To complete the FAFSA application, students must provide their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Dependents also need to submit parental financial information, including tax returns and asset records. Accurate and up-to-date documentation ensures eligibility for federal student aid and streamlines the application process.

What Documents Are Necessary for FAFSA Application?

| Number | Name | Description |

|---|---|---|

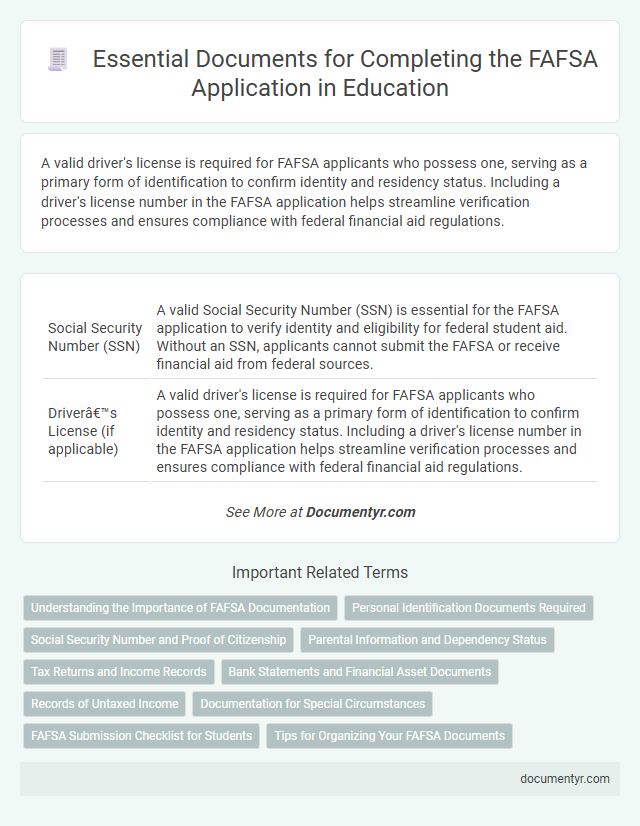

| 1 | Social Security Number (SSN) | A valid Social Security Number (SSN) is essential for the FAFSA application to verify identity and eligibility for federal student aid. Without an SSN, applicants cannot submit the FAFSA or receive financial aid from federal sources. |

| 2 | Driver’s License (if applicable) | A valid driver's license is required for FAFSA applicants who possess one, serving as a primary form of identification to confirm identity and residency status. Including a driver's license number in the FAFSA application helps streamline verification processes and ensures compliance with federal financial aid regulations. |

| 3 | Alien Registration Number (for non-U.S. citizens) | Non-U.S. citizens applying for FAFSA must provide their Alien Registration Number (A-Number), typically found on Form I-94, Permanent Resident Card, or Employment Authorization Document, to verify eligibility for federal student aid. This unique identifier allows the Department of Education to confirm immigration status and determine the applicant's qualification for financial assistance. |

| 4 | Federal Income Tax Returns (IRS Form 1040, 1040A, or 1040EZ) | Federal Income Tax Returns, such as IRS Form 1040, 1040A, or 1040EZ, are essential documents required for the FAFSA application to verify income information. Accurate tax return data ensures proper calculation of the Expected Family Contribution (EFC) for financial aid eligibility. |

| 5 | W-2 Forms | W-2 Forms are essential for completing the FAFSA application as they provide accurate information on earned income, which helps determine financial aid eligibility. Applicants must gather all W-2 Forms from employers to report wages, tips, and other compensation accurately for both the student and parents if applicable. |

| 6 | Records of Untaxed Income (child support, interest income, veterans benefits) | FAFSA applications require detailed Records of Untaxed Income, including child support received, interest income from savings or investments, and veterans benefits documentation. These records are essential to accurately determine the applicant's financial aid eligibility and ensure compliance with federal guidelines. |

| 7 | Bank Statements | Bank statements are essential for the FAFSA application as they provide proof of financial resources and help verify income, savings, and assets used to determine eligibility for federal student aid. Applicants should include recent bank statements covering checking, savings, and investment accounts to ensure accurate financial assessment. |

| 8 | Investment Records (stocks, bonds, real estate not including primary residence) | Investment records required for the FAFSA application include statements detailing stocks, bonds, and real estate holdings excluding the primary residence, along with their current market values and any earned dividends or interest. Accurate documentation of these assets is essential for calculating the Expected Family Contribution (EFC) and determining financial aid eligibility. |

| 9 | Records of Other Assets (business and farm records) | Records of other assets, including detailed business and farm financial statements, are essential for the FAFSA application to accurately report net worth and income. Applicants must gather documents such as profit and loss statements, balance sheets, and asset depreciation schedules to ensure precise asset valuation on the FAFSA form. |

| 10 | FAFSA ID (FSA ID) | The FAFSA application requires a FAFSA ID (FSA ID) for electronic signing and access to personalized information; students and parents must create separate FSA IDs at fsaid.ed.gov to complete and submit the form securely. Key documents needed to create the FSA ID include a valid email address, Social Security number, and personal contact information, ensuring identity verification during the FAFSA process. |

Understanding the Importance of FAFSA Documentation

Completing the FAFSA application requires specific documentation to verify your financial and personal information accurately. Understanding which documents are necessary ensures a smooth application process and maximizes financial aid eligibility.

- Social Security Number - Essential for identity verification and linking your application to government records.

- Tax Returns - Used to report income and taxes paid, critical for determining financial need.

- Proof of Citizenship or Eligible Non-Citizen Status - Confirms eligibility for federal student aid programs.

Gathering these documents before starting your FAFSA application helps prevent errors and delays.

Personal Identification Documents Required

Personal identification documents are essential for completing the FAFSA application accurately. These documents typically include a valid Social Security card, a government-issued photo ID such as a driver's license or passport, and a birth certificate. Ensure you have these ready to verify your identity and avoid delays in the financial aid process.

Social Security Number and Proof of Citizenship

Submitting a FAFSA application requires specific documents to verify identity and eligibility. Your Social Security Number and Proof of Citizenship are essential for accurate processing and qualification.

- Social Security Number - Your valid Social Security Number must be entered exactly as it appears on your card to confirm your identity.

- Proof of Citizenship - Documentation such as a U.S. birth certificate, U.S. passport, or Certificate of Naturalization is required to verify U.S. citizenship.

- Matching Records - These documents help the FAFSA process match your information with government databases to ensure eligibility for federal student aid.

Parental Information and Dependency Status

Completing the FAFSA application requires specific documents related to parental information and dependency status. Understanding these requirements ensures an accurate and timely submission.

- Parental Tax Returns - Submit your parents' most recent federal tax returns to verify income information if you are a dependent student.

- Dependency Status Documentation - Provide documents such as birth certificates or legal guardianship papers to confirm your dependency classification.

- Household Information - Gather details on the number of people in your parents' household to determine eligibility for financial aid.

Tax Returns and Income Records

| Document Type | Details |

|---|---|

| Federal Tax Returns | IRS Form 1040 is required to verify income and tax filing status. Recent tax returns provide accurate financial information. Include W-2 forms and any IRS tax schedules used in the filing process. |

| Income Records | Records of earned income such as pay stubs, profit and loss statements for self-employed individuals, and Social Security benefits statements. These documents help verify non-taxable income sources. |

| Other Financial Documents | Untaxed income records such as child support received, interest income statements (1099-INT), and veteran's non-education benefits. Accurate reporting of these ensures proper calculation of Expected Family Contribution (EFC). |

Bank Statements and Financial Asset Documents

Bank statements and financial asset documents are critical for completing the FAFSA application accurately. These documents provide proof of your financial status, which helps determine your eligibility for federal student aid.

Bank statements should show all accounts held in your name, including checking and savings accounts. Financial asset documents include stocks, bonds, and any other investments. Having these ready ensures that the financial information entered on the FAFSA is complete and precise, avoiding delays in processing your application.

Records of Untaxed Income

What records of untaxed income are necessary for the FAFSA application? Students must provide documentation of untaxed income such as child support received, payments to tax-deferred pensions, and veterans' noneducation benefits. Accurate records help ensure the financial aid eligibility is correctly assessed.

Documentation for Special Circumstances

Documentation for special circumstances in the FAFSA application includes proof of unusual financial situations, such as loss of income or dependency status changes. These documents help provide a clearer financial picture beyond standard income reports.

You may need to submit letters from employers, court orders, or verification of untaxed income to support your case. Accurate and complete documentation ensures your application reflects your current financial reality.

FAFSA Submission Checklist for Students

To complete the FAFSA application, students need several key documents to verify their financial and personal information. Essential paperwork includes a Social Security number, driver's license, and previous year's federal income tax returns.

Other necessary items include W-2 forms, bank statements, and records of untaxed income. Having this FAFSA submission checklist ready ensures a smooth and timely application process.

What Documents Are Necessary for FAFSA Application? Infographic