College students must provide proof of identity, such as a valid Social Security number, along with their federal tax returns or income records when submitting the FAFSA. A valid driver's license or state ID and records of untaxed income may also be required to verify eligibility. The student's citizenship status or eligible noncitizen documentation is essential for the application process.

What Documents Does a College Student Need for FAFSA Submission?

| Number | Name | Description |

|---|---|---|

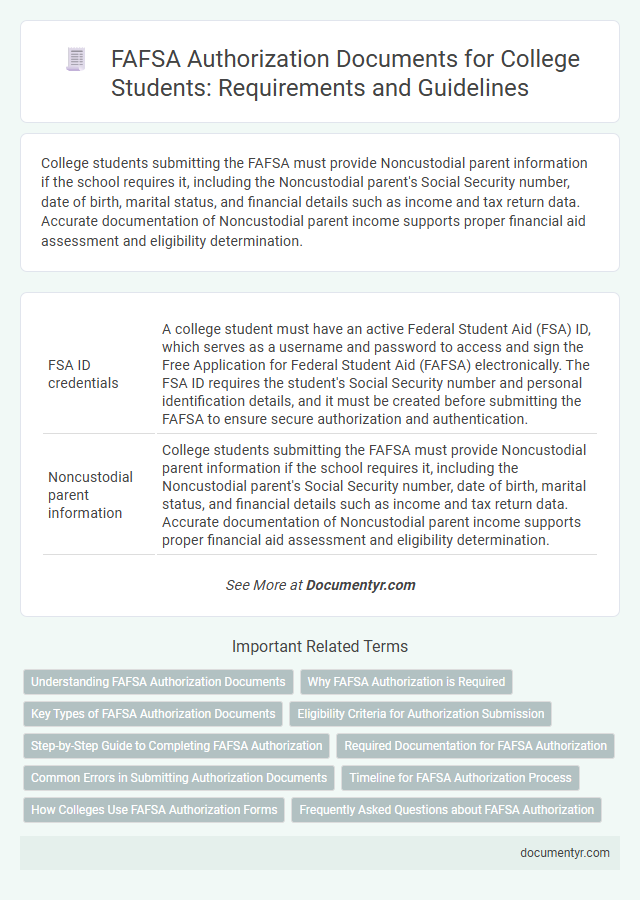

| 1 | FSA ID credentials | A college student must have an active Federal Student Aid (FSA) ID, which serves as a username and password to access and sign the Free Application for Federal Student Aid (FAFSA) electronically. The FSA ID requires the student's Social Security number and personal identification details, and it must be created before submitting the FAFSA to ensure secure authorization and authentication. |

| 2 | Noncustodial parent information | College students submitting the FAFSA must provide Noncustodial parent information if the school requires it, including the Noncustodial parent's Social Security number, date of birth, marital status, and financial details such as income and tax return data. Accurate documentation of Noncustodial parent income supports proper financial aid assessment and eligibility determination. |

| 3 | IRS Data Retrieval Tool (DRT) confirmation | College students must confirm the use of the IRS Data Retrieval Tool (DRT) during FAFSA submission by having a valid Social Security number, a completed federal income tax return, and login credentials for the IRS website to transfer tax data securely. Successful IRS DRT confirmation streamlines the FAFSA process and ensures accurate income information is automatically imported, reducing errors and verification requirements. |

| 4 | Asset protection allowance statements | College students must provide asset protection allowance statements as part of their FAFSA submission to demonstrate the portion of assets exempt from financial aid calculations. These statements help accurately account for allowable asset protection, minimizing expected family contribution and maximizing eligibility for need-based aid. |

| 5 | Untaxed income verification | College students submitting FAFSA must provide documentation verifying untaxed income sources such as child support received, veterans' non-education benefits, and workers' compensation. Acceptable documents include official benefit statements, IRS verification of untaxed income, and signed statements detailing amounts not reported to the IRS. |

| 6 | Selective Service registration proof | College students submitting FAFSA must provide proof of Selective Service registration if they are male and between the ages of 18 and 25, which can be verified using the Selective Service System confirmation number or registration status online. Failure to provide valid registration documentation may affect eligibility for federal student aid. |

| 7 | Dependency override documentation | College students seeking a dependency override for FAFSA submission must provide official documentation such as court orders, letters from a qualified third party (e.g., social worker, shelter director), or evidence of parental abuse or abandonment to substantiate the change in dependency status. These documents are crucial to demonstrate unusual circumstances that justify the student being considered independent for financial aid purposes. |

| 8 | Special circumstance appeal letters | Special circumstance appeal letters require detailed documentation such as a written explanation of the hardship, supporting financial records, and any relevant legal or medical documents to substantiate the appeal for FAFSA adjustments. Colleges often request these documents alongside standard FAFSA submissions to accurately assess changes in a student's or family's financial situation. |

| 9 | FAFSA Submission Summary (formerly SAR) | The FAFSA Submission Summary, formerly known as the Student Aid Report (SAR), provides a comprehensive overview of the student's FAFSA application, highlighting key data required to verify eligibility for federal student aid. Students must keep this document along with their Social Security number, federal income tax returns, and proof of citizenship or eligible non-citizen status for successful FAFSA submission and verification. |

| 10 | Legal guardianship court orders | College students submitting the FAFSA must provide legal guardianship court orders if they are not living with their biological parents to verify custodial status. These documents establish the student's eligibility for financial aid by confirming the guardian's legal authority and responsibility. |

Understanding FAFSA Authorization Documents

Submitting the Free Application for Federal Student Aid (FAFSA) requires specific authorization documents to verify identity and eligibility. These documents ensure accurate financial aid assessment and compliance with federal regulations.

Valid identification such as a Social Security card or U.S. passport is essential for FAFSA submission. Tax returns, W-2 forms, and income records may also be needed to complete the authorization process effectively.

Why FAFSA Authorization is Required

FAFSA authorization requires access to specific documents to verify identity and financial status. This process ensures the accuracy of information provided for federal student aid eligibility.

Documents such as your Social Security number, driver's license, and recent tax returns are essential for FAFSA submission. Authorization protects your data and confirms your consent for financial information review.

Key Types of FAFSA Authorization Documents

College students must gather specific authorization documents to complete the FAFSA submission accurately. These documents verify identity and financial information essential for federal aid eligibility.

- Social Security Number - Used to confirm the student's identity and eligibility for federal student aid.

- Driver's License or State ID - Provides additional proof of identity for verification purposes during FAFSA processing.

- Federal Tax Return - Includes income information from the IRS, which is crucial for calculating the Expected Family Contribution (EFC).

Eligibility Criteria for Authorization Submission

College students must provide specific documents to meet the eligibility criteria for FAFSA submission. These documents verify identity, financial status, and dependency status to ensure proper authorization.

Valid identification such as a Social Security number or Alien Registration Number is required. Students need their federal income tax returns, W-2 forms, and records of untaxed income. Additionally, dependency status documentation, such as parent information or legal guardianship papers, is necessary for accurate FAFSA processing.

Step-by-Step Guide to Completing FAFSA Authorization

What documents are required for a college student to complete FAFSA authorization? A valid Social Security number and your most recent federal income tax returns are essential. These documents verify your identity and financial information for accurate FAFSA processing.

How do you start the FAFSA authorization process? Begin by creating an FSA ID, which serves as your electronic signature. This ID grants access to the FAFSA form and allows you to sign it securely online.

What role does tax information play in FAFSA submission? Use the IRS Data Retrieval Tool or provide tax return transcripts to report income details. Accurate tax data helps determine your eligibility for federal student aid.

Why is identification verification important for FAFSA? Submit a valid driver's license or passport to confirm your identity. This step safeguards against identity fraud during authorization.

How should household information be prepared for FAFSA? List all household members and their Social Security numbers along with your dependency status. Correct household data ensures proper calculation of financial need.

What is the final step in completing FAFSA authorization? Review your information thoroughly before electronically signing the form with your FSA ID. Submitting the authorized FAFSA form completes your application process for federal aid.

Required Documentation for FAFSA Authorization

To complete the FAFSA authorization, you must provide specific documents verifying identity and financial information. Required documentation includes a valid Social Security number, your federal income tax returns, and records of untaxed income. Additionally, you need proof of U.S. citizenship or eligible non-citizen status and an FSA ID to sign the application electronically.

Common Errors in Submitting Authorization Documents

Submitting the Free Application for Federal Student Aid (FAFSA) requires specific authorization documents to verify identity and eligibility. Errors in these documents can delay financial aid processing or result in application denial.

- Missing Signatures - Failure to provide the student's or parent's signature on the FAFSA form often leads to rejection or requests for additional verification.

- Incorrect Social Security Number - Entering an inaccurate Social Security Number causes identity mismatches and processing delays.

- Unverified Identity Information - Submitting documents without proper identity verification, such as mismatched names or birthdates, results in application errors and potential aid loss.

Ensuring all authorization documents are accurate and complete enhances the likelihood of timely FAFSA approval and financial aid distribution.

Timeline for FAFSA Authorization Process

| Document | Description | Purpose in FAFSA Authorization | Timeline Consideration |

|---|---|---|---|

| Social Security Number (SSN) | Valid SSN issued by the Social Security Administration | Confirms identity for FAFSA submission and authorization | Required at initial FAFSA completion; delays affect processing time |

| FSA ID (Federal Student Aid ID) | Username and password used to sign FAFSA electronically | Authorizes FAFSA application and access to federal student aid records | Create before FAFSA submission to avoid delays in authorization |

| Federal Income Tax Returns | IRS Form 1040 or equivalent for student and/or parents | Verify income and tax information for financial need assessment | Use most recent tax data; IRS Data Retrieval Tool can speed up authorization |

| W-2 Forms and Other Income Records | Documentation of earnings and untaxed income | Supports accuracy in income reporting for FAFSA | Gather before filing to ensure timely authorization process |

| Driver's License or State ID (if available) | Government-issued identification | May be used for identity verification during FAFSA submission | Helpful but not always required; having it ready can prevent delays |

| Bank Statements and Investment Records | Recent statements documenting assets and investments | Used to determine financial strength impacting aid eligibility | Collect before FAFSA submission; incomplete info could delay authorization |

| Proof of Citizenship or Eligible Noncitizen Status | U.S. passport, birth certificate, or immigration documentation | Confirms eligibility for federal student aid | Maintain readily accessible to avoid authorization delays |

| Selective Service Registration Confirmation (for males aged 18-25) | Proof of registration with Selective Service System | Required for federal aid eligibility verification | Register early to prevent authorization issues affecting FAFSA processing |

How Colleges Use FAFSA Authorization Forms

College students must submit specific documents to complete the FAFSA submission process accurately. Authorization forms play a crucial role in how colleges access and use financial information to determine aid eligibility.

- Student Identification - Valid government-issued ID or Social Security Number confirms the student's identity for FAFSA records.

- Parental Financial Information - FAFSA authorization allows colleges to review parental tax returns and income details when applicable.

- Consent for Data Sharing - Authorization forms permit colleges to access FAFSA data directly from the U.S. Department of Education for aid verification and processing.

What Documents Does a College Student Need for FAFSA Submission? Infographic