When applying for a business loan, essential documents include a detailed business plan, financial statements such as balance sheets and income statements, and tax returns for the past two to three years. Lenders also typically require personal identification, proof of business ownership, and bank statements to assess cash flow. Securing a certificate pet, which verifies your entity's registration status, can further strengthen your application by confirming your business's legitimacy.

What Documents are Necessary for Applying for a Business Loan?

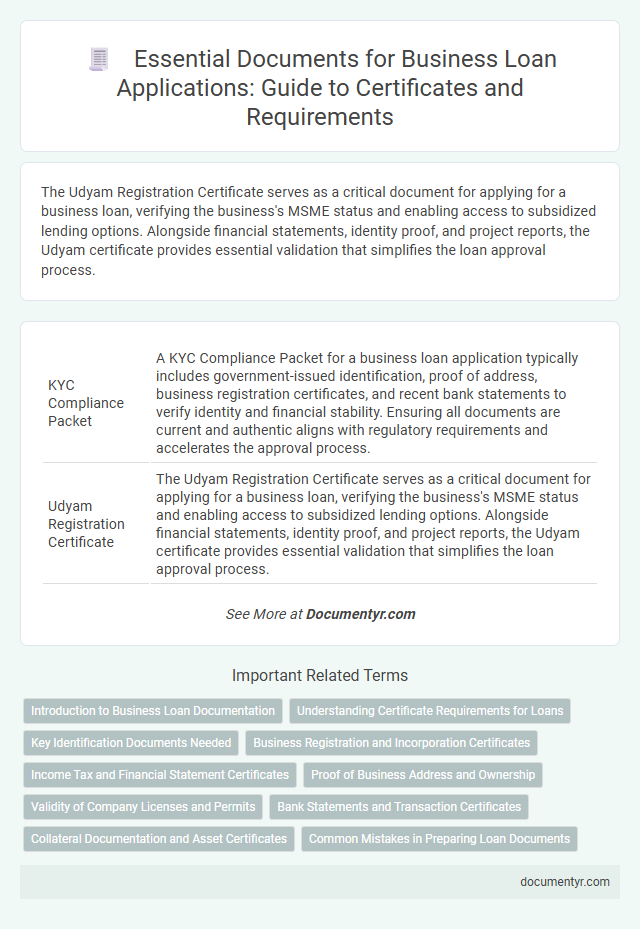

| Number | Name | Description |

|---|---|---|

| 1 | KYC Compliance Packet | A KYC Compliance Packet for a business loan application typically includes government-issued identification, proof of address, business registration certificates, and recent bank statements to verify identity and financial stability. Ensuring all documents are current and authentic aligns with regulatory requirements and accelerates the approval process. |

| 2 | Udyam Registration Certificate | The Udyam Registration Certificate serves as a critical document for applying for a business loan, verifying the business's MSME status and enabling access to subsidized lending options. Alongside financial statements, identity proof, and project reports, the Udyam certificate provides essential validation that simplifies the loan approval process. |

| 3 | Digital Business Financial Footprint | Lenders require comprehensive digital business financial footprints such as bank statements, tax returns, and digital payment processor records to assess creditworthiness when applying for a business loan. Detailed financial documents including profit and loss statements, balance sheets, and e-invoices are crucial to demonstrate consistent revenue streams and financial stability in the digital landscape. |

| 4 | GST Return Filings Summary | A comprehensive GST Return Filings Summary demonstrates consistent business transactions and revenue, which lenders use to assess financial stability when applying for a business loan. Accurate GST returns, including details of Input Tax Credit and output tax liability, validate compliance and enhance loan approval chances. |

| 5 | Neobank Transaction Statement | Submitting a Neobank transaction statement is essential when applying for a business loan as it provides a detailed record of recent financial activity, demonstrating cash flow and spending patterns. Lenders utilize these statements to assess the business's financial health and repayment capability, making them a critical part of the document verification process. |

| 6 | Alt Credit Score Report | Providing an Alt Credit Score Report is crucial when applying for a business loan, as it offers lenders an alternative evaluation of creditworthiness beyond traditional credit scores. Along with this report, essential documents include financial statements, tax returns, business licenses, and identification to verify the business's legitimacy and financial health. |

| 7 | E-Agreement of Collateral | E-Agreement of Collateral is essential when applying for a business loan as it legally binds the borrower to secure the loan with specified assets, ensuring lender protection. This digital document must include detailed terms of the collateral, signatures, and compliance with e-signature regulations to validate its authenticity and enforceability. |

| 8 | MSME Self-Declaration Form | MSME Self-Declaration Form is a crucial document for applying for a business loan, serving as proof of micro, small, and medium enterprise status. It accelerates loan approval by verifying eligibility and enabling access to special interest rates and government-backed schemes. |

| 9 | Purpose of Loan Affidavit | The Purpose of Loan Affidavit is a crucial document in applying for a business loan, as it clearly states the intended use of the loan funds, ensuring transparency and compliance with lender requirements. This affidavit helps financial institutions assess the viability and risk associated with the loan by verifying that the funds will be used strictly for business-related purposes. |

| 10 | ESG Compliance Certificate | An ESG Compliance Certificate is crucial when applying for a business loan as it demonstrates adherence to environmental, social, and governance standards, which lenders increasingly require for risk assessment and sustainability goals. Essential documents include the ESG Compliance Certificate itself, financial statements, business plans, tax returns, and relevant licenses, ensuring transparency and commitment to responsible business practices. |

Introduction to Business Loan Documentation

Applying for a business loan requires thorough preparation of specific documents to prove your financial stability and business legitimacy. Proper documentation streamlines the approval process and enhances your chances of securing funds.

The essential documents typically include financial statements, tax returns, business plans, and identification proofs. These papers provide lenders with a clear picture of your business's performance and repayment capability. Understanding these requirements helps you organize your application efficiently and avoid delays.

Understanding Certificate Requirements for Loans

Understanding certificate requirements is crucial when applying for a business loan. Proper documentation ensures a smoother loan approval process and demonstrates your business's legitimacy.

- Business Registration Certificate - This certificate verifies the legal existence of your business and is required by lenders to confirm your company is officially registered.

- Tax Registration Certificate - Lenders require this document to ensure your business complies with tax regulations and has a valid tax identification number.

- Ownership or Incorporation Certificate - This certificate specifies the ownership structure or incorporation details of your business, helping lenders assess your business's credibility and structure.

Key Identification Documents Needed

When applying for a business loan, key identification documents are crucial to verify the legitimacy of the applicant. These documents establish the identity of the business owner and the legal status of the business.

Essential identification documents include a valid government-issued ID such as a passport or driver's license. Business registration documents and tax identification numbers are also required to confirm the business's legal existence and compliance.

Business Registration and Incorporation Certificates

Business registration and incorporation certificates are essential documents when applying for a business loan. These certificates verify the legal existence and legitimacy of your company.

- Business Registration Certificate - Confirms that your business is officially registered with the appropriate local or national authorities.

- Incorporation Certificate - Provides legal proof that your business is incorporated under corporate laws, establishing it as a separate legal entity.

- Importance for Loan Approval - Lenders require these certificates to ensure your business meets compliance standards and is eligible for funding.

Including accurate business registration and incorporation certificates increases the likelihood of securing a business loan.

Income Tax and Financial Statement Certificates

What documents are necessary for applying for a business loan? Income Tax Returns and Financial Statement Certificates play a crucial role in this process. These documents provide lenders with a clear picture of your business's financial health and tax compliance.

Proof of Business Address and Ownership

| Document | Description | Purpose |

|---|---|---|

| Proof of Business Address | Official documents verifying the physical location of the business, such as utility bills, lease agreements, or property tax receipts. | Establishes the legitimacy and operational location of the business for the lender. |

| Certificate of Business Ownership | Legal documents proving ownership, including business registration certificates, partnership agreements, or articles of incorporation. | Confirms the rightful owner(s) of the business applying for the loan. |

Validity of Company Licenses and Permits

Applying for a business loan requires submitting various documents, with company licenses and permits being crucial for approval. Valid and up-to-date licenses demonstrate your business's compliance with legal and regulatory standards. Ensuring the validity of these documents helps streamline the loan application process and increases your chances of securing funding.

Bank Statements and Transaction Certificates

Applying for a business loan requires specific documents to verify financial stability and business transactions. Bank statements and transaction certificates are essential to provide a clear financial history.

- Bank Statements - These documents show detailed records of your account activities, proving your income flow and expenses.

- Transaction Certificates - These certificates validate specific transactions, confirming the authenticity of key business deals.

- Financial Verification - Both documents work together to demonstrate creditworthiness and operational transparency to lenders.

Collateral Documentation and Asset Certificates

Collateral documentation is essential when applying for a business loan, as it provides proof of assets that can secure the loan. Typical documents include property deeds, vehicle titles, and machinery ownership certificates.

Asset certificates validate the ownership and value of your business assets, ensuring the lender's confidence in the collateral provided. These certificates often include inventory lists, equipment appraisals, and financial statements verifying asset worth.

What Documents are Necessary for Applying for a Business Loan? Infographic