To submit the FAFSA, students typically need their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Parents of dependent students must provide their financial information, including tax returns and income details. Having accurate documentation ensures a smooth and timely application process for federal student aid.

What Documents are Needed for FAFSA Submission?

| Number | Name | Description |

|---|---|---|

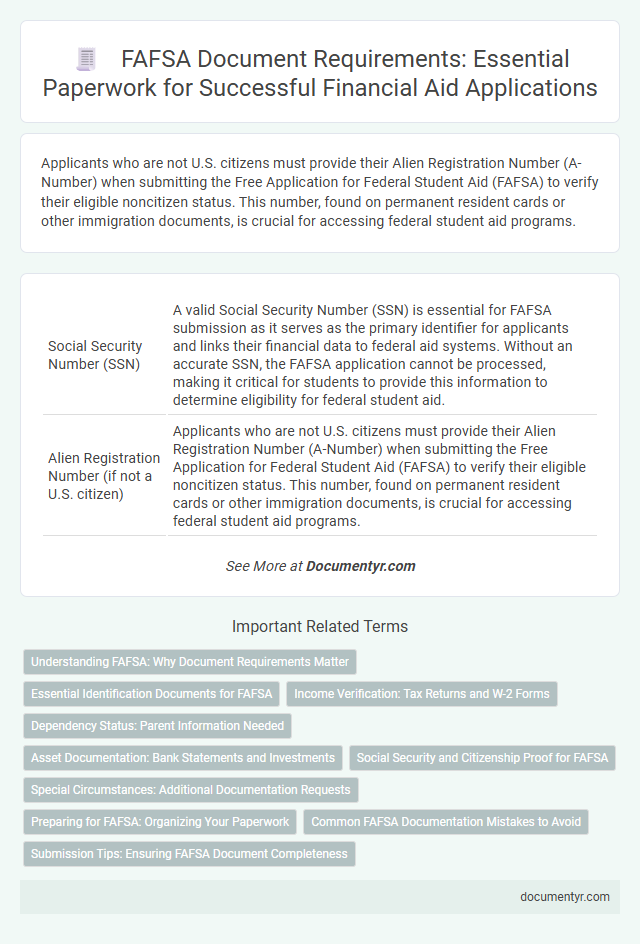

| 1 | Social Security Number (SSN) | A valid Social Security Number (SSN) is essential for FAFSA submission as it serves as the primary identifier for applicants and links their financial data to federal aid systems. Without an accurate SSN, the FAFSA application cannot be processed, making it critical for students to provide this information to determine eligibility for federal student aid. |

| 2 | Alien Registration Number (if not a U.S. citizen) | Applicants who are not U.S. citizens must provide their Alien Registration Number (A-Number) when submitting the Free Application for Federal Student Aid (FAFSA) to verify their eligible noncitizen status. This number, found on permanent resident cards or other immigration documents, is crucial for accessing federal student aid programs. |

| 3 | Federal Income Tax Returns (IRS 1040) | Federal Income Tax Returns (IRS 1040) are essential for FAFSA submission as they provide accurate financial information for determining eligibility for federal student aid. Students and parents must include their most recent IRS 1040 forms or use the IRS Data Retrieval Tool to directly transfer tax data into the FAFSA application. |

| 4 | W-2 Forms | W-2 forms are essential for FAFSA submission as they provide accurate information on earned income, helping to determine financial need and eligibility for federal aid. Applicants should gather W-2s from all employers for the relevant tax year to ensure the FAFSA form reflects precise income data. |

| 5 | Records of Untaxed Income | Records of untaxed income required for FAFSA submission include child support received, veterans noneducation benefits, and worker's compensation. Documentation such as Social Security benefits statements and tax return transcripts help verify these income sources accurately. |

| 6 | Bank Statements | Bank statements provide verification of financial accounts and assets required for accurate FAFSA submission, reflecting current balances and transaction histories. These documents help confirm income, savings, and other resources affecting federal student aid eligibility and award calculations. |

| 7 | Records of Investments | Accurate records of investments such as stocks, bonds, mutual funds, and real estate holdings are essential for FAFSA submission to determine the Expected Family Contribution (EFC). Documentation should include recent statements or account summaries reflecting current values to ensure precise financial information is reported. |

| 8 | FSA ID (for electronic signature) | A valid FSA ID, serving as an electronic signature, is essential for FAFSA submission and must be created online using your Social Security number, full name, and date of birth. Retain your FSA ID credentials securely, as it grants access to your FAFSA account and allows corrections, as well as federal student aid access. |

| 9 | Driver’s License (if applicable) | A valid driver's license is required for FAFSA submission if the applicant has one, as it serves as a form of identification to verify the student's identity. Including the driver's license number helps ensure accurate processing of the Free Application for Federal Student Aid and prevents identity fraud. |

| 10 | Records of Other Assets | Records of other assets required for FAFSA submission include statements for savings accounts, checking accounts, and investments such as stocks, bonds, and mutual funds. Documentation of business and farm assets must also be reported to accurately assess the financial situation. |

| 11 | Parents' Income Information (for dependent students) | Parents' income information required for FAFSA submission includes recent federal tax returns, W-2 forms, and records of untaxed income such as child support or veterans' benefits. Accurate documentation of this financial data is essential for determining a dependent student's eligibility for federal aid. |

| 12 | Child Support Records (if applicable) | FAFSA submission requires child support records if applicable, including documentation showing amounts paid or received during the relevant tax year and proof of legal agreements or court orders. Accurate child support records ensure proper reporting of income or expenses, which can impact financial aid eligibility and award decisions. |

| 13 | Supplemental Nutrition Assistance Program (SNAP) Documentation (if applicable) | FAFSA submission requires Supplemental Nutrition Assistance Program (SNAP) documentation if the applicant or their family received benefits in the past 24 months, which helps qualify for additional financial aid considerations. Applicants should provide official SNAP award letters or benefit verification forms as part of their application to ensure accurate income assessment. |

| 14 | TANF Documentation (if applicable) | FAFSA submission requires TANF documentation if the applicant or their family received Temporary Assistance for Needy Families benefits, including official award letters or proof of payments. This documentation verifies eligibility for certain income exemptions or aid, ensuring accurate financial assessment for federal student aid. |

| 15 | Veterans Benefits Documentation (if applicable) | Veterans benefits documentation required for FAFSA submission includes the Certificate of Eligibility (COE) or proof of VA benefits statement, such as the VA award letter detailing education benefits. Applicants must also provide a copy of their DD Form 214 or proof of military service to verify veteran status and ensure appropriate financial aid consideration. |

Understanding FAFSA: Why Document Requirements Matter

Submitting a FAFSA application requires specific documents to verify your financial and personal information. Understanding these requirements ensures a smooth and accurate application process.

- Social Security Number - This number is essential for identity verification and eligibility determination.

- Federal Income Tax Returns - Tax returns from you and your parents or spouse help calculate your Expected Family Contribution (EFC).

- Bank Statements and Records of Investments - These documents provide detailed information about your financial assets.

Gathering all required documents early can prevent delays and improve your chances of receiving financial aid.

Essential Identification Documents for FAFSA

Submitting the Free Application for Federal Student Aid (FAFSA) requires several essential identification documents to verify your identity and eligibility. Key documents include your Social Security number, a valid driver's license or state ID, and your federal income tax returns. These items ensure accurate processing and help secure your financial aid for education expenses.

Income Verification: Tax Returns and W-2 Forms

Income verification is a critical component of the FAFSA submission process, requiring accurate financial documentation. The primary documents accepted for this purpose are federal tax returns and W-2 forms from the most recent tax year.

Federal tax returns provide a comprehensive overview of an applicant's income, ensuring precise calculation of financial aid eligibility. W-2 forms offer detailed records of earned wages and taxes withheld, supporting the verification of reported income.

Dependency Status: Parent Information Needed

What documents are needed for FAFSA submission regarding dependency status and parent information? You must provide your parents' financial details if you are considered a dependent student. This includes their tax returns, W-2 forms, and records of untaxed income.

Asset Documentation: Bank Statements and Investments

| Document Type | Description | Purpose |

|---|---|---|

| Bank Statements | Recent statements from checking, savings, and money market accounts. | Verify cash, savings, and liquid assets for FAFSA asset reporting. |

| Investment Records | Statements reflecting stocks, bonds, mutual funds, and real estate investments (excluding primary residence). | Provide value of investments to determine financial need and aid eligibility. |

Social Security and Citizenship Proof for FAFSA

To complete the FAFSA submission, applicants must provide their Social Security number as a key identifier. This number ensures accurate matching of financial and personal information across federal databases.

Proof of U.S. citizenship or eligible non-citizen status is essential for FAFSA eligibility. Acceptable documents include a U.S. birth certificate, passport, or permanent resident card.

Special Circumstances: Additional Documentation Requests

When submitting the FAFSA, students with special circumstances may be required to provide additional documentation to verify their unique financial or family situations. Common documents requested include tax returns, proof of income, court orders, or letters explaining changes in household status. These materials help the financial aid office accurately assess eligibility and ensure appropriate aid distribution.

Preparing for FAFSA: Organizing Your Paperwork

Preparing for FAFSA submission requires gathering specific documents to ensure accurate and timely completion. Organizing your paperwork in advance simplifies the process and helps avoid delays.

- Social Security Number - This unique identifier is essential for FAFSA verification and personal records matching.

- Federal Income Tax Returns - Recent tax return documents provide income information necessary for eligibility assessment.

- Bank Statements and Records of Investments - Financial documentation supports the reporting of assets affecting aid qualification.

Common FAFSA Documentation Mistakes to Avoid

Submitting the Free Application for Federal Student Aid (FAFSA) requires precise documentation to ensure eligibility for financial aid. Understanding common mistakes can prevent delays and improve the accuracy of your application.

- Incorrect Social Security Number - Entering an incorrect or mismatched Social Security number can lead to application rejection or processing delays.

- Missing Tax Return Information - Omitting or inaccurately reporting tax return details from the IRS complicates verification and eligibility determination.

- Failing to Update Household Information - Not reflecting changes in household size or member status may result in incorrect aid calculation or delays.

What Documents are Needed for FAFSA Submission? Infographic