Independent contractors need to gather key documents for taxes, including Form 1099-NEC from clients reporting nonemployee compensation, receipts and invoices to track business expenses, and records of estimated tax payments made throughout the year. Maintaining organized documentation of income and deductible expenses is essential for accurate tax filing and maximizing deductions. Proper record-keeping ensures compliance with IRS regulations and simplifies the preparation of Schedule C and self-employment tax forms.

What Documents Does an Independent Contractor Need for Taxes?

| Number | Name | Description |

|---|---|---|

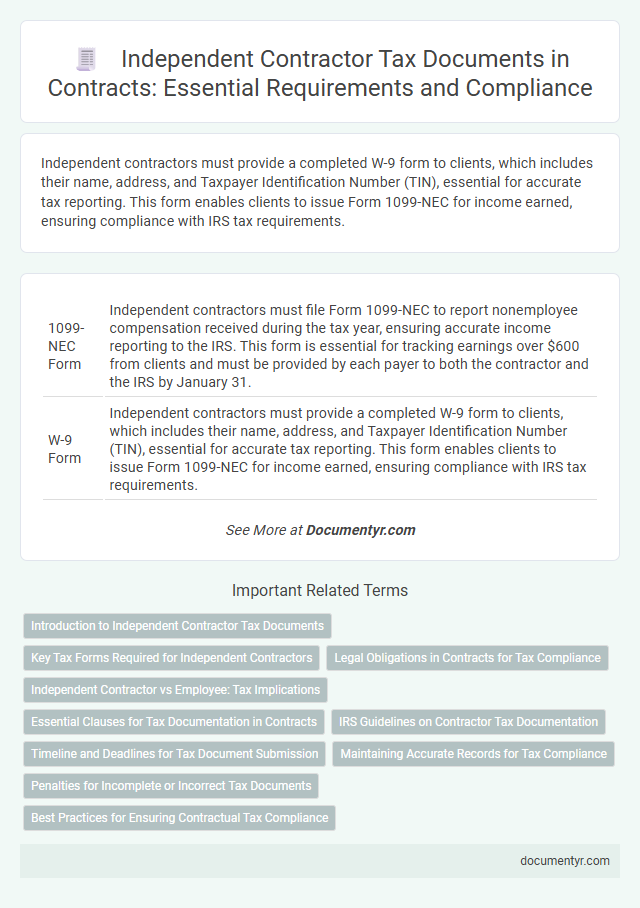

| 1 | 1099-NEC Form | Independent contractors must file Form 1099-NEC to report nonemployee compensation received during the tax year, ensuring accurate income reporting to the IRS. This form is essential for tracking earnings over $600 from clients and must be provided by each payer to both the contractor and the IRS by January 31. |

| 2 | W-9 Form | Independent contractors must provide a completed W-9 form to clients, which includes their name, address, and Taxpayer Identification Number (TIN), essential for accurate tax reporting. This form enables clients to issue Form 1099-NEC for income earned, ensuring compliance with IRS tax requirements. |

| 3 | Schedule C (Form 1040) | Independent contractors must file Schedule C (Form 1040) to report income and expenses related to their business activities accurately, ensuring proper tax calculation and potential deductions. Essential documents for completing Schedule C include Form 1099-NEC for income verification, receipts, invoices, and expense records to substantiate deductible costs. |

| 4 | Form 8829 (Home Office Deduction) | Independent contractors must maintain accurate records including Form 8829 to claim the Home Office Deduction, which allows deduction of expenses related to the business use of a home. Proper documentation such as mortgage interest, utilities, and depreciation must be substantiated to maximize tax benefits under IRS guidelines. |

| 5 | Form 4562 (Depreciation & Amortization) | Independent contractors must file IRS Form 4562 to claim depreciation and amortization deductions for business assets used in their work, which lowers taxable income and maximizes tax benefits. Accurate records of asset purchases, usage, and cost basis are essential to properly complete Form 4562 and comply with tax regulations. |

| 6 | Quarterly Estimated Tax Vouchers (Form 1040-ES) | Independent contractors must use Quarterly Estimated Tax Vouchers (Form 1040-ES) to calculate and pay estimated taxes on income not subject to withholding, ensuring compliance with IRS deadlines for each quarter. Maintaining accurate records of income and expenses along with timely submission of Form 1040-ES payments prevents underpayment penalties and facilitates smooth annual tax filing. |

| 7 | Digital Payment Platform Annual Summaries (e.g., PayPal 1099-K) | Independent contractors must obtain Digital Payment Platform Annual Summaries such as the PayPal 1099-K form, which reports gross payment transactions exceeding $600. This document is essential for accurate income reporting on tax returns and ensures compliance with IRS regulations on digital payment reporting. |

| 8 | Business Expense Receipts (Cloud-Based Storage) | Independent contractors should maintain organized business expense receipts using cloud-based storage solutions like QuickBooks or Expensify to ensure easy access and accurate tax reporting. Digitally stored receipts reduce the risk of loss, streamline expense tracking, and support comprehensive documentation for IRS deductions and audits. |

| 9 | Mileage Tracking Logs (App Generated) | Independent contractors need mileage tracking logs app-generated to accurately record business-related travel for tax deductions and IRS compliance. These digital logs automatically capture trip details such as date, distance, and purpose, ensuring precise documentation essential for maximizing mileage expense claims. |

| 10 | Virtual Contract Agreements (E-signature Authentication) | Independent contractors must secure virtual contract agreements with e-signature authentication to ensure legal validity and seamless tax documentation, including IRS Form 1099-NEC filings. These digitally authenticated contracts serve as critical evidence for income verification and expense deductions during tax audits, enhancing compliance and record accuracy. |

Introduction to Independent Contractor Tax Documents

What documents does an independent contractor need for taxes? Independent contractors must gather specific tax documents to accurately report their income and expenses. Proper documentation ensures compliance with tax regulations and helps maximize potential deductions.

Key Tax Forms Required for Independent Contractors

Independent contractors must gather specific tax documents to accurately report income and expenses. Key tax forms include the 1099-NEC, which reports non-employee compensation, and Schedule C for reporting business income and deductions. You should also retain Form 1040-ES for estimated tax payments, ensuring compliance with IRS requirements.

Legal Obligations in Contracts for Tax Compliance

Independent contractors must collect and maintain key documents to comply with tax regulations. Essential forms include the IRS Form W-9 and invoices detailing services provided.

Contracts should explicitly outline the contractor's responsibility to provide accurate tax information. Form 1099-NEC must be issued by clients to report payments made to contractors. Proper documentation ensures legal compliance and smooth tax reporting.

Independent Contractor vs Employee: Tax Implications

Understanding the tax documents required for an independent contractor is crucial to manage tax obligations properly. Your classification as an independent contractor versus an employee significantly impacts the forms you need to file and the taxes you pay.

- Form 1099-NEC - Independent contractors receive this form from clients to report nonemployee compensation to the IRS.

- Form W-2 - Employees receive this form from employers summarizing wages and withheld taxes for the year.

- Schedule C and Schedule SE - Independent contractors use Schedule C to report business income and Schedule SE to calculate self-employment tax.

Essential Clauses for Tax Documentation in Contracts

Independent contractors need specific documents for accurate tax reporting, including Form W-9, 1099-NEC, and detailed invoices. Essential clauses in contracts should specify the responsibility for providing and maintaining these tax documents to ensure compliance. Your contract must clearly outline deadlines and penalties related to the submission of tax documentation to avoid issues with the IRS.

IRS Guidelines on Contractor Tax Documentation

Independent contractors must maintain specific documents for accurate tax reporting according to IRS guidelines. These include Form W-9, invoices, and records of business expenses relevant to your contract work.

The IRS requires Form 1099-NEC submitted by clients to report payments made to contractors over $600. Keeping detailed records ensures compliance and simplifies the preparation of your tax returns.

Timeline and Deadlines for Tax Document Submission

Independent contractors must gather specific tax documents to accurately report income and expenses. Key documents include Form 1099-NEC, issued by clients by January 31, and expense receipts for deductions.

You should maintain organized records throughout the year to ensure timely submission of tax forms. The IRS deadline to file your tax return is typically April 15, with extensions available until October 15.

Maintaining Accurate Records for Tax Compliance

Maintaining accurate records is essential for independent contractors to ensure tax compliance and avoid potential issues with the IRS. Proper documentation supports income reporting and deductible expenses.

- Form 1099-NEC - This form reports nonemployee compensation received from clients and is crucial for accurate income tracking.

- Receipts and Invoices - Keeping copies of all business-related receipts and invoices helps verify deductible expenses and reduce taxable income.

- Expense Logs - Detailed records of business expenses, such as mileage, office supplies, and travel costs, support legitimate deductions and tax accuracy.

You should maintain organized and thorough records throughout the year to simplify tax filing and maximize compliance.

Penalties for Incomplete or Incorrect Tax Documents

Independent contractors must maintain accurate and complete tax documents to avoid costly penalties and legal issues. Failure to provide correct information can trigger audits and fines from the IRS.

- Missed Deadlines - Late or missing tax filings can result in penalties that increase over time, affecting the contractor's financial stability.

- Incorrect Information - Submitting inaccurate income or deduction data can lead to audits, additional taxes owed, and penalties for fraud or negligence.

- Unreported Income - Failure to report all earnings can cause severe fines, interest charges, and potential legal action by tax authorities.

What Documents Does an Independent Contractor Need for Taxes? Infographic