| 10 | Referral Letter | A referral letter is essential for out-of-network insurance claims as it serves as formal documentation from a primary care physician recommending specialist care, validating the necessity of treatment. This document helps insurers verify that the patient followed proper protocols, increasing the likelihood of claim approval and reimbursement. |

| 11 | Pre-Authorization Letter (if applicable) | A Pre-Authorization Letter is a crucial document for out-of-network insurance claims, confirming that the insurance provider approved the medical service in advance. Patients should obtain this letter from their healthcare provider to ensure reimbursement eligibility and avoid claim denials. |

| 12 | Explanation of Benefits (EOB) | Patients must provide the Explanation of Benefits (EOB) when submitting out-of-network insurance claims, as this document details the services billed, amounts covered, and patient responsibility. The EOB serves as essential proof of payment, facilitating accurate reimbursement from the insurance company for out-of-network care. |

| 13 | Copy of Consultation Notes | A copy of consultation notes is essential for out-of-network insurance claims as it provides detailed documentation of the diagnosis, treatment plan, and medical services rendered by the consulting physician. These notes help verify the necessity of care and support the claim's legitimacy when submitting to insurance providers. |

| 14 | Operative/Procedure Notes | Operative or procedure notes are critical documents required for out-of-network insurance claims as they provide detailed descriptions of surgeries or medical procedures performed, including the diagnosis, treatment, and any complications encountered. These notes serve as essential evidence for insurers to validate the necessity and scope of care, facilitating accurate reimbursement for out-of-network services. |

| 15 | Ambulance Invoice (if used) | For out-of-network insurance claims involving ambulance services, patients must provide a detailed ambulance invoice specifying date of service, pickup and drop-off locations, type of ambulance used, mileage, and itemized charges. This invoice is essential for verifying medical necessity and ensuring accurate reimbursement from the insurance provider. |

| 16 | Pharmacy Bills | Patients submitting out-of-network insurance claims must provide detailed pharmacy bills that include the medication name, dosage, quantity, and total cost to ensure accurate reimbursement. These documents should be itemized, dated, and accompanied by the pharmacy's contact information and the prescribing physician's details to meet insurer requirements. |

| 17 | Cover Letter/Claim Letter | A patient must submit a detailed cover letter or claim letter explaining the need for out-of-network care, including dates of service, provider information, and itemized medical bills. This document is essential for insurance companies to process reimbursement requests accurately and expedite claim approval. |

| 18 | Bank Account Details (for reimbursement) | Patients submitting out-of-network insurance claims must provide detailed bank account information, including account number, bank name, branch address, and routing or SWIFT codes, to ensure accurate and timely reimbursement. Accurate bank details minimize processing delays and prevent claim payment errors, facilitating seamless direct deposits from insurance providers. |

| 19 | Provider’s Tax ID (if required) | Patients filing out-of-network insurance claims must provide comprehensive documentation, including the provider's Tax Identification Number (TIN) if required by the insurer, which ensures proper processing and reimbursement. Including the provider's Tax ID alongside itemized bills, receipts, and medical records facilitates accurate claim verification and expedites payment. |

| 20 | Power of Attorney (if submitted by representative) | Patients submitting out-of-network insurance claims through a representative must provide a valid Power of Attorney document authorizing the representative to act on their behalf. This legal authorization ensures the insurer recognizes the claim and facilitates proper processing and communication. |

Introduction to Out-of-Network Insurance Claims

Out-of-network insurance claims arise when medical services are provided by healthcare professionals or facilities not contracted with your insurance plan. These claims often require additional documentation compared to in-network services to ensure proper processing and reimbursement.

You must gather specific documents such as itemized medical bills, proof of payment, and detailed medical records. Submitting the correct paperwork helps avoid delays and increases the likelihood of claim approval.

Understanding Out-of-Network Coverage Policies

Patients seeking reimbursement for out-of-network medical services must gather specific documents to support their insurance claims. Essential paperwork includes detailed medical bills, itemized receipts, and a completed claim form from the insurance provider. Understanding out-of-network coverage policies helps patients identify required documentation, ensuring timely and accurate claim processing.

Essential Documentation for Out-of-Network Claims

Patients filing out-of-network insurance claims must gather specific documents to ensure proper processing and reimbursement. Essential documentation includes detailed medical records, itemized bills, and the insurance claim form provided by the insurer.

Medical records should clearly describe the diagnosis, treatments, and services received from the out-of-network provider. Itemized bills must list each service with corresponding dates, provider details, and charges. The insurance claim form often requires patient information, treatment descriptions, and signatures to validate the request for claim reimbursement.

Gathering Required Medical Records and Receipts

Gathering required documents is essential for submitting out-of-network insurance claims efficiently. Your claim approval depends heavily on the completeness and accuracy of medical records and receipts.

- Medical Records - Detailed healthcare provider notes and treatment summaries verify the necessity of the services received.

- Receipts and Invoices - Itemized bills from healthcare providers document the costs incurred during treatment.

- Proof of Payment - Receipts or bank statements show that you have paid for the services out-of-pocket.

Collecting these documents promptly helps streamline the insurance claim process and avoid delays.

Preparing Itemized Bills and Proof of Payment

Patients filing out-of-network insurance claims must prepare specific documents to ensure successful reimbursement. Properly itemized bills and proof of payment are critical components for submitting these claims.

- Itemized Medical Bills - These documents provide a detailed list of services rendered, including dates, procedure codes, and costs charged by the healthcare provider.

- Proof of Payment - Receipts, bank statements, or credit card statements that verify the patient has paid for the medical services out-of-pocket are required.

- Insurance Claim Form - Although not the focus here, this form must be accurately completed using information from the itemized bills and proof of payment to process the out-of-network claim.

Completing Insurance Claim Forms Accurately

What documents are essential for submitting out-of-network insurance claims? Accurate completion of insurance claim forms is critical to ensure timely processing. Your medical bills, detailed receipts, and provider's invoices support the information you provide on the claim form.

How do you complete insurance claim forms correctly for out-of-network claims? Carefully review each section to avoid errors that can delay reimbursement. Providing accurate personal information, service dates, and medical codes is vital for claim approval.

Why should you keep copies of all medical documents and claim submissions? Maintaining organized records of all communications and submissions helps resolve disputes and track the claim status. Copies of your claim form, receipts, and correspondence create a complete documentation trail.

Submission Guidelines for Out-of-Network Claims

Submitting out-of-network insurance claims requires specific documentation to ensure timely processing. Key documents often include a detailed itemized bill, the provider's credentials, and a completed claim form from your insurance company.

Medical records that support the necessity of treatment must accompany the claim. Following your insurer's submission guidelines closely, such as sending documents within specified deadlines and using approved channels, increases the likelihood of claim approval.

Common Mistakes to Avoid in Claim Submission

Submitting out-of-network insurance claims requires careful preparation of specific documents to ensure successful reimbursement. Patients often encounter delays or denials due to common errors in claim submissions.

- Incomplete Medical Records - Missing or unclear medical documentation can result in claim rejection by the insurance provider.

- Incorrect Billing Codes - Using wrong or outdated CPT and ICD codes can lead to processing errors and denials.

- Lack of Pre-Authorization - Failing to obtain pre-authorization where required causes delays or outright denial of coverage.

Tracking, Appeals, and Resolving Denials

For out-of-network insurance claims, essential documents include the itemized medical bill, the detailed explanation of benefits (EOB), and all correspondence related to the service. Tracking your claim involves regularly checking the insurer's online portal and maintaining a log of submission dates and responses. To appeal and resolve denials, gather medical records, a letter of medical necessity from your provider, and any denial notices to support your case effectively.

What Documents Does a Patient Need for Out-of-Network Insurance Claims? Infographic