SEC registered investment advisors must provide a Form ADV as a primary certificate document, detailing their business practices, fees, and conflicts of interest. They are also required to maintain and submit audited financial statements to demonstrate compliance with regulatory standards. Proper certification documents ensure transparency and adherence to SEC rules for investor protection.

What Certificate Documents Are Needed for SEC Registered Investment Advisor?

| Number | Name | Description |

|---|---|---|

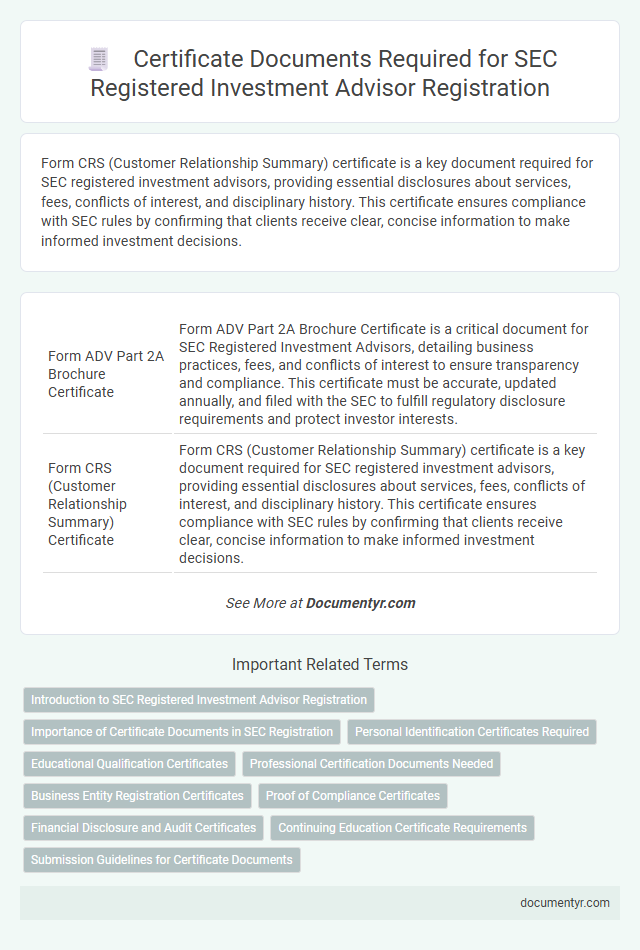

| 1 | Form ADV Part 2A Brochure Certificate | Form ADV Part 2A Brochure Certificate is a critical document for SEC Registered Investment Advisors, detailing business practices, fees, and conflicts of interest to ensure transparency and compliance. This certificate must be accurate, updated annually, and filed with the SEC to fulfill regulatory disclosure requirements and protect investor interests. |

| 2 | Form CRS (Customer Relationship Summary) Certificate | Form CRS (Customer Relationship Summary) certificate is a key document required for SEC registered investment advisors, providing essential disclosures about services, fees, conflicts of interest, and disciplinary history. This certificate ensures compliance with SEC rules by confirming that clients receive clear, concise information to make informed investment decisions. |

| 3 | Compliance Policies & Procedures Attestation | SEC registered investment advisors must submit a Compliance Policies & Procedures Attestation as a critical certificate document to confirm adherence to SEC regulatory standards. This attestation verifies that the firm's compliance policies are effectively implemented and maintained in accordance with SEC Rule 206(4)-7 requirements. |

| 4 | Chief Compliance Officer Designation Certificate | The Chief Compliance Officer (CCO) Designation Certificate is a critical document required for SEC-registered investment advisors to demonstrate the appointment of a qualified individual responsible for overseeing and implementing compliance programs. This certificate must validate the CCO's credentials and their authority to ensure adherence to SEC regulations and internal policies. |

| 5 | Code of Ethics Acknowledgment | SEC Registered Investment Advisors must submit a signed Code of Ethics Acknowledgment as part of their compliance documentation, demonstrating adherence to ethical standards mandated by the SEC. This certificate ensures that all employees and associated persons commit to the firm's Code of Ethics, supporting regulatory transparency and investor protection. |

| 6 | Anti-Money Laundering (AML) Training Certificate | SEC registered investment advisors must obtain and maintain an Anti-Money Laundering (AML) Training Certificate as part of their compliance with federal regulations to prevent financial crimes. This certificate demonstrates that the advisor and their staff have completed mandatory AML training programs designed to detect and report suspicious activities in accordance with SEC guidelines. |

| 7 | Cybersecurity Preparedness Attestation | SEC Registered Investment Advisors must provide a Cybersecurity Preparedness Attestation certificate demonstrating compliance with regulatory cybersecurity standards to ensure client data protection and risk mitigation. This document typically includes detailed assessments of cybersecurity policies, incident response plans, and evidence of ongoing employee training programs. |

| 8 | Business Continuity Plan Certification | SEC registered investment advisors must provide a Business Continuity Plan (BCP) certification demonstrating their ability to resume operations promptly after significant disruptions. This certificate includes documentation of risk assessment, disaster recovery strategies, and communication protocols to ensure compliance with SEC regulations and safeguard client interests. |

| 9 | Privacy Policy Disclosure Certificate | SEC registered investment advisors must provide a Privacy Policy Disclosure Certificate outlining their commitment to protecting client information in compliance with the Gramm-Leach-Bliley Act (GLBA). This certificate ensures transparency about data collection, sharing practices, and safeguards to maintain client confidentiality. |

| 10 | Regulatory Assets Under Management (RAUM) Certification | SEC Registered Investment Advisors must provide accurate Regulatory Assets Under Management (RAUM) certification documents, including detailed calculations of assets under management and supporting financial statements. These documents ensure compliance with SEC regulations and validate the advisor's reported RAUM for proper oversight and investor protection. |

Introduction to SEC Registered Investment Advisor Registration

What certificate documents are required for SEC Registered Investment Advisor registration? Your registration process with the SEC mandates specific documentation to ensure compliance. These certificates verify your qualifications, background, and adherence to regulatory standards.

Importance of Certificate Documents in SEC Registration

Certificate documents are crucial for SEC Registered Investment Advisors as they validate compliance and legal standing. These documents ensure Your registration reflects adherence to regulatory standards, protecting both the advisor and clients.

- Form ADV - This primary disclosure document outlines the advisor's business, ownership, clients, and potential conflicts of interest.

- State Registration Certificates - Required if the advisor operates in specific states, demonstrating state-level authorization alongside SEC registration.

- Compliance Policies and Procedures - Certifications confirming the implementation of internal controls to meet SEC regulatory requirements.

Personal Identification Certificates Required

Personal identification certificates are essential for SEC registered investment advisors to verify their identity and maintain compliance with regulatory requirements. These documents ensure that advisors meet legal standards and protect client interests.

- Government-Issued ID - A valid passport or driver's license serves as primary proof of identity and citizenship.

- Social Security Card - This card confirms the advisor's Social Security number, necessary for tax and employment verification.

- Proof of Residency - Recent utility bills or bank statements verify the advisor's residential address to ensure proper jurisdictional identification.

Maintaining up-to-date personal identification certificates is critical for SEC registered investment advisors to uphold integrity and regulatory compliance.

Educational Qualification Certificates

Educational qualification certificates are essential documents for SEC registered investment advisors to verify their academic background. These certificates typically include degrees in finance, business administration, economics, or related fields relevant to investment advising. Providing your educational certificates ensures compliance with SEC registration requirements and demonstrates professional credibility.

Professional Certification Documents Needed

Professional certification documents are essential for SEC registered investment advisors to demonstrate expertise and compliance. These certifications validate the advisor's qualifications and adherence to regulatory standards.

Key documents include copies of licenses such as the Series 65 or 66, Certified Financial Planner (CFP) certification, and Chartered Financial Analyst (CFA) credentials. Proof of continuing education and any relevant state registrations may also be required. Your submission must include all current certifications to satisfy SEC documentation requirements.

Business Entity Registration Certificates

SEC registered investment advisors must obtain Business Entity Registration Certificates as part of their compliance documentation. These certificates verify the legal formation and authorization of the advisory firm within its operating jurisdiction. Common examples include Articles of Incorporation, Certificates of Formation, and State Business Licenses required for registration with the SEC.

Proof of Compliance Certificates

Proof of compliance certificates are essential documents required for SEC registered investment advisors. These certificates verify adherence to regulatory standards and help maintain transparency with clients and regulators.

- Form ADV Compliance Certification - Demonstrates that you comply with the SEC's registration and reporting requirements.

- Compliance Policies and Procedures Certificate - Confirms the establishment and implementation of internal controls to meet SEC regulations.

- Annual Compliance Review Report - Provides evidence of periodic internal audits and compliance assessments as required by the SEC.

Financial Disclosure and Audit Certificates

SEC registered investment advisors must provide specific certificate documents to ensure regulatory compliance. These include financial disclosure statements and audit certificates that verify the accuracy of financial information.

Financial disclosure documents detail your firm's financial condition and highlight any potential conflicts of interest. Audit certificates, prepared by independent auditors, confirm the integrity and reliability of your financial statements.

Continuing Education Certificate Requirements

| Certificate Document | Description | Purpose | Frequency/Deadline |

|---|---|---|---|

| Continuing Education (CE) Certificate | Proof of completion of required continuing education courses as mandated for SEC Registered Investment Advisors (RIAs). | Demonstrates ongoing compliance with industry knowledge and regulatory updates to maintain advisory certification and registration standards. | Typically required annually or biennially depending on specific SEC rules or firm policies. |

| Accredited Investment Fiduciary (AIF) Certificate | Certification indicating completion of fiduciary education programs designed to strengthen compliance and fiduciary responsibility. | Supports fiduciary duty standards adherence and professional competence for SEC-registered advisors. | Renewal or proof of updated fiduciary education often required every 1-3 years. |

| CFA Continuing Education Credits | Documentation of ongoing professional development credits for Chartered Financial Analyst charterholders acting as RIAs. | Ensures maintenance of ethical and professional standards per CFA Institute and SEC guidelines. | Recurrent reporting and education typically on an annual basis. |

| Compliance and Regulatory Training Certificate | Records of successful completion of compliance training focused on SEC rules and regulations for investment advisors. | Enhances understanding and adherence to evolving SEC regulatory frameworks and reduces risk of violations. | Generally required annually or as updated regulatory mandates demand. |

| Anti-Money Laundering (AML) Training Certificate | Certification proving completion of AML courses relevant to investment advisory practices. | Meets regulatory requirements for preventing financial crimes and ensures advisor awareness of AML procedures. | Required periodically, often annually or per specific SEC compliance timelines. |

What Certificate Documents Are Needed for SEC Registered Investment Advisor? Infographic