To complete a FAFSA application, students must provide a valid Social Security number and a driver's license if available. Tax returns, W-2 forms, and records of untaxed income are necessary for accurate financial information. Parents or guardians also need to supply their tax and income documents if the student is dependent.

What Documents are Required for FAFSA Application?

| Number | Name | Description |

|---|---|---|

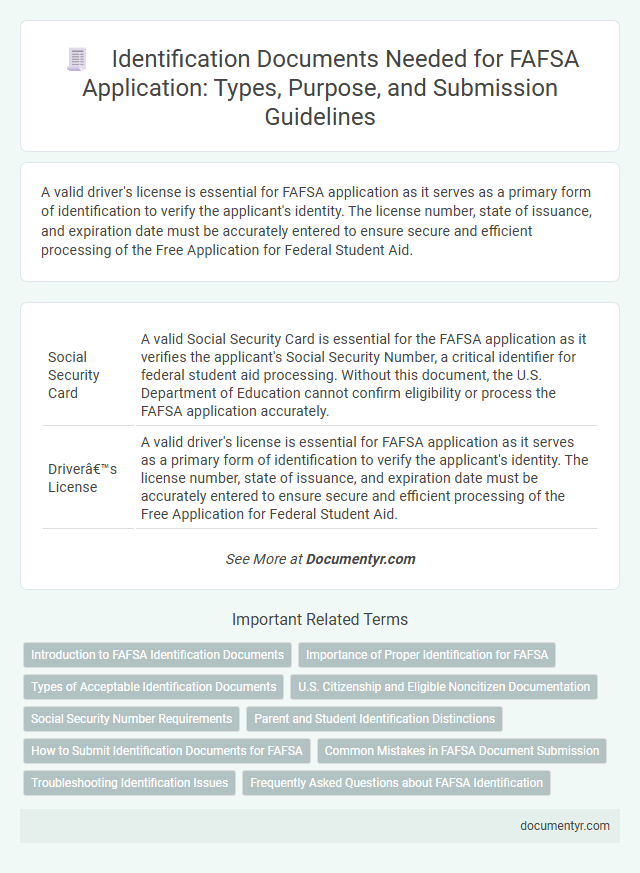

| 1 | Social Security Card | A valid Social Security Card is essential for the FAFSA application as it verifies the applicant's Social Security Number, a critical identifier for federal student aid processing. Without this document, the U.S. Department of Education cannot confirm eligibility or process the FAFSA application accurately. |

| 2 | Driver’s License | A valid driver's license is essential for FAFSA application as it serves as a primary form of identification to verify the applicant's identity. The license number, state of issuance, and expiration date must be accurately entered to ensure secure and efficient processing of the Free Application for Federal Student Aid. |

| 3 | Alien Registration Card (if not a U.S. citizen) | Applicants who are not U.S. citizens must provide an Alien Registration Card (Form I-551 or I-94) as proof of their eligible immigration status when submitting the FAFSA application. This card verifies lawful permanent residency or specific noncitizen classifications necessary to qualify for federal student aid. |

| 4 | Federal Income Tax Returns (student and parent) | Federal Income Tax Returns for both the student and parent are crucial documents required for the FAFSA application to verify reported income and determine financial aid eligibility. Submitting accurate IRS Tax Return Transcripts ensures the FAFSA form reflects true financial status, impacting Expected Family Contribution (EFC) calculations. |

| 5 | W-2 Forms | W-2 forms are essential documents required for the FAFSA application as they provide accurate income information from employers, necessary for determining financial aid eligibility. Submitting complete and correct W-2 forms ensures the FAFSA can accurately assess the applicant's tax data for federal student aid calculations. |

| 6 | Records of Untaxed Income (e.g., child support, veteran’s benefits) | Records of untaxed income required for the FAFSA application include documentation of child support received, veteran's non-education benefits, and other untaxed income sources such as workers' compensation and disability benefits. Applicants must provide accurate records of these untaxed income types to ensure proper financial aid eligibility assessment. |

| 7 | Bank Statements | Bank statements are required for the FAFSA application to verify income and financial assets, helping determine eligibility for need-based federal student aid. These statements provide detailed records of deposits, withdrawals, and account balances critical for accurately reporting financial information. |

| 8 | Investment Records (stocks, bonds, real estate, business/farm) | FAFSA applicants must provide detailed investment records, including statements for stocks, bonds, real estate (excluding primary residence), and any business or farm asset values. Accurate documentation of these assets is essential for calculating the Expected Family Contribution (EFC) and determining eligibility for financial aid. |

| 9 | FSA ID (Federal Student Aid Identification) | The FAFSA application requires a valid FSA ID, which serves as your electronic signature to access and submit your federal student aid information securely. Creating an FSA ID involves using your Social Security number, email address, and creating a unique username and password for authentication. |

| 10 | High School Diploma or GED (if applicable) | A high school diploma or GED certificate is essential for completing the FAFSA application as it verifies your educational status and eligibility for federal student aid. Applicants must provide official documentation or transcripts confirming the completion of secondary education or an equivalent credential. |

| 11 | Records of U.S. Permanent Residency (if applicable) | Applicants providing Records of U.S. Permanent Residency must submit a valid Permanent Resident Card (Green Card) as proof of status for the FAFSA application. This documentation verifies eligibility to receive federal student aid and ensures accurate processing of the application. |

| 12 | Proof of Household Size | To verify household size for the FAFSA application, applicants must provide documents such as a tax return transcript, a signed IRS Form 1040, or a verification worksheet listing household members. Supporting evidence may also include birth certificates, adoption records, or foster care documentation to confirm the individuals living in the household. |

| 13 | Current Business and Farm Records | FAFSA application requires current business and farm records including income statements, balance sheets, and tax returns to verify financial information. Accurate documentation of assets, debts, and operational expenses for these entities ensures proper assessment of eligibility for federal student aid. |

Introduction to FAFSA Identification Documents

The Free Application for Federal Student Aid (FAFSA) requires specific identification documents to verify the applicant's identity and eligibility. These documents ensure that the information provided is accurate and secure throughout the application process.

Key identification documents include a valid Social Security number, driver's license, and federal income tax returns. These items help streamline verification and prevent fraud during FAFSA processing.

Importance of Proper Identification for FAFSA

Proper identification is essential for completing the FAFSA application accurately and securely. Required documents typically include a valid Social Security number, a driver's license or state ID, and tax return information. These documents verify identity and eligibility, helping to prevent fraud and ensure timely financial aid processing.

Types of Acceptable Identification Documents

Submitting a FAFSA application requires specific identification documents to verify your identity and eligibility for financial aid. Understanding the types of acceptable identification documents helps ensure a smooth application process.

- Valid Social Security Number (SSN) - Your SSN must be accurate and match the one assigned by the Social Security Administration.

- Government-Issued Photo ID - Accepted forms include a driver's license, state ID card, or a passport to confirm your identity.

- Alien Registration Number - For non-U.S. citizens, providing this number proves eligible immigration status for FAFSA consideration.

U.S. Citizenship and Eligible Noncitizen Documentation

Applying for the Free Application for Federal Student Aid (FAFSA) requires verification of U.S. citizenship or eligible noncitizen status. Accurate documentation ensures eligibility for federal financial aid programs.

- U.S. Citizenship Proof - Provide a valid U.S. passport, birth certificate, or Certificate of Naturalization as evidence of citizenship.

- Eligible Noncitizen Documentation - Submit a Permanent Resident Card (Green Card), Arrival-Departure Record (Form I-94), or Employment Authorization Document (EAD).

- Social Security Number - Include a valid Social Security number to verify identity and eligibility for FAFSA funding.

Social Security Number Requirements

| Document Type | Details |

|---|---|

| Social Security Number (SSN) | You must provide a valid Social Security Number for the FAFSA application. The SSN is essential for identity verification and eligibility determination for federal financial aid. |

| Social Security Card | Your original Social Security card is the preferred document to confirm the SSN. Copies of the card or alternative documents may be accepted only if they include the full SSN. |

| Alternative Documentation | If a Social Security card is not available, a tax return or other official government-issued documents that display the SSN may be submitted as proof. |

| Verification Process | The U.S. Department of Education verifies the SSN against Social Security Administration records to ensure accuracy and prevent fraud. An incorrect SSN may delay or invalidate the FAFSA application. |

Parent and Student Identification Distinctions

The FAFSA application requires specific identification documents for both the student and parent to verify eligibility and financial information. Students must provide their Social Security number, driver's license (if applicable), and a valid email address. Parents must supply their Social Security numbers, tax return information, and an official ID such as a state-issued driver's license or passport to complete the verification process.

How to Submit Identification Documents for FAFSA

Submitting identification documents is essential for completing the FAFSA application. These documents verify your identity and citizenship status to ensure accurate processing.

Commonly required documents include a valid Social Security card, a driver's license or state ID, and your birth certificate. You may also need tax returns or W-2 forms to verify income information. Upload these documents securely through the FAFSA website or submit them by mail following the official instructions.

Common Mistakes in FAFSA Document Submission

Submitting the correct documents is essential for a successful FAFSA application. Common errors include missing Social Security numbers and incomplete tax return information.

Applicants often forget to provide proof of residency or valid identification. Double-checking all required documents before submission reduces delays and application denials.

Troubleshooting Identification Issues

Accurate identification is crucial for completing the FAFSA application successfully. Missing or incorrect documents can delay the financial aid process and require troubleshooting.

- Valid Social Security Number (SSN) - The SSN must match government records; discrepancies can cause application rejection.

- Government-issued Photo ID - A driver's license or passport verifies identity and resolves verification issues.

- Tax Returns and W-2 Forms - These documents confirm income information and prevent data mismatches during verification.

If identification problems arise, contacting the FAFSA help center promptly helps resolve issues efficiently.

What Documents are Required for FAFSA Application? Infographic