Applicants must submit proof of income, student loan statements, and documentation of qualifying employment or service to apply for student loan forgiveness. Additionally, identification documents such as a government-issued ID and Social Security number are typically required to verify eligibility. Accurate completion of the application form and any supporting affidavits or certifications related to the forgiveness program are essential for processing.

What Documents Are Required for Student Loan Forgiveness Application?

| Number | Name | Description |

|---|---|---|

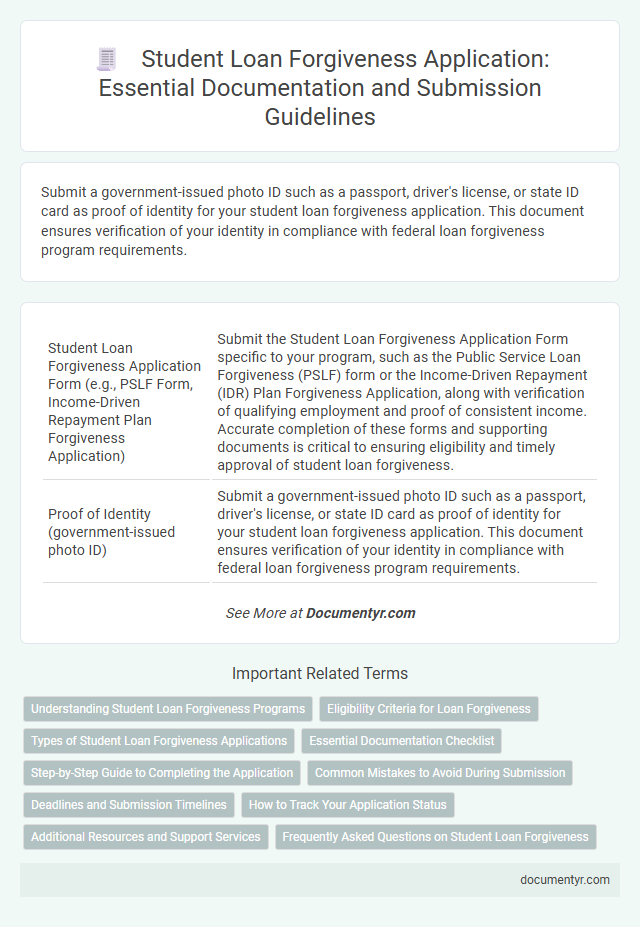

| 1 | Student Loan Forgiveness Application Form (e.g., PSLF Form, Income-Driven Repayment Plan Forgiveness Application) | Submit the Student Loan Forgiveness Application Form specific to your program, such as the Public Service Loan Forgiveness (PSLF) form or the Income-Driven Repayment (IDR) Plan Forgiveness Application, along with verification of qualifying employment and proof of consistent income. Accurate completion of these forms and supporting documents is critical to ensuring eligibility and timely approval of student loan forgiveness. |

| 2 | Proof of Identity (government-issued photo ID) | Submit a government-issued photo ID such as a passport, driver's license, or state ID card as proof of identity for your student loan forgiveness application. This document ensures verification of your identity in compliance with federal loan forgiveness program requirements. |

| 3 | Social Security Number (SSN) | Providing a valid Social Security Number (SSN) is a crucial requirement for student loan forgiveness applications, as it enables accurate identification and verification of the borrower's eligibility. The SSN must match the one on file with the loan servicer to ensure seamless processing and prevent delays in approval. |

| 4 | Loan Statements or Account Summary | Loan statements or account summaries are critical documents for student loan forgiveness applications as they provide detailed information on loan balances, payment history, and loan servicer details. Accurate and up-to-date statements help verify eligibility and ensure the forgiveness program processes the application efficiently. |

| 5 | Employer Certification Form (for PSLF) | The Employer Certification Form is a crucial document for the Public Service Loan Forgiveness (PSLF) application, verifying employment with a qualifying public service organization during periods of loan repayment. Accurate completion and timely submission of this form to the U.S. Department of Education ensure that each qualifying payment is properly credited toward the forgiveness requirements. |

| 6 | Employment Certification (letters or records) | Employment certification for student loan forgiveness applications typically requires letters from current and former employers verifying job titles, dates of employment, and confirmation of full-time or qualifying part-time status. These documents must include employer contact information and be dated within the required timeframe to substantiate eligibility under programs like Public Service Loan Forgiveness (PSLF) or teacher loan forgiveness. |

| 7 | Proof of Qualifying Payments (payment history, bank statements) | Proof of qualifying payments for student loan forgiveness applications includes detailed payment history records from loan servicers, showing consistent, on-time payments over the required period, as well as supporting bank statements that verify these transactions. Accurate documentation must demonstrate the amount, date, and frequency of payments to meet the eligibility criteria for forgiveness programs such as Public Service Loan Forgiveness (PSLF) or Income-Driven Repayment (IDR) plan forgiveness. |

| 8 | Tax Returns or IRS Tax Transcripts | Tax returns or IRS tax transcripts are essential documents required for student loan forgiveness applications, verifying income and tax filing status. Providing accurate, up-to-date tax transcripts ensures eligibility and proper assessment of financial information by loan servicers or forgiveness programs. |

| 9 | Income Documentation (pay stubs, W-2s, 1099s) | Income documentation required for student loan forgiveness applications typically includes recent pay stubs, W-2 forms, and 1099 tax documents to verify employment and income levels. Accurate and up-to-date income records are essential to determine eligibility and calculate the correct loan forgiveness amount. |

| 10 | FAFSA Confirmation (if applicable) | Submitting a FAFSA confirmation is crucial for student loan forgiveness applications as it verifies your financial aid eligibility and income information. This document validates your enrollment status and ensures accurate assessment for income-driven repayment plans or forgiveness programs. |

| 11 | Proof of Loan Type (Direct Loan, FFEL, Perkins Loan documentation) | To apply for student loan forgiveness, applicants must submit official documentation verifying their loan type, such as Direct Loan records from the Department of Education, FFEL (Federal Family Education Loan) Program statements, or Perkins Loan agreements. Ensuring accurate proof of loan classification is crucial for determining eligibility and processing the forgiveness application efficiently. |

| 12 | Discharge Application (for Total & Permanent Disability, Death, or Closed School) | Submit the completed discharge application form along with official documentation such as a Total and Permanent Disability (TPD) certification from the Department of Veterans Affairs, the Social Security Administration, or a physician, a death certificate for borrower death discharge, or proof of school closure from the U.S. Department of Education for closed school discharge. Supporting documents must verify eligibility for loan forgiveness under the Total & Permanent Disability, Death, or Closed School criteria to ensure proper processing of the student loan forgiveness application. |

| 13 | Disability Documentation (if applying for Total & Permanent Disability Discharge) | Disability documentation for Total & Permanent Disability Discharge requires a physician's certification confirming the borrower's inability to engage in substantial gainful activity due to a medically determinable physical or mental impairment expected to last at least 60 months or result in death. Supporting medical records and long-term disability insurance documentation may also be necessary to validate the discharge application. |

| 14 | School Closure Documentation (for Closed School Discharge) | School closure documentation required for student loan forgiveness applications typically includes an official letter from the U.S. Department of Education or the school itself confirming the closure date and the student's enrollment status at that time. This documentation must verify that the borrower was enrolled when the school ceased operations to qualify for Closed School Discharge under federal student loan forgiveness programs. |

| 15 | Borrower Defense Application (if claiming fraud/misrepresentation by school) | Submit the Borrower Defense application along with detailed evidence of fraud or misrepresentation by the school, including enrollment agreements, correspondence, and financial documents. Supporting materials such as loan statements, proof of payments, and any communications indicating misleading practices are crucial for processing loan forgiveness claims. |

| 16 | Marriage or Name Change Certificate (if applicable) | For student loan forgiveness applications, submitting a marriage certificate or a legal name change document is essential when your current name differs from the one on your loan records. These documents verify identity and ensure accurate processing of your forgiveness request under updated personal information. |

| 17 | Proof of Military Service (for Military Forgiveness programs) | Proof of military service for student loan forgiveness applications typically requires official documentation such as the DD Form 214 (Certificate of Release or Discharge from Active Duty) or a Statement of Service from the military branch. Veterans may also submit VA Service Records or military personnel records to verify eligibility for military forgiveness programs under federal student loan policies. |

| 18 | Certification of Teaching Service (for Teacher Loan Forgiveness) | The Certification of Teaching Service is a crucial document for teacher loan forgiveness applications, verifying eligible employment under approved programs. This form must be completed by the school's administration to confirm the applicant's qualifying teaching service duration and subject areas. |

| 19 | Other Supporting Documentation (as requested by servicer/program) | Other supporting documentation for student loan forgiveness applications may include proof of employment in qualifying public service roles, income verification documents, and certification of full-time enrollment or repayment status, as specifically requested by the loan servicer or forgiveness program. Accurate submission of these materials ensures eligibility verification and expedites the forgiveness process. |

Understanding Student Loan Forgiveness Programs

What documents are required for a student loan forgiveness application? You need to gather proof of loan type, employer certification forms, and income documentation. These materials verify eligibility and ensure your application meets program requirements.

Eligibility Criteria for Loan Forgiveness

Eligibility criteria for student loan forgiveness require applicants to submit specific documents verifying their identity, income, and employment status. Key documents include a government-issued ID, recent pay stubs or tax returns, and proof of qualifying employment such as certification from an employer. Meeting these documentation requirements ensures the borrower qualifies for federal loan forgiveness programs like Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness.

Types of Student Loan Forgiveness Applications

Student loan forgiveness applications vary based on the specific program selected, such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. Each program demands distinct documentation to verify eligibility and loan status.

Commonly required documents include proof of employment, such as pay stubs or employer certification forms, and loan statements showing outstanding balances. Applicants must also submit tax returns or income documentation depending on the forgiveness program's criteria.

Essential Documentation Checklist

Applying for student loan forgiveness requires submitting specific documents to verify eligibility and loan details. Proper preparation of these documents ensures a smoother application process.

- Proof of Employment - Documentation from your employer confirming employment duration and type, essential for programs like Public Service Loan Forgiveness.

- Loan Statements - Recent statements from your loan servicer detailing balances and payment history to verify loan status.

- Income Verification - Tax returns or pay stubs to demonstrate income eligibility for income-driven repayment forgiveness plans.

Step-by-Step Guide to Completing the Application

Applying for student loan forgiveness requires submitting specific documents to verify eligibility and employment history. Proper preparation of these documents ensures a smoother application process.

- Gather Proof of Employment - Collect recent pay stubs, employment certification forms, or employer letters confirming qualifying work in education.

- Obtain Your Loan Information - Compile statements or account summaries from loan servicers detailing outstanding balances and repayment history.

- Complete the Application Form - Fill out the official student loan forgiveness application, ensuring all required information is accurate and complete.

Common Mistakes to Avoid During Submission

Applying for student loan forgiveness requires submitting key documents such as proof of employment, loan statements, and income verification. Common mistakes include missing signatures, outdated information, and incomplete forms, which can delay processing. Ensure all documents are accurate, up-to-date, and fully signed before submission to avoid unnecessary rejections.

Deadlines and Submission Timelines

Applying for student loan forgiveness requires specific documents to ensure eligibility and timely processing. Meeting all deadlines is crucial to avoid application delays or denials.

- Proof of Employment - Documentation such as pay stubs or employer certification verifying qualifying employment periods is essential.

- Loan Account Information - Accurate loan statements and account numbers must be submitted to confirm the loans eligible for forgiveness.

- Completed Application Form - The official forgiveness application form must be filled out correctly and submitted before the deadline.

You should submit all materials according to the outlined timelines to guarantee your application is considered on time.

How to Track Your Application Status

To apply for student loan forgiveness, you need to submit essential documents such as your loan statements, proof of income, and employment certification. These documents verify your eligibility and support your application.

Tracking your application status is easy through the loan servicer's online portal, where updates are posted regularly. You can also contact customer service via phone or email for status inquiries. Keeping your contact information up to date ensures you receive timely notifications throughout the review process.

Additional Resources and Support Services

| Required Documents for Student Loan Forgiveness Application |

|---|

|

| Additional Resources |

|

| Support Services |

|

What Documents Are Required for Student Loan Forgiveness Application? Infographic