To obtain 501(c)(3) status, a nonprofit must prepare several key documents, including articles of incorporation, which establish the organization's legal existence and outline its charitable purpose. The organization also needs bylaws that govern internal operations and a detailed Form 1023 or Form 1023-EZ application submitted to the IRS, demonstrating compliance with tax-exempt requirements. Maintaining proper records of meetings, financial statements, and evidence of charitable activities supports transparency and ongoing compliance with 501(c)(3) regulations.

What Documents Does a Nonprofit Need for 501(c)(3) Status?

| Number | Name | Description |

|---|---|---|

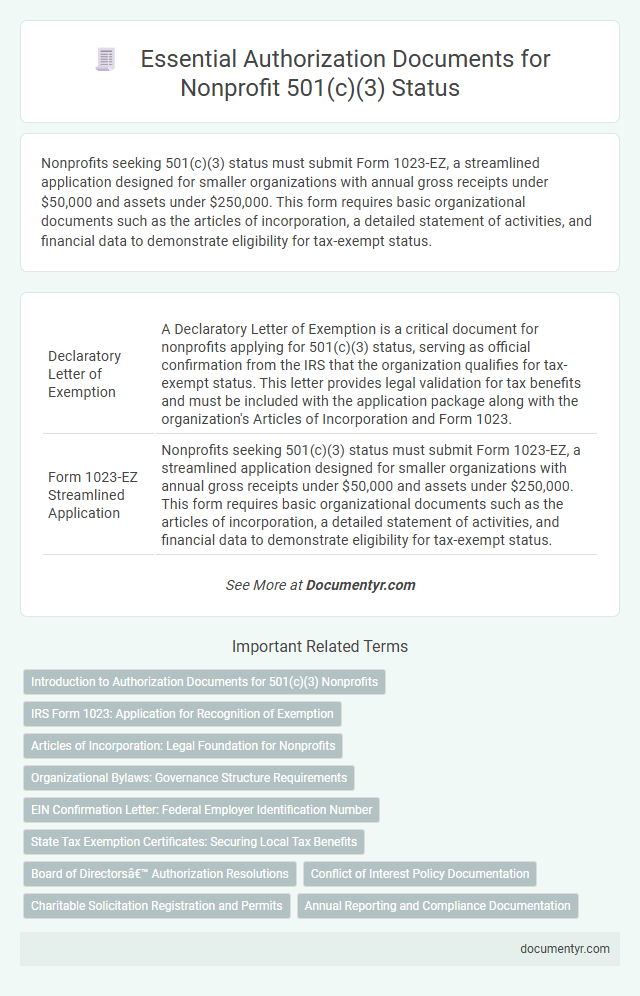

| 1 | Declaratory Letter of Exemption | A Declaratory Letter of Exemption is a critical document for nonprofits applying for 501(c)(3) status, serving as official confirmation from the IRS that the organization qualifies for tax-exempt status. This letter provides legal validation for tax benefits and must be included with the application package along with the organization's Articles of Incorporation and Form 1023. |

| 2 | Form 1023-EZ Streamlined Application | Nonprofits seeking 501(c)(3) status must submit Form 1023-EZ, a streamlined application designed for smaller organizations with annual gross receipts under $50,000 and assets under $250,000. This form requires basic organizational documents such as the articles of incorporation, a detailed statement of activities, and financial data to demonstrate eligibility for tax-exempt status. |

| 3 | Mission Statement Alignment Report | A Mission Statement Alignment Report is essential for 501(c)(3) status as it demonstrates consistency between the nonprofit's activities and its stated charitable purpose required by the IRS. This report ensures that the organization's mission statement aligns precisely with IRS guidelines to qualify for tax-exempt status under section 501(c)(3). |

| 4 | Public Support Test Documentation | Nonprofits seeking 501(c)(3) status must provide Public Support Test Documentation, including IRS Form 990 and detailed records of contributions from the general public to demonstrate sustained public financial support. These documents quantify the organization's reliance on public funding, ensuring compliance with IRS requirements to maintain tax-exempt status. |

| 5 | Organizational Conflict-of-Interest Policy | A comprehensive Organizational Conflict-of-Interest Policy is essential for a nonprofit seeking 501(c)(3) status to ensure board members and employees disclose any financial interests that could compromise the organization's integrity. The IRS requires this policy to demonstrate accountability and prevent decisions that may benefit private interests over the charity's mission. |

| 6 | IRS Determination Letter | A nonprofit seeking 501(c)(3) status must obtain an IRS Determination Letter, which serves as official recognition of its tax-exempt status under the Internal Revenue Code. This letter is issued after submitting Form 1023 or 1023-EZ, along with the organization's organizing documents, financial statements, and a detailed description of its activities. |

| 7 | Fiscal Sponsorship Agreement | A Fiscal Sponsorship Agreement is a critical document for nonprofits seeking 501(c)(3) status, outlining the relationship between the sponsored project and the fiscal sponsor, including financial management and legal responsibilities. This agreement ensures compliance with IRS requirements by clearly defining roles in tax-exempt activities and the handling of funds under the sponsor's tax-exempt status. |

| 8 | Charitable Purpose Compliance Checklist | Nonprofits seeking 501(c)(3) status must prepare a Charitable Purpose Compliance Checklist that includes their articles of incorporation, bylaws, and a detailed statement of purpose aligning with IRS requirements for charitable, religious, educational, or scientific activities. Supporting documents such as financial statements, fundraising plans, and records demonstrating organizational governance further ensure compliance with federal regulations. |

| 9 | Narrative Description of Activities | The narrative description of activities for 501(c)(3) status must clearly outline the nonprofit's specific programs, how they operate, and their charitable purpose to demonstrate alignment with IRS requirements. Detailed explanations of past, present, and planned activities provide crucial evidence that the organization is organized and operated exclusively for exempt purposes under Section 501(c)(3). |

| 10 | Bylaws Transparency Addendum | Nonprofits seeking 501(c)(3) status must include their bylaws and a Transparency Addendum as critical documents to ensure compliance with IRS requirements and promote organizational accountability. The Transparency Addendum outlines governance policies and conflict of interest guidelines, enhancing donor trust and regulatory adherence. |

Introduction to Authorization Documents for 501(c)(3) Nonprofits

What documents are essential for obtaining 501(c)(3) status for a nonprofit? Authorization for 501(c)(3) status requires specific legal and organizational documents. Your application must include evidence of your nonprofit's structure and compliance with IRS requirements.

IRS Form 1023: Application for Recognition of Exemption

IRS Form 1023 is the primary document required to apply for 501(c)(3) tax-exempt status. This detailed application collects information about your nonprofit's structure, finances, and operations to determine eligibility. Accurate completion of Form 1023 is crucial for obtaining official recognition of exemption from federal income tax.

Articles of Incorporation: Legal Foundation for Nonprofits

Articles of Incorporation serve as the legal foundation for nonprofits seeking 501(c)(3) status. This document establishes the organization's existence and outlines its purpose, structure, and governance.

Filing Articles of Incorporation with the state is a mandatory step in the authorization process. Properly drafted articles ensure compliance with IRS requirements for tax-exempt status.

Organizational Bylaws: Governance Structure Requirements

Organizational bylaws are essential documents required for obtaining 501(c)(3) status for a nonprofit. These bylaws establish the governance framework and ensure compliance with IRS regulations.

- Defined Board Structure - Bylaws must specify the composition, roles, and responsibilities of the board of directors.

- Meeting Protocols - Clear procedures for calling, conducting, and documenting board meetings are required.

- Officer Duties - Bylaws should outline the specific duties and authority of key officers such as president, secretary, and treasurer.

Properly drafted bylaws demonstrate the nonprofit's adherence to governance standards critical for 501(c)(3) approval.

EIN Confirmation Letter: Federal Employer Identification Number

The EIN Confirmation Letter is a crucial document for nonprofits applying for 501(c)(3) status. It verifies the organization's Federal Employer Identification Number (EIN), which is required for tax purposes.

Obtaining the EIN Confirmation Letter from the IRS establishes the nonprofit's legal identity. This letter is necessary to complete the Form 1023 application for tax-exempt status. Without this document, the IRS cannot process the 501(c)(3) application.

State Tax Exemption Certificates: Securing Local Tax Benefits

State Tax Exemption Certificates are essential for nonprofits seeking to maximize their local tax benefits after obtaining 501(c)(3) status. These certificates exempt your organization from state sales, property, and use taxes, reducing operational costs significantly.

To secure a State Tax Exemption Certificate, you must submit an application to the relevant state tax authority, often requiring proof of your federal 501(c)(3) determination letter. Maintaining compliance with state regulations ensures continuous eligibility and access to critical tax advantages at the local level.

Board of Directors’ Authorization Resolutions

Obtaining 501(c)(3) status requires specific authorization from the nonprofit's Board of Directors. Board of Directors' authorization resolutions are essential documents demonstrating formal approval of key actions.

- Approval of Incorporation - The board must pass a resolution authorizing the nonprofit's incorporation and formation.

- Application for Tax-Exempt Status - A resolution formally approving the submission of IRS Form 1023 or 1023-EZ is required.

- Adoption of Bylaws - The board must ratify the nonprofit's bylaws through an official resolution supporting organizational governance.

Conflict of Interest Policy Documentation

A Conflict of Interest Policy is a critical document required for 501(c)(3) status application. This policy ensures that board members and staff disclose any potential conflicts to maintain transparency and uphold the organization's integrity. The IRS reviews this documentation to confirm proper governance and prevent personal gain from influencing nonprofit decisions.

Charitable Solicitation Registration and Permits

Charitable solicitation registration is a key requirement for nonprofits seeking 501(c)(3) status to legally raise funds. You must obtain specific permits from state authorities before soliciting donations.

- State Registration - Most states require nonprofits to register with the charity official before fundraising activities.

- Permits and Licenses - Local permits may be necessary to conduct solicitation events depending on jurisdiction.

- Ongoing Compliance - Annual renewal of registrations ensures continued authorization to solicit funds legally.

What Documents Does a Nonprofit Need for 501(c)(3) Status? Infographic