To complete a FAFSA application, you must gather key documents such as your Social Security number, federal income tax returns, W-2 forms, and records of any untaxed income. Students and parents may also need to provide bank statements, investment records, and proof of U.S. citizenship or eligible noncitizen status. Ensuring all required documents are accurate and up-to-date helps streamline the financial aid process.

What Documents Are Necessary for FAFSA (Financial Aid) Application?

| Number | Name | Description |

|---|---|---|

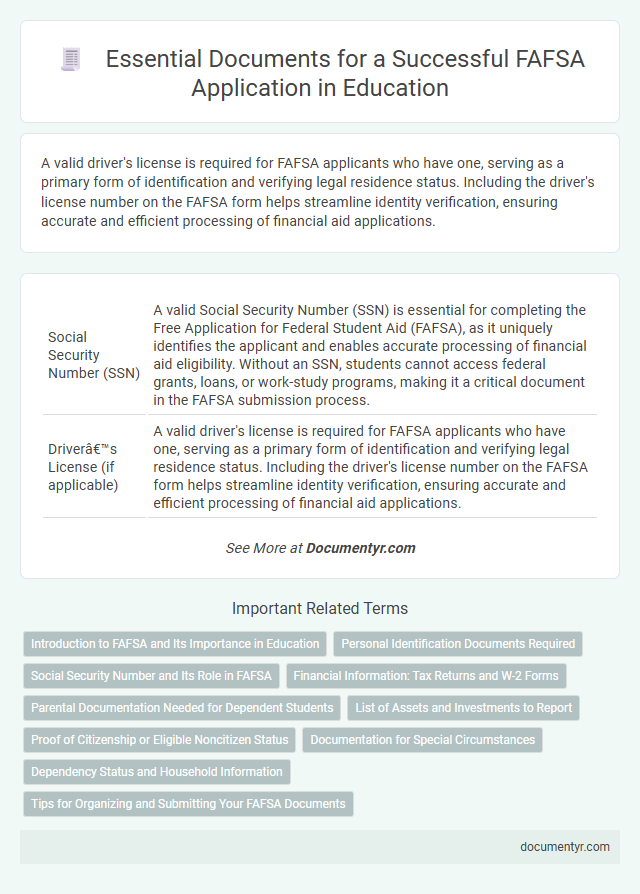

| 1 | Social Security Number (SSN) | A valid Social Security Number (SSN) is essential for completing the Free Application for Federal Student Aid (FAFSA), as it uniquely identifies the applicant and enables accurate processing of financial aid eligibility. Without an SSN, students cannot access federal grants, loans, or work-study programs, making it a critical document in the FAFSA submission process. |

| 2 | Driver’s License (if applicable) | A valid driver's license is required for FAFSA applicants who have one, serving as a primary form of identification and verifying legal residence status. Including the driver's license number on the FAFSA form helps streamline identity verification, ensuring accurate and efficient processing of financial aid applications. |

| 3 | Alien Registration Number (for non-U.S. citizens) | Non-U.S. citizens applying for FAFSA must provide their Alien Registration Number (ARN) to verify legal residency status and eligibility for federal student aid. This number, issued by the Department of Homeland Security, is crucial for completing the FAFSA accurately and securing financial aid opportunities. |

| 4 | Federal Income Tax Returns (IRS Form 1040) | Federal Income Tax Returns (IRS Form 1040) are essential documents for the FAFSA application, providing accurate income information required to determine eligibility for federal student aid. Having the completed IRS Form 1040 on hand ensures precise reporting of taxable income, deductions, and credits needed to calculate the Expected Family Contribution (EFC). |

| 5 | W-2 Forms (wage and income statements) | W-2 forms, which provide detailed wage and income information from employers, are essential for accurately completing the FAFSA application and verifying a student's or parent's earnings. These documents ensure the financial aid office can assess income eligibility and determine appropriate federal student aid amounts. |

| 6 | Records of Untaxed Income (child support, welfare benefits, etc.) | Records of untaxed income, such as child support received, welfare benefits, and veteran noneducation benefits, are necessary for the FAFSA application to accurately assess a student's financial need. Providing official statements or documentation verifying these amounts ensures the financial aid office can correctly calculate the Expected Family Contribution (EFC). |

| 7 | Bank Statements | Bank statements are essential for the FAFSA application as they provide a clear record of your family's current financial assets, which are crucial for determining your Expected Family Contribution (EFC). These documents must show accurate balances and recent transactions to ensure the financial aid office can assess your eligibility for federal student aid accurately. |

| 8 | Investment Records (stocks, bonds, real estate, etc.) | Investment records such as stocks, bonds, and real estate documentation must be thoroughly compiled when applying for FAFSA to accurately report the asset values and potential income. Precise details from brokerage statements, real estate appraisals, and dividend or interest earnings statements are essential for a comprehensive financial assessment. |

| 9 | Records of Assets (savings, checking, and investments) | Records of assets including savings account statements, checking account balances, and investment portfolios such as stocks, bonds, and mutual funds are essential for completing the FAFSA application accurately. These financial documents help determine the Expected Family Contribution (EFC), which directly affects eligibility for federal student aid and grants. |

| 10 | Parent’s Financial Records (if dependent) | Parents of dependent students must provide recent tax returns, W-2 forms, and records of untaxed income when completing the FAFSA application to accurately report their financial status. Other essential documents include bank statements, records of investments, and information on any assets to determine eligibility for federal student aid. |

| 11 | FSA ID (for electronic signature) | The FSA ID is essential for electronically signing the FAFSA application, serving as the unique identifier for students and parents to access and submit financial aid documents securely. Creating an FSA ID requires valid personal information, including a Social Security number, email address, and date of birth, which must match those on the FAFSA form. |

| 12 | Records of Other Financial Resources (529 plans, trusts, etc.) | Records of other financial resources such as 529 college savings plans, trusts, and custodial accounts must be reported on the FAFSA application to accurately determine eligibility for federal financial aid. These documents provide key information about assets and income that affect the Expected Family Contribution (EFC) and the overall financial aid package. |

Introduction to FAFSA and Its Importance in Education

| Introduction to FAFSA and Its Importance in Education | |

|---|---|

| FAFSA | The Free Application for Federal Student Aid (FAFSA) is a critical tool for students seeking financial assistance to fund their higher education. It determines eligibility for federal grants, loans, and work-study programs. |

| Purpose | FAFSA helps families understand their financial situation and identifies available education funding options, making college more affordable and accessible. |

| Essential Documents for FAFSA Application | |

| Social Security Number | Valid Social Security Number (SSN) or Alien Registration Number for eligible non-citizens. |

| Federal Income Tax Returns | Most recent federal income tax returns, including IRS Form 1040, W-2s, and other records of money earned. |

| Bank Statements | Current bank statements or records of cash, savings, and checking account balances. |

| Investment Records | Documentation of business and investment farm net worth, if applicable. |

| Proof of Citizenship | U.S. birth certificate or valid passport to prove citizenship or eligible noncitizen status. |

| Driver's License | Optional but useful for identity verification during application. |

| Records of Untaxed Income | Include child support, veterans' benefits, or worker's compensation information if relevant. |

| Parent Information | For dependent students, parents' financial information is required, including their tax returns and income details. |

| Significance | |

| Access to Financial Aid | Submitting an accurate FAFSA with the necessary documentation maximizes chances for federal, state, and institutional financial aid. |

| Education Affordability | FAFSA reduces the financial burden on students by unlocking grants and subsidized loans. |

| Future Planning | Helps students and families plan for educational expenses efficiently by understanding estimated aid and out-of-pocket costs. |

Personal Identification Documents Required

What personal identification documents are required for a FAFSA application? FAFSA applicants must provide proof of identity to verify their eligibility. Common documents include a valid Social Security card and a government-issued photo ID such as a driver's license or passport.

Social Security Number and Its Role in FAFSA

The Social Security Number (SSN) is a crucial document required for the FAFSA (Free Application for Federal Student Aid) application. It serves as a unique identifier to verify an applicant's identity and eligibility for federal student aid programs.

Applicants must provide a valid SSN to ensure accurate processing of their FAFSA form and avoid delays in financial aid disbursement. The SSN also enables the Department of Education to cross-check data and confirm citizenship or eligible noncitizen status.

Financial Information: Tax Returns and W-2 Forms

Accurate financial information is critical when completing the FAFSA application to determine eligibility for federal student aid. Key documents include tax returns and W-2 forms, which provide verified income details required for the application process.

- Federal Tax Returns - Submit the most recent IRS tax return transcript or copies of your tax return forms to report all taxable income.

- W-2 Forms - Include all W-2 wage statements from employers to document earned income and withholdings.

- Parental Tax Information - For dependent students, parents must also provide their most recent tax return and income documents to complete the FAFSA accurately.

Parental Documentation Needed for Dependent Students

Applying for FAFSA requires specific parental documentation for dependent students to verify financial and family information. Parents must prepare several essential documents to ensure accurate submission and eligibility assessment.

- Parental Income Tax Returns - Copies of federal tax returns, including W-2 forms, are necessary to report parents' income accurately.

- Social Security Numbers - Parents must provide their Social Security numbers to validate identity and link financial information.

- Records of Untaxed Income - Documentation of untaxed income, such as child support or veterans' benefits, must be included for a complete financial profile.

Gathering these documents early streamlines the FAFSA application process and improves the chances of receiving financial aid.

List of Assets and Investments to Report

When completing the FAFSA application, it is essential to report specific assets and investments accurately. These financial details help determine eligibility for federal student aid.

The list of assets to report includes cash, savings, and checking account balances, as well as investment accounts like stocks, bonds, mutual funds, and real estate (excluding your primary residence). Also include any business and farm assets if applicable. Accurate reporting of these items ensures the financial aid office has a clear picture of your financial situation.

Proof of Citizenship or Eligible Noncitizen Status

For the FAFSA application, providing proof of citizenship or eligible noncitizen status is essential to qualify for federal financial aid. This documentation verifies your eligibility and ensures your application is processed correctly.

- U.S. Passport - A valid U.S. passport serves as official proof of citizenship for FAFSA submission.

- Birth Certificate - A certified birth certificate confirms U.S. citizenship status required for financial aid eligibility.

- Permanent Resident Card - This card verifies eligible noncitizen status needed to access federal student aid programs.

Documentation for Special Circumstances

Documentation for special circumstances is crucial when applying for FAFSA to accurately reflect your financial situation. Common documents include letters from employers, medical bills, divorce decrees, and proof of unusual expenses. These records help ensure your FAFSA application is evaluated fairly and increases eligibility for financial aid.

Dependency Status and Household Information

To complete the FAFSA application, students must provide documents verifying their dependency status, such as birth certificates, marriage certificates, or court orders if applicable. Household information requires current tax returns, W-2 forms, and records of untaxed income for the student and their parents or guardians. Accurate documentation ensures eligibility for federal financial aid programs based on financial need and family circumstances.

What Documents Are Necessary for FAFSA (Financial Aid) Application? Infographic