To open a trust account, you need to provide a valid identification document such as a passport or driver's license, proof of address like a utility bill or bank statement, and the trust agreement outlining the terms and beneficiaries. Some institutions may also require a Tax Identification Number (TIN) or Employer Identification Number (EIN) if applicable. Supporting documents that verify the trust's existence and authorized signatories are essential to comply with legal and regulatory requirements.

What Documents are Necessary for Opening a Trust Account?

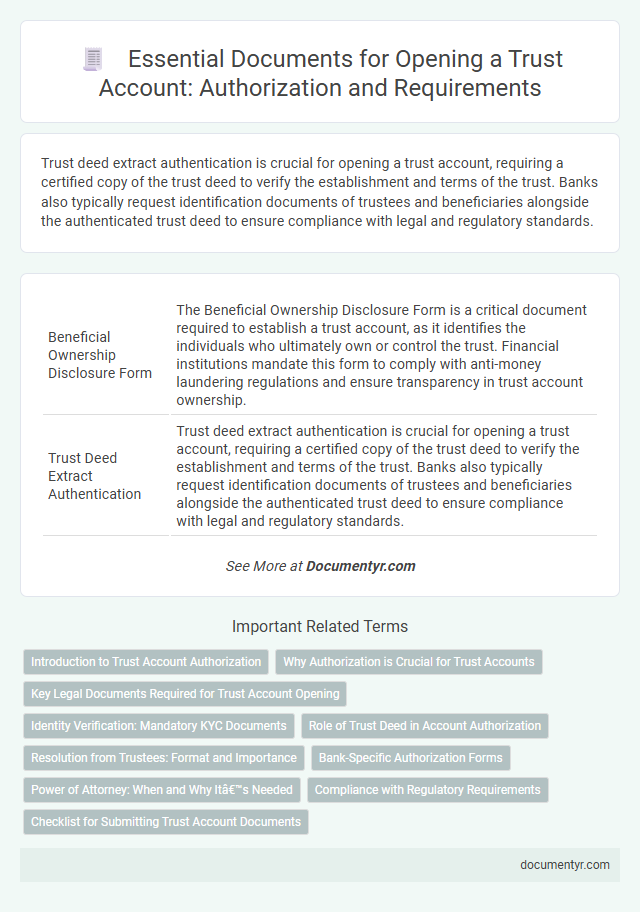

| Number | Name | Description |

|---|---|---|

| 1 | Beneficial Ownership Disclosure Form | The Beneficial Ownership Disclosure Form is a critical document required to establish a trust account, as it identifies the individuals who ultimately own or control the trust. Financial institutions mandate this form to comply with anti-money laundering regulations and ensure transparency in trust account ownership. |

| 2 | Trust Deed Extract Authentication | Trust deed extract authentication is crucial for opening a trust account, requiring a certified copy of the trust deed to verify the establishment and terms of the trust. Banks also typically request identification documents of trustees and beneficiaries alongside the authenticated trust deed to ensure compliance with legal and regulatory standards. |

| 3 | Digital KYC Verification Certificate | A Digital KYC Verification Certificate is essential for opening a trust account as it verifies the identity of all trustees and beneficiaries through secure online authentication methods. This certificate complies with regulatory standards, ensuring seamless authorization and reducing the risk of fraud during the account setup process. |

| 4 | Ultimate Beneficiary Identification Statement | The Ultimate Beneficiary Identification Statement is critical for opening a trust account, as it verifies the identities of the individuals who ultimately benefit from the trust's assets. This document, alongside government-issued identification and the trust agreement, ensures compliance with anti-money laundering regulations and establishes clear ownership. |

| 5 | Settlor Source of Funds Declaration | A Settlor Source of Funds Declaration is essential for opening a trust account to verify the origin and legitimacy of the funds contributed by the settlor, ensuring compliance with anti-money laundering regulations. This document typically includes detailed information about the settlor's income sources, asset history, and financial transactions linked to the trust funding. |

| 6 | e-Signature Mandate Sheet | The e-Signature Mandate Sheet is a crucial document for opening a trust account, authorizing electronic signatures to streamline transaction approvals and legal compliance. It ensures secure, verifiable consent from all trust parties, facilitating efficient, paperless account management. |

| 7 | FATCA/CRS Self-Certification Form | Opening a trust account requires submitting a FATCA/CRS Self-Certification Form to comply with international tax regulations and ensure accurate reporting of beneficial ownership. This form verifies the trust's tax residency status under the Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS), essential for preventing tax evasion and meeting regulatory requirements. |

| 8 | GDPR-Compliant Data Consent Agreement | A GDPR-compliant data consent agreement is essential for opening a trust account, ensuring that clients explicitly authorize the collection, processing, and storage of their personal data in accordance with European data protection regulations. This document must clearly outline the purpose of data use, the rights of data subjects, and the mechanisms for withdrawal of consent to guarantee transparency and legal compliance. |

| 9 | Digital Asset Custody Acknowledgement | Opening a trust account requires key documents including the trust agreement, identification proofs, and a Digital Asset Custody Acknowledgement that verifies the trustee's responsibility and compliance with digital asset safeguarding protocols. This acknowledgment ensures adherence to regulatory standards for digital asset management and protects against unauthorized access or loss. |

| 10 | Electronic Document Attestation Receipt | Electronic Document Attestation Receipt serves as critical proof for the legitimacy and verification of digital documents when opening a trust account, ensuring compliance with regulatory standards. This authenticated digital certification streamlines the authorization process by confirming the authenticity of identity, trust deeds, and related legal documents electronically submitted. |

Introduction to Trust Account Authorization

Opening a trust account requires specific authorization documents to ensure legal compliance and proper management of assets. These documents verify the identity of the trust creator, beneficiaries, and trustees, establishing the framework for account operations. Proper authorization helps protect all parties involved and ensures the trust operates according to its intended purpose.

Why Authorization is Crucial for Trust Accounts

Authorization is crucial for trust accounts to ensure that only designated individuals can manage and access the funds. Proper authorization helps maintain legal compliance and protects the trust from unauthorized transactions or fraud.

- Legal Identification Documents - Valid IDs verify the identity of trustees and beneficiaries to prevent identity theft and ensure legitimacy.

- Trust Agreement - This document authorizes the creation and management of the trust account by outlining roles and responsibilities.

- Authorization Letters - Explicit written consent from the trustor or beneficiaries confirms who is allowed to operate the account and make decisions.

Key Legal Documents Required for Trust Account Opening

| Document | Description |

|---|---|

| Trust Agreement | Legal document outlining the terms, trustee duties, and beneficiary rights. Essential for defining the trust's purpose and administration. |

| Identification Documents | Valid government-issued IDs such as passports or driver's licenses for trustees and grantors to verify identity and prevent fraud. |

| Trustee Resolution | Formal authorization by the trustee(s) to open and manage the trust account, ensuring proper decision-making authority. |

| Tax Identification Number (TIN) | Unique tax ID assigned to the trust for reporting and tax purposes, required by financial institutions and tax authorities. |

| Certificate of Trust | Summary document verifying the existence of the trust without revealing sensitive information, often requested by banks. |

| Trustee Contact Information | Current contact details of all trustees for communication and correspondence related to the trust account. |

| Funding Instructions | Details on initial contributions and asset transfers into the trust account, specifying source and amount. |

Identity Verification: Mandatory KYC Documents

Opening a trust account requires thorough identity verification to comply with legal and regulatory standards. Mandatory KYC documents are essential to establish the identity and legitimacy of all parties involved.

- Government-issued Photo ID - Valid passports or driver's licenses verify the identity of trustees and beneficiaries.

- Proof of Address - Utility bills or bank statements confirm the residential address of account holders.

- Tax Identification Number - Social Security numbers or tax IDs ensure proper tax reporting and compliance.

Submitting these documents accurately ensures smooth authorization and trust account setup.

Role of Trust Deed in Account Authorization

What documents are necessary for opening a trust account? Opening a trust account requires several key documents to verify the trust's legitimacy and the authority of the trustees. The trust deed plays a central role in this authorization process by outlining the terms, beneficiaries, and powers granted to trustees.

Why is the trust deed crucial for account authorization? The trust deed serves as the primary legal document that confirms the formation of the trust and designates the trustees authorized to operate the account. Banks rely on it to ensure compliance with trust terms and protect the interests of the beneficiaries.

Resolution from Trustees: Format and Importance

Opening a trust account requires specific documentation to verify authority and compliance. A resolution from trustees is a crucial document that formalizes decisions and authorizations related to the trust account.

- Resolution Format - The resolution must be a formal written document outlining the trustees' agreement to open the trust account.

- Trustee Authorization - It should clearly state which trustees are authorized to act on behalf of the trust to manage the account.

- Legal Importance - This resolution serves as legal proof of consent and authority, preventing unauthorized access and ensuring proper account management.

Bank-Specific Authorization Forms

Opening a trust account requires submitting bank-specific authorization forms tailored to the institution's compliance standards. These forms ensure that the bank recognizes the authorized individuals who can manage the trust account.

Authorization forms typically include detailed information about the trustee, beneficiaries, and the nature of the trust. Accurate completion of these documents is critical for seamless account setup and ongoing management.

Power of Attorney: When and Why It’s Needed

Opening a trust account requires specific documents to verify identity and authority. One crucial document is the Power of Attorney, which grants legal authority to act on behalf of the trust.

The Power of Attorney is needed when someone other than the trust grantor manages the account. It ensures authorized transactions comply with legal standards and protects all parties involved. Your financial institution will require this document to confirm that the appointed agent has the proper authorization to perform trust-related activities.

Compliance with Regulatory Requirements

Opening a trust account requires strict compliance with regulatory requirements to ensure legal and financial integrity. Essential documents include valid identification, proof of address, and trust formation papers.

Regulators demand verified documents such as the trust deed, taxpayer identification numbers, and any relevant authorization letters. Providing accurate documentation helps you avoid delays and maintains transparency throughout the account opening process.

What Documents are Necessary for Opening a Trust Account? Infographic