To apply for FAFSA, you need your Social Security number, your federal income tax returns from the previous year, W-2 forms, and records of untaxed income. Students and their parents should also have their bank statements and investment records ready to provide accurate financial information. Having these documents on hand ensures a smooth and timely submission of your FAFSA application.

What Documents are Needed to Apply for FAFSA?

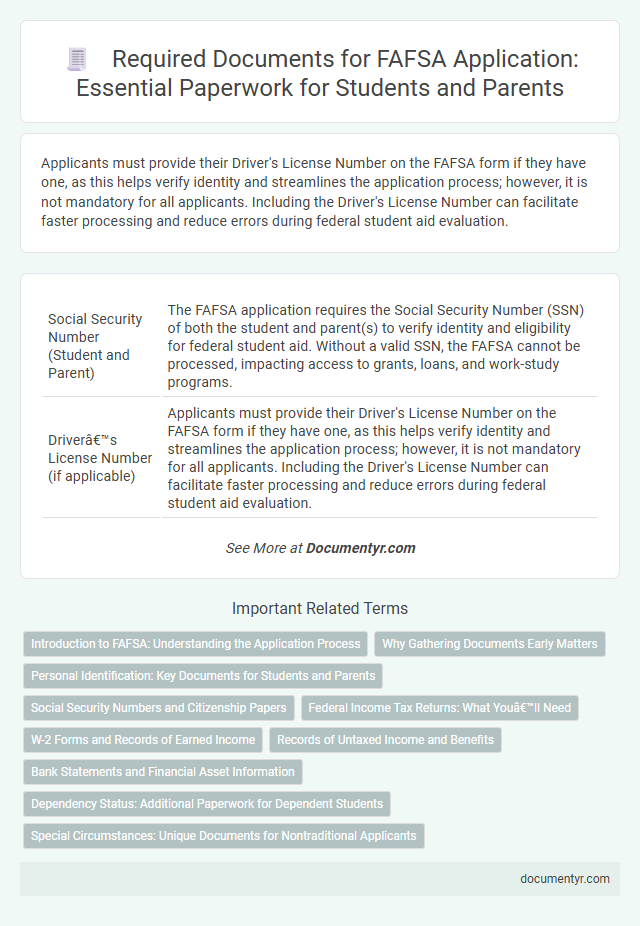

| Number | Name | Description |

|---|---|---|

| 1 | Social Security Number (Student and Parent) | The FAFSA application requires the Social Security Number (SSN) of both the student and parent(s) to verify identity and eligibility for federal student aid. Without a valid SSN, the FAFSA cannot be processed, impacting access to grants, loans, and work-study programs. |

| 2 | Driver’s License Number (if applicable) | Applicants must provide their Driver's License Number on the FAFSA form if they have one, as this helps verify identity and streamlines the application process; however, it is not mandatory for all applicants. Including the Driver's License Number can facilitate faster processing and reduce errors during federal student aid evaluation. |

| 3 | Alien Registration Number (if not a U.S. citizen) | Applicants who are not U.S. citizens must provide their Alien Registration Number (ARN), also known as the A-Number, when applying for FAFSA to verify their eligible noncitizen status. This number is found on immigration documents such as the Permanent Resident Card (Green Card) or Employment Authorization Document (EAD) and is essential for FAFSA processing and federal aid eligibility. |

| 4 | Federal Income Tax Returns (Student and Parent) | Federal income tax returns for both the student and parent are essential documents when applying for FAFSA, as they provide accurate income information required to determine financial aid eligibility. Submitting the IRS tax transcript or the completed 1040 forms ensures verification of reported earnings and helps calculate the Expected Family Contribution (EFC). |

| 5 | W-2 Forms (Student and Parent) | To apply for FAFSA, students and parents must provide their most recent W-2 forms to verify earned income and ensure accurate financial data reporting. These W-2 documents are essential for calculating the Expected Family Contribution (EFC) and determining eligibility for federal student aid. |

| 6 | Records of Untaxed Income (Child support, veterans benefits, etc.) | Records of untaxed income required for FAFSA include child support received, veterans non-education benefits, and other untaxed pensions or disability payments. Accurate documentation of these sources is essential for a complete and precise financial aid application. |

| 7 | Bank Statements (Student and Parent) | Bank statements for both the student and parent are essential documents when applying for FAFSA, as they verify current financial status and provide accurate information about available funds. These statements help determine the Expected Family Contribution (EFC), directly influencing the amount of federal student aid awarded. |

| 8 | Investment Records (Stocks, bonds, real estate, etc.) | Accurate investment records, including statements for stocks, bonds, mutual funds, and real estate holdings, are essential when applying for FAFSA to determine your financial assets. These documents help assess your net worth and influence the Expected Family Contribution (EFC) calculation for financial aid eligibility. |

| 9 | FSA ID (Student and Parent) | To apply for FAFSA, students and parents must create separate FSA IDs, which serve as electronic signatures for the application process. Essential documents to complete the FSA ID setup include a Social Security number, a valid email address, and personal identification details such as driver's license number or passport information. |

| 10 | High School Diploma or GED (for verification, if requested) | A High School Diploma or GED certificate is required for FAFSA to verify your educational background if requested by the financial aid office. Submitting this documentation ensures eligibility confirmation for federal student aid programs. |

| 11 | Records of Other Financial Assets (Trust funds, 529 plans, etc.) | Applicants must provide detailed records of other financial assets such as trust funds, 529 college savings plans, and investment accounts when applying for FAFSA, as these assets impact the Expected Family Contribution (EFC) calculation. Accurate documentation of account statements, ownership details, and current balances ensures precise assessment of financial resources for federal student aid eligibility. |

Introduction to FAFSA: Understanding the Application Process

The Free Application for Federal Student Aid (FAFSA) is a crucial step for students seeking financial aid for college. Understanding the necessary documents streamlines the application process and ensures timely submission.

- Social Security Number - Required to verify identity and eligibility for federal aid programs.

- Federal Income Tax Returns - Used to report income and tax information from the previous year for both the applicant and parents, if applicable.

- Records of Assets and Untaxed Income - Needed to provide a complete financial picture, including savings, investments, and benefits received.

Why Gathering Documents Early Matters

Filing the Free Application for Federal Student Aid (FAFSA) requires several key documents, including your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Gathering these documents early ensures accuracy and helps meet application deadlines.

Missing or incorrect information can delay processing and reduce the amount of financial aid you receive. Early preparation allows time to resolve discrepancies and submit a complete application. Ensuring all paperwork is ready ahead of time improves your chances of securing maximum aid for college expenses.

Personal Identification: Key Documents for Students and Parents

To apply for FAFSA, students and parents must provide personal identification documents. Essential items include a Social Security number, a valid driver's license, and an Alien Registration Number for non-citizens. These documents verify identity and eligibility, ensuring accurate financial aid processing.

Social Security Numbers and Citizenship Papers

| Document Type | Description | Purpose |

|---|---|---|

| Social Security Number (SSN) | Valid Social Security Number issued by the Social Security Administration | Used to verify identity and process FAFSA application |

| Citizenship Papers | Proof of U.S. citizenship such as a U.S. birth certificate, Certificate of Naturalization, or U.S. passport | Confirms eligibility as a U.S. citizen for federal student aid |

| Permanent Resident Card | Valid Permanent Resident Card (Green Card) for eligible non-citizen applicants | Establishes eligible non-citizen status for FAFSA |

Federal Income Tax Returns: What You’ll Need

Completing the FAFSA application requires accurate financial information, primarily sourced from your federal income tax returns. These documents verify your income and are crucial for determining your eligibility for federal student aid.

- Recent Tax Return - Submit the federal income tax return from the most recent tax year, typically IRS Form 1040, to provide verified income details.

- Tax Return Transcript - Use a tax return transcript as an alternative to the full tax return for verification purposes, obtainable from the IRS website.

- Adjusted Gross Income (AGI) - Report your AGI from the tax document, as it is essential for calculating your Expected Family Contribution (EFC) on the FAFSA.

W-2 Forms and Records of Earned Income

Applying for FAFSA requires gathering specific income documentation to accurately report financial information. W-2 forms and records of earned income are essential documents needed during this process.

- W-2 Forms - These forms report your annual wages and the taxes withheld by your employer.

- Records of Earned Income - Include pay stubs or other proof of income if you do not receive a W-2 form.

- Multiple Employers - Collect W-2 forms from each employer you worked for during the tax year to ensure complete income reporting.

Having these documents ready streamlines your FAFSA application and helps determine your eligibility for financial aid.

Records of Untaxed Income and Benefits

To apply for FAFSA, gathering accurate records of untaxed income is essential for a complete financial profile. Untaxed income examples include child support received, workers' compensation, and veterans noneducation benefits.

You must also provide documentation of benefits such as Temporary Assistance for Needy Families (TANF) and Supplemental Security Income (SSI). These records ensure the FAFSA accurately reflects your financial situation for aid eligibility.

Bank Statements and Financial Asset Information

When applying for FAFSA, bank statements are essential to verify your available cash and checking or savings account balances. Accurate financial asset information, including stocks, bonds, and other investments, must be reported to assess your family's ability to contribute to education costs. These documents ensure that the FAFSA application reflects a true picture of your financial situation, influencing your eligibility for federal student aid.

Dependency Status: Additional Paperwork for Dependent Students

What documents are needed to apply for FAFSA if you are a dependent student? Your dependency status requires additional paperwork beyond the basic FAFSA form. This includes your parents' financial information and tax returns to accurately determine your eligibility for federal aid.

What Documents are Needed to Apply for FAFSA? Infographic