FAFSA verification requires several important documents to confirm the accuracy of the financial information submitted. Applicants typically need to provide tax returns, W-2 forms, and proof of income, along with identification documents such as Social Security cards and birth certificates. Additional paperwork may include records of untaxed income and household size to ensure a complete and accurate verification process.

What Documents are Needed for FAFSA Verification?

| Number | Name | Description |

|---|---|---|

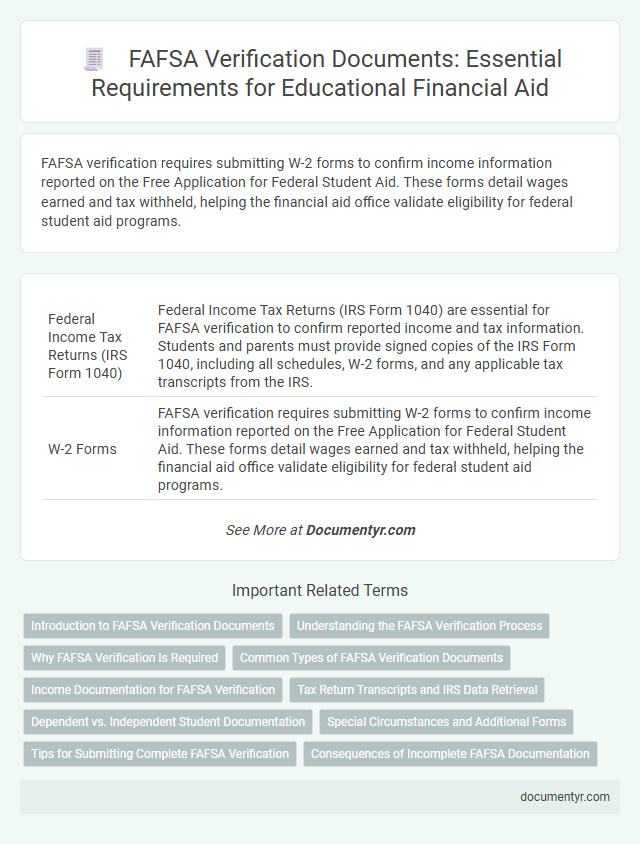

| 1 | Federal Income Tax Returns (IRS Form 1040) | Federal Income Tax Returns (IRS Form 1040) are essential for FAFSA verification to confirm reported income and tax information. Students and parents must provide signed copies of the IRS Form 1040, including all schedules, W-2 forms, and any applicable tax transcripts from the IRS. |

| 2 | W-2 Forms | FAFSA verification requires submitting W-2 forms to confirm income information reported on the Free Application for Federal Student Aid. These forms detail wages earned and tax withheld, helping the financial aid office validate eligibility for federal student aid programs. |

| 3 | 1099 Forms | FAFSA verification often requires submission of IRS Form 1099, including 1099-INT for interest income, 1099-DIV for dividends, and 1099-MISC for miscellaneous income, to verify income details. Accurate reporting of these 1099 Forms ensures proper assessment of financial aid eligibility and prevents delays in grant or loan disbursement. |

| 4 | Untaxed Income Records (e.g., child support, workers’ compensation) | FAFSA verification requires documentation of untaxed income sources such as child support payments and workers' compensation benefits to accurately assess a student's financial situation. Providing official statements, court orders, or benefit award letters ensures compliance and prevents processing delays in the FAFSA review process. |

| 5 | Proof of U.S. Citizenship or Eligible Noncitizen Documentation | FAFSA verification requires applicants to provide proof of U.S. citizenship, such as a U.S. birth certificate, U.S. passport, or Consular Report of Birth Abroad, or eligible noncitizen documentation like an Alien Registration Card (Form I-551), Arrival/Departure Record (Form I-94), or Employment Authorization Document (EAD). These documents confirm the applicant's eligibility for federal student aid by verifying their citizenship or immigration status. |

| 6 | Social Security Card | A valid Social Security Card is essential for FAFSA verification to confirm the student's identity and eligibility for federal aid. This document must match the information provided on the FAFSA application to prevent delays in processing financial aid. |

| 7 | Government-issued Photo Identification (ID) | Government-issued photo identification (ID) such as a valid passport, state driver's license, or military ID is essential for FAFSA verification to confirm the student's identity. This document helps prevent fraud and ensures that financial aid is awarded to the correct individual. |

| 8 | Proof of High School Completion (diploma, GED certificate, transcript) | FAFSA verification requires proof of high school completion, including a high school diploma, GED certificate, or official transcript indicating graduation. These documents confirm eligibility and must be submitted to the financial aid office to finalize the verification process. |

| 9 | SNAP Benefits Documentation | FAFSA verification requires submitting SNAP benefits documentation such as the Electronic Benefit Transfer (EBT) card statement, a benefit letter from the state agency, or an official notice confirming receipt of Supplemental Nutrition Assistance Program benefits within the previous tax year. These documents help verify eligibility for federal financial aid by confirming household income and assistance status accurately. |

| 10 | Temporary Assistance for Needy Families (TANF) Documentation | FAFSA verification requiring Temporary Assistance for Needy Families (TANF) documentation includes submission of official TANF award letters or benefit statements verifying the applicant's receipt of TANF funds. Providing these documents confirms financial need and eligibility for federal student aid during the verification process. |

| 11 | Asset Statements (bank statements, investment records) | FAFSA verification requires asset statements such as recent bank statements and investment records to accurately report a student's and parents' financial resources. These documents help verify the information provided on the FAFSA form, ensuring eligibility for federal student aid. |

| 12 | Selective Service Registration Proof (if required) | FAFSA verification may require proof of Selective Service Registration for male applicants aged 18-25, which can be obtained through the Selective Service System's online registration status tool or a registration acknowledgement letter. Failure to provide this documentation could delay financial aid processing or affect eligibility for federal student aid programs. |

| 13 | Household Size Confirmation Form | The Household Size Confirmation Form is a crucial document for FAFSA verification, used to validate the number of individuals supported by the applicant's household. This form helps ensure accurate aid distribution by confirming the household size reported on the FAFSA application. |

| 14 | Number in College Confirmation Form | The Number in College Confirmation Form requires students to provide official documentation verifying the total number of family members enrolled in college during the academic year, which affects FAFSA verification and financial aid eligibility. Accurate submission of this form ensures that the financial aid office can correctly calculate expected family contribution and disburse appropriate aid amounts. |

| 15 | Legal Guardianship Documentation (if applicable) | Legal guardianship documentation required for FAFSA verification includes a court order or legal paperwork proving the student's guardian status, which must be submitted to the financial aid office. This documentation verifies that the guardian is responsible for the student's care, impacting dependency status and financial information accuracy on the FAFSA application. |

| 16 | Social Security Benefit Statements | Social Security Benefit Statements, such as Form SSA-1099 or Form RRB-1099, are required during FAFSA verification to confirm the amount of benefits received by the student or their family. These documents provide essential income information needed to accurately verify and adjust the Expected Family Contribution (EFC) for financial aid eligibility. |

| 17 | Household Tax Transcripts (from IRS, if requested) | Household tax transcripts from the IRS, including 1040 forms and W-2s, are often required for FAFSA verification to confirm reported income and tax information. These documents ensure accurate assessment of financial aid eligibility by verifying the student's and family's tax details reported on the FAFSA application. |

| 18 | Orphan or Ward of Court Documentation (if applicable) | FAFSA verification for orphans or wards of the court requires official documentation such as court orders or legal guardianship papers to confirm the student's status. These documents validate that the student is an orphan or was in foster care, ensuring accurate determination of financial aid eligibility. |

| 19 | Emancipated Minor Documentation (if applicable) | FAFSA verification for emancipated minors requires legal documentation such as a court order declaring emancipation or proof of emancipation through a legal guardian's statement. Supporting documents like birth certificates, emancipation letters, or affidavits must be submitted to confirm the applicant's independent status. |

| 20 | Foster Care Documentation (if applicable) | FAFSA verification for students with foster care status requires submitting official documentation such as a letter from a foster care agency, court documentation verifying foster care placement, or a determination from the Department of Social Services confirming foster care status. These documents ensure eligibility for specific financial aid benefits and must reflect the student's foster care situation after age 13. |

Introduction to FAFSA Verification Documents

FAFSA verification is a process used to confirm the accuracy of the information provided on your Free Application for Federal Student Aid. This step ensures that financial aid awards are based on verified data.

Common documents required for FAFSA verification include tax transcripts, proof of income, and household information. These documents help financial aid offices validate financial details and family size to determine eligibility.

Understanding the FAFSA Verification Process

The FAFSA verification process requires specific documents to confirm the accuracy of the information provided on your application. Commonly requested documents include tax returns, W-2 forms, and proof of income.

Other documents may include verification of household size, student's citizenship status, and eligibility for certain federal aid programs. Submitting these materials promptly ensures timely processing and award notifications.

Why FAFSA Verification Is Required

| Why FAFSA Verification Is Required | FAFSA verification is a mandatory process used by the U.S. Department of Education to ensure that the financial information submitted on the Free Application for Federal Student Aid (FAFSA) form is accurate and complete. This step prevents errors or fraudulent data that could affect financial aid eligibility. Verification helps institutions confirm the validity of income, tax, and dependency status details, ensuring fair distribution of funds. You must provide supporting documents to confirm your FAFSA data and secure the correct financial aid package. |

|---|---|

| Documents Needed for FAFSA Verification |

|

Common Types of FAFSA Verification Documents

FAFSA verification requires submitting specific documents to confirm the accuracy of the information provided. Common types of verification documents help ensure eligibility for federal financial aid.

- Tax Return Transcript - An official transcript from the IRS verifying income information reported on the FAFSA.

- Proof of Income - Recent pay stubs or W-2 forms that demonstrate earned income for the tax year in question.

- Household Size and Number in College - Documentation such as a signed statement or school enrollment verification to confirm family details.

Submitting the correct verification documents promptly helps process your FAFSA efficiently.

Income Documentation for FAFSA Verification

What income documents are required for FAFSA verification? You must submit official income verification such as tax returns and W-2 forms. These documents confirm your reported income to ensure accurate financial aid assessment.

Tax Return Transcripts and IRS Data Retrieval

FAFSA verification requires specific documents to confirm the accuracy of the information submitted. Tax Return Transcripts from the IRS are crucial as they provide an official record of your income and tax filing status. The IRS Data Retrieval Tool simplifies the process by allowing direct transfer of tax information into your FAFSA application, ensuring accuracy and speeding up verification.

Dependent vs. Independent Student Documentation

FAFSA verification requires different documents based on whether you are a dependent or independent student. Identifying your status is crucial for submitting the correct paperwork.

Dependent students must provide parental tax returns, W-2 forms, and a completed verification worksheet. Independent students are asked for their own tax returns, W-2 forms, and possibly spousal tax information if married. Accurate and timely submission ensures efficient processing of financial aid eligibility.

Special Circumstances and Additional Forms

FAFSA verification requires specific documents to confirm the accuracy of the information submitted, especially when special circumstances affect your financial situation. Schools may request additional forms to better understand and verify these unique conditions.

- Proof of Income - Recent tax returns, W-2 forms, or alternative income documentation are needed to verify reported earnings.

- Special Circumstance Documentation - Statements of unemployment, divorce decrees, or letters explaining changes in income must be provided.

- Additional Verification Forms - Schools may require signed verification worksheets or institutional forms tailored to the student's situation.

Tips for Submitting Complete FAFSA Verification

Submitting complete FAFSA verification documents is essential to avoid delays in financial aid processing. Understanding the required documents helps ensure a smooth verification process.

- Tax Returns and W-2 Forms - Provide signed federal tax returns and W-2 forms to verify income reported on the FAFSA.

- Verification of Household Size - Submit documentation confirming the number of household members, such as a federal tax return or a signed statement.

- Proof of Identity and Citizenship - Include a copy of a government-issued ID and Social Security card to confirm identity and citizenship status.

What Documents are Needed for FAFSA Verification? Infographic