To authorize a third party to access a bank account, the primary documents required include a valid authorization or power of attorney form, a government-issued identification for both the account holder and the authorized individual, and the original bank account details. Some banks may also require proof of relationship or a notarized consent form to ensure the authenticity of the authorization. It is essential to check with the specific bank for any additional documentation or specific format requirements.

What Documents are Necessary for Third-Party Bank Account Authorization?

| Number | Name | Description |

|---|---|---|

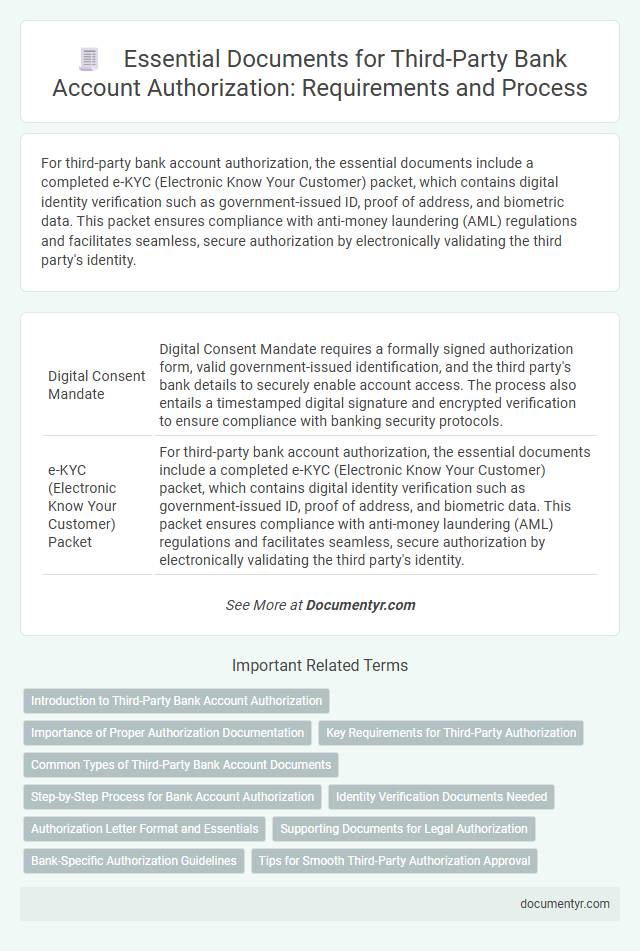

| 1 | Digital Consent Mandate | Digital Consent Mandate requires a formally signed authorization form, valid government-issued identification, and the third party's bank details to securely enable account access. The process also entails a timestamped digital signature and encrypted verification to ensure compliance with banking security protocols. |

| 2 | e-KYC (Electronic Know Your Customer) Packet | For third-party bank account authorization, the essential documents include a completed e-KYC (Electronic Know Your Customer) packet, which contains digital identity verification such as government-issued ID, proof of address, and biometric data. This packet ensures compliance with anti-money laundering (AML) regulations and facilitates seamless, secure authorization by electronically validating the third party's identity. |

| 3 | Power of Attorney (PoA) Addendum | A Power of Attorney (PoA) Addendum is a critical document for third-party bank account authorization, specifying additional powers granted to the agent beyond the original PoA. This addendum must be signed, notarized, and comply with the bank's policies to ensure the authorized party can legally manage the account on behalf of the principal. |

| 4 | Dynamic Authorization Token | A Dynamic Authorization Token is essential for third-party bank account authorization as it ensures secure, time-sensitive access to financial information and transactions. This token, combined with identity verification documents such as a government-issued ID and a completed authorization form, enables banks to authenticate the third party while mitigating fraud risks. |

| 5 | Biometric Authorization Waiver | A biometric authorization waiver is essential for third-party bank account authorization, allowing the bank to verify identity through fingerprints or facial recognition instead of traditional signatures. This waiver streamlines the approval process and enhances security by leveraging biometric data, reducing the risk of fraud. |

| 6 | API-Enabled Authorization Letter | An API-enabled authorization letter must include the account holder's full name, bank account number, specific permissions granted, and a clear scope of access linked to the third party's API credentials. This document should also contain a valid signature, date, and explicit consent aligned with the bank's security protocols to enable secure, real-time account management via third-party applications. |

| 7 | Multi-Factor Consent Form | A Multi-Factor Consent Form is essential for third-party bank account authorization as it verifies identity through multiple authentication methods, ensuring the security and legitimacy of consent given by the account holder. This form typically complements government-issued ID, proof of address, and a signed authorization letter to establish comprehensive validation for third-party access. |

| 8 | Wet Signature Verification Sheet | A Wet Signature Verification Sheet is essential for third-party bank account authorization as it provides a tangible proof of the authorized individual's handwritten consent, ensuring legitimacy and preventing fraud. This document typically accompanies identification proofs and authorization forms to verify the authenticity of the signatures involved in the transaction. |

| 9 | Real-Time Beneficiary Declaration | Real-Time Beneficiary Declaration requires a valid government-issued ID, proof of address, and an authorization letter specifying third-party access rights to the bank account. Banks may also request a notarized consent form and account holder's signature verification to ensure secure and immediate beneficiary authorization. |

| 10 | Blockchain-Stamped Authorization Certificate | A Blockchain-Stamped Authorization Certificate provides an immutable and verifiable record, essential for third-party bank account authorization, ensuring authenticity and reducing fraud risk. Banks typically require this certificate alongside a valid government-issued ID and a notarized authorization letter to validate the third party's access rights securely. |

Introduction to Third-Party Bank Account Authorization

Third-party bank account authorization allows an individual or entity to access and manage another person's bank account with permission. This process ensures that authorized parties can perform transactions on behalf of the account holder legally and securely.

Essential documents are required to verify identity and establish authorization clearly. These documents protect both the account owner and the bank by preventing unauthorized access and ensuring compliance with banking regulations.

Importance of Proper Authorization Documentation

What documents are necessary for third-party bank account authorization? Proper authorization documentation typically includes a notarized authorization letter, a valid government-issued ID of both the account holder and the authorized person, and a signed bank-approved authorization form. These documents ensure legal compliance and prevent unauthorized access to your bank account.

Key Requirements for Third-Party Authorization

Third-party bank account authorization requires specific documents to ensure legal and secure access. Your authorization must clearly establish identity and consent.

- Valid Identification - Government-issued ID such as a passport or driver's license is necessary to verify the identity of both the account holder and the authorized party.

- Authorization Letter or Power of Attorney - A written and signed document that explicitly grants permission for the third party to manage the account.

- Bank's Specific Forms - Forms provided by the financial institution must be completed to comply with their internal procedures for third-party access.

Common Types of Third-Party Bank Account Documents

| Document Type | Description | Purpose |

|---|---|---|

| Third-Party Authorization Letter | Formal written permission from the account holder allowing another person to act on their behalf. | Grants legal authority to access and manage the bank account. |

| Identification Documents | Government-issued IDs such as passports, driver's licenses, or national ID cards of both the account holder and the authorized third party. | Verifies the identities involved in the authorization process. |

| Bank Forms for Third-Party Access | Bank-specific forms required to add a third party to an account or to grant limited access. | Officially records the authorization within the bank's system. |

| Power of Attorney (POA) | Legal document that grants comprehensive decision-making authority over the bank account to the third party. | Allows extensive control beyond standard authorization letters, often used for long-term arrangements. |

| Proof of Relationship or Agreement | Documents such as contracts, partnership agreements, or family relationship proof. | Establishes the connection and justifies the need for third-party access. |

Step-by-Step Process for Bank Account Authorization

Authorizing a third party to access a bank account requires specific documents to verify identity and intent. The process involves clear steps to ensure legal and financial security.

- Identification Documents - Valid government-issued IDs are required for both the account holder and the third party to confirm their identities.

- Authorization Form - A signed and notarized authorization form specifies the scope of access granted to the third party.

- Proof of Account Ownership - Documentation such as recent bank statements or account contracts is needed to verify ownership of the bank account.

Your bank may request additional documentation based on internal policies and local regulations.

Identity Verification Documents Needed

To authorize a third party to access a bank account, identity verification documents are essential. These documents confirm the identity of both the account holder and the authorized individual.

Primary documents include government-issued photo IDs such as passports or driver's licenses. Banks may also require proof of address, like utility bills or bank statements, to verify residency. In some cases, notarized authorization letters or power of attorney forms strengthen the verification process.

Authorization Letter Format and Essentials

A third-party bank account authorization requires a formal authorization letter that clearly states the account holder's consent for another individual to access or manage their account. The authorization letter format should include the account holder's full name, account number, and the authorized person's details along with specific permissions granted. Essential elements also include the date, signature of the account holder, and sometimes a notarization to validate the letter's authenticity.

Supporting Documents for Legal Authorization

Supporting documents for legal authorization of a third-party bank account typically include a power of attorney, a notarized authorization letter, and valid identification for both the account holder and the authorized individual. These documents must clearly outline the scope of authority granted to ensure compliance with banking regulations and to protect all parties involved. You should prepare these materials carefully to facilitate a smooth authorization process and avoid any legal complications.

Bank-Specific Authorization Guidelines

Third-party bank account authorization requires specific documents that vary by institution. Understanding bank-specific authorization guidelines ensures smooth processing and compliance.

- Authorization Form - Most banks require a completed and signed third-party authorization form tailored to their policies.

- Identification Documents - Valid government-issued IDs for both account holders and authorized third parties are mandatory.

- Proof of Relationship - Some banks ask for documents demonstrating the relationship between the account holder and the third party, such as a power of attorney or legal agreements.

What Documents are Necessary for Third-Party Bank Account Authorization? Infographic