To obtain student loan authorization, applicants must provide proof of identity such as a government-issued ID, a completed loan application form, and verification of enrollment from their educational institution. Financial documents like proof of income or tax returns may also be required to assess eligibility and repayment capacity. Loan authorization processes often include submitting a signed promissory note and adhering to any specific requirements set by the lending institution or government agency.

What Documents Are Required for Student Loan Authorization?

| Number | Name | Description |

|---|---|---|

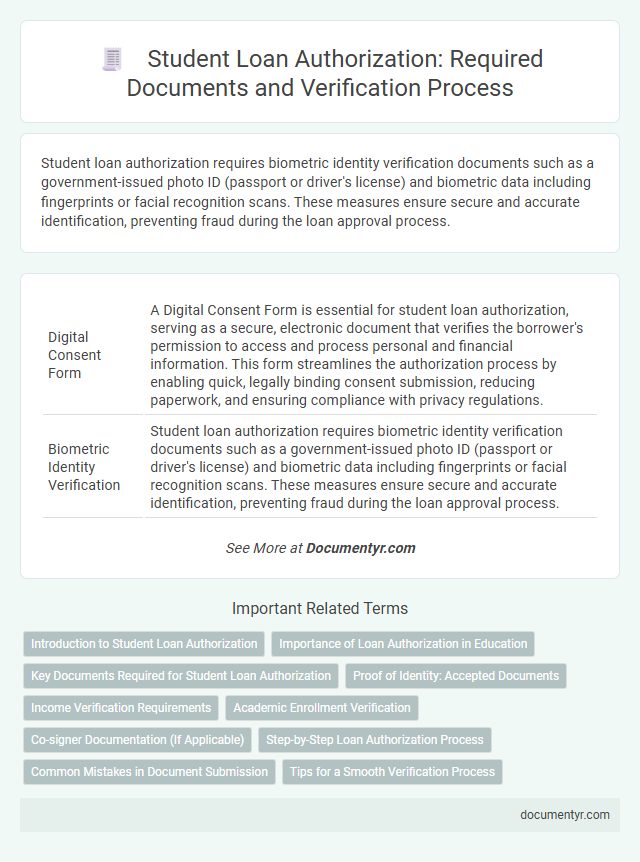

| 1 | Digital Consent Form | A Digital Consent Form is essential for student loan authorization, serving as a secure, electronic document that verifies the borrower's permission to access and process personal and financial information. This form streamlines the authorization process by enabling quick, legally binding consent submission, reducing paperwork, and ensuring compliance with privacy regulations. |

| 2 | Biometric Identity Verification | Student loan authorization requires biometric identity verification documents such as a government-issued photo ID (passport or driver's license) and biometric data including fingerprints or facial recognition scans. These measures ensure secure and accurate identification, preventing fraud during the loan approval process. |

| 3 | Blockchain-based Academic Transcript | Student loan authorization requires submission of official academic transcripts, with blockchain-based academic transcripts providing a secure, tamper-proof verification method recognized by financial institutions. These digital records ensure the authenticity and accuracy of a student's academic credentials, streamlining the loan approval process. |

| 4 | Parental Income E-verification Certificate | The Parental Income E-verification Certificate is a crucial document required for student loan authorization, as it validates the financial status of the borrower's parents through a secure electronic verification system. This certificate ensures accurate assessment of repayment capacity and eligibility by linking income data directly from government tax records. |

| 5 | e-KYC (Know Your Customer) Document | Student loan authorization requires the submission of e-KYC documents such as a valid government-issued ID (passport, driver's license, or national ID card), proof of address (utility bill or bank statement), and a recent photograph to verify identity electronically. These documents facilitate secure, compliant verification processes, ensuring borrower authenticity and eligibility for loan approval. |

| 6 | Auto-generated Loan Affordability Report | The Auto-generated Loan Affordability Report requires recent income statements, credit history, enrollment verification, and identification documents to accurately assess a student's financial status. This report consolidates key financial data to facilitate timely and precise authorization decisions for student loan applications. |

| 7 | AI-powered Creditworthiness Assessment | Student loan authorization requires documents such as proof of identity, income statements, academic enrollment verification, and credit history reports, enabling AI-powered creditworthiness assessment algorithms to analyze financial reliability accurately. These AI systems integrate data from tax returns, bank statements, and prior loan repayment records to deliver personalized loan approval decisions efficiently. |

| 8 | Remote Signature Authorization | Remote signature authorization for student loans requires valid identification documents such as a government-issued ID or passport, proof of enrollment from an accredited educational institution, and a signed authorization form completed via secure electronic signature platforms compliant with the E-SIGN Act. Lenders may also require recent income documentation or tax returns to verify eligibility before granting authorization remotely. |

| 9 | Real-time Enrollment Status Certificate | A Real-time Enrollment Status Certificate is essential for student loan authorization as it verifies the borrower's current enrollment status directly with the educational institution, ensuring up-to-date information for loan processing. This document is critical for lenders to confirm eligibility and disburse funds accordingly within the authorized academic period. |

| 10 | API-linked Scholarship Proof | Student loan authorization requires submission of official transcripts, a valid government-issued ID, and an API-linked scholarship proof document verifying financial aid eligibility through secure data integration. This API-linked scholarship proof streamlines verification by automatically cross-referencing scholarship awards with loan applications, ensuring accurate and timely authorization. |

Introduction to Student Loan Authorization

Student loan authorization is a crucial step in securing financial aid for education. It involves submitting specific documents that verify your identity and eligibility.

- Proof of Identity - A government-issued ID such as a passport or driver's license is required to confirm your identity.

- Enrollment Verification - Official documentation from your educational institution confirming your current or upcoming enrollment is essential.

- Financial Information - Pay stubs, tax returns, or bank statements may be needed to assess your financial situation and loan eligibility.

Importance of Loan Authorization in Education

Student loan authorization is essential for accessing educational funding and ensuring eligibility for financial aid. Required documents typically include identification proof, admission letters, income statements, and credit history reports.

Loan authorization protects your financial interests and confirms your ability to repay the loan responsibly. This process supports a smooth approval, enabling uninterrupted focus on academic goals and future success.

Key Documents Required for Student Loan Authorization

Student loan authorization requires submitting specific documents to verify eligibility and identity. These key documents ensure the loan application process complies with regulatory standards and protects both the lender and borrower.

- Proof of Identity - A government-issued ID such as a passport or driver's license is necessary to confirm the borrower's identity.

- Proof of Enrollment - An official enrollment certificate or acceptance letter from the educational institution verifies the student's active status.

- Financial Documentation - Recent tax returns, income statements, or bank statements are required to assess the borrower's financial situation and repayment ability.

Proof of Identity: Accepted Documents

Proof of identity is a crucial requirement for student loan authorization to ensure the borrower's authenticity. Accepted documents commonly include government-issued identification such as a valid passport or driver's license.

Other acceptable forms of proof may include a national identity card or a state-issued ID card. These documents must be current and contain a clear photograph to meet authorization standards.

Income Verification Requirements

When applying for student loan authorization, income verification is a crucial part of the documentation process. This ensures that lenders assess your repayment capacity accurately.

Typical income verification documents include recent pay stubs, federal tax returns, and W-2 forms. Self-employed applicants may need to provide additional paperwork such as profit and loss statements or 1099 forms. Banks or loan providers use these documents to confirm steady income and evaluate financial stability before authorization.

Academic Enrollment Verification

Academic Enrollment Verification is a crucial document for student loan authorization. It confirms a student's current enrollment status at an accredited institution, ensuring eligibility for loan approval. Lenders often require official enrollment letters or transcripts as proof to process loan applications promptly.

Co-signer Documentation (If Applicable)

| Document Type | Description | Purpose | Additional Notes |

|---|---|---|---|

| Co-signer Identification | Government-issued ID such as passport, driver's license, or state ID | Verifies identity of co-signer to ensure loan agreement validity | ID must be current and unexpired |

| Proof of Income | Recent pay stubs, tax returns, or W-2 forms | Demonstrates co-signer's financial ability to repay the loan | Usually last 2-3 months of pay stubs or most recent tax return |

| Credit History Authorization | Authorization form for credit check | Allows lender to assess creditworthiness and risk associated with co-signer | Must be signed by co-signer and submitted with loan application |

| Co-signer Agreement | Legally binding document outlining responsibilities | Formalizes co-signer's role and obligations in the loan agreement | Required for all loans with a co-signer involved |

| Residency Verification | Utility bills, lease agreements, or other proof of address | Confirms co-signer's address to ensure jurisdiction and communication validity | Documents should be recent, typically within last 3 months |

Step-by-Step Loan Authorization Process

Obtaining student loan authorization requires submitting specific documents to verify identity, enrollment, and financial status. Following a structured process ensures timely approval and access to funds.

- Proof of Identity - Valid government-issued ID such as a passport or driver's license is required to confirm the borrower's identity.

- Enrollment Verification - An official letter or certificate from the educational institution proving current or upcoming enrollment is mandatory.

- Financial Documents - Recent tax returns, bank statements, or proof of income are necessary to assess the borrower's financial capability.

Submitting these documents step-by-step completes the authorization process efficiently and secures the loan approval.

Common Mistakes in Document Submission

What documents are required for student loan authorization? A valid government-issued ID, proof of admission from the educational institution, and financial statements are typically necessary. Submitting incomplete or expired documents often causes delays in the authorization process.

How can applicants avoid common mistakes in document submission for student loan authorization? Applicants should carefully review all document requirements and ensure clarity and accuracy before submission. Missing signatures and unclear photocopies are frequent errors that lead to rejection or additional requests.

Why is it important to submit authentic documents during student loan authorization? Loan officers verify authenticity to prevent fraud and secure proper funding allocation. Forged or altered documents result in immediate disqualification from the loan approval process.

Which proof of income documents are commonly required for student loan authorization? Recent tax returns, pay stubs, and bank statements serve as standard evidence of financial capacity. Submitting outdated or unrelated income documents often undermines the trustworthiness of the application.

What often causes delays in processing student loan authorizations related to documentation? Missing mandatory forms and inconsistent information across submitted documents are major reasons. Ensuring all paperwork is complete and consistent accelerates the loan approval timeline.

What Documents Are Required for Student Loan Authorization? Infographic