Student loan applications typically require proof of identity, such as a government-issued ID or Social Security number, and evidence of enrollment in an accredited educational institution. Applicants must also provide financial information, including income statements, tax returns, and details about any existing debts or assets. Supporting documents like a credit report and loan acceptance forms from the school may further streamline the approval process.

What Documents Are Necessary for Student Loan Applications?

| Number | Name | Description |

|---|---|---|

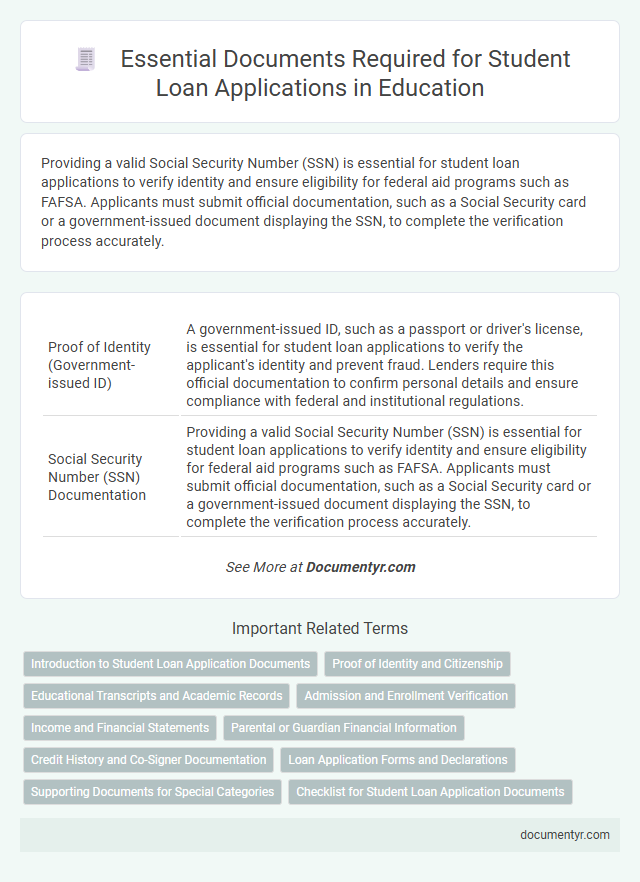

| 1 | Proof of Identity (Government-issued ID) | A government-issued ID, such as a passport or driver's license, is essential for student loan applications to verify the applicant's identity and prevent fraud. Lenders require this official documentation to confirm personal details and ensure compliance with federal and institutional regulations. |

| 2 | Social Security Number (SSN) Documentation | Providing a valid Social Security Number (SSN) is essential for student loan applications to verify identity and ensure eligibility for federal aid programs such as FAFSA. Applicants must submit official documentation, such as a Social Security card or a government-issued document displaying the SSN, to complete the verification process accurately. |

| 3 | Proof of Citizenship or Eligible Noncitizen Status | Proof of citizenship or eligible noncitizen status is required for student loan applications, typically demonstrated through a valid U.S. passport, birth certificate, or permanent resident card (Green Card). Other acceptable documents include a Certificate of Naturalization or a valid Employment Authorization Document (EAD) confirming lawful status in the United States. |

| 4 | Federal Student Aid (FAFSA) Form | Submitting the Free Application for Federal Student Aid (FAFSA) requires essential documents such as the applicant's Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Additionally, students may need their driver's license, alien registration number (if not a U.S. citizen), and bank statements to ensure accurate financial information for federal student aid eligibility. |

| 5 | Income Tax Returns (Student/Parent) | Income tax returns for both the student and parent provide essential verification of income, required to accurately assess financial need for student loan applications. These documents typically include Form 1040, W-2s, and any additional schedules detailing income sources, ensuring eligibility and precise loan amount determination. |

| 6 | W-2 Forms (Student/Parent) | W-2 forms from both the student and parents are essential documents for student loan applications, providing verified income information used to assess financial need and eligibility. Lenders rely on these forms to accurately calculate expected family contributions and determine loan amounts. |

| 7 | Bank Statements | Bank statements are crucial for student loan applications as they verify the applicant's financial stability and ability to make repayments. Lenders typically require recent statements, usually from the past three months, to assess income consistency and existing financial obligations. |

| 8 | Records of Untaxed Income | Records of untaxed income, such as child support received, veterans' noneducation benefits, and housing or food allowances for military personnel, are essential for accurate student loan applications. These documents help determine the borrower's financial need and eligibility by providing a complete picture of income sources not reported on tax returns. |

| 9 | Proof of Enrollment or Admission Letter | Proof of enrollment or an admission letter serves as a critical document for student loan applications, validating the applicant's current or upcoming attendance at an accredited educational institution. Lenders depend on these documents to verify eligibility and determine loan disbursement, making timely submission essential for processing student loan requests. |

| 10 | High School Diploma or GED Certificate | A high school diploma or GED certificate is essential for student loan applications as it verifies the borrower's completion of secondary education, meeting the basic eligibility criteria set by lenders and federal aid programs. Lenders require these documents to confirm academic qualification, ensuring applicants have the foundational education necessary for pursuing higher education and repaying the loan. |

| 11 | Academic Transcripts | Academic transcripts are essential for student loan applications as they provide verified proof of enrollment, course completion, and academic performance, which lenders use to assess eligibility and risk. Submitting official transcripts from accredited institutions ensures the accuracy of educational credentials required for loan approval processes. |

| 12 | List of Selected Colleges or Universities | Student loan applications for selected colleges or universities typically require proof of admission, government-issued identification, and financial documents such as tax returns or income statements. Additionally, applicants must provide the school's official cost of attendance details and enrollment verification to complete the loan process. |

| 13 | Loan History Documentation (if applicable) | Loan history documentation for student loan applications includes previous loan statements, repayment records, and any correspondence with lenders, which help verify existing debt and payment status. Providing accurate loan history ensures proper assessment of eligibility and loan limits by financial institutions or government agencies. |

| 14 | Selective Service Registration (for male applicants) | Male applicants must provide proof of Selective Service registration when applying for federal student loans, as it is a mandatory requirement to demonstrate eligibility. Failure to register with the Selective Service System can result in the denial of federal financial aid, making it essential to submit this documentation along with other application materials. |

| 15 | Asset Records (investments, savings) | Student loan applications require detailed asset records, including documentation of investments, savings accounts, and other financial holdings to assess the applicant's financial status. Providing bank statements, investment portfolio summaries, and proof of savings ensures accurate evaluation of the student's ability to repay the loan. |

| 16 | Proof of Residency (address verification) | Proof of residency for student loan applications typically requires documents such as a recent utility bill, lease agreement, or government-issued identification displaying the applicant's current address. These documents verify the student's place of residence, ensuring loan eligibility aligns with state-specific funding requirements. |

| 17 | Parental Information (for dependent students) | Parental information required for student loan applications typically includes recent tax returns, proof of income such as W-2 forms, and Social Security numbers to verify dependency status. Lenders may also request documentation of parental residency and identification to ensure accurate financial assessment for dependent students. |

| 18 | Credit Report/History (for private loans) | For private student loan applications, lenders require a detailed credit report or credit history to assess the borrower's financial reliability and risk profile. This report includes credit scores, payment history, outstanding debts, and any past defaults, critically influencing loan approval and interest rates. |

| 19 | Cosigner Information (if required for private loans) | Private student loan applications often require cosigner information, including the cosigner's full name, Social Security number, proof of income, credit history, and government-issued identification. Lenders use these details to assess the cosigner's creditworthiness and ability to repay the loan, which can significantly impact loan approval and interest rates. |

| 20 | Proof of Disability (for specific loan programs) | Proof of disability is a critical document for student loan applications under specific federal and state loan programs designed to provide financial assistance to students with disabilities. This proof typically includes a recent official medical certification, documentation from a licensed healthcare provider, or a Social Security Disability Insurance (SSDI) award letter, which verifies the applicant's eligibility for disability-related loan benefits. |

Introduction to Student Loan Application Documents

What documents are necessary for student loan applications? Gathering the correct paperwork is crucial to ensure a smooth application process. Your student loan application typically requires identification, proof of income, and enrollment verification documents.

Proof of Identity and Citizenship

Proof of identity is a fundamental requirement when applying for a student loan, ensuring that the applicant is accurately verified. Valid documents include a government-issued photo ID such as a passport or driver's license. Citizenship verification often involves providing a birth certificate, naturalization papers, or a permanent resident card as essential evidence for eligibility.

Educational Transcripts and Academic Records

Educational transcripts and academic records are essential documents required for student loan applications. These documents verify the applicant's enrollment status and academic progress.

- Educational Transcripts - Official transcripts provide a detailed record of all courses completed and grades earned by the student.

- Academic Records - These include standardized test scores, diplomas, and certificates necessary to confirm eligibility for the loan.

- Verification of Enrollment - Lenders require proof of current enrollment to ensure the loan funds support active education.

Submitting accurate and up-to-date educational documents helps streamline the student loan approval process.

Admission and Enrollment Verification

Admission and enrollment verification are crucial documents required for student loan applications. These documents confirm your acceptance and current enrollment status at an accredited educational institution. Lenders use this information to ensure loan eligibility and disbursement timelines align with your academic schedule.

Income and Financial Statements

Income verification plays a crucial role in student loan applications, requiring recent pay stubs, tax returns, or W-2 forms to demonstrate financial stability. Lenders assess your income to determine repayment ability and loan eligibility.

Financial statements such as bank statements and asset documentation provide a comprehensive view of your economic situation. These documents help verify your financial resources and ensure accurate loan processing.

Parental or Guardian Financial Information

Student loan applications often require detailed financial information from parents or guardians to assess eligibility and repayment capacity. This includes tax returns, proof of income, and documentation of assets.

Providing accurate parental or guardian financial information ensures a smoother application process and may influence loan terms or approval. Lenders use these documents to verify the borrower's financial background and ability to repay the loan.

Credit History and Co-Signer Documentation

Preparing a student loan application requires specific documentation to verify credit history and co-signer information. Lenders demand thorough evidence to assess financial responsibility and repayment ability.

- Credit History Report - A recent credit report from major credit bureaus demonstrates the applicant's creditworthiness and past loan repayment behavior.

- Co-Signer Identification - Valid identification documents, such as a government-issued ID or passport, confirm the co-signer's identity and eligibility.

- Co-Signer Credit Documentation - The co-signer must provide credit history and income verification to support the loan application and reduce lending risk.

Loan Application Forms and Declarations

Loan application forms are essential documents required to initiate the student loan process. These forms collect personal information, financial details, and educational plans necessary for lenders to assess eligibility.

Declarations in the loan application confirm the accuracy of the provided information and consent to terms and conditions. You must review and sign these declarations to validate your application. Properly completed forms and signed declarations streamline the approval process and reduce delays.

Supporting Documents for Special Categories

Submitting the correct supporting documents is crucial for student loan applications, especially when you belong to special categories. These documents help verify eligibility and ensure proper processing of your loan.

- Proof of Disability - Documentation such as a medical certificate or disability identification card is required to confirm your status if you have a physical or mental disability.

- Veteran Status Verification - A military discharge paper (DD214) or veteran ID card must be provided to support applications related to veteran benefits.

- Dependent Care Documentation - Legal custody papers or proof of dependents are necessary to validate claims for dependent care expenses within the loan application.

What Documents Are Necessary for Student Loan Applications? Infographic