To successfully submit the Free Application for Federal Student Aid (FAFSA), students typically need their Social Security number, federal income tax returns, W-2 forms, and other records of income. Parental financial information is also required for dependent students. Having a valid FSA ID for both the student and parent streamlines the application process and ensures accurate submission.

What Documents Are Required for FAFSA Submission?

| Number | Name | Description |

|---|---|---|

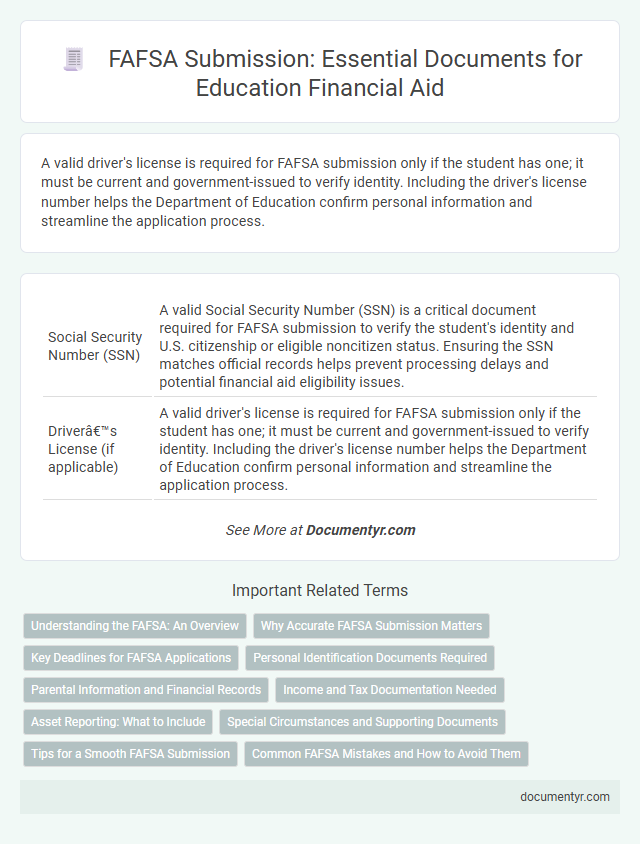

| 1 | Social Security Number (SSN) | A valid Social Security Number (SSN) is a critical document required for FAFSA submission to verify the student's identity and U.S. citizenship or eligible noncitizen status. Ensuring the SSN matches official records helps prevent processing delays and potential financial aid eligibility issues. |

| 2 | Driver’s License (if applicable) | A valid driver's license is required for FAFSA submission only if the student has one; it must be current and government-issued to verify identity. Including the driver's license number helps the Department of Education confirm personal information and streamline the application process. |

| 3 | Alien Registration Number (for non-U.S. citizens) | Non-U.S. citizens applying for FAFSA must provide their Alien Registration Number (ARN) to verify their eligibility for federal student aid; this number is found on permanent resident cards or other immigration documents. Accurate submission of the ARN ensures proper processing of financial aid applications for eligible non-U.S. citizens. |

| 4 | Federal Income Tax Returns (Form 1040) | Federal Income Tax Returns (Form 1040) are essential documents for FAFSA submission, providing critical income information used to determine financial aid eligibility. Accurate completion and timely submission of the Form 1040 ensure proper assessment of household income, directly impacting federal student aid calculations. |

| 5 | W-2 Forms | W-2 forms are essential for FAFSA submission as they provide detailed income information from employers, ensuring accurate financial data reporting. Students and parents must collect all W-2 forms from the previous tax year to complete the FAFSA application properly and verify earnings. |

| 6 | Records of Untaxed Income | Records of untaxed income required for FAFSA submission include Social Security benefits, child support received, and workers' compensation. Accurate documentation of these amounts ensures correct calculation of the Expected Family Contribution (EFC) for federal student aid eligibility. |

| 7 | Bank Statements | Bank statements are essential for FAFSA submission as they provide proof of your current financial status, reflecting cash, savings, and checking account balances. Accurate bank statements help ensure the Expected Family Contribution (EFC) calculation is based on up-to-date financial data, directly impacting financial aid eligibility. |

| 8 | Investment Records | Investment records required for FAFSA submission include recent statements from brokerage accounts, mutual funds, and real estate investments detailing current balances and annual income. Accurate documentation of dividends, interest income, and capital gains from these investments is essential to ensure precise calculation of the Expected Family Contribution (EFC). |

| 9 | Records of Assets | FAFSA submission requires detailed records of assets including current bank statements, investment account statements, and records of real estate or business ownership excluding the primary residence. Accurate documentation of these assets is crucial for determining the Expected Family Contribution (EFC) and eligibility for financial aid. |

| 10 | FSA ID (Federal Student Aid Identification) | The FSA ID, comprised of a username and password, is essential for FAFSA submission as it serves as the unique identifier for both students and parents, granting access to federal student aid websites. Creating an FSA ID requires a valid email address and answers to security questions, ensuring secure access to and electronic signing of the FAFSA form. |

| 11 | Parent’s Income Tax Information (for dependent students) | For FAFSA submission, dependent students must include their parent's recent IRS tax transcripts or signed tax returns to verify income. This documentation ensures accurate calculation of the Expected Family Contribution (EFC) for federal financial aid eligibility. |

| 12 | Records of Child Support Received or Paid | Records of child support received or paid must be provided when submitting the FAFSA to accurately report untaxed income. These documents help determine the applicant's financial need and eligibility for federal student aid. |

| 13 | Records of Public Assistance (e.g., TANF, SNAP) | Records of public assistance such as Temporary Assistance for Needy Families (TANF) and Supplemental Nutrition Assistance Program (SNAP) benefits documentation are required for FAFSA submission to verify financial aid eligibility. Providing accurate records of these public assistance programs helps determine the Expected Family Contribution (EFC) and ensures proper grant or aid allocation. |

| 14 | Documentation of High School Completion or GED Certificate | To complete the FAFSA submission, applicants must provide documentation verifying high school completion, such as a high school diploma or an official transcript showing graduation date. Alternatively, a GED certificate or a state-recognized equivalent credential is required to confirm completion of secondary education. |

Understanding the FAFSA: An Overview

Completing the Free Application for Federal Student Aid (FAFSA) requires several essential documents to ensure accurate financial information submission. Understanding what is needed helps streamline the application process and maximize potential aid.

- Social Security Number - This unique identifier is required to verify your identity and access federal aid records.

- Federal Income Tax Returns - Copies of your and your parents' or spouse's tax returns provide income details necessary for aid calculations.

- Proof of U.S. Citizenship or Eligible Noncitizen Status - Documents such as a U.S. passport or permanent resident card confirm eligibility for federal assistance.

Why Accurate FAFSA Submission Matters

Submitting the Free Application for Federal Student Aid (FAFSA) requires specific documents to ensure an accurate and complete application. Accurate FAFSA submission directly influences the financial aid eligibility and the amount of aid a student can receive.

- Social Security Number - Essential for identity verification and processing federal aid.

- Federal Income Tax Returns - Used to report income information for both the student and parents or spouse.

- Bank Statements and Investment Records - Provide proof of assets and financial resources relevant to aid assessment.

Submitting FAFSA with precise documentation maximizes financial aid opportunities and prevents delays in funding allocation.

Key Deadlines for FAFSA Applications

| Required Documents for FAFSA Submission |

Social Security Number (SSN) or Alien Registration Number for eligible non-citizens Federal income tax returns, W-2s, and other records of money earned Bank statements and records of investments (if applicable) Records of untaxed income (e.g., child support received, interest income) FSA ID to electronically sign the FAFSA form |

|---|---|

| Key Deadlines for FAFSA Applications |

FAFSA opens annually on October 1 Federal deadline usually June 30 of the academic year State-specific deadlines vary; many fall between January and March Institutional deadlines for colleges are often earlier than federal or state deadlines Submit FAFSA as early as possible to maximize financial aid opportunities |

Personal Identification Documents Required

When submitting the Free Application for Federal Student Aid (FAFSA), personal identification documents are essential to verify the applicant's identity. These documents help ensure the accuracy and security of the financial aid process.

Applicants must provide a valid Social Security number (SSN) or Alien Registration Number if applicable. A driver's license or state-issued ID card is often required to confirm identity. Additionally, an email address is necessary for communication and electronic submissions.

Parental Information and Financial Records

For FAFSA submission, accurate parental information is essential, including Social Security numbers, dates of birth, and marital status details. Financial records such as recent tax returns, W-2 forms, and records of untaxed income must be gathered for both the student and parents. These documents ensure proper calculation of the Expected Family Contribution (EFC), which determines federal aid eligibility.

Income and Tax Documentation Needed

When submitting the Free Application for Federal Student Aid (FAFSA), accurate income and tax documentation is essential to ensure proper financial aid assessment. Key documents include federal income tax returns, W-2 forms, and records of untaxed income for the student and parents or spouse.

Federal tax returns from the IRS for the most recent tax year provide the primary source of income verification. Additional documents like Social Security benefits statements, child support received, and records of other taxable and nontaxable income are often required to complete the FAFSA accurately.

Asset Reporting: What to Include

When submitting the FAFSA, accurate asset reporting is crucial for determining financial aid eligibility. Your assets should include savings accounts, checking accounts, investments such as stocks and bonds, and real estate holdings excluding your primary residence. Business and farm assets must also be reported if they exceed specific value thresholds set by the FAFSA guidelines.

Special Circumstances and Supporting Documents

Submitting the FAFSA requires specific documents to verify your financial and personal information. Special circumstances may need additional supporting documents to accurately reflect your situation.

- Proof of Income - Recent tax returns or W-2 forms are essential to report accurate income details.

- Documentation for Special Circumstances - Letters from employers, social workers, or medical professionals can substantiate unique financial situations like job loss or medical expenses.

- Verification of Household Size - Official records such as birth certificates or court documents help confirm the number of dependents in your household.

Tips for a Smooth FAFSA Submission

Gathering necessary documents before starting your FAFSA submission ensures a smoother process. Essential items include your Social Security number, federal income tax returns, and records of untaxed income.

Having your parents' information ready is crucial if you are a dependent student. Also, include bank statements and investment records to accurately report your financial status.

What Documents Are Required for FAFSA Submission? Infographic