Veterans must provide a Certificate of Eligibility (COE) to verify their entitlement to a VA home loan, along with a valid DD214 form that confirms their military service. Essential financial documents include recent pay stubs, bank statements, and tax returns to assess the borrower's income and creditworthiness. Proof of property details and a completed loan application form are also required to facilitate the VA loan approval process.

What Documents Does a Veteran Need for VA Home Loan Application?

| Number | Name | Description |

|---|---|---|

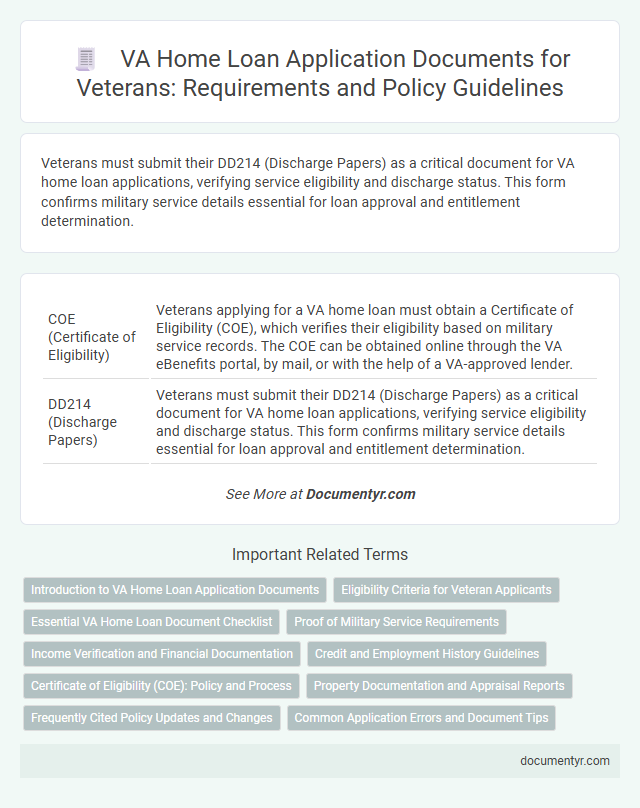

| 1 | COE (Certificate of Eligibility) | Veterans applying for a VA home loan must obtain a Certificate of Eligibility (COE), which verifies their eligibility based on military service records. The COE can be obtained online through the VA eBenefits portal, by mail, or with the help of a VA-approved lender. |

| 2 | DD214 (Discharge Papers) | Veterans must submit their DD214 (Discharge Papers) as a critical document for VA home loan applications, verifying service eligibility and discharge status. This form confirms military service details essential for loan approval and entitlement determination. |

| 3 | VA Form 26-1880 | Veterans need to submit VA Form 26-1880, Request for a Certificate of Eligibility (COE), which verifies their eligibility for a VA home loan and is essential for processing the application. Supporting documents like discharge papers (DD214) and proof of service may also be required to complement the COE in the VA home loan application process. |

| 4 | Statement of Service (Active Duty) | Veterans applying for a VA home loan must provide a Statement of Service as proof of active duty, which verifies their military service status and dates of service. This document is essential for confirming eligibility and is typically issued by the branch of service or the military personnel office. |

| 5 | Residual Income Worksheet | Veterans applying for a VA home loan must submit a Residual Income Worksheet to demonstrate their ability to cover monthly living expenses after mortgage payments, ensuring financial stability. This document is critical for VA lenders to assess the applicant's residual income, a key eligibility criterion that affects loan approval. |

| 6 | Entitlement Restoration Documentation | Veterans applying for a VA home loan must provide entitlement restoration documentation, including DD Form 214, VA Form 26-1880 for previous loan payoff verification, and a Certificate of Eligibility (COE) reflecting restored entitlement status. These documents ensure eligibility and confirm that previous VA loan benefits have been reinstated, enabling the veteran to secure a new VA-backed home loan. |

| 7 | VA Automated Certificate Portal Upload | Veterans applying for a VA home loan must upload key documents such as the Certificate of Eligibility (COE), DD Form 214, and financial records to the VA Automated Certificate Portal (VACP) to verify eligibility and streamline processing. Utilizing the VACP ensures secure submission and faster approval by directly linking necessary documentation to the Department of Veterans Affairs system. |

| 8 | Joint Borrower Eligibility Proof | Veterans applying for a VA home loan with a joint borrower must provide proof of eligibility documents such as a valid Certificate of Eligibility (COE) for the veteran and evidence of entitlement status for the joint borrower. Supporting documentation may include DD214 discharge papers, marriage certificates if applicable, and credit information to establish the joint borrower's financial capacity. |

| 9 | Proof of Surviving Spouse Status | Proof of surviving spouse status for a VA home loan application requires official documents such as a death certificate of the veteran and a marriage certificate confirming the surviving spouse's eligibility. Additional documentation may include a Discharge or Separation Papers (DD214) of the deceased veteran and, if applicable, court orders establishing guardianship or legal status. |

| 10 | Prior VA Loan Restoration Request | Veterans applying for a VA home loan must provide their Certificate of Eligibility (COE), a completed VA loan application, and documents related to prior VA loan restoration requests, including proof of loan payoff or release of liability. Submitting the VA Form 26-8937, Request for a Certificate of Eligibility, ensures verification of restored entitlement after paying off a previous VA loan or disposing of the property securing the prior loan. |

Introduction to VA Home Loan Application Documents

Veterans seeking a VA home loan must submit specific documents to verify eligibility and financial status. Key documents include the Certificate of Eligibility (COE), proof of income, and personal identification. Understanding these requirements streamlines the VA home loan application process and ensures compliance with loan guidelines.

Eligibility Criteria for Veteran Applicants

Veterans applying for a VA home loan must provide specific documents to verify eligibility. Key documents include the Certificate of Eligibility (COE), which confirms military service qualifications.

Additional required documents may include a DD Form 214, showing discharge status, and proof of income to demonstrate repayment ability. These documents ensure applicants meet the VA's eligibility criteria for home loan benefits.

Essential VA Home Loan Document Checklist

What documents are essential for a veteran to apply for a VA home loan? Veterans must gather specific paperwork to verify their eligibility and financial status. A well-prepared document checklist accelerates the VA loan approval process.

Which identification documents are required for a VA home loan application? Veterans need a valid government-issued ID such as a driver's license or passport. Proof of military service status through the Certificate of Eligibility (COE) is mandatory.

What is the importance of the Certificate of Eligibility (COE) in the VA loan process? The COE confirms a veteran's entitlement to the VA home loan benefit. It helps lenders verify the borrower's service history and eligibility quickly.

What financial documents should a veteran prepare for the VA home loan application? Income verification documents include recent pay stubs, W-2 forms, and tax returns. These documents demonstrate the borrower's ability to repay the loan.

Why must veterans provide credit information during the VA loan application? Credit reports and scores assess the borrower's creditworthiness and financial responsibility. Lenders use this data to evaluate risk and loan terms.

Which property-related documents are necessary for the VA home loan process? A signed purchase agreement and property appraisal report are crucial. These documents ensure the property meets VA minimum property requirements.

Proof of Military Service Requirements

Veterans must provide specific documents to prove their military service when applying for a VA home loan. These documents confirm eligibility and facilitate the loan approval process.

- Certificate of Eligibility (COE) - This document verifies a veteran's eligibility for the VA home loan program and is required by lenders.

- DD Form 214 - The discharge papers detail the nature of service and discharge status, essential for verifying military service.

- Statement of Service - Active duty service members provide this letter from their commanding officer confirming current service status and duration.

Income Verification and Financial Documentation

Proper documentation is essential for a successful VA home loan application. Income verification and financial records provide a clear picture of your financial stability.

- Recent Pay Stubs - Provide proof of current income and employment status.

- Tax Returns - Verify annual income and support self-employment or additional earnings.

- Bank Statements - Demonstrate available funds for down payments and reserves.

Submitting comprehensive income and financial documents helps expedite the VA loan approval process.

Credit and Employment History Guidelines

Veterans applying for a VA home loan must provide documentation verifying their credit and employment history. These records help lenders assess the applicant's financial stability and repayment ability.

Credit reports are essential, highlighting payment history, outstanding debts, and credit scores. Employment verification typically includes recent pay stubs, W-2 forms, and possibly a letter from the employer confirming job status.

Certificate of Eligibility (COE): Policy and Process

| Document | Description | Policy Reference | Process Details |

|---|---|---|---|

| Certificate of Eligibility (COE) | Essential VA document certifying eligibility for a VA home loan backed by the Department of Veterans Affairs. | VA Home Loan Program Policy, 38 CFR SS 36.4301 | You must obtain the COE before loan application submission. The application can be completed online through the VA eBenefits portal, by mail using VA Form 26-1880, or through your approved lender who may assist with the COE request. Processing times vary; online submission provides the fastest turnaround. |

| DD Form 214 (Certificate of Release or Discharge from Active Duty) | Proof of military service required to verify veteran status and service dates. | VA eligibility documentation standards | Submit a copy alongside the COE request if applying by mail. Online submissions may auto-verify service history. |

| Financial Documents | Includes income verification, credit reports, and employment history necessary for loan underwriting. | VA Loan Underwriting Guidelines | Collect documents early to support creditworthiness; the COE proves eligibility but does not guarantee loan approval. |

Property Documentation and Appraisal Reports

When applying for a VA home loan, securing complete property documentation is essential for a smooth approval process. Appraisal reports play a critical role in verifying the property's value and condition to meet VA loan requirements.

- Property Title - Ensures clear ownership and absence of liens on the home.

- Purchase Agreement - Details the terms and price agreed upon between buyer and seller.

- VA Appraisal Report - Confirms the property meets the VA's minimum property requirements for safety and value.

Frequently Cited Policy Updates and Changes

Veterans applying for a VA home loan must submit key documents to verify eligibility, income, and property details. Recent policy changes emphasize updated standards for certificate of eligibility and income verification processes.

The most frequently cited policy updates include the streamlined issuance of the Certificate of Eligibility (COE), allowing faster access through eBenefits and online portals. Income documentation requirements have expanded to include recent pay stubs, tax returns, and proof of additional income streams. Property appraisal guidelines have been revised to ensure compliance with new VA minimum property requirements, impacting loan approval timelines.

What Documents Does a Veteran Need for VA Home Loan Application? Infographic