Students applying for FAFSA need their Social Security number, federal income tax returns, and W-2 forms to verify income. They must also gather records of untaxed income, current bank statements, and driver's license information. Having these documents ready ensures a smooth and accurate financial aid application process.

What Documents Does a Student Need to Apply for FAFSA?

| Number | Name | Description |

|---|---|---|

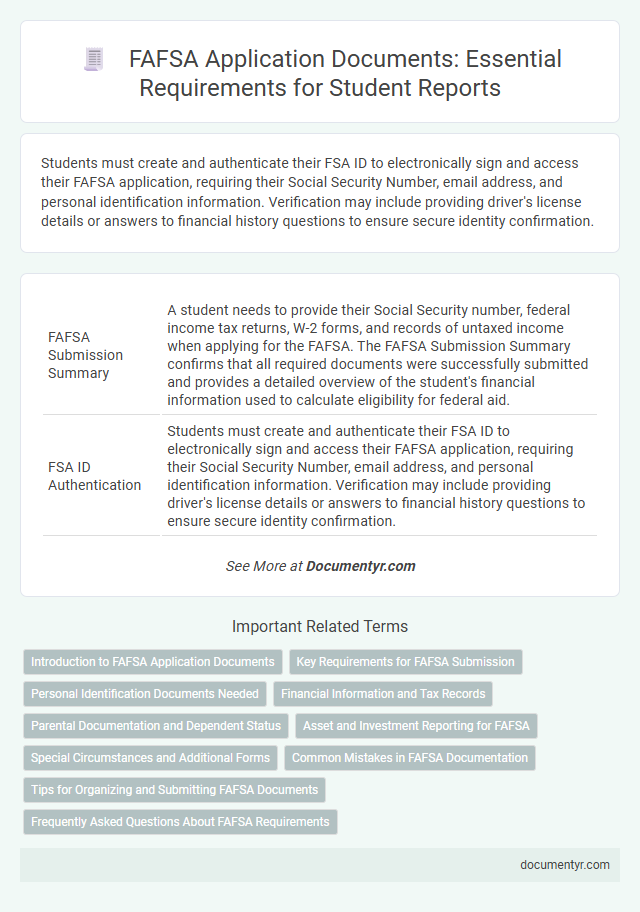

| 1 | FAFSA Submission Summary | A student needs to provide their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income when applying for the FAFSA. The FAFSA Submission Summary confirms that all required documents were successfully submitted and provides a detailed overview of the student's financial information used to calculate eligibility for federal aid. |

| 2 | FSA ID Authentication | Students must create and authenticate their FSA ID to electronically sign and access their FAFSA application, requiring their Social Security Number, email address, and personal identification information. Verification may include providing driver's license details or answers to financial history questions to ensure secure identity confirmation. |

| 3 | IRS Data Retrieval Tool (DRT) Confirmation | The IRS Data Retrieval Tool (DRT) Confirmation is essential for verifying the accuracy of a student's and their family's tax information when applying for FAFSA, streamlining the financial aid process. This confirmation ensures that income data is directly imported from the IRS, reducing errors and accelerating eligibility determination for federal student aid. |

| 4 | Selective Service Registration Proof | Students applying for FAFSA must provide proof of Selective Service registration if they are male and between the ages of 18 and 25, as this is a federal requirement for eligibility. Acceptable documents include a Selective Service registration card, a verification letter from the Selective Service System, or confirmation through the FAFSA website. |

| 5 | SAI (Student Aid Index) Documentation | Students applying for FAFSA must provide documentation supporting their Student Aid Index (SAI), including their most recent federal tax returns, W-2 forms, and records of untaxed income. Verification may also require asset statements such as bank account balances, investment records, and documentation of household size to accurately calculate the SAI. |

| 6 | Non-tax Filer Statement | Students applying for FAFSA who are non-tax filers must provide a Non-Tax Filer Statement, which confirms they did not file a federal tax return for the relevant tax year. This document typically includes details about income earned from work, verification of employment, and a signed statement declaring no tax filing was necessary. |

| 7 | Asset Protection Allowance Report | The Asset Protection Allowance in the FAFSA application requires students to provide documentation of their financial assets, including bank statements, investment portfolios, and retirement account balances. Accurate reporting of these documents ensures the correct calculation of eligibility for federal student aid by protecting a portion of parental assets from being counted in the Expected Family Contribution (EFC). |

| 8 | Legal Guardianship Verification | Legal guardianship verification for FAFSA requires official court documents or a notarized letter proving custody status. Submitting valid documentation ensures correct dependency classification and access to accurate financial aid evaluation. |

| 9 | Homeless Youth Determination Letter | A student applying for FAFSA as homeless or at risk of homelessness must provide a Homeless Youth Determination Letter issued by a homeless shelter director, school liaison, or financial aid administrator; this document verifies the student's status and eligibility for certain federal aid protections. Without this letter, students cannot access specific FAFSA waivers or independent student status needed for financial aid. |

| 10 | Emancipation Status Documentation | Students applying for FAFSA must provide emancipation status documentation if claiming independent status due to emancipation. This typically includes a court order or legal documentation verifying emancipation from parental control. |

Introduction to FAFSA Application Documents

The Free Application for Federal Student Aid (FAFSA) is essential for students seeking financial assistance for college. Understanding the required documents simplifies the application process.

Key documents include your Social Security number, driver's license (if applicable), and federal income tax returns. You also need records of untaxed income and current bank statements. Having these ready ensures a smooth, efficient FAFSA submission.

Key Requirements for FAFSA Submission

Understanding the key documents required for FAFSA submission is essential to ensure a smooth application process. Gathering all necessary paperwork ahead of time can save effort and prevent delays.

- Social Security Number - This number is crucial for identity verification and eligibility confirmation.

- Federal Income Tax Returns - Recent tax documents help determine financial need and aid eligibility calculation.

- Driver's License or State ID - An official government-issued photo ID is required for identity verification purposes.

Personal Identification Documents Needed

What personal identification documents are required to apply for FAFSA? A valid Social Security Number (SSN) is essential to complete your FAFSA application. You will also need your driver's license if you have one, as it helps verify your identity.

Financial Information and Tax Records

| Document Type | Description |

|---|---|

| Federal Tax Returns | Recent IRS tax returns, including Form 1040, are required to verify income and tax paid. For dependent students, parents' tax returns are also necessary. |

| W-2 Forms | Wage and tax statements from all employers provide detailed income information essential for accurate FAFSA completion. |

| Records of Untaxed Income | Documentation of untaxed income such as child support received, veterans' benefits, or workforce compensation must be included. |

| Bank Statements and Investment Records | Statements reflecting current cash, savings, and investment balances are necessary to assess available financial resources. |

| Social Security Benefits Statements | Proof of benefits received is required to include in the income calculation. |

| Business and Farm Records | If applicable, records detailing income and expenses from business or farming activities must be provided. |

| Alien Registration Number | Non-US citizens must have documentation of immigration status, such as a Green Card or Alien Registration Number, for FAFSA eligibility. |

| IRS Data Retrieval Tool (Optional) | This tool allows you to transfer tax return information directly to the FAFSA form, reducing errors and improving accuracy. |

Parental Documentation and Dependent Status

When applying for FAFSA, students classified as dependents must provide specific parental documentation to verify financial information. Key documents include the parents' federal income tax returns, W-2 forms, and records of untaxed income. You will also need proof of your dependent status to ensure eligibility for financial aid based on your parents' financial data.

Asset and Investment Reporting for FAFSA

When applying for FAFSA, accurate reporting of assets and investments is essential to determine financial aid eligibility. Understanding which documents to gather can simplify the application process.

- Bank Statements - Provide recent statements for all checking and savings accounts to report cash and cash equivalents.

- Investment Account Statements - Include documentation for stocks, bonds, mutual funds, and other investment portfolios as part of asset reporting.

- Records of Business and Farm Assets - Submit valuation statements or tax forms for any business or farm assets owned, excluding family farms or small businesses with fewer than 100 full-time employees.

Your accurate asset and investment documentation ensures FAFSA calculations reflect your financial status correctly.

Special Circumstances and Additional Forms

Students applying for FAFSA under special circumstances must provide additional documentation to verify their unique situation. Common scenarios include dependency overrides, homelessness, or recent changes in financial status.

Supporting forms such as the Dependency Override Form, Verification Worksheets, or a letter from a homeless shelter may be required. These documents help the FAFSA processor assess eligibility accurately and ensure appropriate financial aid allocation.

Common Mistakes in FAFSA Documentation

Applying for FAFSA requires accurate and complete documentation to avoid delays or rejections. Common mistakes in FAFSA documentation often lead to unnecessary complications in the financial aid process.

- Using Incorrect Social Security Numbers - Students must ensure their Social Security number matches official records exactly to prevent identity verification issues.

- Submitting Outdated Tax Information - Providing tax returns from incorrect years causes discrepancies in income verification and delays processing.

- Forgetting to Include Dependency Status Documents - Missing proof of dependency status can result in inaccurate financial need assessments.

Tips for Organizing and Submitting FAFSA Documents

Applying for FAFSA requires gathering key documents such as your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Students also need their driver's license, Alien Registration Number if applicable, and bank statements to complete the application accurately.

Organize these documents in a dedicated folder or digital file to streamline the submission process. Ensure all documents are up-to-date and clearly legible to avoid processing delays and improve application accuracy.

What Documents Does a Student Need to Apply for FAFSA? Infographic