Opening a youth bank account requires valid identification such as a government-issued ID, birth certificate, or passport to verify the applicant's identity and age. Parents or legal guardians may need to provide their own identification and proof of relationship when the account holder is a minor. These documents ensure compliance with banking regulations and help prevent fraud.

What Identification is Necessary for Opening a Youth Bank Account?

| Number | Name | Description |

|---|---|---|

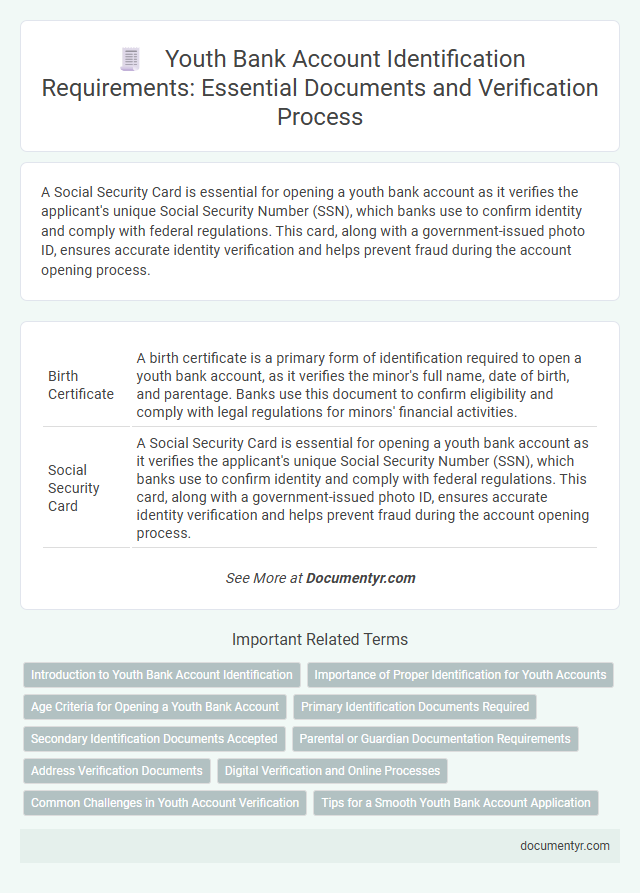

| 1 | Birth Certificate | A birth certificate is a primary form of identification required to open a youth bank account, as it verifies the minor's full name, date of birth, and parentage. Banks use this document to confirm eligibility and comply with legal regulations for minors' financial activities. |

| 2 | Social Security Card | A Social Security Card is essential for opening a youth bank account as it verifies the applicant's unique Social Security Number (SSN), which banks use to confirm identity and comply with federal regulations. This card, along with a government-issued photo ID, ensures accurate identity verification and helps prevent fraud during the account opening process. |

| 3 | Passport (Child or Parent/Guardian) | Opening a youth bank account requires valid identification such as a child's passport or, if unavailable, the passport of a parent or guardian to verify identity and comply with regulatory requirements. These passports provide official proof of identity and residency, ensuring secure account setup and adherence to anti-fraud policies. |

| 4 | State Identification Card | A State Identification Card is a crucial form of identification required for opening a youth bank account, serving as official proof of identity and residency. Banks often accept this card to verify the account holder's age and personal information, ensuring compliance with legal and regulatory requirements. |

| 5 | School Identification Card | A school identification card is a crucial document required to open a youth bank account, providing proof of the applicant's identity and current enrollment status. Banks often accept this ID as it verifies the youth's name, date of birth, and school affiliation, fulfilling regulatory requirements for account opening. |

| 6 | Proof of Address (Utility Bill, Lease, Parent Statement) | Proof of address is a crucial identification requirement for opening a youth bank account, commonly verified through recent utility bills, a lease agreement, or a parent or guardian's official statement confirming residency. These documents ensure the bank can authenticate the minor's residence, aligning with regulatory compliance and fraud prevention standards. |

| 7 | Parent/Guardian Photo ID | Parent or guardian photo identification, such as a valid driver's license or passport, is essential for opening a youth bank account to verify identity and authorize account activity. Financial institutions require this documentation to comply with regulatory standards and safeguard the minor's account. |

| 8 | Consular Identification Card | A Consular Identification Card serves as a valid form of identification for opening a youth bank account, providing proof of identity and residency for minors, especially non-U.S. citizens. Banks typically require this card alongside other documents such as a birth certificate or Social Security number to verify eligibility and comply with regulatory standards. |

| 9 | Health Insurance Card (with Name and Date of Birth) | A Health Insurance Card displaying the name and date of birth serves as a valid and reliable form of identification necessary for opening a youth bank account. Banks use this card to verify the applicant's identity and age, ensuring compliance with legal and regulatory requirements. |

| 10 | Immunization Record | An immunization record is often required for opening a youth bank account to verify the minor's identity and age, ensuring compliance with regulatory standards. This document serves as a trusted form of identification alongside other government-issued IDs, providing proof of personal information necessary for account security. |

| 11 | Adoption Papers (if applicable) | Adoption papers are essential identification documents when opening a youth bank account to verify the minor's legal guardianship and identity. Banks require certified copies of these adoption records to comply with regulatory requirements and ensure accurate account holder information. |

| 12 | Court Documents (Guardianship, Custody) | Court documents such as guardianship and custody papers are essential for opening a youth bank account to verify the legal authority of a guardian or custodian managing the minor's finances. These documents establish the adult's right to act on behalf of the youth, ensuring compliance with banking regulations and protection of the minor's assets. |

| 13 | Certificate of Citizenship/Naturalization | A Certificate of Citizenship or Naturalization is a crucial form of identification required to open a youth bank account, as it verifies the youth's legal status and identity in the country. Banks use this document to comply with regulatory requirements and ensure the account holder's authenticity. |

| 14 | Government-issued Benefits Statement | A government-issued benefits statement is essential for opening a youth bank account to verify the applicant's identity and eligibility through official documentation such as Social Security or Medicaid benefits records. This statement provides proof of government enrollment, ensuring compliance with banking regulations and safeguarding against identity fraud. |

| 15 | Tribal Identification Card | A Tribal Identification Card serves as a vital form of identification for opening a youth bank account, especially for Native American youth, providing proof of tribal membership and identity verification. Banks often accept Tribal ID cards alongside other documents to comply with federal regulations and ensure proper identification for account security and access to financial services tailored for youth. |

Introduction to Youth Bank Account Identification

Opening a youth bank account requires specific identification to verify the applicant's identity and eligibility. Proper identification ensures compliance with banking regulations and protects young account holders.

- Proof of Identity - Common documents include a government-issued ID, such as a passport or national ID card, to confirm the youth's identity.

- Proof of Age - Documents like a birth certificate or school ID validate the applicant's age, a critical factor for youth accounts.

- Parental or Guardian Consent - A signed consent form or identification of the parent/guardian is often necessary to authorize account opening for minors.

Importance of Proper Identification for Youth Accounts

Proper identification is essential for opening a youth bank account to verify the account holder's identity and prevent fraud. Banks typically require documents such as a birth certificate, social security card, or government-issued photo ID to establish the youth's identity. Ensuring accurate identification safeguards the account and helps comply with legal banking regulations.

Age Criteria for Opening a Youth Bank Account

What identification is necessary for opening a youth bank account?

Proof of age is a primary requirement for opening a youth bank account. Typically, banks require identification documents such as a birth certificate or government-issued ID to verify that the applicant meets the age criteria set for youth accounts.

Primary Identification Documents Required

Opening a youth bank account requires specific primary identification to verify identity and ensure security. Your chosen documents must meet the bank's regulatory standards for youth banking.

- Birth Certificate - Serves as official proof of age and identity for minors opening a bank account.

- Government-issued ID - Examples include a passport or state ID card, providing a reliable identity verification source.

- Social Security Number (SSN) or Tax Identification Number (TIN) - Required for tax and identification purposes during the account setup.

Secondary Identification Documents Accepted

Opening a youth bank account requires specific identification to verify the applicant's identity. Primary identification documents are often supplemented by secondary identification for added security.

Secondary identification documents accepted typically include student ID cards, utility bills, or a birth certificate. These documents help confirm personal details and support the primary identification during the account opening process.

Parental or Guardian Documentation Requirements

Opening a youth bank account requires specific identification to verify the identity of both the minor and their parent or guardian. Banks usually request a government-issued ID such as a passport or driver's license from the adult responsible for the account.

Proof of guardianship or parental rights is necessary alongside the parent's identification to ensure legal authorization. This documentation often includes birth certificates or court orders confirming guardianship status for your youth account setup.

Address Verification Documents

Address verification is a crucial requirement when opening a youth bank account. Acceptable documents for this purpose typically include utility bills, bank statements, or government-issued letters displaying the account holder's name and current address. Providing accurate address verification documents ensures compliance with banking regulations and helps secure the account holder's identity.

Digital Verification and Online Processes

Identification for opening a youth bank account primarily involves digital verification methods to streamline the process. These methods ensure secure and swift identity confirmation without the need for physical documents.

Online processes typically require a government-issued ID such as a passport or national identity card, which is scanned or uploaded for verification. Biometric data, including facial recognition or fingerprint scans, may be used to enhance security levels. These digital verification techniques reduce fraud risks and provide a convenient experience for young account holders.

Common Challenges in Youth Account Verification

Identification is essential for opening a youth bank account to verify the account holder's age and identity. Ensuring accurate documentation can be challenging for young applicants and financial institutions alike.

- Proof of Age - Youth accounts require valid proof of age such as a birth certificate or passport to confirm eligibility.

- Parental or Guardian Consent - Many banks mandate identification and consent from a parent or guardian to comply with legal requirements.

- Inconsistent Documentation - Youth applicants often face issues due to incomplete or mismatched identification documents, delaying account approval.

Your bank may have specific verification protocols that can vary, making it important to check the exact identification requirements beforehand.

What Identification is Necessary for Opening a Youth Bank Account? Infographic