To open a business bank account, essential documents typically include a government-issued photo ID, business formation certificates such as Articles of Incorporation or a DBA (Doing Business As) certificate, and an Employer Identification Number (EIN) issued by the IRS. Banks may also require a partnership agreement or operating agreement for LLCs and proof of address for the business. Keeping all documentation accurate and up-to-date ensures a smooth account setup process and compliance with banking regulations.

What Documents Are Needed to Open a Business Bank Account?

| Number | Name | Description |

|---|---|---|

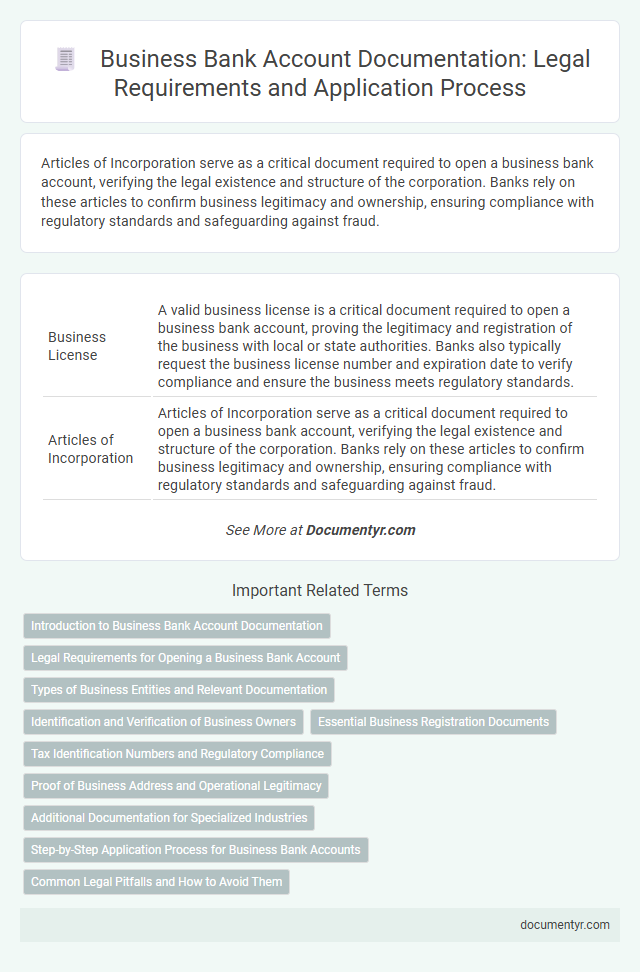

| 1 | Business License | A valid business license is a critical document required to open a business bank account, proving the legitimacy and registration of the business with local or state authorities. Banks also typically request the business license number and expiration date to verify compliance and ensure the business meets regulatory standards. |

| 2 | Articles of Incorporation | Articles of Incorporation serve as a critical document required to open a business bank account, verifying the legal existence and structure of the corporation. Banks rely on these articles to confirm business legitimacy and ownership, ensuring compliance with regulatory standards and safeguarding against fraud. |

| 3 | Partnership Agreement | A Partnership Agreement is essential for opening a business bank account for a partnership, as it outlines the roles, responsibilities, and ownership percentages of each partner. Banks require this document to verify the legitimacy of the partnership and ensure all signatories have authorized authority to operate the account. |

| 4 | DBA (Doing Business As) Certificate | Opening a business bank account requires a valid DBA (Doing Business As) certificate to verify the business's operating name officially registered with the local government. This document ensures the bank recognizes the business under its trade name, facilitating legal compliance and smooth financial transactions. |

| 5 | Employer Identification Number (EIN) Letter | An Employer Identification Number (EIN) letter from the IRS is essential for opening a business bank account as it verifies the legitimacy of the business entity. Banks require the EIN letter to confirm the business's tax identification number, enabling accurate record-keeping and compliance with federal regulations. |

| 6 | Operating Agreement (for LLCs) | An Operating Agreement is a critical document required to open a business bank account for LLCs, as it outlines the ownership structure and operating procedures of the company. Banks use the Operating Agreement to verify authority and confirm the identity of members authorized to manage the account and conduct financial transactions. |

| 7 | Corporate Bylaws | Corporate bylaws are essential legal documents required to open a business bank account, as they outline the company's internal management structure and authorized signatories. Banks often require certified copies of bylaws to verify the legitimacy and governance of the corporation before account approval. |

| 8 | Certificate of Good Standing | A Certificate of Good Standing is a crucial document for opening a business bank account, as it verifies that the company is legally registered and compliant with state regulations. Banks require this certificate to ensure the business is authorized to operate and maintain its legal status, reducing the risk of fraud. |

| 9 | Ownership Agreements | Ownership agreements, such as partnership agreements or articles of incorporation, are essential documents required to open a business bank account, as they verify the legal structure and ownership of the business. Banks require these agreements to confirm authorized signatories and the distribution of ownership interests among the business owners. |

| 10 | Board Resolution (for Corporations) | A board resolution is a formal document required to authorize the opening of a business bank account on behalf of a corporation, detailing the decision made by the board of directors and specifying the authorized signatories. This resolution ensures compliance with banking regulations and corporate governance by verifying the legitimacy of the account opening request. |

| 11 | Government-Issued Photo ID | A government-issued photo ID such as a passport, driver's license, or state ID card is essential for opening a business bank account to verify the identity of the account holder. Banks require this document to comply with KYC (Know Your Customer) regulations and prevent fraud. |

| 12 | Proof of Address | Proof of address documents, such as utility bills, lease agreements, or bank statements dated within the last three months, are essential for opening a business bank account to verify the physical location of the business. These documents must clearly display the business name and address matching the information provided during the account setup process. |

| 13 | Business Tax ID | A valid Business Tax ID, commonly known as an Employer Identification Number (EIN), is essential for opening a business bank account as it verifies the entity's legal tax status with the IRS. Banks require this document to ensure compliance with federal regulations and to distinguish the business's financial activities from personal accounts. |

| 14 | Organizational Meeting Minutes | Organizational meeting minutes are essential documents that verify the formal approval of opening a business bank account during a company's initial or ongoing board meetings. These minutes typically include resolutions authorizing specific individuals to act on behalf of the business, ensuring the bank recognizes the legitimacy of the account signatories. |

Introduction to Business Bank Account Documentation

Opening a business bank account is a crucial step in managing your company's finances efficiently. Proper documentation is required to verify your business identity and ensure compliance with banking regulations.

Commonly requested documents include your business formation papers, such as articles of incorporation or a partnership agreement. Banks may also require identification for business owners and proof of the business's tax identification number (TIN).

Legal Requirements for Opening a Business Bank Account

Opening a business bank account requires submitting specific legal documents to verify the entity's legitimacy and ownership. Key documents include the business formation certificate, such as Articles of Incorporation or a partnership agreement, along with an Employer Identification Number (EIN) issued by the IRS. Identification documents like a government-issued ID of the business owner and proof of address are essential to comply with anti-money laundering regulations and banking policies.

Types of Business Entities and Relevant Documentation

What documents are needed to open a business bank account for different types of business entities? Requirements vary depending on whether your business is a sole proprietorship, partnership, corporation, or limited liability company (LLC). Each entity type requires specific documentation to verify legal and operational status.

What documents are required for a sole proprietorship to open a bank account? Typically, you need a government-issued ID, your Social Security Number (SSN), and a business license or DBA ("Doing Business As") certificate. These documents confirm your identity and the legitimacy of your business.

Which documents should partnerships provide to open a business bank account? Partnerships usually must submit a partnership agreement, government-issued identification for all partners, and an Employer Identification Number (EIN) issued by the IRS. This ensures the bank can verify the partnership's ownership structure and legitimacy.

What paperwork does a corporation need to open a bank account? Corporations generally require Articles of Incorporation, corporate bylaws, a resolution authorizing the account opening, and an EIN. These documents establish the corporation's legal existence and authorization for financial transactions.

What documentation is necessary for an LLC when opening a business bank account? An LLC must provide Articles of Organization, an operating agreement, an EIN, and identification for the authorized members or managers. This confirms the structure and operational authority within the company.

Identification and Verification of Business Owners

Opening a business bank account requires precise identification and verification of business owners to comply with banking regulations. These documents confirm the legitimacy of the business and the identity of its principals.

- Personal Identification - Government-issued photo IDs such as a passport or driver's license verify the identity of business owners.

- Business Formation Documents - Articles of incorporation, partnership agreements, or LLC operating agreements confirm the legal existence and structure of the business.

- Proof of Address - Utility bills or lease agreements establish the physical location associated with the business or its owners.

Your bank may require additional verification steps based on the type of business and regulatory requirements.

Essential Business Registration Documents

Opening a business bank account requires specific essential business registration documents to verify the legitimacy of your company. These documents confirm your business identity and legal status, allowing the bank to comply with regulatory requirements.

The most common essential documents include your Business License, Articles of Incorporation, and Employer Identification Number (EIN). Banks may also request a Partnership Agreement or Operating Agreement for certain business structures such as partnerships or LLCs.

Tax Identification Numbers and Regulatory Compliance

| Document | Description | Importance for Tax Identification and Regulatory Compliance |

|---|---|---|

| Tax Identification Number (TIN) | A unique identifier assigned to businesses for tax purposes by government agencies such as the IRS in the United States. | Essential for tax reporting, withholding, and ensuring compliance with federal and state tax regulations. |

| Employer Identification Number (EIN) | A federal tax ID number issued by the IRS to identify a business entity. | Required for opening a business bank account and fulfilling tax obligations including payroll and income reporting. |

| Business License or Permit | Official authorization from local or state agencies allowing the business to operate legally. | Verifies regulatory compliance and legitimacy of the business for banking and tax authorities. |

| Formation Documents (Articles of Incorporation/Organization) | Legal documents filed to legally form the business entity. | Needed to confirm the business structure and to comply with state registration laws for banking and taxation. |

| Identity Verification Documents | Government-issued IDs such as passports or driver's licenses for business owners or authorized signers. | Ensures compliance with Know Your Customer (KYC) regulations to prevent fraud and money laundering. |

Proof of Business Address and Operational Legitimacy

Opening a business bank account requires specific documents to verify the business address and confirm operational legitimacy. These documents ensure compliance with legal and banking regulations.

- Proof of Business Address - Utility bills, lease agreements, or official correspondence that display the business location are essential to confirm the physical address.

- Business Licenses and Permits - Valid licenses or permits issued by government authorities prove that the business operates legally within its industry.

- Certificate of Incorporation or Formation - Official registration documents demonstrate the legal establishment of the business entity to the bank.

Additional Documentation for Specialized Industries

Opening a business bank account requires specific documents including personal identification, business licenses, and the Employer Identification Number (EIN). Specialized industries such as finance, healthcare, or food services often need to provide extra documentation like compliance certificates, industry-specific permits, and proof of regulatory approvals. Banks may also request additional verification to ensure adherence to industry regulations and mitigate risks associated with these sectors.

Step-by-Step Application Process for Business Bank Accounts

Opening a business bank account requires specific documents to verify your business identity and legal structure. These documents ensure compliance with banking regulations and help protect your financial transactions.

The application process begins with gathering your business formation documents, such as your Articles of Incorporation or Partnership Agreement. You will need your Employer Identification Number (EIN) issued by the IRS and a valid government-issued ID. Lastly, prepare a resolution authorizing account opening if your business is a corporation with multiple owners.

What Documents Are Needed to Open a Business Bank Account? Infographic