To open a bank account as a non-citizen, you typically need a valid passport, a secondary form of identification such as a government-issued ID or driver's license, and proof of address like a utility bill or lease agreement. Some banks also require a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for tax purposes. It is important to check specific bank requirements as documentation can vary depending on the institution and country.

What Documents Do You Need to Open a Bank Account as a Non-Citizen?

| Number | Name | Description |

|---|---|---|

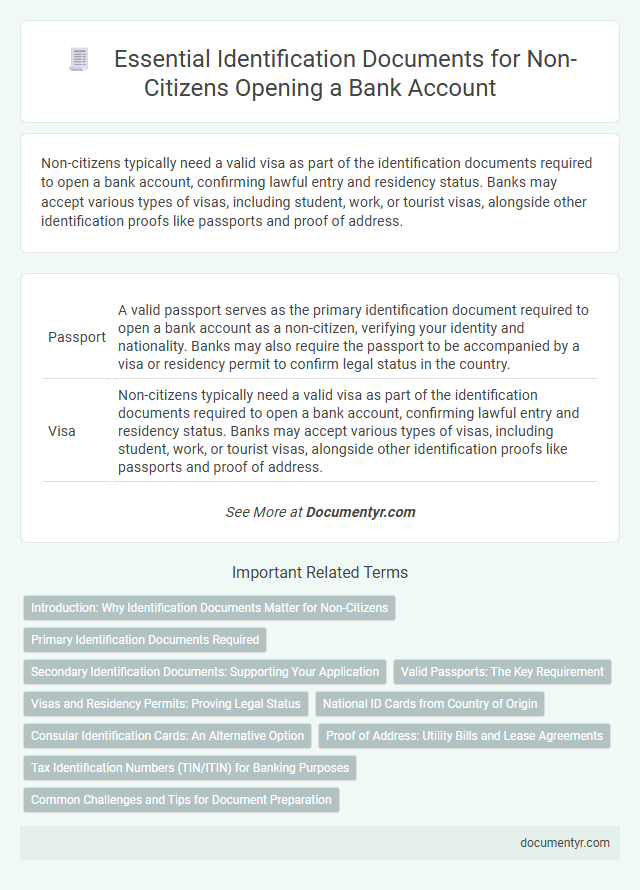

| 1 | Passport | A valid passport serves as the primary identification document required to open a bank account as a non-citizen, verifying your identity and nationality. Banks may also require the passport to be accompanied by a visa or residency permit to confirm legal status in the country. |

| 2 | Visa | Non-citizens typically need a valid visa as part of the identification documents required to open a bank account, confirming lawful entry and residency status. Banks may accept various types of visas, including student, work, or tourist visas, alongside other identification proofs like passports and proof of address. |

| 3 | Foreign National ID Card | A Foreign National ID Card serves as a crucial document for non-citizens opening a bank account, providing government-issued proof of identity and residency status. Banks often require this card alongside a valid passport and proof of address to verify the applicant's identity and comply with anti-money laundering regulations. |

| 4 | Consular Identification Card | A Consular Identification Card serves as a valid form of identification for non-citizens opening a bank account, often accepted alongside a passport and proof of address to fulfill bank verification requirements. Many financial institutions recognize consular IDs issued by foreign government consulates, ensuring non-citizens can access banking services while establishing residency documentation. |

| 5 | Driver’s License (International or Foreign) | Non-citizens can use an international or foreign driver's license as a valid form of identification to open a bank account, provided the document is government-issued and current. Banks often require this alongside proof of address and immigration status to comply with regulatory verification standards. |

| 6 | Employment Authorization Document (EAD) | An Employment Authorization Document (EAD) serves as a primary identification and work authorization form required by most banks for non-citizens opening a bank account. The EAD, issued by the U.S. Citizenship and Immigration Services (USCIS), verifies the holder's legal permission to work, making it a critical document alongside proof of address and Social Security Number or Individual Taxpayer Identification Number (ITIN). |

| 7 | Permanent Resident Card (Green Card) | A Permanent Resident Card, commonly known as a Green Card, serves as a primary form of identification for non-citizens looking to open a bank account in the United States. This card verifies lawful permanent residency status, satisfying banks' requirements for proof of identity and residency. |

| 8 | Individual Taxpayer Identification Number (ITIN) Letter or Card | Non-citizens must present an Individual Taxpayer Identification Number (ITIN) letter or card as a primary form of identification when opening a bank account, ensuring compliance with IRS regulations for tax reporting purposes. This document verifies the account holder's taxpayer status in the absence of a Social Security Number (SSN), facilitating legal banking operations and financial record-keeping. |

| 9 | Social Security Number (SSN) or SSN Ineligibility Letter | Non-citizens opening a bank account typically need to provide a Social Security Number (SSN) or an SSN Ineligibility Letter issued by the Social Security Administration to verify identity and residency status. Banks require these documents to comply with federal regulations and to facilitate tax reporting and identity verification processes. |

| 10 | Proof of Address (Utility Bill, Lease Agreement, Bank Statement) | Non-citizens must provide valid proof of address documents such as a recent utility bill, lease agreement, or bank statement when opening a bank account. These documents confirm residency and are essential for identity verification and regulatory compliance. |

| 11 | Proof of Income or Employment Letter | Non-citizens must provide a proof of income or employment letter to open a bank account, which validates their financial stability and source of funds. This document typically includes employer details, job title, salary, and duration of employment, ensuring compliance with banking regulations and enabling account verification. |

| 12 | Student ID or Enrollment Verification (for student accounts) | Non-citizens opening a student bank account typically need to provide a valid Student ID or official Enrollment Verification letter from their educational institution, confirming their full-time status. These documents serve as proof of identity and student status, essential for account eligibility and compliance with bank regulations. |

| 13 | Refugee or Asylee Documentation | Refugees or asylees must provide valid immigration documents such as Form I-94, Employment Authorization Document (EAD), or Form I-766 to open a bank account as a non-citizen. Banks typically require proof of identity and legal status, including refugee travel documents or asylum approval notices, to comply with federal regulations. |

| 14 | Government-Issued Birth Certificate (translated if required) | A government-issued birth certificate, translated into the official language if necessary, serves as a primary document to establish identity and citizenship status when opening a bank account as a non-citizen. Banks require this certified document to verify personal details and comply with regulatory identification standards. |

Introduction: Why Identification Documents Matter for Non-Citizens

Opening a bank account as a non-citizen requires specific identification documents to verify your identity and legal status. Proper identification ensures compliance with banking regulations and helps protect against fraud.

- Identity Verification - Banks need valid identification to confirm who you are and prevent identity theft.

- Legal Status Confirmation - Documents prove your right to open and operate a bank account in the host country.

- Regulatory Compliance - Proper ID helps banks adhere to anti-money laundering and know-your-customer (KYC) laws.

Primary Identification Documents Required

What primary identification documents are required to open a bank account as a non-citizen? Valid government-issued photo ID such as a passport or national ID card is essential. Proof of residence and immigration status may also be necessary depending on the bank's policies.

Secondary Identification Documents: Supporting Your Application

Secondary identification documents play a crucial role in supporting your bank account application as a non-citizen. These documents provide additional verification to strengthen your identity and residency claims.

Common examples include a utility bill, lease agreement, or a credit card statement that displays your name and current address. These help banks confirm your residential status alongside your primary identification.

Valid Passports: The Key Requirement

Opening a bank account as a non-citizen requires specific identification documents, with a valid passport being the most crucial. This document serves as the primary proof of identity and nationality, which banks rely on for verification purposes.

- Valid Passport as Primary Identification - A current and unexpired passport is essential for authenticating your identity when opening a bank account.

- Proof of Residency Often Required - Banks may request additional documentation such as utility bills or leases to verify your residential address.

- Supporting Immigration Documents - Visa, work permits, or residency permits can be necessary to complete the banking registration process as a non-citizen.

Visas and Residency Permits: Proving Legal Status

Visas and residency permits are essential for proving your legal status when opening a bank account as a non-citizen. Banks require these documents to verify your eligibility to hold an account within the country.

Valid visas, such as work, student, or tourist visas, demonstrate your temporary legal status. Residency permits provide evidence of your authorized long-term stay. Presenting these documents helps financial institutions comply with legal and regulatory requirements.

National ID Cards from Country of Origin

Opening a bank account as a non-citizen requires specific identification documents to verify your identity. National ID cards from your country of origin are often accepted as primary identification.

- Accepted Verification - Many banks recognize national ID cards to confirm your identity and citizenship status.

- Essential Details - The ID card must display your full name, date of birth, and photograph clearly.

- Validity Requirement - The national ID card should be current and not expired for acceptance during account opening.

Providing a valid national ID card streamlines the identity verification process when opening a bank account abroad.

Consular Identification Cards: An Alternative Option

Consular Identification Cards serve as a valid alternative for non-citizens opening a bank account. These cards are issued by a foreign government and confirm your identity and nationality.

Many banks accept consular IDs alongside other documents to fulfill identification requirements. This option helps non-citizens who may lack U.S. state-issued IDs or passports access banking services securely.

Proof of Address: Utility Bills and Lease Agreements

| Document Type | Details | Purpose |

|---|---|---|

| Utility Bills | Recent bills for electricity, water, gas, or internet services. Must include your name and current address. | Serves as a reliable proof of residential address required by banks to verify where you reside. |

| Lease Agreements | Signed rental contract that shows your name, landlord's details, property address, and lease period. | Confirms your living arrangement and validates your address for bank account opening processes. |

Tax Identification Numbers (TIN/ITIN) for Banking Purposes

Non-citizens opening a bank account must provide valid identification, proof of address, and a Tax Identification Number (TIN) or Individual Taxpayer Identification Number (ITIN) for tax reporting. The TIN or ITIN is essential for complying with the IRS regulations and verifying tax obligations. Banks use these identification numbers to ensure proper documentation and legal compliance for non-citizen account holders.

What Documents Do You Need to Open a Bank Account as a Non-Citizen? Infographic