To apply for an FHA loan, borrowers must provide key documents including proof of income such as W-2s, pay stubs, and tax returns, as well as credit history and employment verification. Personal identification like a government-issued ID and social security number is also necessary to complete the application. Lenders may request additional paperwork such as bank statements, asset documentation, and details about any existing debts to assess the applicant's financial stability.

What Documents are Required for FHA Loan Application?

| Number | Name | Description |

|---|---|---|

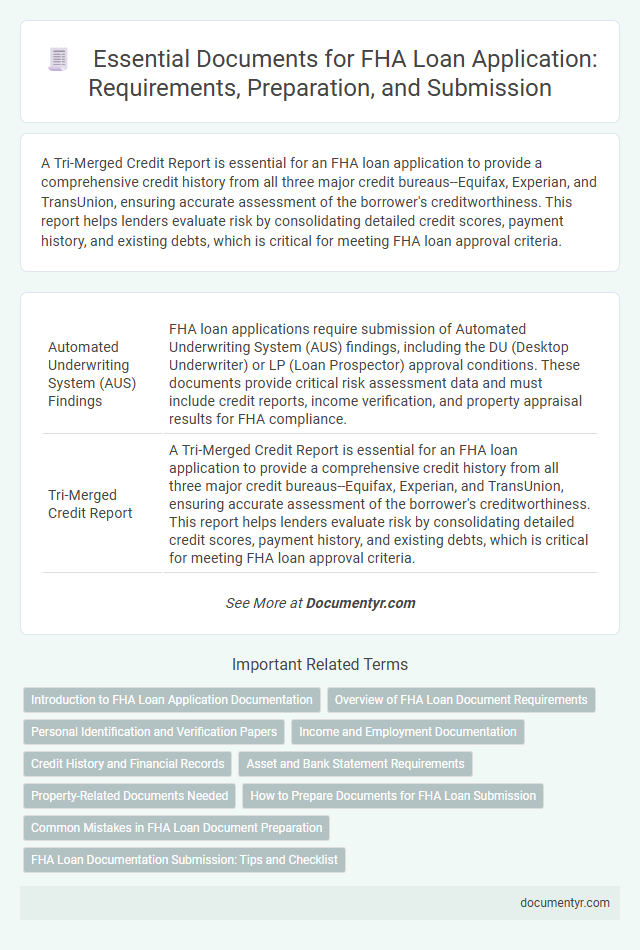

| 1 | Automated Underwriting System (AUS) Findings | FHA loan applications require submission of Automated Underwriting System (AUS) findings, including the DU (Desktop Underwriter) or LP (Loan Prospector) approval conditions. These documents provide critical risk assessment data and must include credit reports, income verification, and property appraisal results for FHA compliance. |

| 2 | Tri-Merged Credit Report | A Tri-Merged Credit Report is essential for an FHA loan application to provide a comprehensive credit history from all three major credit bureaus--Equifax, Experian, and TransUnion, ensuring accurate assessment of the borrower's creditworthiness. This report helps lenders evaluate risk by consolidating detailed credit scores, payment history, and existing debts, which is critical for meeting FHA loan approval criteria. |

| 3 | Digital Asset Verification | Digital asset verification for an FHA loan application requires recent bank statements, investment account statements, and proof of digital wallet ownership to confirm sufficient funds and financial stability. Lenders also typically request authorization for electronic access to these digital accounts to ensure accuracy and streamline the verification process. |

| 4 | Conditional Commitment (HUD Form 92800.5B) | The Conditional Commitment (HUD Form 92800.5B) is a critical document in the FHA loan application process, serving as the lender's formal approval contingent on specific conditions being met. This form outlines the terms and requirements the borrower must satisfy before final loan endorsement, ensuring compliance with FHA standards. |

| 5 | Electronic Income Verification Express (EIV) | Electronic Income Verification Express (EIV) is a critical document for FHA loan applications, providing lenders with accurate and verifiable income data directly from participating employers and government agencies. This system streamlines the verification process, reducing paperwork and enhancing the reliability of income documentation required to assess borrower eligibility. |

| 6 | Personalized Gift Letter with Donor Bank Statement | A personalized Gift Letter is essential in an FHA loan application to verify the source and intent of the gifted funds, explicitly stating that the money is a gift and not a loan. The donor's recent bank statements must accompany the Gift Letter, providing proof of the donor's ability to give the funds and ensuring compliance with FHA guidelines on gifted down payments. |

| 7 | Employment Gap Letter Explanation | An Employment Gap Letter is essential for FHA loan applications when there is a period of unemployment or inconsistent work history, providing a clear explanation to the lender about the reasons for the gap and assurance of income stability. This document strengthens the borrower's profile by detailing circumstances such as layoffs, personal issues, or education, helping the underwriter assess creditworthiness accurately. |

| 8 | IRS 4506-C Transcript Authorization | The IRS 4506-C Transcript Authorization form is a critical document required for an FHA loan application, allowing the lender to verify the borrower's tax return information directly with the IRS. This authorization ensures accurate income verification, reducing the risk of fraudulent income claims during the loan approval process. |

| 9 | Non-Traditional Credit Reference Documentation | Non-traditional credit reference documentation for FHA loan applications includes proof of consistent payment history through utility bills, phone bills, rental payments, and other regular monthly obligations not typically reported to credit bureaus. Applicants must present at least 12 months of documentation demonstrating timely payments to verify creditworthiness without a conventional credit score. |

| 10 | FHA Identity-of-Interest Disclosure | The FHA Identity-of-Interest Disclosure form is essential for FHA loan applications involving buyers, sellers, builders, or real estate agents with personal or business connections. This document ensures transparency and compliance by revealing any relationships that might influence the transaction, helping underwriters assess the legitimacy of the contract and property value. |

Introduction to FHA Loan Application Documentation

What documents are required for an FHA loan application? FHA loan applications require specific documentation to verify creditworthiness, income, and identity. These documents ensure compliance with FHA guidelines and streamline the approval process.

Overview of FHA Loan Document Requirements

Applying for an FHA loan requires a specific set of documents to verify your financial status and eligibility. These documents are essential to ensure compliance with FHA guidelines and streamline the approval process.

Key documents include proof of income such as pay stubs, tax returns, and W-2 forms, which help demonstrate your ability to repay the loan. Verification of employment and residency status is also mandatory. You must provide credit information and details about your debts to complete the application package.

Personal Identification and Verification Papers

For an FHA loan application, personal identification and verification papers are essential. These documents confirm your identity and secure the loan approval process.

You will need a government-issued photo ID such as a driver's license or passport. Verification of your Social Security number through your Social Security card or IRS documents is also required.

Income and Employment Documentation

Income and employment documentation is essential for an FHA loan application to verify the borrower's ability to repay the loan. These documents provide lenders with a clear understanding of the applicant's financial stability and employment history.

- Recent Pay Stubs - Typically, lenders require pay stubs from the last 30 days to confirm current income levels.

- W-2 Forms - W-2 forms from the past two years help establish consistent employment and earnings trends.

- Employment Verification Letter - A letter from the employer confirms the borrower's job status, position, and salary details.

Credit History and Financial Records

| Document Type | Details Required | Purpose |

|---|---|---|

| Credit History Report | Complete credit report from all major credit bureaus | To evaluate creditworthiness and history of loan repayment |

| Pay Stubs | Recent pay stubs covering the last 30 days | To verify current employment income and stability |

| Tax Returns | Federal tax returns for the past two years, including all schedules | To review overall financial status and income consistency |

| Bank Statements | Statements from all bank accounts for the past 2-3 months | To confirm available funds for down payment and reserves |

| Proof of Additional Income | Documentation of bonuses, alimony, child support, or other income sources | To ensure all income streams are considered in loan qualification |

Your credit history and financial records must be comprehensive and current to ensure the FHA loan application proceeds smoothly and meets lender requirements.

Asset and Bank Statement Requirements

For an FHA loan application, borrowers must provide comprehensive asset documentation to verify the availability of funds for down payment and closing costs. Bank statements for the last two to three months are required to demonstrate consistent account activity and sufficient funds. These documents help lenders assess financial stability and ensure compliance with FHA guidelines.

Property-Related Documents Needed

When applying for an FHA loan, specific property-related documents are essential to verify the condition and legality of the home. These documents ensure the property meets FHA standards and protects both the lender and borrower.

- Property appraisal report - An FHA-approved appraiser evaluates the property's value and condition to ensure it meets minimum FHA standards.

- Property deed - This legal document verifies ownership and confirms that the seller has the right to transfer the title.

- Purchase agreement - A signed contract outlining the terms of the property sale between buyer and seller, establishing the transaction details.

How to Prepare Documents for FHA Loan Submission

Preparing documents for an FHA loan application requires gathering key financial and personal records. These include proof of income, employment verification, and credit history reports.

Organize your bank statements, tax returns, and identification documents carefully to streamline the submission process. Ensuring all paperwork is accurate and complete helps avoid delays in FHA loan approval.

Common Mistakes in FHA Loan Document Preparation

Submitting a complete FHA loan application requires specific documents, including pay stubs, bank statements, tax returns, and a credit report. Common mistakes include providing outdated documents, missing signatures, or failing to disclose all sources of income. Ensuring accuracy and completeness in document preparation can prevent delays and increase the likelihood of loan approval.

What Documents are Required for FHA Loan Application? Infographic